We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Barclaycard AP removal [successful]

Comments

-

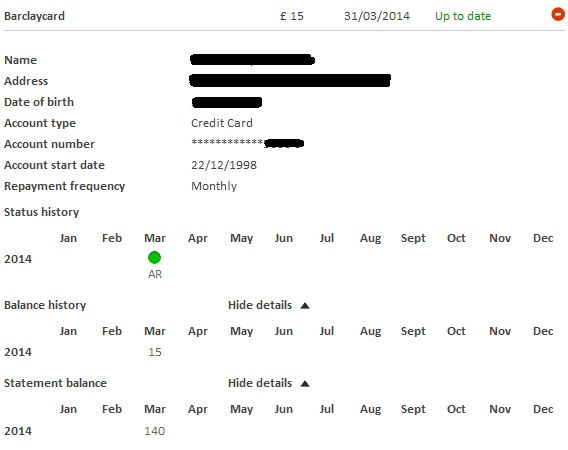

So, I've checked Equifax and the Barclaycard marker is still there. It's definitely been amended because the six years' worth of AP markers are gone, now there's a single marker of 6 late payments in April this year (which isn't the case, they've been getting continuous payments from my DMP).

Raised a dispute with Equifax, and Barclaycard's response was "Account never defaulted. Information on CRA is correct".

The thing is, they then go on to say that I should refer to a letter they sent me on the 14th of April... They did send me a letter then, but it was an acceptance of a settlement offer, and nothing to do with my complaint about the AP markers.

I've replied to Equifax to say that their response is incorrect, but may have to put another call into the Barclaycard complaints department.

My free trial with Experian ended, so I might have to pay for a month of that too to check how it's being reported with them.

Sigh.

Thought this was all sorted. Can't understand why they'd amend the file on Noddle to the correct date of default, meaning it's dropped off the file, but not do the same on Equifax.0 -

greybear40 wrote: »It doesn't say it's their final response it just says "Your account hasn't defaulted with Studio Cards. The account is still open and has never been passed to an external debt collector. Due to this it will show as an outstanding account on your credit file. If we can be of any further assistance in this matter do not hesitate to contact us." Do you think I'll get another reply from them or should just go straight to the FOS?

Hi everyone. Just an update on the Studio situation. They have replied stating "After investigation of your query I can confirm that I am unable to remove the arrangement from your credit file records as this is a true reflection of your credit history with us. After receiving a financial statement from yourself on 1 Sep 2005 you agreed to the arrangement to pay and kept to the arrangement plan. Then on 29 Dec 2013 you asked to cancel the arrangement as you wanted to resume paying the 8% monthly minimum payment". So my question is do I even try the FOS or would it not be worth it? Absolutely gutted as if these 2 accounts had defaulted in Sep 2005 they would be long gone off my file 0

0 -

Following my email only 2 weeks ago, I've also had success!!!

Even got a £25 cheque for the inconvenience.. many thanks to the OP (GAZ$) for posting! :T :AFollowing my success above, I just logged into Noddle, they have deleted, but there is still one AP marker there.. Would this still affect any decision if I applied for credit?

Sounds similar to mine (above). Since my account has not been used since 2001, and they state they are not pursuing the £15 balance, I have written to them asking them to close the Barclaycard account, and mark the CRAs as so.. I await their response.So, I've checked Equifax and the Barclaycard marker is still there. It's definitely been amended because the six years' worth of AP markers are gone, now there's a single marker of 6 late payments in April this year (which isn't the case, they've been getting continuous payments from my DMP).

Raised a dispute with Equifax, and Barclaycard's response was "Account never defaulted. Information on CRA is correct".

The thing is, they then go on to say that I should refer to a letter they sent me on the 14th of April... They did send me a letter then, but it was an acceptance of a settlement offer, and nothing to do with my complaint about the AP markers.

I've replied to Equifax to say that their response is incorrect, but may have to put another call into the Barclaycard complaints department.

My free trial with Experian ended, so I might have to pay for a month of that too to check how it's being reported with them.

Sigh.

Thought this was all sorted. Can't understand why they'd amend the file on Noddle to the correct date of default, meaning it's dropped off the file, but not do the same on Equifax.I Hate Jobsworths!!!0 -

greybear40 wrote: »Hi everyone. Just an update on the Studio situation. They have replied stating "After investigation of your query I can confirm that I am unable to remove the arrangement from your credit file records as this is a true reflection of your credit history with us. After receiving a financial statement from yourself on 1 Sep 2005 you agreed to the arrangement to pay and kept to the arrangement plan. Then on 29 Dec 2013 you asked to cancel the arrangement as you wanted to resume paying the 8% monthly minimum payment". So my question is do I even try the FOS or would it not be worth it? Absolutely gutted as if these 2 accounts had defaulted in Sep 2005 they would be long gone off my file

Yes, go to FOS. If they left you on an AP for so long that goes against the 6 months in the ICO guidelines. You are also in a worse position now than someone who made no attempt to pay.

Nothing to lose other than an hour to fill out the form and a stamp.:beer:0 -

That email address for Barclaycard is no longer active - they have left the company. Does anyone have an email address for them?

I have had AP every month since August 2011

ThanksLBM July 2011 Had debt of £52k

Lost my old forum details so set up a new account

Debt now £38k :beer:

April 2014 and debt now £20k... :beer: :j0 -

I had a nice letter from Capital One today.

I rang them about a week ago, and spoke to a very nice chap. He said he would pass it in to the team dealing with my file.

The Letter said:

" When you first advised us about your financial situation in 2007, and your account wasa subsequently set up on reduced payment plan, it was not our policy to record a default. However our guidelines changed in 2008 which suggested we should report a statement of default on those accounts where customers entered into a ong term payment arrangement.

Although I can appreciate you were experiencing financial difficulties and unable to make regular payments, this policy change was seen as a fair way to reflect that you had defaulted on your credit agreement.

We added the default in April 2009 when we reviewed the payment plan on your acount. As this had originally been set before the change to our internal policies, the default was recorded correctly. However, I can appreciate that you have made regular payments to the account and therefore I believe this should be reflected on your fredit file. It is beause of this that I have arranged to backdate the default to show as 2nd August 2007 which is the date your accouont was first placed on a reduced payment plan.

As more than 6 years have passed, the default will now drop off your credit file. Please allow up to weeks for this to update."

So, a good result.

I have also written to MBNA and Moorgate for my old MBNA Credit card (which is still saying AP 7 yrs later), Next, and Argos/Hillsden securities.

Next will drop off April next year, and Argos June 2016.

I'd be happy to have them sorted out now, but apart from MBNA the others wont make too much difference. Ill still be in my DMP until Jan 2016

MBNA, if they dont play ball, will be showing as AP/DM until 2016 so won't be clear until 2022. That will hurt,Light Bulb Moment: Feb 2007

Debt: £65560 ~~~~~~ Debt Free day 24th March 2016:T0 -

I had a nice letter from Capital One today.

I rang them about a week ago, and spoke to a very nice chap. He said he would pass it in to the team dealing with my file.

The Letter said:

" When you first advised us about your financial situation in 2007, and your account wasa subsequently set up on reduced payment plan, it was not our policy to record a default. However our guidelines changed in 2008 which suggested we should report a statement of default on those accounts where customers entered into a ong term payment arrangement.

Although I can appreciate you were experiencing financial difficulties and unable to make regular payments, this policy change was seen as a fair way to reflect that you had defaulted on your credit agreement.

We added the default in April 2009 when we reviewed the payment plan on your acount. As this had originally been set before the change to our internal policies, the default was recorded correctly. However, I can appreciate that you have made regular payments to the account and therefore I believe this should be reflected on your fredit file. It is beause of this that I have arranged to backdate the default to show as 2nd August 2007 which is the date your accouont was first placed on a reduced payment plan.

As more than 6 years have passed, the default will now drop off your credit file. Please allow up to weeks for this to update."

So, a good result.

I have also written to MBNA and Moorgate for my old MBNA Credit card (which is still saying AP 7 yrs later), Next, and Argos/Hillsden securities.

Next will drop off April next year, and Argos June 2016.

I'd be happy to have them sorted out now, but apart from MBNA the others wont make too much difference. Ill still be in my DMP until Jan 2016

MBNA, if they dont play ball, will be showing as AP/DM until 2016 so won't be clear until 2022. That will hurt,

If MBNA don't play ball, lob it to the FOS to see what they make of it.:beer:0 -

Success!Sounds similar to mine (above). Since my account has not been used since 2001, and they state they are not pursuing the £15 balance, I have written to them asking them to close the Barclaycard account, and mark the CRAs as so.. I await their response.

(Again).

Entry in the Equifax dispute from Barclaycard yesterday at 11:18am, saying "I have referred this account to complaints team to review."

Then another at 3:23pm saying "Please note credit files have now been deleted."

Equifax have updated my report immediately and the Barclaycard is gone.

Curious whether it's on Experian still, but I've paid off a few debts in the last month or so, so I think I'll wait until next month for my reports to be updated again then get the £2 statutory report to see what's what.0 -

Hello there, quick update I just wanted to let you know Barclaycard did in fact delete my account from the credit reference agencies. Success!!

I'm now trying the same with capital one who decided to default my account in 05/2009 after starting my DMP in 2007 meaning that the account will show until 05/2015, although the account is settled.

I have also sent a complaint to idem servicing, (advice wanted with this one) please?

Idem or MBNA started marking my credit file with AR markers in May 2008 although I entered a DMP in March 2007 they later in 10/2008 changed these markers into DM's is the DM the same as an AR / AP marker and fall into the same requirements highlighted by the ICO??

Any advice welcomed, regards0 -

The dm is for debt mangement plan I have the same showed ar for 3 years then when I left the debt mangement company I was with they put marker on mine complained had no luck the ico did not want to know with fos at the moment mine will show for 18 plus years0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards