We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Gold, lost its Glister?

Comments

-

I'm hoping the price drops further or at least stays as low for a while, which I think it will.

I hold gold, in physical form. Not much, but I've bought in the past when I've had spare cash and nothing else has interested me.

Just to explain, MY reasoning for buying it. Unless I've under planned for my retirement etc, my gold will never be sold. The decision to sell will have to be taken by the beneficiaries in my will. In essence, I buy to gift later. Buying and selling gold for a profit doesn't really interest me too much. If I need to sell it, then things have gone pretty bad, financially, for me and under those circumstances, realising the 'investment', at a loss, will hurt, but needs must and all that.0 -

I had a shock yesterday.

Saw how much the price of Thai gold had dipped.

Ouch.

Will it go lower?We love Sarah O Grady0 -

I had a shock yesterday.

Saw how much the price of Thai gold had dipped.

Ouch.

Will it go lower?

If I knew that I wouldn't have got up at 6am to go to work this morning!

I think there's a fair chance that it will. It's hard to see where buying support is going to come from in the face of potential sales of 3,000 tonnes out of Europe. There simply aren't buyers in the market at anything close to the current price for that amount of gold.

That's going to weigh on the futures price which will force down the spot (current price) as the future price can't be less than the cost of covering going short today otherwise I can make money by shorting today and buying to cover tomorrow with a guaranteed profit (if my counterparty doesn't go bust).0 -

Looks like they're having their faces washed over on hpc.co.uk.0

-

Something to consider if you are weighing up options between trackers you find is that although the underlying asset is basically the same, some physical metals ETFs are priced in USD rather than pence. If you had your investment cash in sterling inside your ISA and were trying to buy a USD listed ETF, you might find that your broker/ platorm would add up the trade in USD and charge a couple of percent in the exchange rate when buying it with your pounds.Shaolin_Monkey wrote: »Not a recommendation, but ETFS Physical Gold (PHGP), Gold Bullion Securities (GBSS) or iShares Physical Gold ETC (SGLN) are backed by physical metal and track the gold spot price. They are traded on the London Stock Exchange like a share.

The ETFS Phys Gold and iShares funds are eligible to hold in an ISA.

Both the ETFS and iShares are GBP so no difference there. But for example ETFS also do a physical Platinum, Palladium, Silver, Gold basket (PHPM) which is USD priced. Just something to be aware of if you have a broker with bad exchange rates.0 -

marathonic wrote: »My new pension plan is invested 5% in JPM Natural Resources, and has been for the past 6 weeks.

It's taken a hit but, luckily, I haven't transferred my previous pot over - so it's only 5% of two monthly contributions invested.

The fund is one of the poorest performers of recent years but I'll be sticking with it, even after I transfer over my old pension pot. It does have significant exposure to precious metals so, for now, I'm holding off on transferring my old pot over.

A 5% total investment in this fund will probably see approximately 2% of my pension invested in precious metals. This would be what I would consider the highest risk portion of my pension.

I have gone for First State Global Resources for my ISA this year, need to take the rough with the smooth Looks like a bit of a fight back today

Looks like a bit of a fight back today  'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0

'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

Ark_Welder wrote: »Oh yes they do! But some might pay more VAT than others

Only those that aren't VAT registered actually have VAT as a cost to the business.

The rest merely act as tax collectors on behalf if the government.0 -

Drops in any commodities price can be explained, eventually. The answers for the year and a half bear for gold are not easily identifiable.

The proposed Cypriot sale is a joke answer, the IMF sold way more than that, and gold did not dip.

Margin calls are only boosting sales, not the root cause of what we are seeing.

Bubbles bursting can only be agreed on when the stuff is near worthless. In the meantime it's just a lot of spikes and dips, nothing to do with bubbles.

Conspiracies, manipulations, and lizards, can be left to other threads.

No, it seems that good old fashioned laws of supply and demand are at work in my opinion.

Question I can't answer is who is selling, why they're selling, and why are they selling now. The last time a major sell off occurred was 2008, so lets look for any similarities.

I feel like I'm in a theatre and the curtains have just opened on a new production that may be a hit, or a miss.

..._0 -

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

I have gone for First State Global Resources for my ISA this year, need to take the rough with the smooth

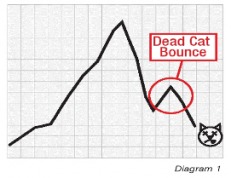

Looks like a bit of a fight back today

Looks like a bit of a fight back today

I'm not sure if this is genuine support or some short coverage.

After all, if you had a short on with a 5% margin you've almost certainly doubled your money and might even have quadrupled it!

Having said that, the resources 'space' is possibly a bit oversold as a whole. I'm not sure China is in as bad a position as people say and anyway, if stuff is going to be made in the USA again rather than China it still needs to be made of something.

I guess the big fear has to be deflation, that too much stuff is being made and the world needs to make fewer things. That is still out there and will destroy commodities' prices.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards