We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

2010 said:@pecunianonolet

You will be able to keep adding to your ISA with NEW money up to the yearly £20k limit after the product is withdrawn

.

You can also transfer other cash ISA`s you have into it.Not sure which to believe as both the Ts and Cs AND the KPI now appear to say you CAN'T deposit after product has been withdrawn - (....although I'm sure they used to say you could?)I'm sure Ts and Cs will trump an email?I was hoping to open the account with the minimum £1K as a future home for some not-yet-matured funds....0 -

The T&C's say you can as mentioned before. The first person I called said only 7 days after it is withdrawn. The second person told me the first person was wrong and this is applicable for non ISA Fixed Bonds and confirmed that I can fund after the initial £1000 as many times as I want from my nominated account and that I could make a further one off payment of 19k or as many as I want and it could be £1 if I would have that spare and want it in. I'll going to treat it as a reg saver and put monthly in or whenever I have more spare.steveksullivan said:2010 said:@pecunianonolet

You will be able to keep adding to your ISA with NEW money up to the yearly £20k limit after the product is withdrawn

.

You can also transfer other cash ISA`s you have into it.Not sure which to believe as both the Ts and Cs AND the KPI now appear to say you CAN'T deposit after product has been withdrawn - (....although I'm sure they used to say you could?)I'm sure Ts and Cs will trump an email?I was hoping to open the account with the minimum £1K as a future home for some not-yet-matured funds....0 -

I can only tell you that in the past when I opened a 1yr fixed rate ISA with Shawbrook one April,

I was still depositing new money in the October of the same year.1 -

I just spotted that the 1 and 3 year Paragon Fixed Rate ISAs that have been withdrawn are actually still available to existing customers, which means that they currently have the highest paying rates for Fixed Rate Cash ISAs of all durations except 5 years, if you're already a Paragon customer.refluxer said:

It's only the 1 year fix that's been withdrawn - the rest are still availableVNX said:I see Paragon rate increases have lasted less than a day!

1 year : 4.20% (existing customers only)

18 months : 4.30%

2 years : 4.28%

3 years : 4.25% (existing customers only)

5 years : 4.00% (just under United Trust Bank @ 4.05%)4 -

Thanks for this. I’ve opted for Paragon three year ISA, can’t fault them.refluxer said:

I just spotted that the 1 and 3 year Paragon Fixed Rate ISAs that have been withdrawn are actually still available to existing customers, which means that they currently have the highest paying rates for Fixed Rate Cash ISAs of all durations except 5 years, if you're already a Paragon customer.refluxer said:

It's only the 1 year fix that's been withdrawn - the rest are still availableVNX said:I see Paragon rate increases have lasted less than a day!

1 year : 4.20% (existing customers only)

18 months : 4.30%

2 years : 4.28%

3 years : 4.25% (existing customers only)

5 years : 4.00% (just under United Trust Bank @ 4.05%)0 -

Paragon 1 year : 4.20% (existing customers only)

Even if you don`t have an active account, you can log in and still get the one year fix ISA.1 -

2010 said:Paragon 1 year : 4.20% (existing customers only)

Even if you don`t have an active account, you can log in and still get the one year fix ISA.

I tried to open one now as an existing customer - and while it opened up the application page for this account when I clicked the apply button I got this message. So its possibly been withdrawn for existing customers too now - not sure if anyone else gets that message?"Sorry, this account is currently unavailable.

Don’t worry, we still have a great range of savings accounts and cash ISAs to help you reach your savings goals"

The 18 months at 4.30% is of course still available to existing customers as of tonight.

1 -

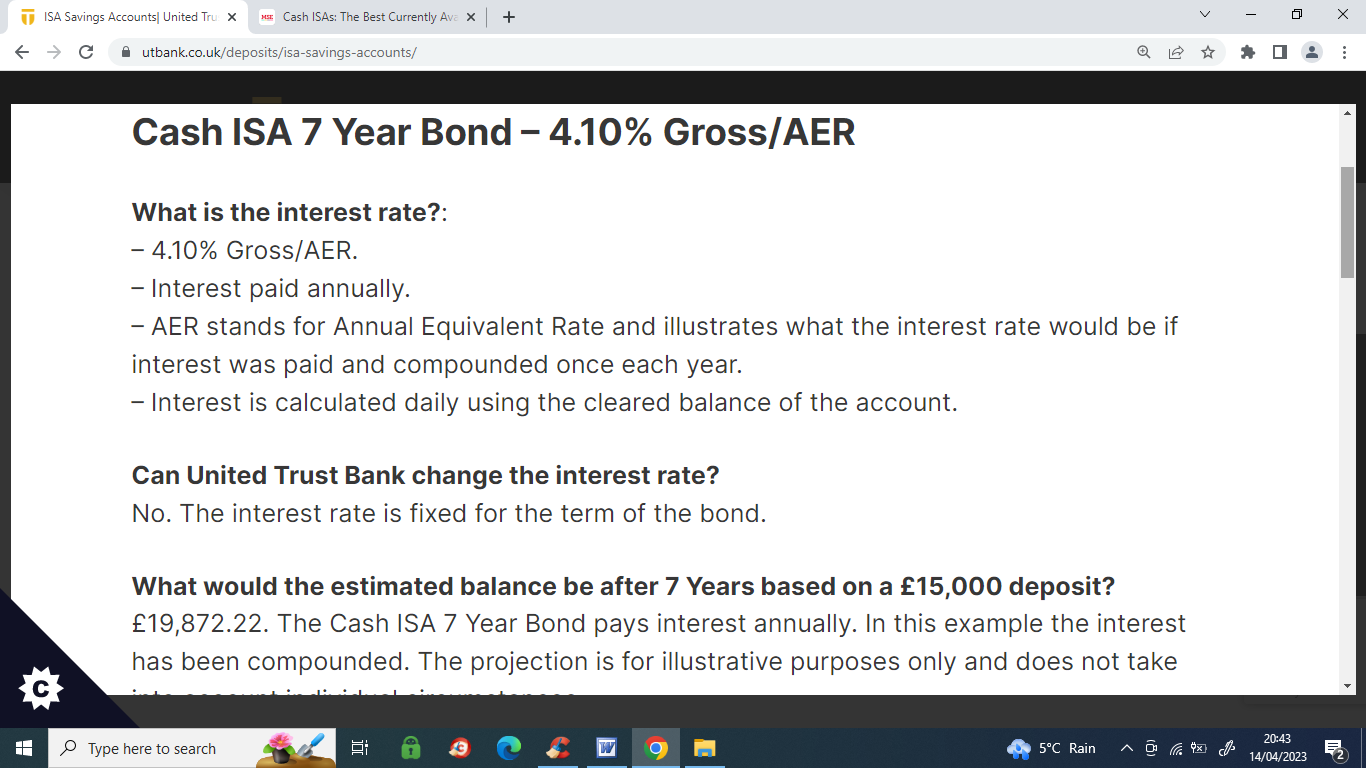

United Trust Bank Minimum £15000

I have not seen any comments about this.

I have already applied to switch a soon to mature 5 year fix

Example they give I work out to average 4.64% for each of the 7 years

They told me applications can be printed off and emailed to them as alternative to posting to them.

https://www.utbank.co.uk/deposits/isa-savings-accounts/

1 -

Seven years is a very long fix. Of course it’s personal decision and we won’t know until 2030 how good a deal it turns out to be, could be a stroke of genius but for me I wouldn’t want to fix for as long as that

I like annual interest on longer fixes as it spreads the interest payments over numerous tax years as this account does2 -

I've got 8 years left on my 2.35% fixed-rate mortgage - so a simple decisionVNX said:Seven years is a very long fix. Of course it’s personal decision and we won’t know until 2030 how good a deal it turns out to be, could be a stroke of genius but for me I wouldn’t want to fix for as long as that

I like annual interest on longer fixes as it spreads the interest payments over numerous tax years as this account does4

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards