We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Salmond and Sturgeon Want the English Fish for More Fat Subsidies

Comments

-

The top 50% of earners pay 90% of the tax take.....Does that include the Amazon, Google, Starbucks, Vodaphone, British American Tobacco,Tate * Lyle, Vedanta or Npower.....and these are just the tip of the iceberg.

This whole corporation tax rant is a massive red herring.

Companies don't pay taxes.... Consumers pay taxes.

Any tax bill a company has to pay can only ever be as a result of monies it has earned through selling goods and services to consumers.

If I earn £10 working, the government takes £4 in income tax from me, an employers income tax charge from my employer, and a bit more in national insurance from both me and my employer.

If I then spend the, lets say, £5 remaining in Starbucks, the government takes £1 of it in VAT, and Starbucks keep the remaining £4. Of that £4, they'll spend some of it on costs of goods, some of it on rent (on which they'll pay tax) they'll pay some of it in business rates, some of it as national insurance and employers income tax, and pay around a third of it in wages to their employees, of which a fair old chunk will be paid back to the government in tax.

Of the literally pennies left as profit for starbucks from that original £10, you then want them to pay some more tax, so that the pension funds, savers with share ISA's, etc, who hold the shares receive less in dividends....

Seriously?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

Read my post again.

BTW you seem to have changed your mind as to who should pay more tax. It was the "seriously wealthy" now it's large corporates. If we wait a while longer will it become Bankers or Jews or fat people?

I read your post and responded with my thoughts. I have not changed my mind on the seriously wealthy having to pay the lions share...I happen to think the companies I referred to are in that bracket of "Seriously wealthy". I do not think it is just down to individual tax - the law requires companies pay tax on their "profit".

But your little joke about Bankers, Jews and fat people had me laughing all the way to my diet coke.

The poor right through to middle incomes will not be able to reduce the debt to a manageable amount. Or I suppose to coin a popular phrase we could just keep borrowing......

By the way with regards to borrowing - Interest rates have never been lower. Might be a good time to borrow and horde the cash in all currencies and repay it back out as loans when the rates go up ? lol.

Seriously I have not at ANY point mentioned more borrowing since I posted in this thread. With that said most western countries with the economies we have would never survive without borrowing. It is a fundamentally flawed system.....But it is where we are and we must deal with it.0 -

To recap I have already said I would be happy to pay more tax. I also would like to see tax avoidance loopholes closed. The cash generated right there is in the billions of pounds per annum.[/B]

The Scottish deficit, including oil revenue, is likely to be in the region of 15% of Scottish GDP this year, or around 25% to 30% of Scottish government spending.

Given that tax take is already close to 50% of the Scottish economy, moving it to 65% would be completely unsustainable.

So what cuts are you willing to have for independence?

If Scotland elected not to pay for Trident, that's about 3% of this years Scottish deficit, but Nanny Sturgeon has already spent that money twice over promising other things.

So which bold, swingeing, massive cuts to benefits and services would you make to balance the books?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »This whole corporation tax rant is a massive red herring.

Companies don't pay taxes.... Consumers pay taxes.

Any tax bill a company has to pay can only ever be as a result of monies it has earned through selling goods and services to consumers.

If I earn £10 working, the government takes £4 in income tax from me, an employers income tax charge from my employer, and a bit more in national insurance from both me and my employer.

If I then spend the, lets say, £5 remaining in Starbucks, the government takes £1 of it in VAT, and Starbucks keep the remaining £4. Of that £4, they'll spend some of it on costs of goods, some of it on rent (on which they'll pay tax) they'll pay some of it in business rates, some of it as national insurance and employers income tax, and pay around a third of it in wages to their employees, of which a fair old chunk will be paid back to the government in tax.

Of the literally pennies left as profit for starbucks from that original £10, you then want them to pay some more tax, so that the pension funds, savers with share ISA's, etc, who hold the shares receive less in dividends....

Seriously?

They happily "collect" the vat but I would then venture to say that they find ways to not pass it on. If you are telling me that Starbucks makes pennies in profit from a £10 income then I challenge you to show me the figures to back that up. I know that is a big ask but I will accept ANY of the companies listed above - prove to me that their profit margin on a £10 income is "pennies".

You also stated that Starbucks employees will go on to pay substantial tax.....Are we talking about those min wage employees who the other tax payers have to subsides their wages through Tax credits, Housing benefit ect ect. Socialism for the rich multi national companies, yep that has worked very well indeed.

The only real way for a society to work is for the majority of cash to flow continuously through the "system". If we allow huge chunks to never enter our economy every year then we are going to come unstuck....as is evident with our nation's finances these days.0 -

I read your post and responded with my thoughts. I have not changed my mind on the seriously wealthy having to pay the lions share...I happen to think the companies I referred to are in that bracket of "Seriously wealthy". I do not think it is just down to individual tax - the law requires companies pay tax on their "profit".

But your little joke about Bankers, Jews and fat people had me laughing all the way to my diet coke.

The poor right through to middle incomes will not be able to reduce the debt to a manageable amount. Or I suppose to coin a popular phrase we could just keep borrowing......

By the way with regards to borrowing - Interest rates have never been lower. Might be a good time to borrow and horde the cash in all currencies and repay it back out as loans when the rates go up ? lol.

Seriously I have not at ANY point mentioned more borrowing since I posted in this thread. With that said most western countries with the economies we have would never survive without borrowing. It is a fundamentally flawed system.....But it is where we are and we must deal with it.

They can and in fact that is really the only way of bridging the current gap between income and expenditure. 1% on basic rate income tax is projected to increase tax revenue by about £5bn a year. 1% on rates above the basic rate band is projected to raise about £0.75bn a year.

This is because there are relatively few people paying anything above basic rate tax. It doesn't take a genius to work out that you cannot therefore bridge a deficit of £90bn or whatever it currently is by raising higher rate income tax because you would need to increase it to about 160% - and that's just to make everyone earning enough to pay the 40% band pay the tax needed, most of them are not "seriously wealthy".

The same rings true with VAT - 1% increase equates to about £5bn of additional revenue the vast majority of which is raised from people who are not incredibly wealthy.

The only way to balance the nation's budget is to tax everyone more or cut spending a lot or both. The idea that we can just tax a couple of rich chaps called Rupert and introduce a cappuccino windfall tax and all our problems are gone is what is known as "cloud cuckoo land".0 -

They happily "collect" the vat but I would then venture to say that they find ways to not pass it on.

VAT is an essentially impossible tax to avoid.

All aspects of the supply chain have to charge it, and only VAT already paid on your cost lines (rent, supplies, etc) is then deductible from your total charge. But it has been paid by your suppliers.

VAT evasion is not the domain of big business at all, small business with cash sales is a different matter....

The tax minimising strategies you complain about are mostly corporation tax paid on profits. But profits are a very small percentage of turnover, and the government has already tax out at many stages along the way before money can be allocated as a corporate profit.If you are telling me that Starbucks makes pennies in profit from a £10 income then I challenge you to show me the figures to back that up.

Read it again, it was £5 of income to starbucks, but my point stands.I know that is a big ask but I will accept ANY of the companies listed above - prove to me that their profit margin on a £10 income is "pennies".

I will have a google later to see if anyone on your list has released easily accessible figures.

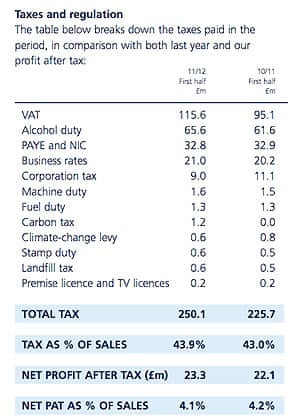

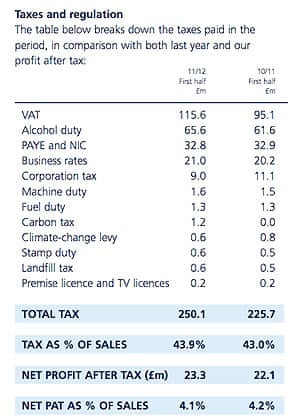

In the meantime though, I'll show you a pretty good illustration of just how much tax can be taken from big business in the UK by the government before a penny of corporation tax on profits becomes due.

Here's the analysis for JD Wetherspoons, the high street food and drink chain....

43% of their sales revenue is paid in various taxes before a penny can be contributed via additional taxation on profits.

And net profit after tax is just 4.1% of sales revenue.

That is frankly outrageous.

Now say you want to increase Scottish tax by roughly 15% of GDP to balance the books, which means in effect every payer of tax has to pay more of it, companies, individuals, etc.

In the example above of Wetherspoons, lets also say you accept it is reasonable for a big company to make 4% of turnover as profit, then Wetherspoons has no option but to increase their prices...... by a lot.

Which brings us right back to my point.

Companies don't pay tax, consumers do.

Any increase in tax is always ultimately going to cost money out of your pocket and my pocket, no matter who the tax is initially levied on.

That is the great big scam that socialist governments and parties like to try and pull on the economically illiterate, they claim higher taxes should be paid by companies, but then fail to mention that these have to be passed on to individuals.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »The Scottish deficit, including oil revenue, is likely to be in the region of 15% of Scottish GDP this year, or around 25% to 30% of Scottish government spending.

Given that tax take is already close to 50% of the Scottish economy, moving it to 65% would be completely unsustainable.

So what cuts are you willing to have for independence?

If Scotland elected not to pay for Trident, that's about 3% of this years Scottish deficit, but Nanny Sturgeon has already spent that money twice over promising other things.

So which bold, swingeing, massive cuts to benefits and services would you make to balance the books?

The FACT is we are not independent so for now we do not have to worry about such things as much as we would. But if pushed into a corner we could have borrowed at record low interest rates.......That dirty word borrowing again.

You know as well as I do that Scotland over the last 20 years or more has paid more in tax receipts than it spent on services....the figures are there to see. For sure this year we will be running well behind due to the oil prices. Don't worry too much about that though as I would gamble that we will be paying £1.50 per liter this time next year.

That bit of course is just my own opinion formed from my own observations....I could well be wrong and maybe water will be more expensive than oil this time next year lol.The record low oil price is the direct result of the world punishing Russia so that their economy becomes so unstable that they begin to starve and revolt/remove Putin.0 -

HAMISH_MCTAVISH wrote: »VAT is an essentially impossible tax to avoid.

All aspects of the supply chain have to charge it, and only VAT already paid on your cost lines (rent, supplies, etc) is then deductible from your total charge. But it has been paid by your suppliers.

VAT evasion is not the domain of big business at all, small business with cash sales is a different matter....

The tax minimising strategies you complain about are mostly corporation tax paid on profits. But profits are a very small percentage of turnover, and the government has already tax out at many stages along the way before money can be allocated as a corporate profit.

Read it again, it was £5 of income to starbucks, but my point stands.

I will have a google later to see if anyone on your list has released easily accessible figures.

In the meantime though, I'll show you a pretty good illustration of just how much tax can be taken from big business in the UK by the government before a penny of corporation tax on profits becomes due.

Here's the analysis for JD Wetherspoons, the high street food and drink chain....

43% of their sales revenue is paid in various taxes before a penny can be contributed via additional taxation on profits.

And net profit after tax is just 4.1% of sales revenue.

That is frankly outrageous.

I know fine that VAT is collected and then offset against the VAT you as a business pays out for and goods that attract vat....The difference then goes to the treasury. VAT fraud is a very serious business though and no large company would get into it due to the consequences.

But you are correct that it is corporation tax that seems to be abused.

It really depends on what type of society we as a collective want. Do we want a healthy, well educated and law abiding civilisation ? If we do then WE and any company wishing to take advantage of this healthy well educated populace MUST pay to upkeep these public services.

That is essentially what I as a person and voter believes. Maybe my tax the rich seems like the politics of envy - But I do wonder where the cash goes.0 -

The FACT is we are not independent so for now we do not have to worry about such things as much as we would.

Yes, we dodged a bullet there....But if pushed into a corner we could have borrowed at record low interest rates.......That dirty word borrowing again.

Really?

Name one country with a 15% of GDP deficit that is currently able to borrow at "record low rates".

Just one will do....:)You know as well as I do that Scotland over the last 20 years or more has paid more in tax receipts than it spent on services....the figures are there to see.

Putting aside for a moment the fact that your claim is incorrect, the last 20 years are of no relevance, we don't have a time machine to go back and re-spend that money, it's gone.

The situation today is very different. Scotland has been running a very large deficit for the last few years, and it's getting bigger every year.

It was bad before the oil price fell from bubble level highs back to the historically normal level it's at today, but it's catastrophically bad now. Of course, many of us knew this, despite the blatant lies coming from some camps to the contrary..... Turns out we were right.For sure this year we will be running well behind due to the oil prices. Don't worry too much about that though as I would gamble that we will be paying £1.50 per liter this time next year. That bit of course is just my own opinion formed from my own observations....I could well be wrong and maybe water will be more expensive than oil this time next year lol.

Gambling on a volatile resource price for your countries ability to pay the bills seems more than a tad reckless.

But "lol" if you want to I guess.....

Thankfully calmer heads prevailed on the day of the vote.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

I know fine that VAT is collected and then offset against the VAT you as a business pays out for and goods that attract vat....The difference then goes to the treasury. VAT fraud is a very serious business though and no large company would get into it due to the consequences.

But you are correct that it is corporation tax that seems to be abused.

It really depends on what type of society we as a collective want. Do we want a healthy, well educated and law abiding civilisation ? If we do then WE and any company wishing to take advantage of this healthy well educated populace MUST pay to upkeep these public services.

That is essentially what I as a person and voter believes. Maybe my tax the rich seems like the politics of envy - But I do wonder where the cash goes.

So say you want to increase Scottish tax by roughly 15% of GDP to balance the books, which means in effect every payer of tax has to pay more of it, companies, individuals, etc.

In the example above of Wetherspoons, lets also say you accept it is reasonable for a big company to make 4% of turnover as profit, then Wetherspoons has no option but to increase their prices...... by a lot.

Which brings us right back to my point.

Companies don't pay tax, consumers do.

Any increase in tax is always ultimately going to cost money out of your pocket and my pocket, no matter who the tax is initially levied on.

That is the great big scam that socialist governments and parties like to try and pull on the economically illiterate, they claim higher taxes should be paid by companies, but then fail to mention that these are always ultimately passed on to individuals.

Can you name one country that is able to finance a 15% of GDP deficit at less than punitive interest rates?

Can you name one country that is able to impose a tax rate higher than 50% of GDP on it's economy without it crashing?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards