We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

No. Definitely opted for annual payment - as confirmed on my account details.

0 -

Went for Shawbrook 1yr fix @ 4.17%.

0 -

4.15% gross monthly works out at 4.23% AER which isn't quite right either. Charter applied the wrong rate to an ISA I took out with them a while back, but that was only because the rate had dropped in-between applying and the transfer occurring. I was able to get them to correct the mistake by messaging them via internet banking, so I would message them and tell them the rate you've been given isn't the rate you applied for and see what they say.Rusty190 said:No. Definitely opted for annual payment - as confirmed on my account details.1 -

I thought that but is it lower because it compounds over 2 years !refluxer said:

4.15% gross monthly works out at 4.23% AER which isn't quite right either. Charter applied the wrong rate to an ISA I took out with them a while back, but that was only because the rate had dropped in-between applying and the transfer occurring. I was able to get them to correct the mistake by messaging them via internet banking, so I would message them and tell them the rate you've been given isn't the rate you applied for and see what they say.Rusty190 said:No. Definitely opted for annual payment - as confirmed on my account details.0 -

I like your thinking, but no - AER is based on the total interest earned after 1 year for comparison purposes.flobbalobbalob said:

I thought that but is it lower because it compounds over 2 years !refluxer said:

4.15% gross monthly works out at 4.23% AER which isn't quite right either. Charter applied the wrong rate to an ISA I took out with them a while back, but that was only because the rate had dropped in-between applying and the transfer occurring. I was able to get them to correct the mistake by messaging them via internet banking, so I would message them and tell them the rate you've been given isn't the rate you applied for and see what they say.Rusty190 said:No. Definitely opted for annual payment - as confirmed on my account details.

What this does mean is that the overall return you get for fixed periods of more than a year will actually be higher than the quoted AER.2 -

Shawbrook used to give you up until a week after the product is withdrawn to deposit new subscriptions but the terms for their latest fixed rate ISAs suggest you can make deposits at any time during the fixed term, which is unusual for this type of account...tiger70 said:

What's the time frame for depositing your Isa allowance ?2010 said:Went for Shawbrook 1yr fix @ 4.17%.

"Please note that the Bank reserves the right to withdraw this product at any time. If the product is withdrawn, you cancontinue to put more money into your account until the expiry of the fixed term."1 -

Once Your account is open and subject to the account conditions in the Key Product Information You can make additional deposits to Your account at any time from Your Nominated Account, until the product to which that account relates is closed to new applications (which You can check on the “Withdrawn Products” section of Our Website) or additional funding (which You can check in the Key Product Information). We reserve the right to return any funds deposited with Us after this date. For certain products, You may be able to make deposits even if it is withdrawn if the Key Product Information applicable to that product allows it.

You can keep putting money in until you reach the max £20k for the tax year.

You can also transfer previous ISA`s from other providers and also previous Shawbrook ISA`s into it.0 -

Can you point me to where it says that monies can only be transferred into the new account from an existing NW account. Thanks.Shedman said:Yes its a lump sum all in in one hit account deposit at time of application with no funding window.Also be aware that if you open a NW Fixed ISA online you can only pay in new money from your NW current or savings account(although oddly this might only be a condition if you already have a NW current or savings account as I can't see that restriction in the product summary if looking at the details when not signed in)

Both of these restrictions put me off it and I am going for Paragon instead0 -

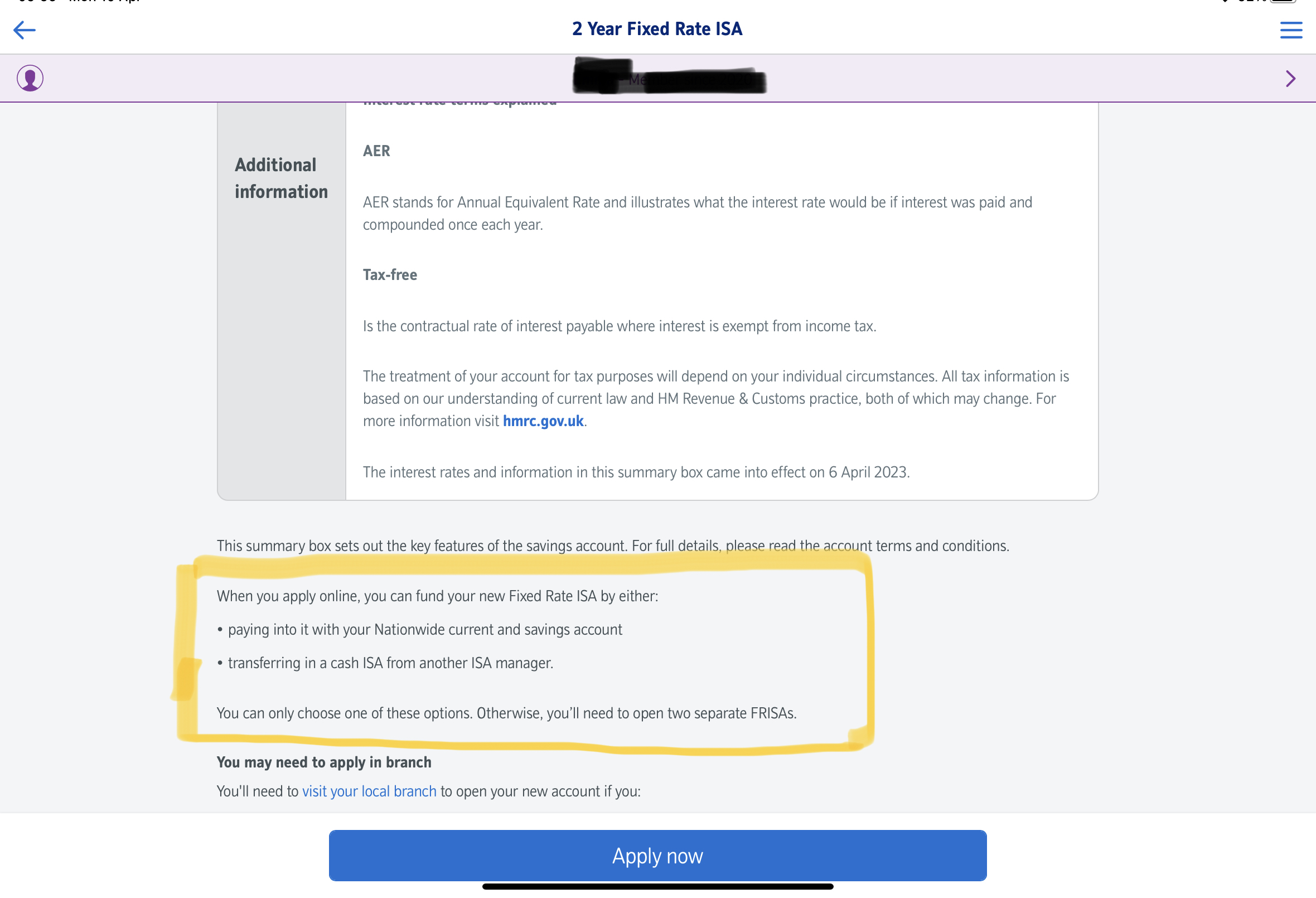

As I indicated this restriction only seem to mentioned if you look at the product summary when logged in if you already have an existing account. It appears after the Summary Box. It does seem strange if it is the case that existing customers have a restriction that is not imposed on new applicants...it could be I'm misinterpreting it (or its poorly worded by NW)caveman38 said:

Can you point me to where it says that monies can only be transferred into the new account from an existing NW account. Thanks.Shedman said:Yes its a lump sum all in in one hit account deposit at time of application with no funding window.Also be aware that if you open a NW Fixed ISA online you can only pay in new money from your NW current or savings account(although oddly this might only be a condition if you already have a NW current or savings account as I can't see that restriction in the product summary if looking at the details when not signed in)

Both of these restrictions put me off it and I am going for Paragon instead

EDIT: I have just tried selecting the Apply button when not logged in and I now see that the same restriction does apply when using an online application ...just doesn't show that on the Summary Box page

This is from viewing Summary Box page when logged in: And this is from the application when not logged in:

And this is from the application when not logged in:You're applying for a Fixed Rate ISA

Before you start

When you apply online, you can fund your new Fixed Rate ISA by either:

- paying into it with your Nationwide current or savings account

- transferring in a cash ISA from another ISA manager.

You can only choose one of these options. Otherwise, you'll need to open two separate FRISAs.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards