We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

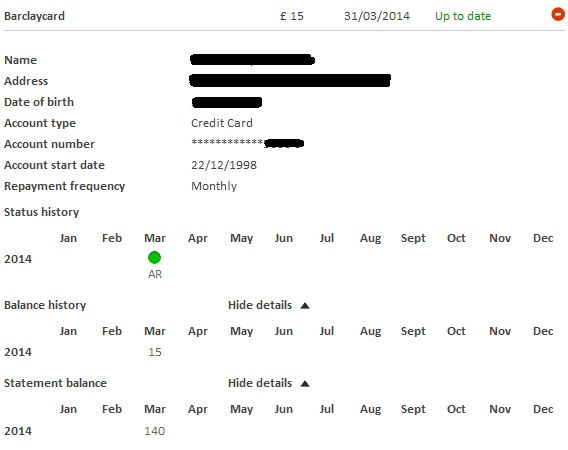

Barclaycard AP removal [successful]

Comments

-

I'm a little confused so you had 3 yrs of AR markers then when you left the DMP they marked your file with an ok status breaking the 6 year cycle resulting in them effectively starting the 6 year process again? I must admit I wasn't aware of this until a nice bloke at barclaycard advised me to stay in an arrangement to allow the 6 year date to complete so they could remove the account, he went on to say that if I came out the arrangement then the process would start over.

I had a letter from idem saying they are going to investigate it as my account has been marked for over 6 years I only hope I have a better outcome.0 -

Mbna put it on an arrangement in feb 2007 when with a paid for debt mangement company had a year before that showing One payment late ie 2006 in 2011 left paid debt mangement went back to normal payments on barclays mbna refused to return to normal payments and then put on credit file d m status settled all the other accounts I had by one which will last payment in September . mbna marks it red with ar monthly status 10 years up in 2018 on credit file for six more years ie 2024 ico said its fair I agreed to plan feel very duped went to fos but seems very slow0

-

All very confusing, only wish I had a better understanding of it all, when I look at all the CRA's the data they hold for that account isn't consistent at all. Some show AR / AP or DM markers where on experian they show all 0's and have a flag stating DMP 01/03/2007 till 01/05/2014 yet they still continue to report the account in a DMP.

I'd be interested to see what happens next month as the flag will be incorrect??0 -

Are your monthly status green on experin will you account be fully paid up next month0

-

Just a quick update as I posted earlier on in the thread.

Capital 1, AP markers agreed not applied fairly. Retrospective default applied for 2006, now gone off my file.

Creation finance. Firstly they refused point blank to remove the 2 years+ of AP markers. Before writing to the Ombudsman I asked creation to prove they informed me of the consequences of the reduced payments and how they would be reported to the credit reference agencies. Today. I had confirmation that they agreed that they had not informed me in any way and have upheld my complaint. All AP markers will be removed in the next 30 days. Happy days.

I now feel after paying back all my debts I'm finally free from the stupidity of my youth and I will have a clean healthy credit file.

For those who are fighting these marks don't give up!!0 -

I contacted Barclaycard again about this, and was told there had been a technical error after they had made previous amendments which caused the markers to be rewritten.Following my success above, I just logged into Noddle, they have deleted, but there is still one AP marker there.. Would this still affect any decision if I applied for credit?

They have told me they have removed all data again.

...and I got another £25 cheque for the inconvenience I hope this is now fully resolved. I Hate Jobsworths!!!0

I hope this is now fully resolved. I Hate Jobsworths!!!0 -

Hello everyone,

Been reading your thread and tried to talk to barclaycard about my AP markers, sent a letter first, then they've been ringing me saying sorry can't change it, it's an arrangement plan we agreed, you followed so therefor it's correct. End of.

So I said ok I will go to the financial ombudsman, to which they have stated in a final letter saying nothing we can do about your case as what we have marked your account as, is correct.

My concern is; all you guys AP markers should have fallen off years ago does that make your case much different to mine........

I've been paying off my creditors using step change DMP paid them all off 2 months ago (all my other creditors defaulted me) and these defaults will come off in another 3 years, whereas barclaycard will now affect me for another 6 years from 2 months ago. Does that make sense, do you think I should send a letter to the financial ombudsman or is barclaycard correct in what they are saying.

Thanks guys.MFW 2018/19 #55 target: £6,847.26/ £500 paid0 -

I have had mine for 8 years could not get them to change as they said I asked to pay less and reduce the interest which they did from 39 to 21 per cent I took it to fos about six weeks ago but not had a response so I would take it to fos or you could be marked for years mine will be between 18 years at best and 23 at the worst0

-

Well had a letter back from capital one saying after checking my credit file they confirm what they have recorded is a true reflection, if I have any queries to ring them on blah blah blah...

Tried this however the number they supply is automated and the only way you can get through is supplying credit card number and security details.. Do they really expect me to have these after 7 years.

Right I entered a DMP in March 2007 now capital one have marked my credit file with around 26 months of 6's and AP markers before finally defaulting me in may 2009, is it me or does this go against ICO guidelines?

Any ideas how I should tackle this or any contact emails or addresses would be helpful. The account was satisfied in feb 14 but it's the only negative showing on my file now.0 -

Well had a letter back from capital one saying after checking my credit file they confirm what they have recorded is a true reflection, if I have any queries to ring them on blah blah blah...

Tried this however the number they supply is automated and the only way you can get through is supplying credit card number and security details.. Do they really expect me to have these after 7 years.

Right I entered a DMP in March 2007 now capital one have marked my credit file with around 26 months of 6's and AP markers before finally defaulting me in may 2009, is it me or does this go against ICO guidelines?

Any ideas how I should tackle this or any contact emails or addresses would be helpful. The account was satisfied in feb 14 but it's the only negative showing on my file now.

Yes, that goes against the guidelines.

Did they say you can refer to FOS if not happy?

I would do that anyhow:

http://www.financial-ombudsman.org.uk/consumer/complaints.htm:beer:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards