We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

Ok it was a bit if a read but I think I understand it. I thought with flexible ISA's the money could be withdrawn and replaced within the same tax year? So if you withdraw the £19,999 from the 22/ 23 ISA can you still refill it in the future?pecunianonolet said:

No, all ISA's were opened and funded in tax year 22/23 with Coventry being funded yesterday and the cash will be taken out today. More detail here of what we're doing to maximise ISA allowances. It's great if you are in a position being able to fund 2 ISA's but actually need some of the cash as it is not completely spare. You money essentially gets granted ISA protection but can work outside of an ISA.pookey said:

Hipecunianonolet said:

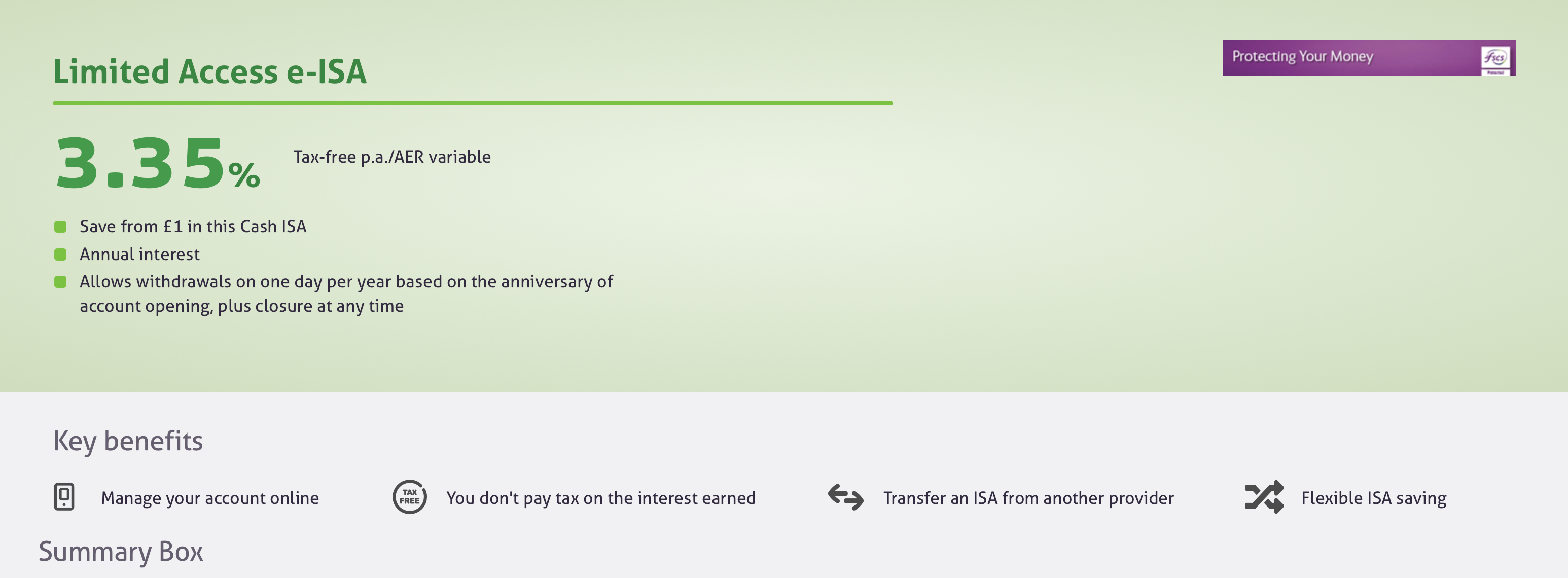

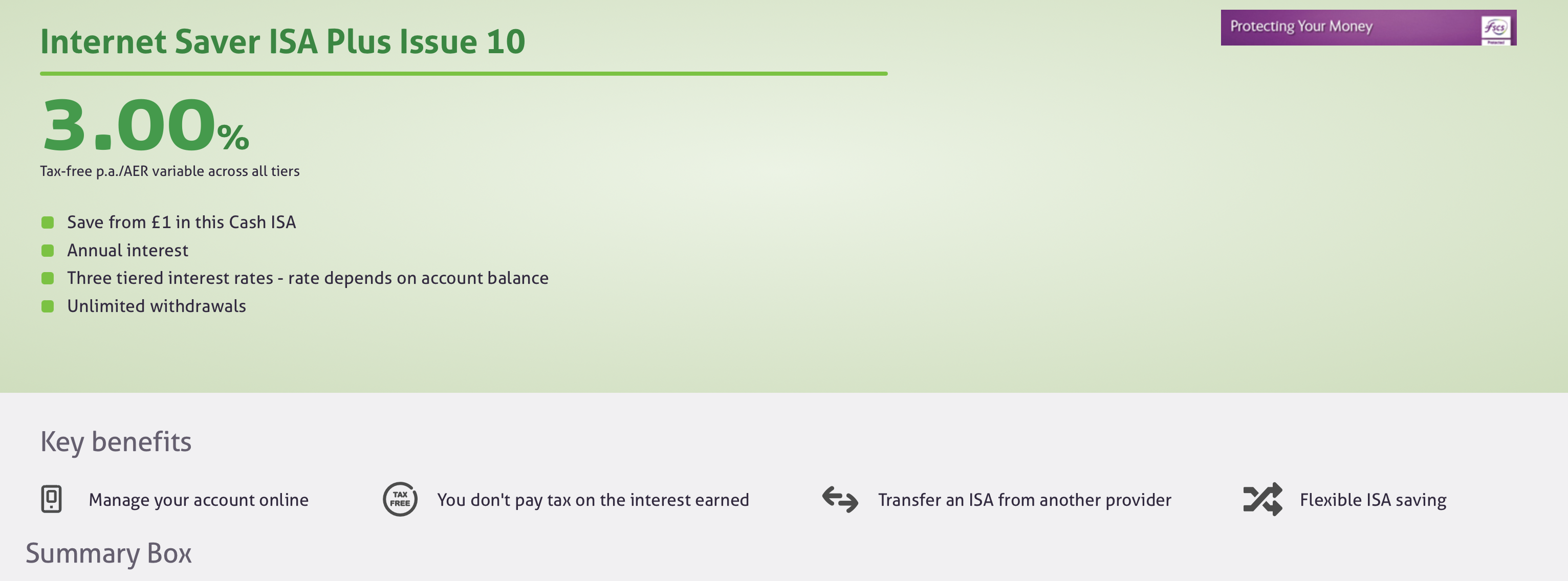

The Limited Access ISA has only one withdrawal if I read this correctly (Coventry has 3.25% and six withdrawals) and the Internet Saver has only 3% and there are better options available for unlimited withdrawals. Anyhow, I fixed for 1y with the Virgin 4.25% and OH went with Coventry Flex and put 20k in and we will take19999 out again today to max out PSA firstForumUser7 said:

I've looked at the other two non-loyalty easy access ISAs, and I think they are all flexible. They both say Flexible ISA savingpecunianonolet said:

Maybe, but I am not elegible for loyalty.ForumUser7 said:

Isn’t their loyalty one flexible? The fact sheet suggests it is ~ https://www.ybs.co.uk/documents/productdata/Factsheet-YB941685W.pdfpecunianonolet said:I wish any of the YBS ISA's would be flexible...

Do you mean he opened it and deposited the money today? And will take the money out today for the better options you mentioned?

It would even work, although a lot more dangerous and not advisable, to take out a loan of let's say 10k to fill up an ISA for 1 day, and repay the full loan the following day. Your income would need to be sufficient in the future to put the 10k aside to fill up the ISA again in 12 months time.0 -

Just waiting for Charter to show their rates at 5pm, then if they beat the Paragon 1 year fix they get me, otherwise Paragon it is. I want monthly interest.0

-

Yes, if you can deposit those amounts now/May/Aug as you said, it would be £635 interest.gele said:Just to put a spanner in the works so to speak, I have just seen the Kent Reliant fixes for 1 and 2 years both paying over 4% and it states on their website payments in are allowed, only Isa transfers have a 30 day time limit. Based on your calculations above I am guessing that one for a year [4.08% I think] would beat both of the above.1 -

Thanks so much. I haven't used Kent Reliant before but have emailed to check the paying in situation as its almost too good to be true from my perspective anyway. Not sure if an account with them needs paperwork sending off or if it can all be done online but I'll cross that bridge when I hear back from them.0

-

Yes, sounds good being able to pay into a fixed rate account for extended periods. I hadn't noticed this feature before, and it will only be available while the bond is on sale. There are other providers with a similar condition on their limited edition isas.gele said:Thanks so much. I haven't used Kent Reliant before but have emailed to check the paying in situation as its almost too good to be true from my perspective anyway. Not sure if an account with them needs paperwork sending off or if it can all be done online but I'll cross that bridge when I hear back from them.0 -

Nationwide new ISA rates 4.1 1 year, 4.25 2 year4

-

I've never noticed this before. I always thought fixed ISA were strict about limiting when you could pay in. Based on what you've said my only concern would be still being able to pay in in late August as it was this £12k as opposed to the £5k that matures in April that I wanted to be sure found its way to an ISA. I initially was thinking the April bond would go into another bond and wait til August to open this years ISA but rates are looking pretty decent now and may not look as good by then. What a dilemma!

0

0 -

Yes, hopefully KR will not withdraw it, but looking at previous issues, not certain it will be around long.gele said:I've never noticed this before. I always thought fixed ISA were strict about limiting when you could pay in. Based on what you've said my only concern would be still being able to pay in in late August as it was this £12k as opposed to the £5k that matures in April that I wanted to be sure found its way to an ISA. I initially was thinking the April bond would go into another bond and wait til August to open this years ISA but rates are looking pretty decent now and may not look as good by then. What a dilemma! 0

0 -

I can confirm that it is possible to have both of the following ISAs:Kazza242 said:

I have a branch-based (though I can also operate it online) YBS Loyalty Six Access ISA (issue 2) opened in April 2022.nomorekids said:Anyone already got or know if you can have the two versions of Yorkshire Loyalty Six ISA? The branch version and the online?

Just wondering if on/just after the 6th, I could open the branch based one for another £20000 at 4.25%

Last month, I applied for the Loyalty Six Access Saver e-ISA (issue 2) online and transferred my previous years ISA subscriptions to it.

In late March, I also posted a product switch form to a YBS branch asking them to switch my branch-based Loyalty Six Access ISA (issue 2) to issue 3. They called a few days later to confirm that this would be ok. They are performing the switch later this week.

If all goes well, then I'll be earning 4.25% on the first £20K of both ISAs. I'll also report back on how it goes.

YBS Loyalty Six Access Saver e-ISA issue 2 (Internet-based)

and

YBS Loyalty Six Access Saver ISA issue 3 (branch/postal)

I now have both of them. I opened the new Loyalty Six Access Saver e-ISA issue 2 last month (4.25% on the first £20,000 and 3.75% above that) and today YBS performed a Product Switch on my existing branch-based Loyalty Six Access ISA (issue 2) which I opened in April 2022, and switched it into the Loyalty Six Access Saver ISA issue 3.

Therefore, I am now earning 4.25% on the first £20,000 in both the issue 2 and issue 3, so £40,000 is earning the higher rate.

(To qualify for the Loyalty products, you have to have had an open account, savings or mortgage with Yorkshire Building Society for at least 12 months prior to applying).Please call me 'Kazza'.7 -

1yr fix ISA

Waiting for Charter and Virgin to decide from the bunch.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards