We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Green, ethical, energy issues in the news

Comments

-

Is it me or is solar falling massively behind wind?

Take today on a good day for solar and a bad day for wind: peak solar generation was around 4GW - this was only around 10% of the total demand, in comparison gas was 22GW and wind 4 GW.

Now, I can see in the future that we can meet demand for wind on windy days. Already the record peak output is around 17GW, so am guessing a trebling of capacity will put us into a position where we can meet demand for the majority of time.

However on a low wind days (which are a plenty) we will be in a position where we could have to make up 30+ GW of power.

From what I can make there is also a vastly increasing gap between wind and solar farms in the pipeline.

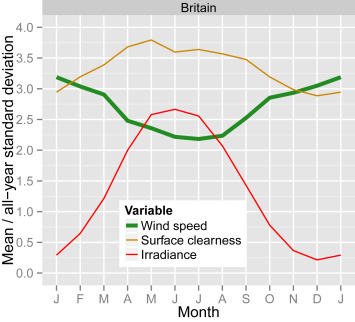

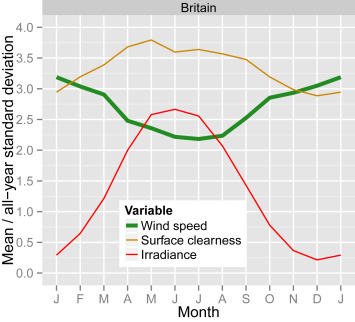

There is a reasonably strong negative correlation between wind and sun, so I am little surprised that more emphasis is not put on solar to give more energy security and less dependence on interconnects and non-renewables when the wind is not blowing.

3 -

I'm guessing ('cos Mart is the expert and I'm not) that the problem of unreliable wind is still a very long way from being sorted and that UK solar is not going to be the solution . At the moment bad wind days can be simply compensated by turning up the gas. As Mart said above, to some degree over capacity of wind turbines can compensate but any move away from FF (Including towards nuclear if more is rolled out) means developing affordable mass storage.2nd_time_buyer said:Is it me or is solar falling massively behind wind?

Take today on a good day for solar and a bad day for wind: peak solar generation was around 4GW - this was only around 10% of the total demand, in comparison gas was 22GW and wind 4 GW.

Now, I can see in the future that we can meet demand for wind on windy days. Already the record peak output is around 17GW, so am guessing a trebling of capacity will put us into a position where we can meet demand for the majority of time.

However on a low wind days (which are a plenty) we will be in a position where we could have to make up 30+ GW of power.

From what I can make there is also a vastly increasing gap between wind and solar farms in the pipeline.

There is a reasonably strong negative correlation between wind and sun, so I am little surprised that more emphasis is not put on solar to give more energy security and less dependence on interconnects and non-renewables when the wind is not blowing.

For me the most exciting solutions to the wind problem are dropping weights down mine-shafts and also using the West coast of Africa for solar generation to export to the UK. If innovations like these turn out to be viable then we have a very exciting future for RE.Install 28th Nov 15, 3.3kW, (11x300LG), SolarEdge, SW. W Yorks.

Install 2: Sept 19, 600W SSE

Solax 6.3kWh battery5 -

2nd_time_buyer said:Is it me or is solar falling massively behind wind?A bunch of factors are at work here:There's definitely a role for solar; small-scale demand-side wind is pretty much never going to happen. But for large scale, arguably we'd be better off building solar farms in Spain, then selling them our excess wind in the winter.

- Solar hasn't been eligible for any of the previous CfD rounds which has made financing it harder.

- Onshore network connections are expensive for big solar farms, so most developments are under 500MWp.

- The UK isn't a great place for solar; the capacity factor (from DUKES chart 6.5) for solar is roughly 10% vs. wind at 45%. In other words, you'll get 4.5x as much electricity from a megawatt of wind turbine as you will from a megawatt of solar panel.

- Wind generates more power in the winter, when we need it, and less in the summer, when we don't. Solar not so much.

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.6 - Solar hasn't been eligible for any of the previous CfD rounds which has made financing it harder.

-

Are the Scots selling leases to areas suitable for offshore wind? Is there as separate CfD process that will determine what will actually get built and how expensive the power will be?Martyn1981 said:These three articles from Renews are all about the same story, the recent ScotWind offshore wind lease auction, but it's such important news, and smallish articles that I couldn't choose between them. 17 projects have been awarded option agreements which total 25GW. For scale, that's 2.5x the whole current UK fleet.UPDATE: Scots auction ‘will create offshore powerhouse'

“To put this landmark into context, the 25GW of new capacity announced today is two and a half times the UK’s entire current offshore wind capacity.

“It’s also equal to the entire current operational offshore wind capacity for the whole of Europe. It will scale up our ability to slash emissions exponentially.

“In the long term, it will also help to reduce the UK’s vulnerability to international gas prices which are hurting consumers.SPR, Shell, BP and SSE win big in 25GW ScotWind bonanza

Crown Estate Scotland has awarded option agreements to 17 projects totalling almost 25GW in its ScotWind offshore wind lease auction.The winning projects were selected out of a total of 74 applications, and have now been offered option agreements which reserve the rights to specific areas of seabed.

A total of just under £700m will be paid by the successful applicants in option fees and passed to the Scottish government for public spending.“The variety and scale of the projects that will progress onto the next stages shows both the remarkable progress of the offshore wind sector, and a clear sign that Scotland is set to be a major hub for the further development of this technology in the years to come.”

Should any application not progress to signing a full agreement, the next highest scoring application will instead be offered an option.

Once these agreements are officially signed, the details of the supply chain commitments made by the applicants as part of their Supply Chain Development Statements will be published.

This is just the first stage of the long process these projects will have to go through before turbines go into the water, as the projects evolve through consenting, financing, and planning stages, Crown Estate Scotland said.ScottishPower toasts 7GW offshore wind success

Iberdrola-owned ScottishPower has been awarded the seabed rights to develop three new offshore wind farms off the coast of Scotland totalling 7GW as part of Crown Estate Scotland’s ScotWind leasing round.

The trio of wind farms will more than treble ScottishPower’s existing offshore wind pipeline to 10.1GW from 3.1GW.

Edit: Will ScotWind auction deliver a renewables revolution? - BBC News

Sounds like it is effectively acquiring the site to support bids in the CfD round.

Sadly like when the govt made 22bn auction the 3g mobile phone spectrum it turned out that all the money was recovered from consumers through high mobile phone contract prices which actually had the net result of pushing the UK behind in terms of mobile data adoption. In this case any fees for using 'crown estate offshore land' will end up in higher CfD bids and thus higher electricity prices.I think....2 -

I have some empathy with you there on the phone charges, although I cannot remember if they had to bid competitively against others/each other regarding future prices as with CfD energy auction.michaels said:Are the Scots selling leases to areas suitable for offshore wind? Is there as separate CfD process that will determine what will actually get built and how expensive the power will be?

Edit: Will ScotWind auction deliver a renewables revolution? - BBC News

Sounds like it is effectively acquiring the site to support bids in the CfD round.

Sadly like when the govt made 22bn auction the 3g mobile phone spectrum it turned out that all the money was recovered from consumers through high mobile phone contract prices which actually had the net result of pushing the UK behind in terms of mobile data adoption. In this case any fees for using 'crown estate offshore land' will end up in higher CfD bids and thus higher electricity prices.

East coast, lat 51.97. 8.26kw SSE, 23° pitch + 0.59kw WSW vertical. Nissan Leaf plus Zappi charger and 2 x ASHP's. Givenergy 8.2 & 9.5 kWh batts, 2 x 3 kW ac inverters. Indra V2H . CoCharger Host, Interest in Ripple Energy & Abundance.1 -

michaels said:Sounds like it is effectively acquiring the site to support bids in the CfD round.

Sadly like when the govt made 22bn auction the 3g mobile phone spectrum it turned out that all the money was recovered from consumers through high mobile phone contract prices which actually had the net result of pushing the UK behind in terms of mobile data adoption. In this case any fees for using 'crown estate offshore land' will end up in higher CfD bids and thus higher electricity prices.OK, but let's look at the prices paid.The first on the list is BP who paid almost £86M for a site that can hold 2.9GW of turbines. At a 45% capacity factor those turbines will generate 11.5TWh per year - 11.5 million megawatt-hours. Over a typical turbine life of 25 years that works out as 30p per MWh.Or we can look at it another way. Wind turbines are around £1/watt. 2.9GW or turbines will be £2900M. The lease on the site is 3% of the price of the turbines (and the turbines will cost an average of £10/MWh over their life). (Caveat: Google turned up a £3M price for 3MW turbines. Larger ones are probably cheaper, per watt.)N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.3 -

I suppose I was thinking about what these would look like in the future but it's not easy.Martyn1981 said:Just an addendum, because I mentioned interconnectors. Thought I'd repeat something I posted recently.

Last year UK interconnectors expanded from 5GW to 7.4GW, and planned additions take the total to ~17GW by 2025. This is really important because on average UK demand is ~40GW (varying from around 20GW in the early summer hours, to about 50GW in the winter between 5-7pm), so 17GW has the potential to make a massive difference to the UK's ability to hit a high RE average penetration, assuming that the rest of Europe has spare RE to export, when we need it, and vice versa.

https://gridwatch.co.uk/

1 -

I'm with you, and good question, those figures are going to be all over the place as we transition. I'm hoping I don't get bored of all this and get to watch some freaky changes.shinytop said:

I suppose I was thinking about what these would look like in the future but it's not easy.Martyn1981 said:Just an addendum, because I mentioned interconnectors. Thought I'd repeat something I posted recently.

Last year UK interconnectors expanded from 5GW to 7.4GW, and planned additions take the total to ~17GW by 2025. This is really important because on average UK demand is ~40GW (varying from around 20GW in the early summer hours, to about 50GW in the winter between 5-7pm), so 17GW has the potential to make a massive difference to the UK's ability to hit a high RE average penetration, assuming that the rest of Europe has spare RE to export, when we need it, and vice versa.

https://gridwatch.co.uk/

Again, just my guess, but I think we'll lean into FF gas for lots of the load following, with storage rolling out a bit behind the curve in order to ensure each development will be profitable. Or the Gov will shift subsidies and penalties (perhaps a CO2 fee) to push storage faster.

So we'll continue to see gas generation reducing on an annual percentage, but there will be times where much/most gen comes from the ~25GW gas fleet. So gas will get lumpier.

Also, in case I've mislead anyone, that 14yr projection won't be zero gas, as I've implied, but hopefully 100% RE net. The difference being that the UK will generate enough RE that exports will exceed any domestic gas generation + imported FF generation.

After net zero for the UK, it will all be down to overcapacity and storage to remove FF gen completely, which is a big ask, but we've got lots of time to develop storage as the technologies evolve and costs settle over the next decade. We will also have to work closely with the rest of Europe.

I'm not sure if I've posted this on this forum, and I hope it makes sense, but part of the reason I'm bullish on RE and storage is because the problem isn't that big ....... WHAT!!!!!!!! OK I'm being a bit pedantic, the task is enormous, but I think we need to draw a distinction between a problem and the scale of work needed. We know the solutions, and they work, so the problem isn't too big, but the scale of the work to solve the problem is enormous.

I hope that makes sense, It's a bit like needing to provide any product on a large scale, the problem is finding a working solution which at first is a big problem, but once you have a solution, then it simply becomes an issue of scale and production, and in the case of RE, interconnectors and storage (still developing) solutions to the problem exist, but greater scale is needed.

Hope that makes sense and is a positive.Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.3 -

The 3g auction put providers into a monopoly situation where they could exploit the market and as they knew this would happen could afford to bid so high. Turbine operators are entering a competitive market so will have had to have been far more careful in their bidding. They are at the mercy of the markets and are dependent on sufficient overall demand. They will also appreciate that when they are operating at their best, so will a lot of other wind farms across the country. As wind is now a very significant part of the energy mix, energy prices are likely to come down when turbines are producing at high rates. This is why the purchase price of the leases is so low compared to output (as helpfully calculated by QrizB above). So we shouldn't see a repeat of the a repeat of the 3g scandal.michaels said:

Sadly like when the govt made 22bn auction the 3g mobile phone spectrum it turned out that all the money was recovered from consumers through high mobile phone contract prices which actually had the net result of pushing the UK behind in terms of mobile data adoption. In this case any fees for using 'crown estate offshore land' will end up in higher CfD bids and thus higher electricity prices.Install 28th Nov 15, 3.3kW, (11x300LG), SolarEdge, SW. W Yorks.

Install 2: Sept 19, 600W SSE

Solax 6.3kWh battery6 -

Just thought I'd post this as it's a short article and gives a simple analysis/view on FF gas going forward, whilst fairly explaining why its tricky to predict in much detail as there are lots of factors that will impact consumption.

Outlook For Fossil Gas Is “Bumpy”

Wood Mackenzie’s recent press release highlights the difficulties that may lie ahead for the gas industry. As the preeminent global research and consultancy business powering the natural resources industry, Wood Mackenzie’s voice is a voice that should be heard.It is expected that global gas demand will remain constant in the short term, but the role of gas in the energy transition is uncertain and likely to reduce as prices remain high.Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards