We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

No viewings in 6 months

Comments

-

Crashy_Time wrote: »Don`t give up the day job, stand up comedy isn`t going to work for you. The bubble hasn`t "lasted" it has been propped up at great political expense (to the elites) and financial expense to the younger generations. Also volumes have slipped and many people are stuck because they can`t find a buyer. Don`t kid yourself, the QE/ZIRP mode is no longer working (for the elites, or anyone else) and they are going to turn the ship around, those carrying the biggest debts will be hurt the most.

You may have thought I was laughing at your misfortune yet the black comedy of property prices is no laughing matter. But I equally suggest you don't give up the day job for economic prophesy.

The bubble has lasted in that it's still inflated. It's still here. Doesn't matter if it's self-sustaining, propped up by the elites and/or done so at the expense of the youth. It still is. The elites won't "turn the ship around" because in the UK at least, the richest people are by and large, landowners. Furthermore, what elite would support anything which would benefit the masses, and make the elites somehow (ie through the ownership of property) less elite, less exclusive, less special? None. Literally and figuratively, there's too much invested in high property prices, and Britons will never ever man the barricades to challenge it.0 -

I keep banging on about this but a little-noticed factor driving a permanent upward move to house prices is the changed economic and tax status of wives nowadays.

Until a date in the past wives' earnings were taxed at their husbands' marginal rate of tax, and they had no personal allowance. Instead, hubby had a larger allowance in his own name.

So if your husband were well-paid on and on Labour's 83% tax rate of the 1970s (for example) you'd lose £5 out of every £6 you earned.

It wasn't worth working in that situation so many women who could have didn't bother. If they did, their net salary bought less than it would have had their husband earned it, because he got a tax allowance and they didn't and he paid at the lower band rates and women paid at his top rate. Per £1 earned, women almost always paid more tax than their husbands.

For this reason mortgage lenders took the view that when lending they'd treat the woman's salary as being worth less than the man's. They were perfectly right about this. After tax, her salary was worth less than a man's, even if she was paid exactly the same gross wage.

Add in the aberration of inflation and hence high interest rates from 1970 to 1995 and you have the complete explanation for the factors that gave rise to the "3.5x the man's and 1x the woman's" lending model of yesteryear.

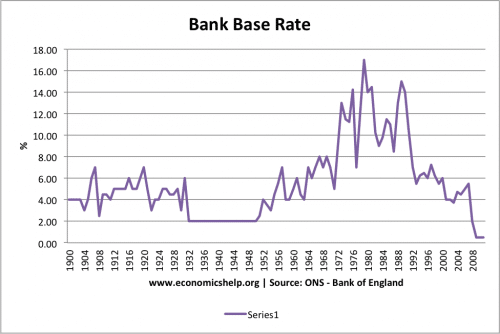

The inflation is gone. In the last 300 years, the base rate has only been over 10% in 20 of them and all 20 were between 1970 and 1995. So what's truly the norm and what's the aberration - 15% base rates, or 0.25% base rates? I would suggest that what we see now is back in line with long term historical levels of base rate - certainly of mortgage rate.

And the sexist taxation of women? That surely ended in the 1930s, or something? No, it was actually abolished by Nigel Lawson in 1988.

Anyone who thinks the clock is going to turn back to 1987 and gift them a cheap house at a mortgage of 3.5x their salary is in dreamland, I'm afraid. In fact, in a crash, finding anyone who'll sell and finding anyone who'll lend become hugely harder. Paradoxically it was much easier to afford property before the bust, in 1988, than it was afterwards, in say 1990.0 -

Of course, many may - and do - still lament the fact that half of the population now have the same right to have a fulfilling career as the other half...

You're right, too, about looking at the longer view of the base rate to see what's "normal".

Since 1970

Since 1900

If we view the second graph, about 4.5% would seem to be normal. If we view the first graph, arguably much more representative of modern conditions, then higher than that - about 8%. If we restrict ourselves to the 1990s onwards, then we're back to around 4.5%.

So - shall we agree on 4.5%ish as historically "normal"? In many ways, though, we do appear to be heading for a political framework that absolutely turns "normal" on its head.0 -

ReadingTim wrote: »You may have thought I was laughing at your misfortune yet the black comedy of property prices is no laughing matter. But I equally suggest you don't give up the day job for economic prophesy.

The bubble has lasted in that it's still inflated. It's still here. Doesn't matter if it's self-sustaining, propped up by the elites and/or done so at the expense of the youth. It still is. The elites won't "turn the ship around" because in the UK at least, the richest people are by and large, landowners. Furthermore, what elite would support anything which would benefit the masses, and make the elites somehow (ie through the ownership of property) less elite, less exclusive, less special? None. Literally and figuratively, there's too much invested in high property prices, and Britons will never ever man the barricades to challenge it.

I think you are confused "elites" are not guys with ten rental houses in Stoke on Trent :rotfl: The real elites will make money in all conditions, there were landowners long before this bubble and they will be there after it goes. The "elites" now want higher interest rates, so that means leveraged ten house guy will get burnt fingers I`m afraid.0 -

westernpromise wrote: »I keep banging on about this but a little-noticed factor driving a permanent upward move to house prices is the changed economic and tax status of wives nowadays.

Until a date in the past wives' earnings were taxed at their husbands' marginal rate of tax, and they had no personal allowance. Instead, hubby had a larger allowance in his own name.

So if your husband were well-paid on and on Labour's 83% tax rate of the 1970s (for example) you'd lose £5 out of every £6 you earned.

It wasn't worth working in that situation so many women who could have didn't bother. If they did, their net salary bought less than it would have had their husband earned it, because he got a tax allowance and they didn't and he paid at the lower band rates and women paid at his top rate. Per £1 earned, women almost always paid more tax than their husbands.

For this reason mortgage lenders took the view that when lending they'd treat the woman's salary as being worth less than the man's. They were perfectly right about this. After tax, her salary was worth less than a man's, even if she was paid exactly the same gross wage.

Add in the aberration of inflation and hence high interest rates from 1970 to 1995 and you have the complete explanation for the factors that gave rise to the "3.5x the man's and 1x the woman's" lending model of yesteryear.

The inflation is gone. In the last 300 years, the base rate has only been over 10% in 20 of them and all 20 were between 1970 and 1995. So what's truly the norm and what's the aberration - 15% base rates, or 0.25% base rates? I would suggest that what we see now is back in line with long term historical levels of base rate - certainly of mortgage rate.

And the sexist taxation of women? That surely ended in the 1930s, or something? No, it was actually abolished by Nigel Lawson in 1988.

Anyone who thinks the clock is going to turn back to 1987 and gift them a cheap house at a mortgage of 3.5x their salary is in dreamland, I'm afraid. In fact, in a crash, finding anyone who'll sell and finding anyone who'll lend become hugely harder. Paradoxically it was much easier to afford property before the bust, in 1988, than it was afterwards, in say 1990.

The difference now is BTL, they will sell and sell cheaply. In the late 80`s how many offices had a half or two thirds of the staff with extra property to rent out? Many of these "investors" won`t know what is happening to them when rates rise and they owe more tax. You keep comparing chalk and cheese to try and make a credit bubble appear normal, no one is buying it I`m afraid 0

0 -

westernpromise and AdrianC, I don't often post much on this forum because I'm not planning on buying a house for at least another year yet, but thank you so much for that interesting context to interest rates and lending practices. I always wondered why one salary was traditionally worth less than the other when it came to mortgage lending, and now I know

This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0

This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

http://www.straitstimes.com/business/property/chinas-crackdown-on-capital-outflows-sending-shudders-through-global-property

Cheaper property will be good for the real economy.0 -

Crashy_Time wrote: »http://www.straitstimes.com/business/property/chinas-crackdown-on-capital-outflows-sending-shudders-through-global-property

Cheaper property will be good for the real economy.

I could be wrong, but I can't actually imagine that this slightly dingy 1.5 bed flat was ever going to attract an off-shore buyer from China, Crashy. Just like 99.5% of the rest of the property bought and sold in this country.

Obviously there are some ridiculous prices in places like 1 Hyde Park, The Shard etc. which were only ever aimed at the investment market, and no one will be crying if they come down in price. Apart from the odd investor, possibly, if they've been silly enough not to spread their bets.Mortgage - £[STRIKE]68,000 may 2014[/STRIKE] 45,680.0 -

and the predictions of Crashy are based on known facts from the future?????Crashy_Time wrote: »Stop being silly.

you have your view of life and pay rent as a consequence, others do not share your view and choose to pay for their accommodation differently. Live with your choice, but don't pretend you can foresee things and should therefore be listened to as someone in the know.

History has always been full of doomsayers, sometimes they win, sometimes they loose. In neither case were they anything other than lucky or unlucky.0 -

Crashy_Time wrote: »I think you are confused "elites" are not guys with ten rental houses in Stoke on Trent :rotfl: The real elites will make money in all conditions, there were landowners long before this bubble and they will be there after it goes. The "elites" now want higher interest rates, so that means leveraged ten house guy will get burnt fingers I`m afraid.

Timing is the key and never over strectch yourself like I did to my cost 2007/8.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards