We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

Also, this is not flexible.dc_scotland said:ATOM BANKNot sure if already mentioned, but Atom Bank have an Easy Access Cash ISA paying 4.25%. New money only, no transfers in.

https://www.atombank.co.uk/savings/isa/easy-access-cash-isa/1 -

Just transferred mine to a Nat West fix @ 4.2% for exactly that reason....I'm expecting a rate drop before Christmas.clairec666 said:

That Principality account is a good one - as we're predicted to see a base rate cut soon, the rate will probably fall, but Principality are generally quite fair with their rate cuts, usually in line with the base rate or sometimes only a 0.2% drop instead of 0.25%.Patr100 said:

I do use Moneyfacts already. I'm going for the Easy Access Principality ISA 4.20 with a bonus for a year. Transfer from Trading 212 initiated by paper form by post (that is annoying though) plus I still have this years allowance to use.Gambler said:

That's because Chip change their new offerings almost on a daily basisPatr100 said:Chip Cash ISA

"We’re paying new customers a rate boost of 0.76% AER for 12 months, this results in a boosted rate of 3.80% AER (variable tracker)."

This is different to the opening post here that says:Chip Cash ISA - 4.42% **New Rate**Minimum deposit: £1.Operated via: Mobile app.Notes: This is a flexible cash ISA.**This rate is available to new Chip customers only. The rate includes a bonus of 1.33% for the first 12 months.

Use moneyfacts

Not the highest rate but I had decent experience with them on a previous for a savings account so happy to use as flexible ISA and

easy to move later if necessary. Just want to get it out of trading 212 for now.0 -

Have you read the T&Cs of the specific ISA? Some (perhaps most) have a funding window (eg, 30 days) but some do allow funding throughout the year.SickGroove said:

Can I open an easy access cash ISA from 6th April 2026 & just keep adding into it with new money every month, until the 20K threshold is met?dc_scotland said:ATOM BANKNot sure if already mentioned, but Atom Bank have an Easy Access Cash ISA paying 4.25%. New money only, no transfers in.

https://www.atombank.co.uk/savings/isa/easy-access-cash-isa/

I've got the 18 mouth Nationwide 10K account maturity next October, so would want to put that in as a lump sum...

Need to max out the 20K whilst I still can!1 -

Cynergy dropping the rate from 4.35% to 4.05% on 18th December on an NLA account.

Rather sad to see them lowering the rate before any reduction is even announced. Going to be difficult keeping a flexible ISA rate above 4%.

EDIT: The so far available 4.2% offer is now also NLA, replaced by issue 60 at 4.00%.

Would be interesting to know if those who opened the 4.2% version (guess issue 59), also received a rate drop email and by what rate.2 -

Yes, you can generally fund an easy access cash ISA any time you like - it's fixed rate ISAs that have a limited funding window.SickGroove said:Can I open an easy access cash ISA from 6th April 2026 & just keep adding into it with new money every month, until the 20K threshold is met?

I've got the 18 mouth Nationwide 10K account maturity next October, so would want to put that in as a lump sum...

Need to max out the 20K whilst I still can!

If you think you might need access to some or all of the money (with the option of paying it back in without it counting again towards your ISA allowance), make sure you pick one that is flexible but if you don't need that option, then any will do (and you'll get a bigger choice as not all EA cash ISAs are flexible).1 -

It doesn't matter whether the previous ISAs were flexible, only whether the current one is.liger said:Question about ISA flexibility: I opened a Monument Flexible ISA this year with contributions from this tax year. I then did a transfer to Kent Reliance ISA which is Non-Flexible when Monument dropped to 4% so I now longer have the flexiblility feature with the contributions with Kent Reliance. I am now thinking about doing an ISA transfer from Kent Reliance to an existing Virgin Exclusive 3 ISA I have which is a Flexible ISA. Will the contributions from this tax year have flexibility after they arrive in the Virgin Exclusive 3 Flexible ISA?1 -

My fairly positive memory of Principality was when I had a normal annual fixed savings account a few years ago and moved on but still got the occasional required letter eg annual legal rights type reminders , as logins were long in the past, I no longer could access my online account , and had moved house, decided to phone.clairec666 said:

That Principality account is a good one - as we're predicted to see a base rate cut soon, the rate will probably fall, but Principality are generally quite fair with their rate cuts, usually in line with the base rate or sometimes only a 0.2% drop instead of 0.25%.Patr100 said:

I do use Moneyfacts already. I'm going for the Easy Access Principality ISA 4.20 with a bonus for a year. Transfer from Trading 212 initiated by paper form by post (that is annoying though) plus I still have this years allowance to use.Gambler said:

That's because Chip change their new offerings almost on a daily basisPatr100 said:Chip Cash ISA

"We’re paying new customers a rate boost of 0.76% AER for 12 months, this results in a boosted rate of 3.80% AER (variable tracker)."

This is different to the opening post here that says:Chip Cash ISA - 4.42% **New Rate**Minimum deposit: £1.Operated via: Mobile app.Notes: This is a flexible cash ISA.**This rate is available to new Chip customers only. The rate includes a bonus of 1.33% for the first 12 months.

Use moneyfacts

Not the highest rate but I had decent experience with them on a previous for a savings account so happy to use as flexible ISA and

easy to move later if necessary. Just want to get it out of trading 212 for now.

I got through quickly and spoke to a lady with a charming Welsh accent (charming at least to this Londoner) and was reminded how local they are - to Wales . Anyway she soon sorted the now long closed account.0 -

Well this is at least reassuring from Principality re my posted form for transfer from Trading212, though I had to log in (no email notification) to see the message:"Thank you for your ISA Transfer Form, we've asked Trading 212 UK Ltd (email only) to make the transfer. Depending on the ISA, the transfer could take up to 15 business days. Don't worry, you'll start to earn interest on your ISA on the date the ISA closes with Trading 212 UK Ltd (email only)."

1 -

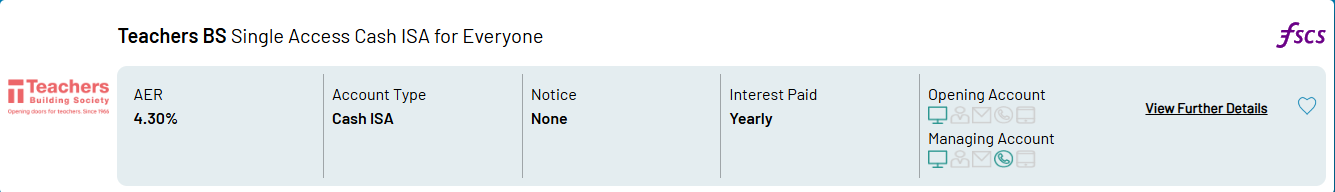

Teacher BS Single Access ISA at 4.30% (4.35% for teachers)

Anyone experience with them? Are they participating in electronic transfers?3 -

Chorley BS Online Cash ISA (Triple Access)

4.1% variable.

Not flexible, does allow transfers in.

Maximum 3 withdrawals per calendar year (so 3 allowed this month!) plus an extra withdrawal of interest (paid annually on 5th April). Interest rate drops to 1% variable if more withdrawals are made.

https://www.chorleybs.co.uk/savings/isas/online-cash-isa-triple-access0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards