We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Easy Access Savings Discussion Area

Comments

-

You are right, withdrawals should not be subject to limits. AFAIK, there's no Open Banking involved in withdrawals from CHIP, just Faster Payments. I have withdrawn £40+k from CHIP to Santander in a single transaction, without any problems (arriving back in Santander within seconds). There's also no checking on the CHIP side of things as your only option is to withdraw to the account you have registered with CHIP.tg99 said:

Thanks. In terms of withdrawals back to Santander from Chip, am not aware of any limits that would apply here at either end or do things work differently when doing it by open banking (e.g. would Santander not accept payments in over a certain limit by open banking etc?)Band7 said:

The max limit from Santander to CHIP is actually £15k. I am not sure whether this is a CHIP limit, or a Santander limit for Open Banking transactions. You can make several £15k deposits a day though, in short succession (if Santander let you.....but that's a different matter....)tg99 said:Does pulling in money to the Chip instant access account work in tandem with your linked bank account’s payment limits? Eg so for Santander that has max £25k per bank transfer faster payment online would you need to do two £25k pulls if wanted to deposit £50k in total?

I have seen people reporting their CHIP limit at other banks are lower. Barclays £8k, for example, and I think someone else said £2k but I can't remember which bank1 -

It wil be interesting to see what happens. So far issues 1 to 29 have all been given the 2.75 on the same date (but not issue 30 !)jaypers said:Looks as though Charter have launched an Easy Access Issue 31 at 2.64%

Would suspect that this issue won’t be getting uplift to 3% on 23/2 but I’m guessing here.0 -

Coventry BS account is "active" but have been waiting for many days for online login to be working. How long does that take, after registering a login with them online?

0 -

Freedommm said:Coventry BS account is "active" but have been waiting for many days for online login to be working. How long does that take, after registering a login with them online?Depends what you mean by "active". Online login should be working at all times. If you have recently opened an account with them, say a Limited Access Saver, but didn't previously have an open account with them they would have had to send you a letter headed - It's time to set up your Telephone Password.Then more stuff about accessing Telephone Services which sounds like you don't particularly need, BUT ---if you want to manage your money online, as I do, you'll need your Telephone Password when you register for Online Services.If you're saying you've done the latter two stages, and ARE registered for Online Services, then there should be nothing stopping you accessing your personal page, and operating the account.If you've just received the news that your account has been opened then I can say I received mine yesterday 12th, dated 9th. However I applied in December! Yesterday's letter made no mention of a letter to come as I've noted above - re Telephone Password. Why would it? I am/was registered for Online Services.If you've got the time and patience to look at my tale at 12 January at 8:22PM (p1017) I can add that when I visited the branch yesterday the lovely lady had to ring and check that there wasn't already a "set up Telephone Password letter" in the post to me. She said she'd found there wasn't (presumably as I'd been able to log in back in December before applying they accepted I was already registered). When post arrived at 16.15 today lo and behold a letter with temporary password to set up Telephone Password etc etc. Seeing it dated 11th I knew it couldn't be the one she'd asked to be sent, but rather the one they claimed hadn't been sent.Unsurprisingly when I correctly inputted the temporary password it was refused, obviously failing due to test 3 of the reasons showing online -"you've already set up your new password by post/online or you’ve ordered another Password Letter and the temporary password is no longer valid."So on and on we go......

0 -

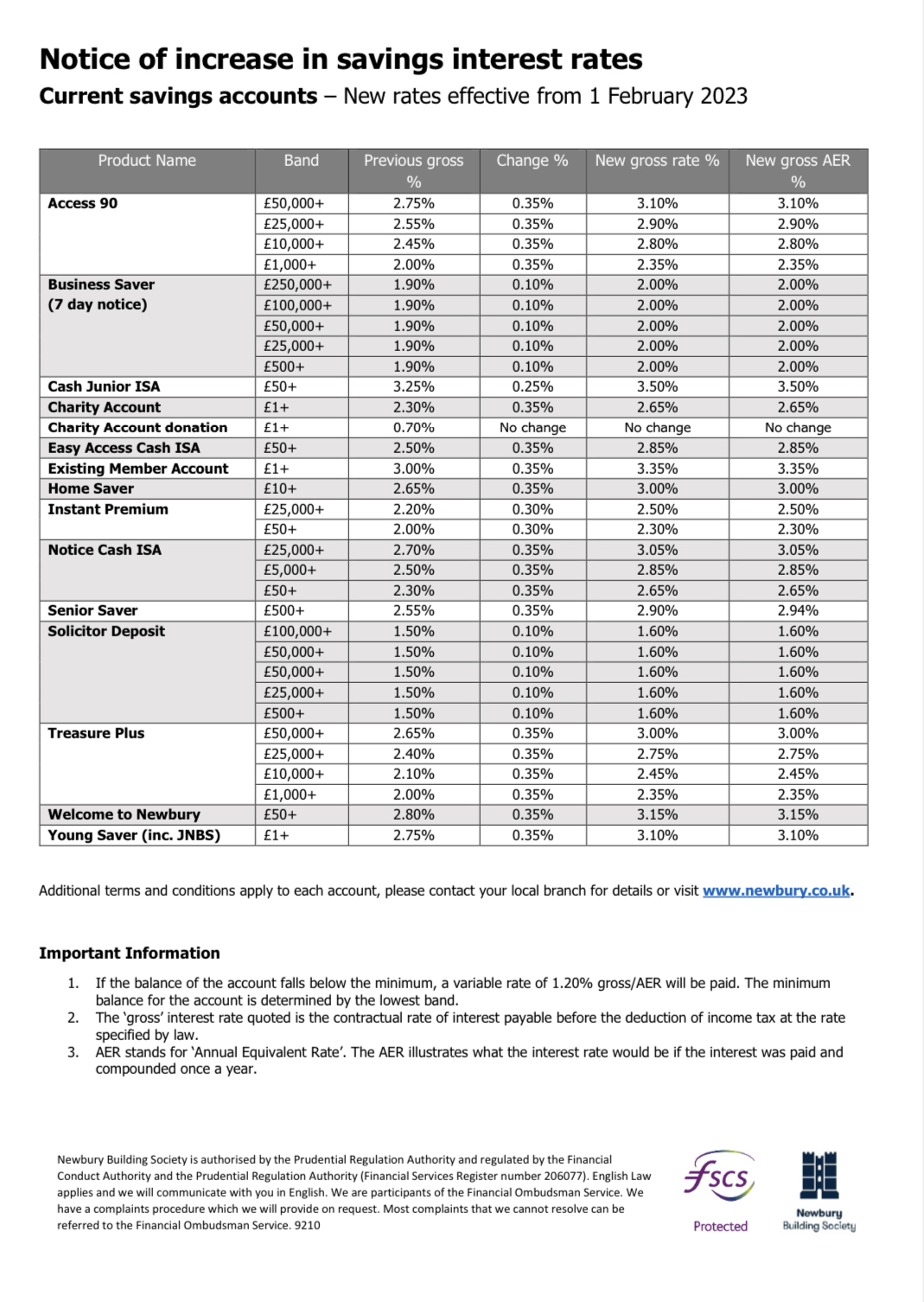

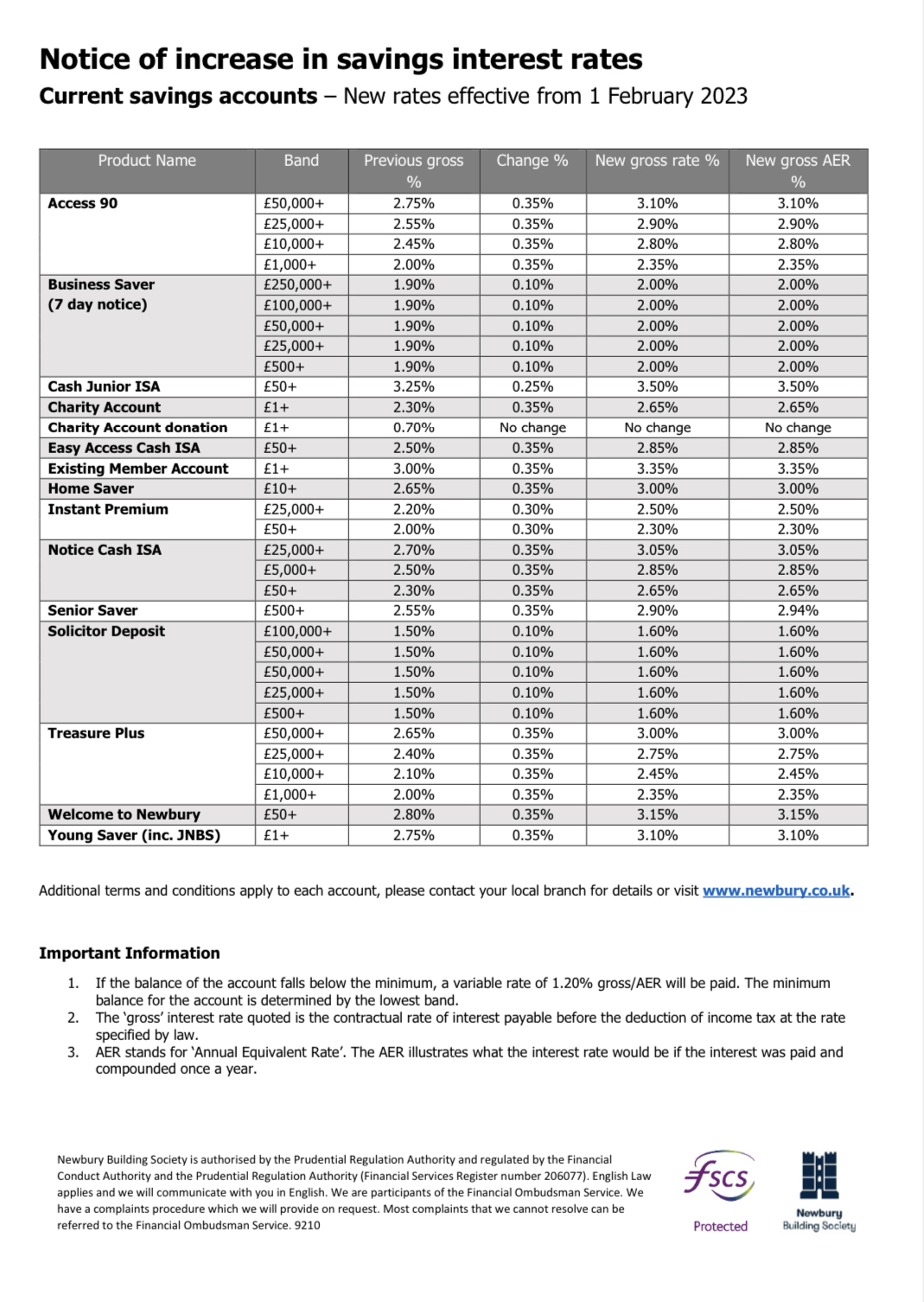

Newbury BS new rates effective 01/02/2023 ~ https://newburytest-live-f3d63f7f4dcc44ad8831e6-4e875e3.divio-media.com/filer_public/04/2a/042a0ae7-acaa-4527-9323-e55391fb6a8d/9210_-_interest_rate_change_table.pdf:

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3 -

Thanks, I shoved the max 4k in my EMA yesterday, hopefully they will continue with the 4k limit after April if they aren't getting overrun with deposits.1

-

Welcome to Newbury rising to 3.15%ForumUser7 said:Newbury BS new rates effective 01/02/2023 ~ https://newburytest-live-f3d63f7f4dcc44ad8831e6-4e875e3.divio-media.com/filer_public/04/2a/042a0ae7-acaa-4527-9323-e55391fb6a8d/9210_-_interest_rate_change_table.pdf:

Existing member account rising to 3.35%

All in all it's a strong performance from Newbury of late.1 -

Charter Savings - I've opened but not funded an Issue 30, so unsure in these circumstances whether I'd be eligible for rate update emails if there were any. Anyone who's been with CS a fair while know how this works? Or when the final tranche of Issues new rates are formally announced? I gather the next rate increases will be the 23rd?Thanks0

-

Are you sure you still have this account because Charter sayGrouchy said:Charter Savings - I've opened but not funded an Issue 30

"If we don't receive your initial deposit within 14 days of your application, we'll assume you no longer wish to save with us."

0 -

Yes. Still well within the 14 days.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards