We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Debt Free by September 2014 - SOA included

Comments

-

Good morning people!! Happy monday to all!! :j:j

Don't worry I'm not actually that excited that it is Monday, but I'm trying to put on a brave face.

So time to do a little round up of the weekend and last week and see where we are. First things first I made a list at the beginning of the week of stuff I needed to get done so lets have a look at that:

*[STRIKE]Thank you cards!!!!!!![/STRIKE]

*[STRIKE]eBay 5 items[/STRIKE]

*Send off Euro coins

*[STRIKE]Laundry[/STRIKE]

*Sort out my makeup/toiletry side in the bedroom

*[STRIKE]Hospital Appointment[/STRIKE]

Ok, 4 out of 6 isn't bad. The thank you cards were a major one so I'm really glad I got that done and the eBay. I very nearly didn't get it done yesterday but I gave myself a kick up the bum and got 6 items listed. Some have already got watchers so fingers crossed for some sales come the end of the week.

Spent most of the weekend in the kitchen baking. I made lemon butter biscuits and lemon whoopie pies. The whoopie pies went down a storm but they did take a long time to make, I need to invest in more baking sheets, or ask for some for Christmas.

Other than that husband and I tried to discover our post it note. You know the one really simple invention that is so useful and would make you millions. Problem was we couldn't think of anything that hadn't already been invented! Doh!

Now a round up of where I stand on challenges:

No Spend Challenge

I'm doing really well on this one I reckon. So far I have had 5 NSD days which means I am half way to my target of 10. I'm pretty confident that I should be able to manage 4 this week as well.:D

Sealed Pot Challenge

Just by putting any extra change I had in my purse and searching through the house I have put £10.26 in my sealed pot this week. Even if I keep going at a third of this rate I'll easily hit £150 in a year, so I'm confident I can hit my £200 by next Christmas.:beer:

Make £10 a Day

I was aiming for £5 a day and honestly I'm not doing very well, however I do have over £100 tied up in survey sites at the moment which hopefully I will be able to start cashing out of on some of them in the next few weeks. Also got some stuff on eBay so hopefully that will make some cash. Current amount made £2.76

100% Challenge

After the £2.75 that I had from surveys last week my percentage paid has gone from 4.22% to 4.30%!! :j:j Whoop! Not a huge amount but it's in the right direction!

To Sum Up

Amount Paid to Credit Card: £103.76

Amount Paid to Loan: £44.63

Amount of Personal Spending: £71.09 :eek: (£39 on bodyshop which won't happen again for ages)

Baking projects completed: 4

Here's to another great MSE debt busting week!! :money::money:0 -

That is one hell of a round up, wegle! Well done! I am also feeling the pressure on that make £10 a day challenge......we can do it. Just gotta focus on the end goal. Fingers crossed for those eBay auctions this week. Good lord you have a lot of cash on the survey sites! I must pull my finger out and sign up to some more of those.

And send those Euro coins off! Lol! Looks like I'm going to get the chance to actually spend mine at the end of next week instead.

Just think wegle, this time next month we will both be carrying less debt with a chunk more pennies in the sealed jars. And a year from now.....well......we'll both be dancing the debt free jig! :dance:Credit Card Freedom gained 14 Feb 2014!!Total Debt Freedom gained 29 Apr 2014!!Savings goal 30/9/23: £72,000/£538,001.....yes I'm serious!Total Debt August 2013: [STRIKE]$21,587[/STRIKE] April 2014: $0!!!!:j0 -

Ok so it's time I came clean, there's no point doing a debt free journey unless you are going to be completely honest. And I feel like a bit of a hypocrite giving other people advice when I can't even admit to the entirity of my own situation, so here goes.

I have a secret overdraft that I haven't included in my previous debt calculations. There's no excuse, and I justified leaving it off by saying to myself that I have always lived in it and that's just how it goes. No more however, I'm coming clean and I'm adding it to the pot!

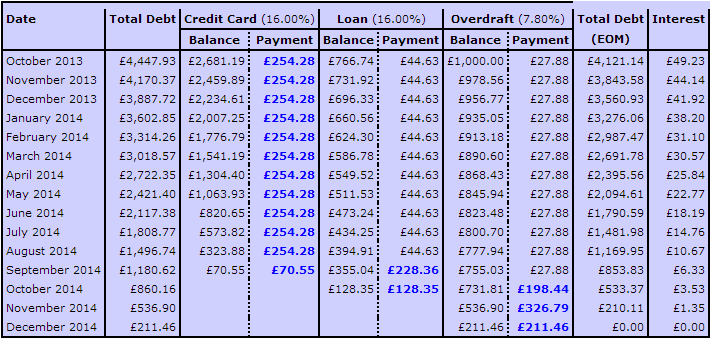

So it's a planned overdraft facility of £1000. So not a mega problem and once I've added it to my other debts and run the snowball calculator again my revised debt free date is November 2014, so only an extra 2 months!!

My plan for this is each month when I make the overdraft charge and interest payment out of my account, I'm going to treat this as the minimum repayment. The way I'll manage this is to transfer the same amount to a seperate account, so that I am building up the minimum payments. Once the credit card and loan are paid off I will stop this, transfer whatever has built up back into my account and reduce my overdraft by that amount. Then each month when I get paid I will reduce my overdraft by my surplus amount each month.

I'm going to revise my SOA here to take account of the overdraft.

Phew! That's quite a weight off my chest and I'm pretty excited actually that I will be 100% debt free by November next year. I promise I have no other naughty little secrets! Well none to do with debt anyway!!:rotfl:0 -

So here's my new SOA. I've also changed a couple of entries as hubby and I have come up with set amounts that we want to allocate to Xmas, Car servicing, emergency fund and our long term savings (these are joint expenses). The good news is it give me and extra £2.50 to allocate to debt each month!!

Statement of Affairs and Personal Balance Sheet

Household Information

Number of adults in household........... 2

Number of children in household......... 0

Number of cars owned.................... 1

Monthly Income Details

Monthly income after tax................ 1400

Partners monthly income after tax....... 0

Benefits................................ 0

Other income............................ 0

Total monthly income.................... 1400

Monthly Expense Details

Mortgage................................ 0

Secured/HP loan repayments.............. 0

Rent.................................... 285

Management charge (leasehold property).. 0

Council tax............................. 51

Electricity............................. 17.5

Gas..................................... 17.5

Oil..................................... 0

Water rates............................. 22.75

Telephone (land line)................... 15

Mobile phone............................ 40

TV Licence.............................. 6.06

Satellite/Cable TV...................... 5.99

Internet Services....................... 0

Groceries etc. ......................... 75

Clothing................................ 30

Petrol/diesel........................... 60

Road tax................................ 0

Car Insurance........................... 19.09

Car maintenance (including MOT)......... 8

Car parking............................. 5

Other travel............................ 0

Childcare/nursery....................... 0

Other child related expenses............ 0

Medical (prescriptions, dentist etc).... 10

Pet insurance/vet bills................. 4.58

Buildings insurance..................... 0

Contents insurance...................... 3.84

Life assurance ......................... 0

Other insurance......................... 0

Presents (birthday, christmas etc)...... 17

Haircuts................................ 30

Entertainment........................... 80

Holiday................................. 0

Emergency fund.......................... 25

Car Lease............................... 100

Work Tea Fund........................... 2.17

Work Lottery............................ 2.17

Graze Box............................... 16.86

Tabbaco................................. 73.7

Savings................................. 50

Total monthly expenses.................. 1073.21

Assets

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 0

Other assets............................ 0

Total Assets............................ 0

No Secured nor Hire Purchase Debts

Unsecured Debts

Description....................Debt......Monthly...APR

Credit Card....................2681.19...54........16

Loan...........................766.74....44.63.....16

Overdraft......................1000......13.94.....7.8

Total unsecured debts..........4447.93...112.57....-

Monthly Budget Summary

Total monthly income.................... 1,400

Expenses (including HP & secured debts). 1,073.21

Available for debt repayments........... 326.79

Monthly UNsecured debt repayments....... 112.57

Amount left after debt repayments....... 214.22

Personal Balance Sheet Summary

Total assets (things you own)........... 0

Total HP & Secured debt................. -0

Total Unsecured debt.................... -4,447.93

Net Assets.............................. -4,447.93

Created using the SOA calculator at https://www.stoozing.com.

Reproduced on Moneysavingexpert with permission, using other browser.

I've got to dash now, have a dentist appointment, but will repost the new snowball later. xxx0 -

Good for you hun - bet you feel better knowing you are dealing with everything now. Hugs.

Credit Card Freedom gained 14 Feb 2014!!Total Debt Freedom gained 29 Apr 2014!!Savings goal 30/9/23: £72,000/£538,001.....yes I'm serious!Total Debt August 2013: [STRIKE]$21,587[/STRIKE] April 2014: $0!!!!:j0

Credit Card Freedom gained 14 Feb 2014!!Total Debt Freedom gained 29 Apr 2014!!Savings goal 30/9/23: £72,000/£538,001.....yes I'm serious!Total Debt August 2013: [STRIKE]$21,587[/STRIKE] April 2014: $0!!!!:j0 -

Hi, you have a very similar debt to us so will be following this.Squirrelling away in September No 33It's not about the money, it's about financial freedom, being in control of it and living in the natural world and not a material world0

-

Sorry that was abrupt! Been busy trying to sort out some stoopid payment I was signed up to that I didn't consent to so mind wasn't fully on it!

I would axe the Graze box, that's 16.86 to go into a payment also saving while debt isn't worth it, just plough that money into payments too. We are freezing our savings in a high interest account until we are in a position to change it so we will keep them as they are and then pay the amount we were paying in there to pay debts. Squirrelling away in September No 33It's not about the money, it's about financial freedom, being in control of it and living in the natural world and not a material world0

also saving while debt isn't worth it, just plough that money into payments too. We are freezing our savings in a high interest account until we are in a position to change it so we will keep them as they are and then pay the amount we were paying in there to pay debts. Squirrelling away in September No 33It's not about the money, it's about financial freedom, being in control of it and living in the natural world and not a material world0 -

Good for you hun - bet you feel better knowing you are dealing with everything now. Hugs.

I am, thanks hun. Just figured there was no point lying to myself anymore!Sorry that was abrupt! Been busy trying to sort out some stoopid payment I was signed up to that I didn't consent to so mind wasn't fully on it!

I would axe the Graze box, that's 16.86 to go into a payment also saving while debt isn't worth it, just plough that money into payments too. We are freezing our savings in a high interest account until we are in a position to change it so we will keep them as they are and then pay the amount we were paying in there to pay debts.

also saving while debt isn't worth it, just plough that money into payments too. We are freezing our savings in a high interest account until we are in a position to change it so we will keep them as they are and then pay the amount we were paying in there to pay debts.

Hey Mrs GSR, welcome along. I do understand about saving whilst paying off debts, but the savings is a joint expense, whereas the debt is mine alone to deal with. Hubby and I are keen to be in a position where if anything unexpected happened we would be able to deal with it. The emergency fund is mostly for this but the savings will cover anything more expensive, for example all my family live overseas, so were anything to go wrong over there I would be able to drop everything and go straight away without any worry. If we already had some savings then we probably would do the same as you and freeze, but all our savings went into our wedding a couple of months ago, so we're starting from ground zero so to speak. Maybe a slightly a*se backwards way of doing things but it's what we're gonna stick with for now.

Yep, I've been contemplating chucking in the graze box. It is a nice little treat to have but really there's no need for it, and I can always bulk buy raisins much cheaper. Tell you what, I'll allow myself one more box and then it's gone!

Right, gonna sign off this post and do another one with my updated snowball and some targets for this week! :j0 -

Right here's the new snowball. Official definitive debt free date is December 2014. I aim to actually beat this and have it all paid off by my original target of September 2014.

Just back from the dentist and I need to have 1 filling, so that's £49 that I need to make sure I have. I paid £18 of it today, so must make sure to ear mark £31 for the rest of it next month.

So a couple of targets to keep me on track this week.

* Cancel Graze box after next week

* 5 more items for eBay this weekend

* Set up new account to put overdraft money into

* Update spreadsheets to include overdraft debt

That should be enough for now. In fact I'm gonna crack straight on with those spreadsheets!! :j0 -

I am, thanks hun. Just figured there was no point lying to myself anymore!

Hey Mrs GSR, welcome along. I do understand about saving whilst paying off debts, but the savings is a joint expense, whereas the debt is mine alone to deal with. Hubby and I are keen to be in a position where if anything unexpected happened we would be able to deal with it. The emergency fund is mostly for this but the savings will cover anything more expensive,? example all my family live overseas, so were anything to go wrong over there I would be able to drop everything and go straight away without any worry. If we already had some savings then we probably would do the same as you and freeze, but all our savings went into our wedding a couple of months ago, so we're starting from ground zero so to speak. Maybe a slightly a*se backwards way of doing things but it's what we're gonna stick with for now.

Yep, I've been contemplating chucking in the graze box. It is a nice little treat to have but really there's no need for it, and I can always bulk buy raisins much cheaper. Tell you what, I'll allow myself one more box and then it's gone!

Right, gonna sign off this post and do another one with my updated snowball and some targets for this week! :j

I see where you are coming from. We too have family abroad and DH had to go over earlier in the year (again adding into the debt!) I guess every situation is different, ours is joint debt so we are focussing on that, we are still paying small amounts to the childrens accounts though.

Weddings are so expensive too, we were lucky that we didn't have much to pay from ours.

Graze boxes are a lovely treat but yeah buy a few bags of nuts and raisins and little pots and ou can prduce something similar Squirrelling away in September No 33It's not about the money, it's about financial freedom, being in control of it and living in the natural world and not a material world0

Squirrelling away in September No 33It's not about the money, it's about financial freedom, being in control of it and living in the natural world and not a material world0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards