We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

I agree, they should display the current interest rate in the app. They say in their T&Cs that they are doing so........obvs not true.SanguineOnSaturn said:Kroo............. also it would be nice to see the current interest rate displayed somewhere.

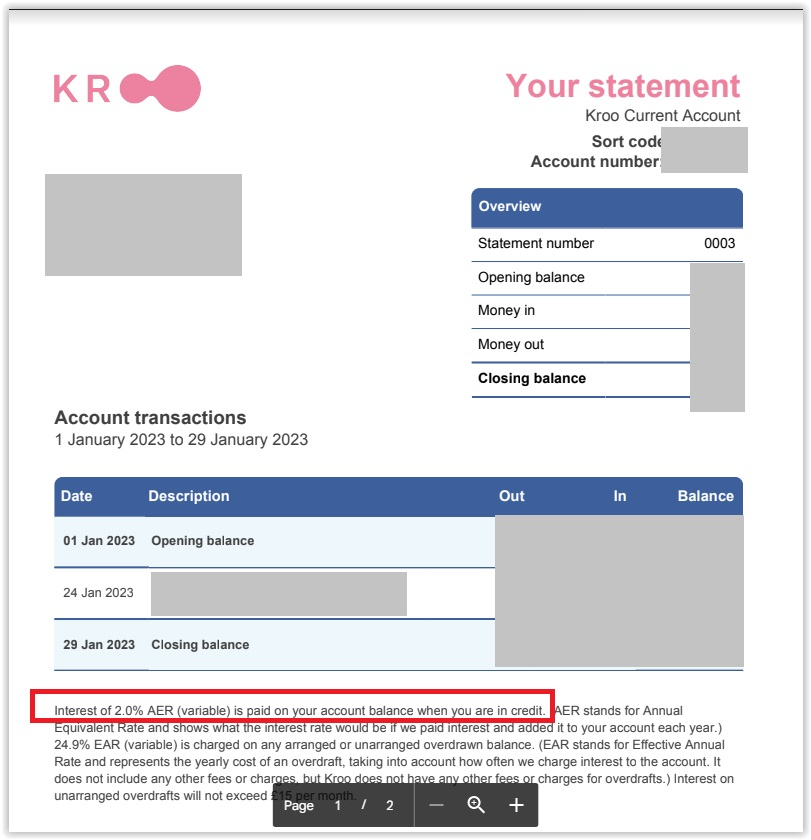

There's a bit of a longwinded way of seeing your interest rate, on your statement. Looks like you can generate a statement for the current month anytime you like. 4

4 -

Natwest daily limit is £20k and for week days only. £50k for premier customersBand7 said:All banks also have limits for individual and/or daily Faster Payment transaction limits. Natwest/RBS are now defaulting it to £5k, though you can up it to £10k (?). Others have limits between £10k and £100k.0 -

It's also in the faqsProfile > read our faqs > Personal Current Account > What interest is paid on current account balances.I think the important thing is not wanting to miss a reduction if they are doing a quick customer grab with short term headline rate.0

-

According to their T&Cs, they will give at least 2 months notice of reductions.SanguineOnSaturn said:It's also in the faqsProfile > read our faqs > Personal Current Account > What interest is paid on current account balances.I think the important thing is not wanting to miss a reduction if they are doing a quick customer grab with short term headline rate.1 -

That's decent enough. Just a colour scheme change, a name change and I'm all in then 😁

0 -

It's already gone from this board's TotP. Sainsbury's latest Defined Access ousted it from the top 10.Bridlington1 said:Al Rayan's looking as though they're in danger now. If Skipton's tracker account is still available a fortnight after the next BOE base rate they will jump to at least 2.85% if not 3.1%, thus ending Al Rayan's stint of many months of being in the top 10 EA accounts.1 -

What is the restriction with Shawbrook?RG2015 said:Am I correct in saying that the Zopa easy access account has the highest unrestricted interest rate at 2.86% AER / 2.82% gross?

I am excluding Aldermore, Shawbrook, Monmouth, Sainsbury's, Cynergy, Yorkshire BS and Chip as each has some sort of restriction along with the Virgin Money 3.00% ISA.

I'm not aware of any (2.92%).Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone0 -

If the interest goes below £1000 then the interest becomes 0.05%.cloud_dog said:

What is the restriction with Shawbrook?RG2015 said:Am I correct in saying that the Zopa easy access account has the highest unrestricted interest rate at 2.86% AER / 2.82% gross?

I am excluding Aldermore, Shawbrook, Monmouth, Sainsbury's, Cynergy, Yorkshire BS and Chip as each has some sort of restriction along with the Virgin Money 3.00% ISA.

I'm not aware of any (2.92%).1 -

The minimum balance of £1,000 and transaction of £500, but like the others I excluded will be absolutely fine for some.cloud_dog said:

What is the restriction with Shawbrook?RG2015 said:Am I correct in saying that the Zopa easy access account has the highest unrestricted interest rate at 2.86% AER / 2.82% gross?

I am excluding Aldermore, Shawbrook, Monmouth, Sainsbury's, Cynergy, Yorkshire BS and Chip as each has some sort of restriction along with the Virgin Money 3.00% ISA.

I'm not aware of any (2.92%).

1 -

So it has. Apologies, I must have somehow missed that update.AmityNeon said:

It's already gone from this board's TotP. Sainsbury's latest Defined Access ousted it from the top 10.Bridlington1 said:Al Rayan's looking as though they're in danger now. If Skipton's tracker account is still available a fortnight after the next BOE base rate they will jump to at least 2.85% if not 3.1%, thus ending Al Rayan's stint of many months of being in the top 10 EA accounts.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards