We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Barclaycard AP removal [successful]

Comments

-

hi I just wanted to say thanks to GAZ (?) whose letter is at the beginning of this thread. I was in the same situation with BC and AP markers. I adapted the letter you posted on here, emailed it over and they have agreed to remove the file from my credit record! I am extremely happy, so thanks! Equifax removed it straight away, waiting for the other 2 to follow suit. Not sure how long they will take though.

Can take a month so I would give them that long.:beer:0 -

Very odd. I'm in the process of ordering my Statutory Credit Report from Experian and Equifax to see what they come back with on theirs.

There was no mention in HSBC's letter that they'd reopen the account to clear the AP markers!

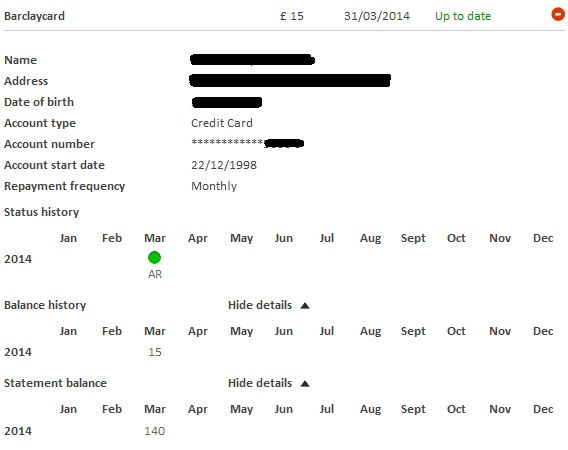

This is what appears on my Noddle report...

Interestingly enough my Stat. report from Equifax has shown my AP markers have been removed from there; and that the account hasn't been reopened and the date satisfied is still the same (2008.)

Strange. At least its a clean entry.

Maybe just write and ask them to close it?:beer:0 -

happy_bunny wrote: »Strange. At least its a clean entry.

Maybe just write and ask them to close it?

I think it's worth a shot, definitely... just waiting for Capital One to get back to me as that's still showing the markers.It's not your credit score that counts, it's your credit history. Any replies are my own personal opinion and not a representation of my employer.0 -

I too have sent off GAZ$'s letter to Barclaycard, sent it on Thursday and have an email from Barclaycard today confirming that they will remove the details of the AP, and change it so that it would've been a default that expired in 2013, essentially, it will no longer appear on my credit report

great stuff, just awaiting responses from Sainsburys Bank and Capital One, who have been a nightmare to deal with historically, but we'll see0 -

chaosmonkey wrote: »I too have sent off GAZ$'s letter to Barclaycard, sent it on Thursday and have an email from Barclaycard today confirming that they will remove the details of the AP, and change it so that it would've been a default that expired in 2013, essentially, it will no longer appear on my credit report

great stuff, just awaiting responses from Sainsburys Bank and Capital One, who have been a nightmare to deal with historically, but we'll see

If they refuse, refer to the FOS.:beer:0 -

My circumstances are pretty much exactly the same as GAZ$,

I too have just fired off a couple of emails from the template that GAZ$ supplied.. Fingers crossed I should have some success!!

Out of interest has anyone found that on experian my barclays account shows markers being paid on time (green 0's) however equivax and call credit show AP or AR markers since 20070 -

My circumstances are pretty much exactly the same as GAZ$,

I too have just fired off a couple of emails from the template that GAZ$ supplied.. Fingers crossed I should have some success!!

Out of interest has anyone found that on experian my barclays account shows markers being paid on time (green 0's) however equivax and call credit show AP or AR markers since 2007

It could depend on when the Barclays update the relevant information with the three credit agencies; Experian may have got the data first hence the "green markers" before Callcredit and Equifax.It's not your credit score that counts, it's your credit history. Any replies are my own personal opinion and not a representation of my employer.0 -

Following my email only 2 weeks ago, I've also had success!!!

Even got a £25 cheque for the inconvenience.. many thanks to the OP (GAZ$) for posting! :T :A

Following my success above, I just logged into Noddle, they have deleted, but there is still one AP marker there.. Would this still affect any decision if I applied for credit? I Hate Jobsworths!!!0

I Hate Jobsworths!!!0 -

Success!!!!!! Yay... After a very long phone call with a quite rude Indian man, I raised a complaint and he forwarded me onto to a very nice man called Louis who called me... At first advised me to stay in a payment plan so he could delete my account in October 2014 then after managing to send him a screen shot of my account stating I went into arrangement in 2007 he said brilliant I'll delete it now and should show on your CRA tomorrow :-). Happy days 1 down 1 more to go!!!0

-

Success!!!!!! Yay... After a very long phone call with a quite rude Indian man, I raised a complaint and he forwarded me onto to a very nice man called Louis who called me... At first advised me to stay in a payment plan so he could delete my account in October 2014 then after managing to send him a screen shot of my account stating I went into arrangement in 2007 he said brilliant I'll delete it now and should show on your CRA tomorrow :-). Happy days 1 down 1 more to go!!!

Excellent, I'm really pleased for you.... :TIt's not your credit score that counts, it's your credit history. Any replies are my own personal opinion and not a representation of my employer.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards