We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Red Across the Board

Comments

-

My lovely property fund is still green

That's the great thing about uncorrelated assets; my bonds, gilts, property, infrastructure, etc. are all largely unaffected by the recent falls.

Of course, the big question is what people will do if equities continue to slide. Will they be able to bring themselves to rebalance?

I know I will as I've seen how very well it's worked in the past!I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

Ryan_Futuristics wrote: »It's the fact you think there's anything extraordinary about Value Averaging - it's as well researched as 60:40 portfolios, it was developed at Harvard ... Which you'd know if you'd searched "Value averaging studies" without the words "wrong", "hokum" and "phooey"

For what it is worth I googled "value averaging paper uk" in response to guymo saying "I would be interested to know where Ryan picked up this strategy from though -- if there are studies out there it would be good to see them."

The 1st, 2nd, 3rd, and 4th results in the top 10 are all the Hayler papers I linked to. If "wrong", "hokum" and "phooey" show up, they may be in the results, but they are not in the search terms.0 -

TheTracker wrote: »For what it is worth I googled "value averaging paper uk" in response to guymo saying "I would be interested to know where Ryan picked up this strategy from though -- if there are studies out there it would be good to see them."

The 1st, 2nd, 3rd, and 4th results in the top 10 are all the Hayler papers I linked to. If "wrong", "hokum" and "phooey" show up, they may be in the results, but they are not in the search terms.

Ah, well it seems typing "UK" into your Google search does limit results somewhat - which isn't surprising considering Harvard, Stanford, MIT, Yale, Sloan, etc. are all being filtered out

I don't know if you read Hayley's paper, but the criticism on VA's efficiency comes down to the cash reserves you'd need to make it work

I.e. Keeping 25% of your portfolio in cash would be inefficient ... But this is why it's down to the individual - do you already keep 25% in cash? What if the reserve was in high-yield fixed income as I described? Hayley's conclusion is fine, but seems more applicable to fund and pension managers, don't you think?0 -

Ryan_Futuristics wrote: »I.e. Keeping 25% of your portfolio in cash would be inefficient ... But this is why it's down to the individual - do you already keep 25% in cash? What if the reserve was in high-yield fixed income as I described? Hayley's conclusion is fine, but seems more applicable to fund and pension managers, don't you think?

What about Harry Browne's permament portfolio? 25% cash, 25% equities, 25% gold, 25% bonds.

http://www.marketwatch.com/story/a-portfolio-for-all-seasons-2013-07-19

It is not for me but has returned on average 9% per year over the last 40 years, and in I think 39 of those years the return was positive.0 -

racing_blue wrote: »What about Harry Browne's permament portfolio? 25% cash, 25% equities, 25% gold, 25% bonds.

http://www.marketwatch.com/story/a-portfolio-for-all-seasons-2013-07-19

It is not for me but has returned on average 9% per year over the last 40 years, and in I think 39 of those years the return was positive.

I've always felt the permanent portfolio (ironically) shows how much things change ... I don't think many would be confident holding that much in gold these days ... (But I certainly have at least 25% in cash)

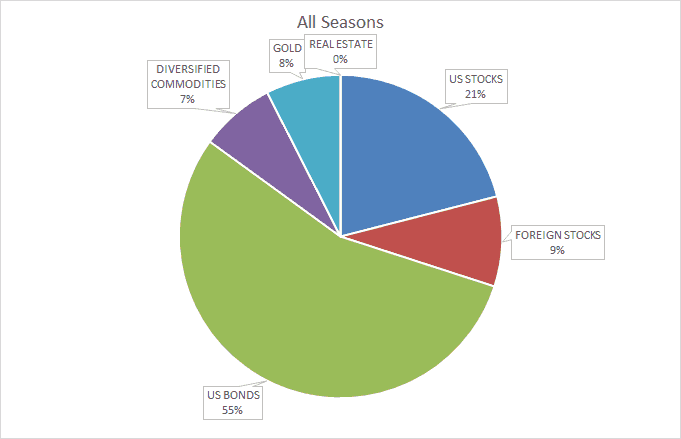

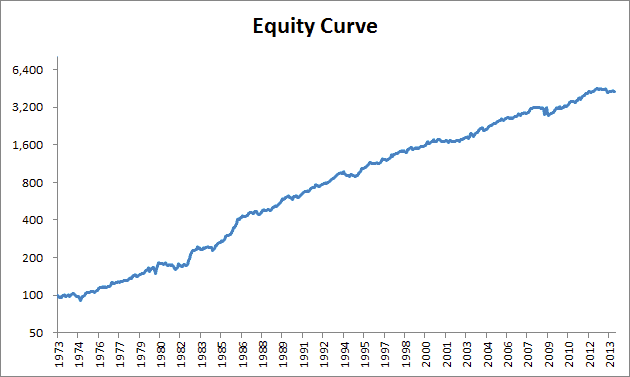

For me, Tony Robbins' All Seasons Portfolio is sort of the modern rejig of the PP - also returns over 9% with very low volatility

But of course bonds don't look appealing now, and it's uncertain what role they'll play in tomorrow's portfolios, so I think it shows how in periods of change (leaving a bond bubble and with a global shift in growth and demographics) there aren't necessarily safe haven portfolios0 -

Ryan_Futuristics wrote: »But of course bonds don't look appealing now, and it's uncertain what role they'll play in tomorrow's portfolios, so I think it shows how in periods of change (leaving a bond bubble and with a global shift in growth and demographics) there aren't necessarily safe haven portfolios

In short - no one knows what is going to happen. It's business as usual.0 -

In short - no one knows what is going to happen. It's business as usual.

Possibly ... But then if you still held 25% gold today, you'd have a less stable portfolio than the one Browne envisaged - so nature still favours adaption every so often

Technically these portfolios are about risk parity, and one way of looking at it could be that with the risk of holding bonds going up (both in terms of risk to capital from a rates rise, and risk from investor behaviour anticipating a loss of capital) along with yields at all-time lows, bond allocations should probably be lowered

My bond replacement is becoming P2P lending (at 7-8% interest) balanced with the best rates you can get holding cash - generally envisage this century looking quite different from the previous one, and expect different "stable" asset classes0 -

Ryan_Futuristics wrote: »...so nature still favours adaption every so often

You can't possibly know how that adaption will play out ahead of time though, it's all guess work and hindsight.

Better to have a broad allocation and rebalance plan and more or less stick to it for the duration imho.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

You can't possibly know how that adaption will play out ahead of time though, it's all guess work and hindsight.

Better to have a broad allocation and rebalance plan and more or less stick to it for the duration imho.

Well the philosophy behind this kind of portfolio is that we can't easily predict the future, but we can reasonably assess risk

I often liken it to the quantum measurement problem: We can't predict where something will be, but we can predict how likely it will be there - and risk always has to be weighed against returns

There's a good article here:

The Biggest Mistake in Investing

https://www.bwater.com/ViewDocument.aspx?f=23&agreed=3481170 -

Russia just boosted its interest rate up to a whopping 17% from 10%

My Neptune Greater Russia fund isn't looking so great (cheap though!). Down 15% total. Only 30 years left to run too 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards