We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

Charter have also increased their EA ISA to issue 69 at 4.16%.

Also, anyone who has within the last 14 days, taken out their previous 1yr fixed ISA at 4.24%, can open the new one at 4.3% and transfer the old one in (online) with no penalty.

Whether it`s worth bothering for 0.06% is debatable.4 -

Yorkshire Building Society, so it should use BACs.refluxer said:

Who is the current ISA with ? If they (like Charter) use the BACs ISA transfer service, then that at least means the transfer stands a chance of being completed in a few days. That'll depend on the efficiency of both providers though and some are quicker than others as staff are still involved in the transfer process, even when the fund transfer itself is electronic.Ocelot said:

Yes, I noticed that yesterday. I have an ISA maturing on 31 Dec, and I've been waiting for enough time to transfer into the 3 year one (given their 30 day funding window). Will probably open one today or friday (giving them only a few days to complete the transfer, though).refluxer said:Charter have increased the rates of their 1 and 2 year fixed rate cash ISAs to 4.30% and 4.20% respectively, which makes them the best 1 and 2 year rates currently available.

The 3 year fixed rate has had a smaller bump to 4.14%, which is not far off the best rate available for that time period.

Investec's 1 year fix is also 4.30%, but they don't allow transfers-in which rules them out for anyone looking to do that.

With Charter, you can complete a transfer request as part of the online application process but I think subsequent transfer requests involve downloading a form, printing and posting.

If the current provider doesn't use the BACs transfer service, then you'll obviously need to fill out a paper form regardless of when the transfer is requested, though.0 -

Shouldn't be an issue. Paper form deals with everythingpecunianonolet said:

So I take it it would not be an issue to transfer in from Cynergy?allegro120 said:

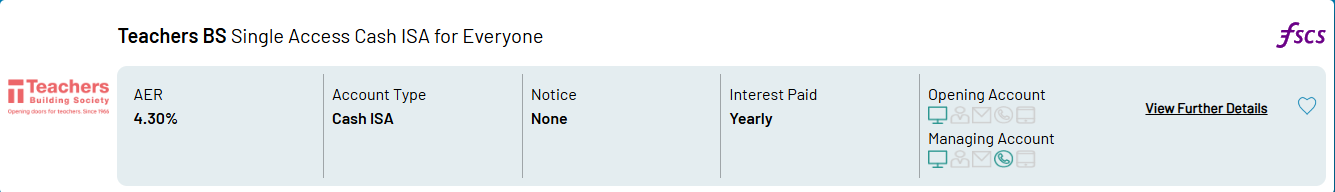

No electronic transfers. You have to scan and e-mail the form. Transfers in are quick. I've made two, one took 4 days and the other one 3 days.pecunianonolet said:Teacher BS Single Access ISA at 4.30% (4.35% for teachers)

Anyone experience with them? Are they participating in electronic transfers?

I've requested a £500 test transfer from Cynergy to Tembo 4.3% fixed. We'll see how it goes, I might add more if this transfer goes smooth. It's likely that the 4.3% rate will remain its current standing over the next 12 months.1 -

I had to jump through hoops to open this account. I used to have Tembo ISA so still had the app on my phone. Tried to login, no joy. After a long string of e-mails they reactivated my acces to the app by reactivating my old redundant ISA account. The next step (opening 4.3% fixed) didn't go smooth either. Tembo requires ID check for every new account you open even if you are an existing customer. Passport, selfie, video and saying 3 numbers failed so I had to contact Tembo again. They sent me the link to do my ID on desktop, I've done it, e-mailed Tembo rep to confirm and got the reply that my ID check passed and I can now apply for 4.3% fixed. The application brought me back to the same "passport, selfie, video and saying 3 numbers" thing, but this time it worked.s71hj said:

"Tembo via Investec" is how it was described in the MSE top ISAs list. When I go in from the link on that page it takes me to the Investec app and in the product key features download it says "Yes, you can transfer money from an existing Cash or Stocks and Shares ISA held with Tembo orrefluxer said:

Sorry, but I'm not sure what you mean. Why do you want to go to Tembo via Investec... or did you mean you were looking at Tembo vs Investec ?s71hj said:

Looking at the Tembo via Investec 1 Yr fix at 4.3% I'm reading it that you can transfer in :refluxer said:Charter have increased the rates of their 1 and 2 year fixed rate cash ISAs to 4.30% and 4.20% respectively, which makes them the best 1 and 2 year rates currently available.

The 3 year fixed rate has had a smaller bump to 4.14%, which is not far off the best rate available for that time period.

Investec's 1 year fix is also 4.30%, but they don't allow transfers-in which rules them out for anyone looking to do that.

"Each tax year, you can pay in up to your total ISA allowance (currently setat £20,000 for the 2025/26 tax year). You can transfer funds into a TemboCash ISA - Fixed Rate from another Cash ISA or Stocks and Shares ISAyou have with another provider."

Am I minsinterpreting this?

I don't know anything about Tembo, but you can't transfer funds from another cash ISA into an Investec cash ISA - it's new subscriptions only.

From their Summary Box... "Please note, we don't currently accept ISA transfers in from other providers."another provider to a Tembo Cash ISA - Fixed Rate. To request a transfer, simply request a transfer viathe Tembo app. Your transfer will then be processed within 15 working days, and once completed, yourmoney will show in your Tembo Cash ISA - Fixed Rate account."1 -

I see lots of people coming off fixed/matured deals. Are we talking high 4s or even 5% ?0

-

Typical now I have opened one. I'll ask them to upgrade me as I am within 14 days of application and see what they say.refluxer said:Charter have increased the rates of their 1 and 2 year fixed rate cash ISAs to 4.30% and 4.20% respectively, which makes them the best 1 and 2 year rates currently available.

The 3 year fixed rate has had a smaller bump to 4.14%, which is not far off the best rate available for that time period.

Investec's 1 year fix is also 4.30%, but they don't allow transfers-in which rules them out for anyone looking to do that.16 Panel (250W JASolar) 4kWp, facing 170 degrees, 40 degree slope, Solis Inverter. Installed 29/9/2015 - £4700 (Norfolk Solar Together Scheme); 9.6kWh US2000C Pylontech batteries + Solis Inverter installed 12/4/2022 Year target (PVGIS-CMSAF) = 3880kWh - Installer estimate 3452 kWh:Average over 6 years = 4400 :j0 -

They won't.Rheumatoid said:

Typical now I have opened one. I'll ask them to upgrade me as I am within 14 days of application and see what they say.refluxer said:Charter have increased the rates of their 1 and 2 year fixed rate cash ISAs to 4.30% and 4.20% respectively, which makes them the best 1 and 2 year rates currently available.

The 3 year fixed rate has had a smaller bump to 4.14%, which is not far off the best rate available for that time period.

Investec's 1 year fix is also 4.30%, but they don't allow transfers-in which rules them out for anyone looking to do that.

You need to open a new one and then transfer the old one into it.

0 -

Does anyone have any experience of transferring out of a Shawbrook Fixed Rate Cash ISA at maturity by giving advance notice? I have a 1 Yr Fix with Shawbrook that matures on 1st Jan. I'd like to grab the 2 Yr offering at Charter Savings Bank, which has a generous 30 days to fund, before it gets pulled.I can partially fund the Charter Fix from an EA Cash ISA held elsewhere, so securing the rate isn't the concern, rather that if I apply for the CSB Fix now (12/12), I've only got until 11/1 to top it up. If Shawbrook drag their heels over the New Year period to process the transfer, I run the risk of missing the 30-day deadline.Just wondering if anyone had had an experience with Shawbrook and their transfers at maturity? I had a Skipton fix mature in the summer and gave advance notice to transfer. They transferred the funds on the maturity date, so it's possible.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards