We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Greece downgraded to CCC by S&P, Greek MPs plan their getaway!

Comments

-

worldtraveller wrote: »

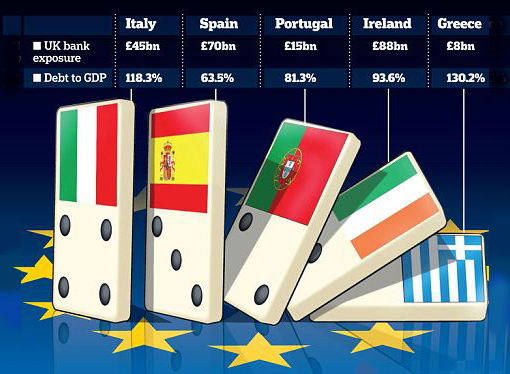

It's this potential domino:

OK then, one really possible scenario:

http://blogs.telegraph.co.uk/finance/andrewlilico/100010332/what-happens-when-greece-defaults/

However, let's be honest here. Who really knows what will ultimately happen, until it, happens (the default, that is!)? :think:

That is quite scary.

20% of all of the above comes out to ~£35BN. That would spell another round of chaos for the banking sector.

That having been said, the Greeks own worst enemy are the Greeks. Its time to accept that banks need to take some pain, and time to throw the Greeks to the dogs as they are just incapable of taking austerity.

One has to ask, who in their right mind would pour so much cash into Irish, Italian, Spanish & Portuguese debt. It seems that banks have just bought left right and centre, relying only on the rating agencies with no regard as to the underlying capacity of the sovereigns in question to repay.0 -

Don't worry- if you look at the picture the Irish Portuguese and Greek dominos are falling away from the other two and so won't knock them over.0

-

UK banks abandon eurozone over Greek default fears

Senior sources have revealed that leading banks, including Barclays and Standard Chartered, have radically reduced the amount of unsecured lending they are prepared to make available to eurozone banks, raising the prospect of a new credit crunch for the European banking system.

Standard Chartered is understood to have withdrawn tens of billions of pounds from the eurozone inter-bank lending market in recent months and cut its overall exposure by two-thirds in the past few weeks as it has become increasingly worried about the finances of other European banks.

Barclays has also cut its exposure in recent months as senior managers have become increasingly concerned about developments among banks with large exposures to the troubled European countries Greece, Ireland, Spain, Italy and Portugal.

http://www.telegraph.co.uk/finance/financialcrisis/8584442/UK-banks-abandon-eurozone-over-Greek-default-fears.htmlPlease stay safe in the sun and learn the A-E of melanoma: A = asymmetry, B = irregular borders, C= different colours, D= diameter, larger than 6mm, E = evolving, is your mole changing? Most moles are not cancerous, any doubts, please check next time you visit your GP.

0 -

Great article Vivatifosi.

Anyone else see a European Bank bailout coming?0 -

ChiefGrasscutter wrote: »Snag is the foreign debt is held mainly by such institutions as French and German Pension funds and their banksQUOTE]

Slight case of miss-selling there? Did anybody here opt to have their pension pot invested in Greek debt?This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

My gut feeling, for this whole multifacited thing, is that the EU are stretching this issue out as much as they possibly can (ie. "sweeping the issue under the carpet"/more short term bailouts), hoping, short term, for this to have as little negative market reaction as is possible under the circumstances, before............

I believe that they are trying to find some way to allow an "orderly" default by Greece.

BTW, you can take "orderly" in any way that you like.

There is a pleasure in the pathless woods, There is a rapture on the lonely shore, There is society, where none intrudes, By the deep sea, and music in its roar: I love not man the less, but Nature more...0

There is a pleasure in the pathless woods, There is a rapture on the lonely shore, There is society, where none intrudes, By the deep sea, and music in its roar: I love not man the less, but Nature more...0 -

Anyone else see a European Bank bailout coming?

What's increasingly apparent is that a one interest rate fits all for the Eurozone doesn't work. As the ability of the weaker economies to borrow at German/French rates of interest has backfired. As they've borrowed more than they can possibly afford to repay let alone service.0 -

Guardian Doomsday scenario

http://www.guardian.co.uk/world/2011/jun/17/greek-parliament-vote-austerity?intcmp=239The euro trashed

On Monday the Greek parliament votes against George Papandreou's new cabinet and its plans for further EU-inspired austerity. The decision triggers a refusal by the EU and the IMF to forward new funds to pay interest on Greek debts.

Credit ratings agencies say that Greek banks are in effect bust because they are the biggest lenders to the Athens government. French and German banks, which are the biggest foreign lenders, lose billions. Markets crash. US and Middle Eastern investors begin a fire sale of assets in Spain and Italy as well as in Portugal and Ireland.

Within hours Silvio Berlusconi is on the phone to Brussels begging for funds. Italian public sector workers join counterparts in Greece and Spain on the streets to protest at steep wage cuts. Riots topple democratic governments and usher in military dictatorships promising order. The EU falls apart as each country decides to leave the euro and issue their own currency.

Likelihood: 2/50 -

Interesting article in Friday's Economist. Who would have thought that Slovakia is the european country with the hardman attitude?

A SMALL country should aim to avoid antagonising its allies. Slovakia, previously known as a committed euro-enthusiast, earned the wrath of both Brussels and Berlin last year when the new government decided to opt out of the first Greek bail-out.

Since then, Slovak diplomacy has upped its game. As euro-zone leaders ponder a second rescue for Greece, Bratislava is displaying a slightly more flexible attitude. This week, Slovakia sent a cautious signal to its European partners: if it is asked to approve another package for Athens—which could reach up to €120 billion—the answer will be “yes, but”.

This was not Slovakia going soft. Richard Sulik, leader of the market-friendly Freedom and Solidarity (SaS), a junior partner in the ruling centre-right coalition, says “We want to reach an agreement that will involve a declaration of insolvency.” Iveta Radicova, the prime minister, and her brainy finance minister, Ivan Miklos, have also been heard to murmur about bankruptcies.

Falling into line behind the Germans, the Slovaks want to see Greece's private creditors take a share of the pain by extending the maturity of their bonds by seven years. Slovakia also wants the Greek government to strike a deal with the opposition on more belt-tightening, structural reform and privatisation. Finally, the Slovaks insist that any new loan for Athens must be guaranteed by Greek state property....

.....Slovakia’s ruling centre-right parties regularly take the EU to task for going easy on the likes of Greece, Portugal and Spain. They claim to dislike what they see as the habit of rewarding extravagance and punishing frugality. But in recent weeks this criticism has been repackaged. Controversial remarks about “bailouts that resemble Ponzi schemes” are now rarely heard.

Interesting situation this. Through the lens of a single country (Greece) I'm learning so much about the politics of others. Here's a link to the full article:

http://www.economist.com/blogs/easternapproaches/2011/06/slovakia-and-euroPlease stay safe in the sun and learn the A-E of melanoma: A = asymmetry, B = irregular borders, C= different colours, D= diameter, larger than 6mm, E = evolving, is your mole changing? Most moles are not cancerous, any doubts, please check next time you visit your GP.

0 -

Greece will need a second international financial bailout of the same magnitude as last year's €110bn (£97bn) lifeline in order to avoid a tumultuous debt default, the prime minister, George Papandreou, has conceded while mounting a last-ditch appeal to parliament and the nation to back his austerity programme.

Guardian.co.uk

OK, pick a number. Any number will do..... :think:There is a pleasure in the pathless woods, There is a rapture on the lonely shore, There is society, where none intrudes, By the deep sea, and music in its roar: I love not man the less, but Nature more...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards