We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Cash ISAs: The Best Currently Available List

Comments

-

This is probably a dumb question not worth opening a new thread for: Why are there only 7 LISA's? Like for the entire UK? Why do none of the high street banks do them? Unless there are some not listed on Moneyfacts but from Googling only the same 7 came up.0

-

You should be able to message Principality and they'll convert your existing ISA to the new one, with the same account number and everything. I've done it earlier this year with their flexible ISAs when the interest rate went up. It wasn't an issuewhere_are_we said:I have a flexible Principality Online bonus ISA4 @4.75% opened in late 23-24 tax year. I have made quite a few withdrawals from it in this tax year and now have a balance only a few hundred. I intend to replace the money taken out before the end of 24-25 to preserve my ISA protection. I was thinking about transferring this OBISA4 into a new OB5AISA issue2 @4.85% with no new 24-25 ISA money involved - this would mean a small gain in interest and also an extension of the bonus interest period to 12 months from now. However in T&C`s it states "If transferring an existing Principality cash ISA then this must be transferred in full"Does this mean to preserve my previous years ISA protection I would have to top up my present OSISA4 with the full replacement allowance in one go, before initiating a transfer or does it mean just transfer the present full balance of a few hundred pounds? I would rather replace this allowance gradually over the next 5 months into the new OB5ISA.I consider myself to be a male feminist. Is that allowed?2 -

Not profitable products. There's a limited market, and people can only pay in £4k per year. The money the bank could make on that would be wiped out by the cost of sending a couple of statements, especially in the low interest rate environment we've seen until the last couple of years.Zaul22 said:This is probably a dumb question not worth opening a new thread for: Why are there only 7 LISA's? Like for the entire UK? Why do none of the high street banks do them? Unless there are some not listed on Moneyfacts but from Googling only the same 7 came up.1 -

Found this one - Virgin Money Defined Access Cash E-ISA Issue 31 4.51% .

Three withdrawals a year or the rate drops to 2%. No current account required. Only difference between this and the one that requires a current account is the limit of 3 withdrawals a year. Both now at the same rate of 4.51%

I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.2 -

Just seen this on mse website

Only three penalty-free withdrawals per year, includes a fixed 0.42% bonus for 12 monthsMoneybox, 5.12% (click for info)- Min £500- Open via app- Interest paid: annually1 -

I opened this account in March when it was last available and transferred the £500 minimum in from Virgin (3 days turnaround time) as a backup option. The rate at the time was 4.25% plus a bonus of 0.91% making it 5.16% AER and this rate has been consistent so far. The app shows you daily interest and current earnings so you know what you get paid at anniversary.pookey said:Just seen this on mse website

Only three penalty-free withdrawals per year, includes a fixed 0.42% bonus for 12 monthsMoneybox, 5.12% (click for info)- Min £500- Open via app- Interest paid: annually

Crucially, as there are many reporting problems with Trading212, Moneybox allows transfer in from Trading212. Unless you need more flexibility or interest payment at anniversary is an issue, this account can be recommended. Moneybox customer service (limited dealings) have been good.

In light of the UK budget, US elections and all the other macroeconomic elements ongoing in the world, a rate cut by the BOE is likely but by no means certain on the 7th November so potentially good account to secure with a top rate.0 -

Trading 212 has increased the interest rate on GBP balances to 5.15% AER6

-

Along with Moneybox, who have matched the rate.gt94sss2 said:Trading 212 has increased the interest rate on GBP balances to 5.15% AER2 -

gt94sss2 said:Trading 212 has increased the interest rate on GBP balances to 5.15% AER

Trading website shows 5.15% indeed.Bridlington1 said:

Along with Moneybox, who have matched the rate.gt94sss2 said:Trading 212 has increased the interest rate on GBP balances to 5.15% AER

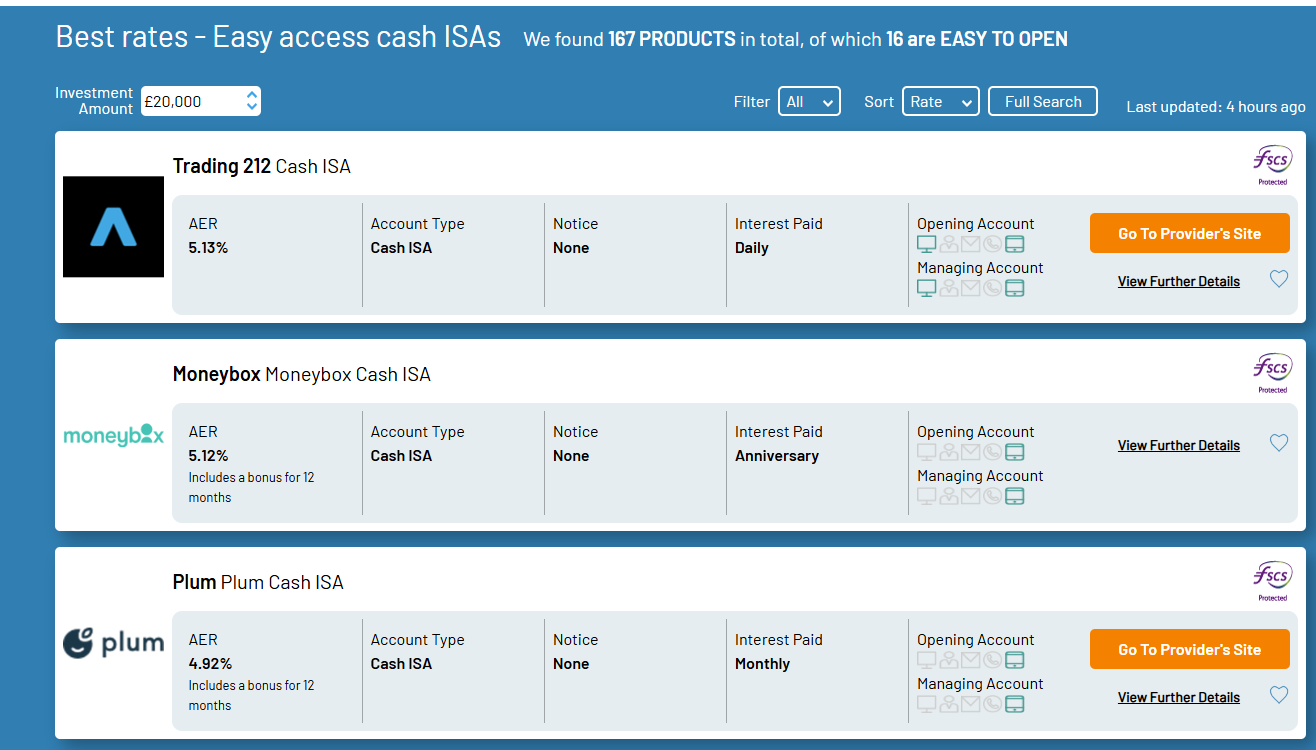

Moneyfacts shows the below and has so catching up to do

Trading212 interest change history:Interest changes 25th May 2024* 5.07% 5.2% AER 9th September 2024 4.88% 5.0% AER 16th September 2024 4.93% 5.05% AER 17th September 2024 4.975% 5.1% AER 29th October 2024 5.02% 5.15% AER

*Rate was at that level before but I captured the rate on the day the Cash ISA was opened

4 -

Excellent. T212's willingness to nudge the rate up to be at the top of the table - at a time of savings rates generally declining - is the account's best feature.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards