We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

I like trackers in principal because they give some certainty, but it doesn't look like -0.51% will become competitive in near future. My Chip balance stays £0 since 6th Sept 2023 when I withdrew the remaining interest.pecunianonolet said:

And they introduce ISA's as well to hold on for longer to funds as it is more work moving it around, although the new rules state you can just open a new account anywhere you like but will be interesting to see if they launch with any promotions to attract funds. Once there easy access becomes attractive again, my balance with them is 0 and I have enough other and tracker accounts that I don't foresee any cash going there anytime soon. ISA's may well change thisCuparLad said:

It seems from "Harry"'s eMail that they've taken the last few months to revamp their market offering. I can imagine their business was decimated once Tandem forced EA rates over 5% and perhaps their existing deal with Clearbank didn't give them any further wiggle room so they've renegotiated a new arrangement that allows them to effectively offer a base rate-linked fix. Worth keeping an eye on once base rates start to shift downwards.Zopa_Trooper said:Chip have announced their instant access account will from the 14th February be directly linked to the bank of England rate, less 0.51%.0 -

Chorley Easy Access Saver (1 Withdrawal) NLA

Goes down from 5.3% to 5.1% from19th February 2024.

2 -

In case this hasn't been mentioned, Monument's Easy Access Savings account has increased from 5.03% to 5.08%.

£25k minimum balance / unlimited withdrawals / app-only

https://www.monument.co/savings/easy-access-savings

6 -

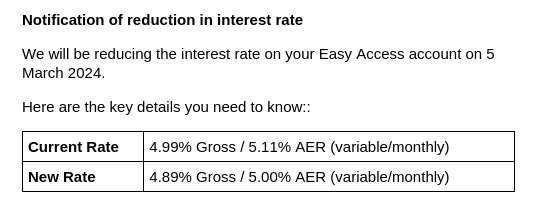

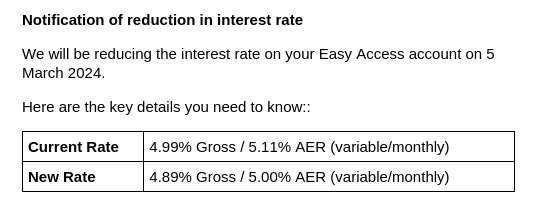

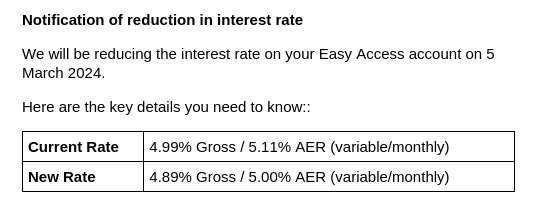

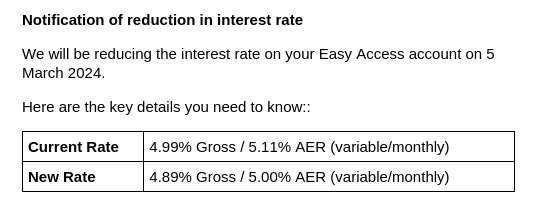

Shawbrook email:

7 -

Note that it seems those with the NORTH WEST & LOYALTY EASY ACCESS SAVER account that you will be affected too as I received the same email.allegro120 said:Chorley Easy Access Saver (1 Withdrawal) NLA

Goes down from 5.3% to 5.1% from19th February 2024.

0 -

I've expected this to happen at some point, but never thought of what would be the best strategy when it happens. I definitely want to keep continuous membership. It's either open one of Chorley's low paying (£1 minimum to operate) accounts or withdraw leaving £500 there at 5.1%. So far I'm inclined to do the latter. I have more than enough in 5.2%+ EAs to fund all my RSs up to their maturities and on the larger scale the difference from 5.1% and 5.2% on £500 is negligible.simonsmithsays said:

Note that it seems those with the NORTH WEST & LOYALTY EASY ACCESS SAVER account that you will be affected too as I received the same email.allegro120 said:Chorley Easy Access Saver (1 Withdrawal) NLA

Goes down from 5.3% to 5.1% from19th February 2024.

0 -

I already hold a legacy and poor account with them with a couple of pounds in.allegro120 said:

I've expected this to happen at some point, but never thought of what would be the best strategy when it happens. I definitely want to keep continuous membership. It's either open one of Chorley's low paying (£1 minimum to operate) accounts or withdraw leaving £500 there at 5.1%. So far I'm inclined to do the latter. I have more than enough in 5.2%+ EAs to fund all my RSs up to their maturities and on the larger scale the difference from 5.1% and 5.2% on £500 is negligible.simonsmithsays said:

Note that it seems those with the NORTH WEST & LOYALTY EASY ACCESS SAVER account that you will be affected too as I received the same email.allegro120 said:Chorley Easy Access Saver (1 Withdrawal) NLA

Goes down from 5.3% to 5.1% from19th February 2024.

I'll be closing the EA when the rate falls and move it to a better place1 -

Is this the start of savings rates dropping and others will follow?SJMALBA said:Shawbrook email:

I have this account and while Shawbrook have never been top of the list for rates, it was reasonably decent for the small amount I have with them.

I’ll probably leave what I have in there as I’m waiting for my new ISA allowance in April.“Hardware: The parts of a computer system that can be thrown out of the nearest window!”0 -

Inevitably, yes. The Base Rate will start to drop, arguably starting in March. As that happens savings rates will follow suit. The peaks have long gone but if you are concerned and are able to lock some money in, you should look at some of the fixed rate deals if you want certainty on returns.XDA said:

Is this the start of savings rates dropping and others will follow?SJMALBA said:Shawbrook email:

I have this account and while Shawbrook have never been top of the list for rates, it was reasonably decent for the small amount I have with them.

I’ll probably leave what I have in there as I’m waiting for my new ISA allowance in April.1 -

Shawbrook are often quite high up / top the rates don't they? That's where I first came to notice them.XDA said:

Is this the start of savings rates dropping and others will follow?SJMALBA said:Shawbrook email:

I have this account and while Shawbrook have never been top of the list for rates, it was reasonably decent for the small amount I have with them.

I’ll probably leave what I have in there as I’m waiting for my new ISA allowance in April.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards