We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

Ho hum - too late - dipped out at 2.6%savethepandas said:_All_125x100.png) Family Building Society Online Saver (5)AER 3.20% Annual interest Minimum £1000

Family Building Society Online Saver (5)AER 3.20% Annual interest Minimum £1000 -

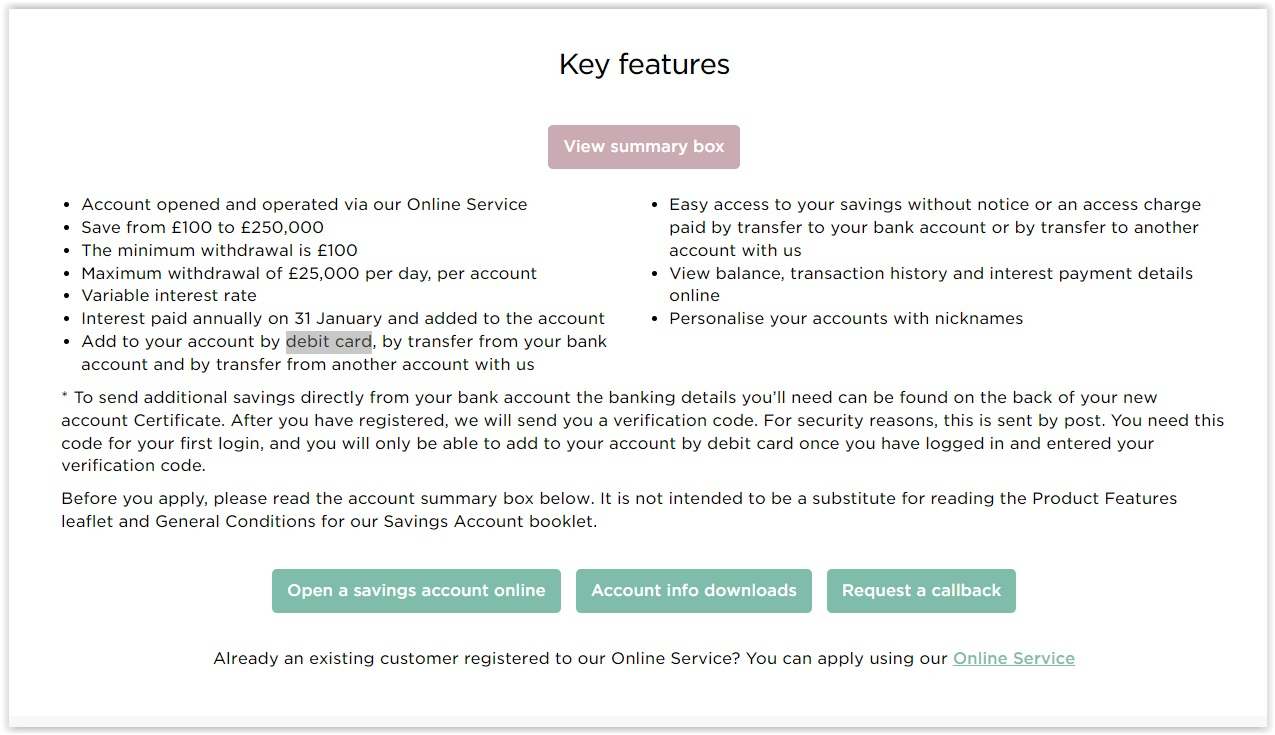

Thanks for the heads up. Very interesting account for anyone looking for accounts allowing debit card depositssavethepandas said:_All_125x100.png) Family Building Society Online Saver (5)AER 3.20% Annual interest Minimum £100

Family Building Society Online Saver (5)AER 3.20% Annual interest Minimum £100

4 -

What's the advantage of allowing debit card deposits please?0

-

Some current account reward schemes require a number of debit card transactions to be made each month. Funding a savings account with (say) several £1 deposits is one way to satisfy these requirements.BarGin said:What's the advantage of allowing debit card deposits please?2 -

I'm showing my ignorance here, but does anyone know whather the Family Account will accept debit card transactions from someone other than the account holder. So would my wife be able to open an account and fund it using one of my Halifax debit cards.0

-

don’t know the answer - though why would she not use her own debit card(s), and why wouldn’t you have your own savings account?Winchmore_Hill_Shot said:I'm showing my ignorance here, but does anyone know whather the Family Account will accept debit card transactions from someone other than the account holder. So would my wife be able to open an account and fund it using one of my Halifax debit cards.0 -

Or topping up your Amazon gift card account with a bunch of £1 deposits.flaneurs_lobster said:

Some current account reward schemes require a number of debit card transactions to be made each month. Funding a savings account with (say) several £1 deposits is one way to satisfy these requirements.BarGin said:What's the advantage of allowing debit card deposits please?0 -

Yorkshire B/S loyalty 4% and six withdrawals allowed per year.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards