We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Debt Free by September 2014 - SOA included

wegle

Posts: 546 Forumite

Hello everyone!

I've been a long time lurker and follower of MSE but have finally decided that I just want rid of this debt now and am going to get serious about it. I've never had any trouble making debt repayments but I've always been just happy to pootle along paying what I can instead of really getting my teeth into it to get it done.

My husband and I got married 2 months ago and we want to try for a baby in a couple of years or so but I want a completely clean slate, no debt before we start down that road.

I've done an SOA which I will post below, I don't really need tips on where to cut back as I can see the obvious ones (smoking, I know!), but I want to use this thread as a motivational tool to keep me on track and hopefully get some ideas of where I can get a little extra each month on top of my income to make things go quicker. However please do hilight the areas where you think I could cut back as that is always an option if I want to speed things up even more or if I have a change in circumstance. Also please point out anything I might of missed.

Even though I'm married thism SOA is based on me alone, my husband and I earn approx the same money so split everything down the middle. He has his own expenses from before he met me, child maintenance, his son's trust fund and I have my debt. We both agreed when we got together that we would be responsible for managing our own money bar any joint expenses which would be halved. Obviously if it were a dire straits situation we would help each other out, but that isn't my situation so that's why his income is not included. So without further ado here's my SOA, I really hope you can read it properly I'm on my iPad and it won't let me use the MSE format tool button.

Statement of Affairs and Personal Balance Sheet

Household Information

Number of adults in household........... 2

Number of children in household.........

Number of cars owned....................

Monthly Income Details

Monthly income after tax................ 1400

Partners monthly income after tax....... 0

Benefits................................ 0

Other income............................ 0

Total monthly income.................... 1400

Monthly Expense Details

Mortgage................................ 0

Secured/HP loan repayments.............. 0

Rent.................................... 285

Management charge (leasehold property).. 0

Council tax............................. 51

Electricity............................. 17.5

Gas..................................... 17.5

Oil..................................... 0

Water rates............................. 22.75

Telephone (land line)................... 15

Mobile phone............................ 40

TV Licence.............................. 6.06

Satellite/Cable TV...................... 5.99

Internet Services....................... 0

Groceries etc. ......................... 75

Clothing................................ 30

Petrol/diesel........................... 60

Road tax................................ 0

Car Insurance........................... 19.09

Car maintenance (including MOT)......... 12.5

Car parking............................. 5

Other travel............................ 0

Childcare/nursery....................... 0

Other child related expenses............ 0

Medical (prescriptions, dentist etc).... 10

Pet insurance/vet bills................. 4.58

Buildings insurance..................... 0

Contents insurance...................... 3.84

Life assurance ......................... 0

Other insurance......................... 0

Presents (birthday, christmas etc)...... 25

Haircuts................................ 30

Entertainment........................... 80

Holiday................................. 0

Emergency fund.......................... 50

Tabbacco................................ 73.7

Pet Food................................ 15

Graze Box............................... 16.86

Work Lottery............................ 2.17

Work Tea Fund........................... 2.17

Car Lease............................... 100

Total monthly expenses.................. 1075.71

Assets

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 0

Other assets............................ 0

Total Assets............................ 0

No Secured nor Hire Purchase Debts

Unsecured Debts

Description....................Debt......Monthly...APR

Credit Card....................2681.19...54........16

Loan...........................766.74....44.63.....16

Total unsecured debts..........3447.93...98.63.....-

Monthly Budget Summary

Total monthly income.................... 1,400

Expenses (including HP & secured debts). 1,075.71

Available for debt repayments........... 324.29

Monthly UNsecured debt repayments....... 98.63

Amount left after debt repayments....... 225.66

Personal Balance Sheet Summary

Total assets (things you own)........... 0

Total HP & Secured debt................. -0

Total Unsecured debt.................... -3,447.93

Net Assets.............................. -3,447.93

Created using the SOA calculator at https://www.stoozing.com.

Reproduced on Moneysavingexpert with permission, using other browser.

based on these figures I have done a snowball calculation and I should be able to be debt free in 13 months, hence the title of this thread. That would be perfect because that would give us a year after my debts are paid off to start saving for baby!

Anyway, please, any info, tips, motivation, general chit chat you guys can offer would be great. Xxxxx

I've been a long time lurker and follower of MSE but have finally decided that I just want rid of this debt now and am going to get serious about it. I've never had any trouble making debt repayments but I've always been just happy to pootle along paying what I can instead of really getting my teeth into it to get it done.

My husband and I got married 2 months ago and we want to try for a baby in a couple of years or so but I want a completely clean slate, no debt before we start down that road.

I've done an SOA which I will post below, I don't really need tips on where to cut back as I can see the obvious ones (smoking, I know!), but I want to use this thread as a motivational tool to keep me on track and hopefully get some ideas of where I can get a little extra each month on top of my income to make things go quicker. However please do hilight the areas where you think I could cut back as that is always an option if I want to speed things up even more or if I have a change in circumstance. Also please point out anything I might of missed.

Even though I'm married thism SOA is based on me alone, my husband and I earn approx the same money so split everything down the middle. He has his own expenses from before he met me, child maintenance, his son's trust fund and I have my debt. We both agreed when we got together that we would be responsible for managing our own money bar any joint expenses which would be halved. Obviously if it were a dire straits situation we would help each other out, but that isn't my situation so that's why his income is not included. So without further ado here's my SOA, I really hope you can read it properly I'm on my iPad and it won't let me use the MSE format tool button.

Statement of Affairs and Personal Balance Sheet

Household Information

Number of adults in household........... 2

Number of children in household.........

Number of cars owned....................

Monthly Income Details

Monthly income after tax................ 1400

Partners monthly income after tax....... 0

Benefits................................ 0

Other income............................ 0

Total monthly income.................... 1400

Monthly Expense Details

Mortgage................................ 0

Secured/HP loan repayments.............. 0

Rent.................................... 285

Management charge (leasehold property).. 0

Council tax............................. 51

Electricity............................. 17.5

Gas..................................... 17.5

Oil..................................... 0

Water rates............................. 22.75

Telephone (land line)................... 15

Mobile phone............................ 40

TV Licence.............................. 6.06

Satellite/Cable TV...................... 5.99

Internet Services....................... 0

Groceries etc. ......................... 75

Clothing................................ 30

Petrol/diesel........................... 60

Road tax................................ 0

Car Insurance........................... 19.09

Car maintenance (including MOT)......... 12.5

Car parking............................. 5

Other travel............................ 0

Childcare/nursery....................... 0

Other child related expenses............ 0

Medical (prescriptions, dentist etc).... 10

Pet insurance/vet bills................. 4.58

Buildings insurance..................... 0

Contents insurance...................... 3.84

Life assurance ......................... 0

Other insurance......................... 0

Presents (birthday, christmas etc)...... 25

Haircuts................................ 30

Entertainment........................... 80

Holiday................................. 0

Emergency fund.......................... 50

Tabbacco................................ 73.7

Pet Food................................ 15

Graze Box............................... 16.86

Work Lottery............................ 2.17

Work Tea Fund........................... 2.17

Car Lease............................... 100

Total monthly expenses.................. 1075.71

Assets

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 0

Other assets............................ 0

Total Assets............................ 0

No Secured nor Hire Purchase Debts

Unsecured Debts

Description....................Debt......Monthly...APR

Credit Card....................2681.19...54........16

Loan...........................766.74....44.63.....16

Total unsecured debts..........3447.93...98.63.....-

Monthly Budget Summary

Total monthly income.................... 1,400

Expenses (including HP & secured debts). 1,075.71

Available for debt repayments........... 324.29

Monthly UNsecured debt repayments....... 98.63

Amount left after debt repayments....... 225.66

Personal Balance Sheet Summary

Total assets (things you own)........... 0

Total HP & Secured debt................. -0

Total Unsecured debt.................... -3,447.93

Net Assets.............................. -3,447.93

Created using the SOA calculator at https://www.stoozing.com.

Reproduced on Moneysavingexpert with permission, using other browser.

based on these figures I have done a snowball calculation and I should be able to be debt free in 13 months, hence the title of this thread. That would be perfect because that would give us a year after my debts are paid off to start saving for baby!

Anyway, please, any info, tips, motivation, general chit chat you guys can offer would be great. Xxxxx

0

Comments

-

Arrrggghhh I spent ages putting spaces in between the words and numbers to try and make it look nice but it didn't work! Sorry guys, I will get into work early tomorrow morning so I can use the computer there to post it properly. Xxx0

-

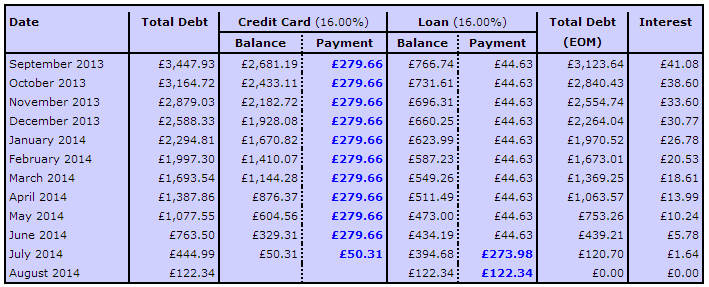

Right I've managed to get it all formatted correctly and I've also got a nice neat table of my snowball calculation.

Had a chat with husband about all this last night and he thinks it's a great idea. We've also given me a more solid incentive (rather than the potential to have a baby). I've wanted a Macbook for ages but with saving for the wedding and having debt it's just never seemed appropriate or achievable. Now however, as soon as my credit card & loan is paid off I am allowed to start putting the money aside so I can buy one. I reckon this means I could have it by Christmas next year as long as I stick to the plan!!0 -

Had a really positive day today. I've joined the NSD challenge and I'm going to do the make £10 a day challenge but I'm going to aim for £5 for my first month. Already been thinking of what I can do. Other positive debt busting stuff I have done:

- Made a spreadsheet to log my spending for the NSD challenge

- Did all my survey invites one of which resulted in being invited to an online focus group which I've just finished and will pay me £10!!

- Got an old coffee tin from work to use as a sealed pot. Scoured the house for change and emptied our little copper jar £13.28 in there to get that started!

- Been reading MSE threads to get me motivated.

- Looked at switching energy supplier as our fixed term comes to an end on 31 October.

- Logged onto clubcard website to look at coupons and vouchers that can be used for next months big shop.

- Found a 17p off next shop receipt voucher for Tesco in my handbag. Instead of chucking it like I would normally, have stuck it on the fridge to use at next big shop. Every little helps!!! :-)

I did buy myself one little treat today but it will be worth it in the long run. Bougt a 250 sweet treats recipe book. I've recently got into baking and it has become my weekend hobby, however I've finished all the recipes in my learn to bake book so I'm looking forward to getting into this new one. It only cost £4, so I'm happy with that!

Tomorrow is pay day. I have 5 bank accounts. My current account, our joint account (which is only for joint expenses, never spending money), an esavings account, a cash ISA and a spare current account.

I use the spare current account as a holding account for my CC payment. The CC payment is always due on the 29th of the month but I'm usually paid on the 30th or 31st so what I normally do is move the minimum payment from my current account to the spare one then I can't spend it by accident. Then I move it back to my current account for the 29 th when the direct debit goes out. I'm going to use this for my overpayments too. Plan is tomorrow when I get paid to put the £324.29 into the spare account then on the 29th pay the minimum and the overpayment. I could just pay the overpayment straight away tomorrow but I'm really conscious of once it's gone it will be gone. At least by holding it separate until the end of the month if there is any emergency then at least I have something to dip into.

Our esaver has nothing in at the moment and our ISA has our wedding present money. I refuse to use this money for debt repayment, it was given to us as a gift for our marriage and should be spent on something appropriate. Current plan is to spend it on a trip to Silverstone next year to watch the British Grand Prix on our wedding anniversary. We're huge F1 fans and have never been to see a race live so this will be a real treat for us and something we will remember forever.

There's five weekends in September so I have to stretch my usual £20 a weekend entertainment money over 5 weekends instead of 4 but I'm sure we can do it. Lots of movie watching and free walks with the doggy. Hubby is happy playing his computer game for fun and I can catch up on some TV series I've missed. Plus, my new baking book will keep me occupied.

Got 3 birthdays this month, but none of them are ones we buy gifts for and the one that actually might entail any going out actually falls on next months payday so they should be cometely manageable.

We're currently waiting to take delivery of our new car which is due in October. The figures above are based on this. Our current car has suffered big end failure which apparently means its knackered! It's still soldiering on though for the time being, just really hope it lasts until the new one gets here. We've always bought second hand cars then end up spending a fortune keeping them going, this time we've gone down the PCP route with the intention of only ever leasing the car, so we will return it in 3 years and start a new lease on another vehicle. I know technically it's a form of debt but I have no intention of ever owning this car and I much prefer the idea of paying a monthly rental for the use of a brand new, economical, warranty covered car than saving for ages for another crappy lump of metal. Hopefully when we get the new one we'll be able to sell this one for something. It won't be a lot but every penny counts.

Ok I've rambled on far too much now, so I'm off to have a cuppa and put my feet up!0 -

I've just realised that I probably should have posted this in the debt free diaries bit. Sorry! I'll see if I can get it moved.0

-

Hi Wegle -

Good luck in your Debt Free Quest. I think it's great that you're thinking ahead to the day you'll be saving for your Macbook & being debt free for when you start a family.

The fags bill looks high in comparison to the food - could you have a No Ciggies Day, or cut out 1 or more cigs a day & put the amount you've saved by not smoking them in a special pot to put towards overpayment?

ie. if each cig costs 40p & you smoke 5 less one day than you would normally, you put £2 in the pot that day...

I'm not going to go on at you about what a terrible habit it is as I hate nagging & I am (unfortunately) still a smoker too! :embarasse0 -

Hi Geanariesgirl, thanks for stopping by!

I know, the fags are terrible and such a high spend to literally puff up in smoke. I know I can quit. I gave up for 18 months 2 years ago, my problem is I really do enjoy it. It's my one vice. I don't drink, I eat very healthily and I run approx 40 miles a week. You're right though even a couple not smoked a day would save some money. In fact before posting this I was just about to pop outside for one, but I'm going to follow your advice and just have a glass of squash instead! I've just done a quick calculation and each cig I smoke costs 25p, so I shall put 25p in my pot tomorrow!

Xxxx0 -

Hi Wegle. Joining you on your journey. Also not nagging as an ex smoker but perhaps also use your cutting down as a baby incentive. One less a day is one step closer to a healthier pregnancy. I say healthier as I couldn't run 40 miles if I tried.0

-

Tell me about it! It's the only time when I get "time out" - I've tried having a cup of tea / glass of water outside or just sitting but my mind keeps whizzing around & I feel guilty about not DOING something - with a cig break everything is put on <pause>.:cool:my problem is I really do enjoy it...

I went to one of those Stop Smoking clinic thingys & came back after tests as non nicotine dependent, above average fitness but "psychologically dependent" on the act of smoking... they sent me away, saying there was nothing they could do to help.

I've got to quit too & I have before for over a year, just need something to fill the hole my fag breaks will leave! 0

0 -

Hi There, I wanted to wish you well on your Journey and I hope it's okay that I will Subscribe and keep up to date with your Journey?

I won't nag on the Cigarettes front either....because when I gave up I was determined NOT to be one of those annoying people who told everyone else to give up. However, just a quick thing....I used to spend about £250 a month on cigarettes :eek: And when I gave up I used the money to start a Course that I had wanted to do since I was 16....and I'm still on that Course now and nearly at the end of it....So think about what you could spend your money on....maybe part of it could go towards a treat for yourself....and the other bit on Debt Repayments? And I shall shut up now

You seem to be doing really really well....Keep Going!0 -

Hi Wegle. Joining you on your journey. Also not nagging as an ex smoker but perhaps also use your cutting down as a baby incentive. One less a day is one step closer to a healthier pregnancy. I say healthier as I couldn't run 40 miles if I tried.

Hi Roxy - Welcome! You're right, I would want to cut down before we started trying and eventually totally give up. I'm very concious that I'm over 30 now and don't want to hinder my baby making ability in anyway. I just know that right now, I don't want to quit, so I'm going to follow Graneriegirls advice and for each ciggie not smoked put 25p in my pot, at least I will be able see a direct benefit.

It took a long time to get to running 40 miles! I remember when I first started about 4 years ago on the Couch to 5K programme, you had to run for 30 seconds then walk for 2 minutes, until you had done 30 mins in total. I thought I was going to die!!! Granariesgirl wrote: »Tell me about it! It's the only time when I get "time out" - I've tried having a cup of tea / glass of water outside or just sitting but my mind keeps whizzing around & I feel guilty about not DOING something - with a cig break everything is put on <pause>.:cool:

Granariesgirl wrote: »Tell me about it! It's the only time when I get "time out" - I've tried having a cup of tea / glass of water outside or just sitting but my mind keeps whizzing around & I feel guilty about not DOING something - with a cig break everything is put on <pause>.:cool:

I went to one of those Stop Smoking clinic thingys & came back after tests as non nicotine dependent, above average fitness but "psychologically dependent" on the act of smoking... they sent me away, saying there was nothing they could do to help.

I've got to quit too & I have before for over a year, just need something to fill the hole my fag breaks will leave!

I think I'm probably the same. Last time I quit was because my husband had decided he wanted to stop, and I thought as he was I might as well. He went and got all these patches, books, mints etc but I didn't use any, I just stopped buying tabacco and stopped smoking. It's good because I know I can quit when I want to, but it's bad as well as I use the excuse, "I'll quit soon, I know I can do it easy.". I am definitely addicted to the act of smoking, I love a ciggie when I'm stressed, and a coffee break just isn't the same without one.DreamerHelen wrote: »Hi There, I wanted to wish you well on your Journey and I hope it's okay that I will Subscribe and keep up to date with your Journey?

I won't nag on the Cigarettes front either....because when I gave up I was determined NOT to be one of those annoying people who told everyone else to give up. However, just a quick thing....I used to spend about £250 a month on cigarettes :eek: And when I gave up I used the money to start a Course that I had wanted to do since I was 16....and I'm still on that Course now and nearly at the end of it....So think about what you could spend your money on....maybe part of it could go towards a treat for yourself....and the other bit on Debt Repayments? And I shall shut up now

You seem to be doing really really well....Keep Going!

Hey DreamerHelen, thanks for stopping by and subscribing! I've tried in the past using the idea of what would I spend the money on, but generally me and husband aren't overly materialistic and I think we even had one conversation about what we would spend the money on and all I wanted to spend it on was ciggies!! Doh!!

I've got active goals now though, baby in the next couple of years, MacBook, first anniversary to Silverstone (this trip is paid for but I'd like to take a load of spending money and get me and hubby some Mercedes merchandise before we go), this means I can see the benefit of putting the money elsewhere.

All you guys have given me an idea, I'm going to, as part of this diary write down the number of ciggies smoked each day. This might help spur me on to cut back.

On the money front, I have been paid today! Yay! Just spent 20 mins moving money around on the online banking. £324.29 has been put in my spare account so it is tucked away for debt repayments. I've put my share of the joint costs in the joint account. I'd forgotten that we had been awarded a 1% pay rise which has been back dated to April so this was in my wages too. I have been very MSE though and immediately paid it to my credit card! If you never had it you can't miss it and all that!. £47.39 overpayment made! Yay!

Other MSE things I am going to do today.

- Need to get some petrol but will wait till later when I'm going past Tesco to fill up there so I can get clubcard points

- Need to do the big shop. Will do online at home to avoid temptation on things we don't need. Will remember to check my clubcard account for relevant vouchers I can use.

- Complete all my surveys, I've already got 6 invites in my inbox

- Cancel Experian and Equifax!!!!!! :eek::eek::eek: Meant to do this for ages but keep forgetting!!

NSD and £5 a day challenge start on Sunday, I've already got some great ideas!

Tonight is treat night in our house, so me and Mr Wegle will be having fish and chips for tea and watching a movie. Not exactly the high life, but it means we will have a treat and it should come in under £8.

Have a great day everyone!! xxxx :j:j:j0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards