We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Gold, lost its Glister?

Comments

-

Wait till it goes to less than half in less than a year, you'll see what I mean then. There is a tipping point of regret.

I could be wrong, but you appear to be saying (almost to the extent of glee) that you expect the value of my house to drop by 50%+ by March next [STRIKE](October this)[/STRIKE]year. Even if it did it would still be valued at far more then we paid for it. We are mortgage free, and I am retired, so have no need/intention to try to sell anyway. What's your point? Did you suffer a loss of that scale at some point? Or have you waited and waited for too long before buying?

WR

(Edited as shown - sorry I misread your post!)0 -

HAMISH_MCTAVISH wrote: »

Ironically the commodity stocks are virtually the only risers on the ftse today.'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

HAMISH_MCTAVISH wrote: »

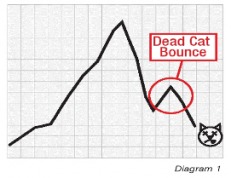

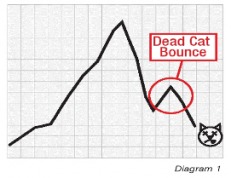

Oddly, I woke up at 5AM this morning and powered up IG Index. I thought "time for a dead cat bounce" and closed out half my position at 1346. Now, why didn't I have the courage of my convictions and close the whole position, as the price is up 30 since then?

The real question is where it will go next, and I recognise my current position accurately as that of a "pseudo-information-based-transactor". In other words, I don't have a clue!No reliance should be placed on the above! Absolutely none, do you hear?0 -

-

it's quite plausible to argue that gold hasn't had a bull run, but that paper currencies have been steadily falling with the QE dilution. what we're seeing here is actually a sudden 'bubble' in the paper, which will surely burst.

any time it looks like gold is bust, just expand the timescale on your graph and this looks like a blip in the longer term trend.:beer:0 -

taking_stock wrote: »it's quite plausible to argue that gold hasn't had a bull run, but that paper currencies have been steadily falling with the QE dilution. what we're seeing here is actually a sudden 'bubble' in the paper, which will surely burst.

any time it looks like gold is bust, just expand the timescale on your graph and this looks like a blip in the longer term trend.

The problem with gold, like fiat currency, is that it is all based on public confidence. If the public lose confidence then it fails, thats the same for gold as it is for fiat currencies.

At least when you own shares, you own a percentage of a business. Even if the market prices that share very low, you still know what you own and the percentage of that companies earnings that are effectively yours. With gold, all you have is what other people will pay for it, and the extremely unlikely event of an end to fiat currency and return to gold as currency (too impractical to actually happen, plus governments have a vested interest in retaining fiat currency)Faith, hope, charity, these three; but the greatest of these is charity.0 -

Wozza has some good stuff to say on gold:

http://investorplace.com/2012/05/why-warren-buffett-hates-gold/You could take all the gold that’s ever been mined, and it would fill a cube 67 feet in each direction. For what that’s worth at current gold prices, you could buy all — not some — all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?0 -

Wild_Rover wrote: »Hi warehouse - sorry to hear that. I've been watching the sovereigns price on line since Dec/Jan, but hadn't taken the plunge - I was going to buy a few 2012/13 ones as souvenirs as I retired on 31 Dec. I had considered buying 10 :eek::eek:with the "logic" being that if the price rose enough I'd sell; then buy 11 if the price fell enough I have always been pretty cautious, so never took a final decision.

Thanks WR. I'm not a serious investor. I just intend to buy sovereigns when I can afford the next one from the few quid I put away now and again. Looks like the next one will be affordable sooner than I thought . 0

. 0 -

Former assistant secretary to the United states treasury has his own view, he says fed will crush gold market and a couple of days later it crashed:

apr 10th video interview with Dr Paul Craig Roberts:

http://www.youtube.com/watch?v=0vkV50nrZwk

Interesting especially considering the source.0 -

Old_Slaphead wrote: »Only those that aren't VAT registered actually have VAT as a cost to the business.

The rest merely act as tax collectors on behalf if the government.

Not even a VAT registered business can reclaim VAT in all circumstances. That paid on business entertainment, being one.

https://www.hmrc.gov.uk/vat/managing/reclaiming/entertainment.htmLiving for tomorrow might mean that you survive the day after.

It is always different this time. The only thing that is the same is the outcome.

Portfolios are like personalities - one that is balanced is usually preferable.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards