We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cash ISAs: The Best Currently Available List

Comments

-

From tomorrow Coventry BS loyalty ISA 4.4% fixed until 31.5.2024.4

-

The Paragon rate is still 4.07% monthly on a 2 year fix (same as 27 days ago) but I have opened a second account today, still at 4.07%) which gives me 28 days breathing room. Having done the maths though, even if the AER went up by 0.1% it would only gain me 5p a day, so probably will stick with my original plan.2010 said:

You don`t know what Charter`s new rates will be.JGB1955 said:

That's left me with a dilemma..2010 said:Charter have withdrawn all current cash ISA`s.Coming Soon: 2023/2024 Cash ISAsOur new Cash ISAs are launching on 6 April at 5pm.

I have applied for a Paragon ISA with a subscription date that ends on 6th April...should I stick or wait (the ISAs mentioned above wouldn't be accessible until after the Bank Holiday, I.e on 11th April....

I take it you are talking about the new tax year.

If the times up for Paragon tomorrow you must have applied a while ago for it.

Rates have moved on since then.#2 Saving for Christmas 2024 - £1 a day challenge. £325 of £3660 -

Always the dilemma, wait for a better rate but the longer one waits you’re losing out while waiting. I have a paragon ISA open unfunded think I’ll wait a few days then decide what to do won’t wait longJGB1955 said:

The Paragon rate is still 4.07% monthly on a 2 year fix (same as 27 days ago) but I have opened a second account today, still at 4.07%) which gives me 28 days breathing room. Having done the maths though, even if the AER went up by 0.1% it would only gain me 5p a day, so probably will stick with my original plan.2010 said:

You don`t know what Charter`s new rates will be.JGB1955 said:

That's left me with a dilemma..2010 said:Charter have withdrawn all current cash ISA`s.Coming Soon: 2023/2024 Cash ISAsOur new Cash ISAs are launching on 6 April at 5pm.

I have applied for a Paragon ISA with a subscription date that ends on 6th April...should I stick or wait (the ISAs mentioned above wouldn't be accessible until after the Bank Holiday, I.e on 11th April....

I take it you are talking about the new tax year.

If the times up for Paragon tomorrow you must have applied a while ago for it.

Rates have moved on since then.

0 -

Marcus up to 3.2% AER1

-

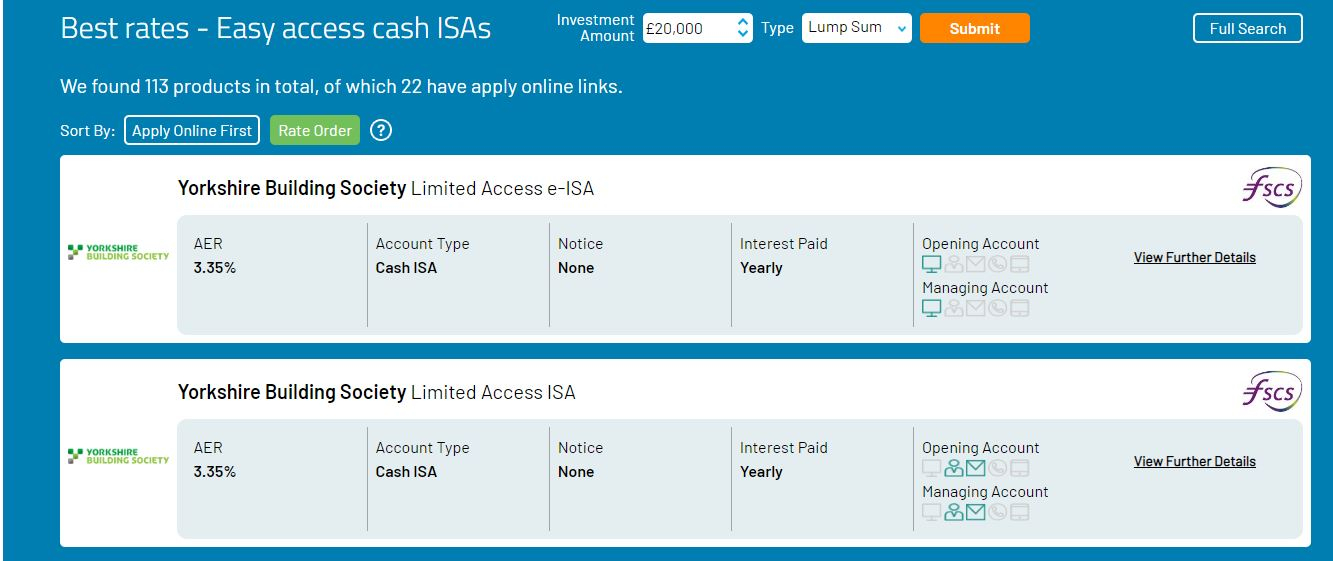

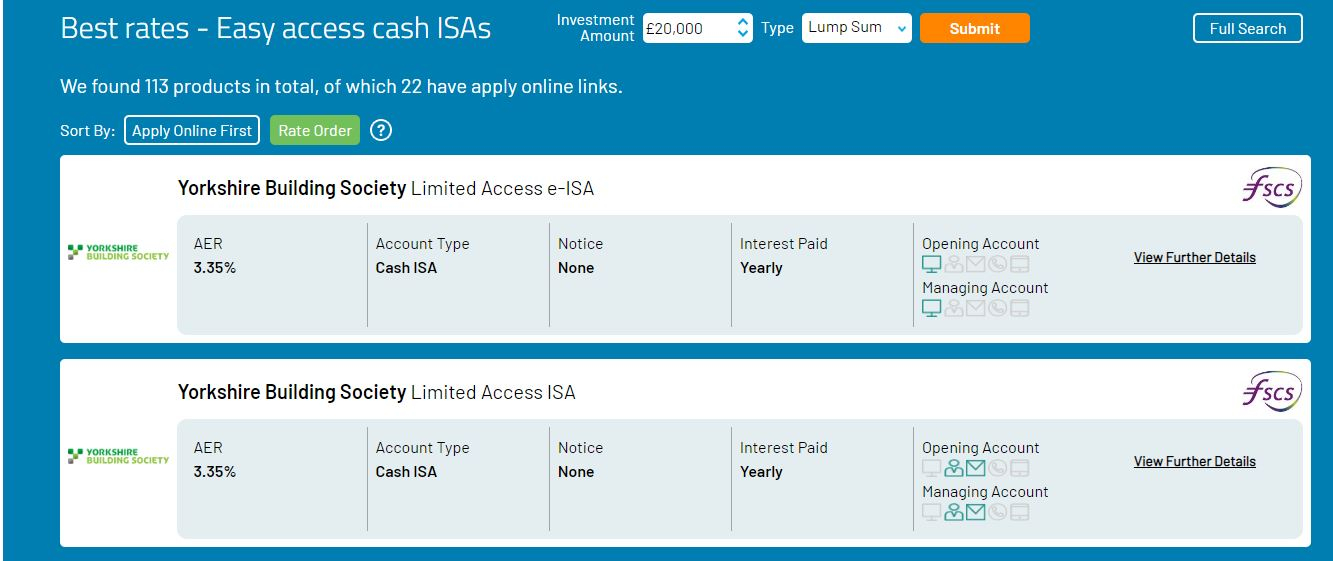

All of YBS’ variable rates have gone up by 0.25% today (source ~ https://www.ybs.co.uk/boe-rate-change)pecunianonolet said:Not sure if this was reported before but looks like YBS ISA's rate is increasing. Currently showing 3.1% on the website https://www.ybs.co.uk/savings/product?id=YB851683W If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

-

From the Coventry homepage;

“We're rewarding loyalty

On 6 April we will be offering our loyal customers exclusive access to a highly competitive Loyalty Fixed ISA.

Previous years' ISA savings cannot be transferred into this account”From feudal serf to spender, this wonderful world of purchase power 2

2 -

Nb transfers? Pah. I thought that gimmick died a while ago.1

-

YBS variable also gone up to 4.25 % Loyalty Six Access Saver e-ISA Issue 2ForumUser7 said:

All of YBS’ variable rates have gone up by 0.25% today (source ~ https://www.ybs.co.uk/boe-rate-change)pecunianonolet said:Not sure if this was reported before but looks like YBS ISA's rate is increasing. Currently showing 3.1% on the website https://www.ybs.co.uk/savings/product?id=YB851683W

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards