We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Greece downgraded to CCC by S&P, Greek MPs plan their getaway!

Comments

-

Exactly the point I was making.To be fair, almost no one really met the criteria to join the euro http://news.bbc.co.uk/1/hi/special_report/single_currency/66945.stm . And anyone who invests in greek bonds knew the Greeks don't pay taxation before they did it. They have been in default almost 1 out of every 2 years since they gained independence. So it's not stunning, unprecedented news that they default.

They aren't willing to change or have ever been likely to.

Greece was, and will continue to be, the ginger stepchild of Europe.Nothing is foolproof, as fools are so ingenious! 0

0 -

True, but they were also encouraged to do so by those who run the EU.tartanterra wrote: »The Greek government fiddled the books to get into the Euro.

Like Ireland, the EU loans ridiculous amounts of money to a known bad risk. The risk defaults and the EU then moves in, having just bought itself another country.They have tried to borrow their way out of trouble, and are now heading to default on their loans.

It's an old trick."Never underestimate the mindless force of a government bureaucracyseeking to expand its power, dominion and budget"Jay Stanley, American Civil Liberties Union.0 -

Clifford_Pope wrote: »Ireland is a special case, for us, because of past ties and shared culture. We should bail them out if necessary on condition they ditch the Euro and rejoin the sterling area.

Has more to do with the UK banks exposure to Eire than anything else. In years gone by industry (particularly subsidaries of US corporations such as Dell) relocated on the basis of low corporation tax and the ability to build as they wished. So no economic tie there either.0 -

If the Germans wont pony up, the only option would be to withdraw from the EU, reinstate the Drachma as a devalued currency to inflate away the debt.

Either that, or have a socialist revolution, nationalise the banks and cancel all foreign debts.Freedom is the freedom to say that 2+2 = 4 (George Orwell, 1984).

(I desire) ‘a great production that will supply all, and more than all the people can consume’,

(Sylvia Pankhurst).0 -

cootambear wrote: »Either that, or have a socialist revolution, nationalise the banks and cancel all foreign debts.

Snag is the foreign debt is held mainly by such institutions as French and German Pension funds and their banks....so if the debt is cancelled so are the pension funds and savings pots of a quite few French and German people - which would indeed be a really big issue indeed.

Hence the old saying: "you own your bank £1000 - you have a problem; you owe the bank £1,000,000 - the bank has a problem".0 -

AFP is carrying an interesting article on its wires. It states that Merkel wants substantial aid from private creditors in order to sort out Greece's debt. It talks about the way the ratings agencies will react to coercion. It then goes on to say:

Eurogroup chief Jean-Claude Juncker said Saturday that the problems which have forced Greece, Ireland and Portugal to seek emergency aid could affect Italy and Belgium, even before Spain, tipped as the next casualty.

The Luxembourg prime minister, who heads the group of eurozone finance ministers, told the German daily Suddeutsche Zeitung, "we are playing with fire."

http://www.google.com/hostednews/afp/article/ALeqM5gTX4oHCUrZ-5tul29HVAIXhpyB5g?docId=CNG.2dfdb203756c4e45e90cf7e499472db5.5d1

Where exactly is the B in PIIGS?Please stay safe in the sun and learn the A-E of melanoma: A = asymmetry, B = irregular borders, C= different colours, D= diameter, larger than 6mm, E = evolving, is your mole changing? Most moles are not cancerous, any doubts, please check next time you visit your GP.

0 -

vivatifosi wrote: »Where exactly is the B in PIIGS?

BIG PIS :eek:0 -

The last thing that financial markets needed this morning was a wobbly Spanish auction, but that’s exactly what they got. Spain’s borrowing costs have soared, with 10 year Spanish government bond yields jumping a massive 20bps at one point.

Spain’s long term borrowing costs greatly exceed its current nominal growth levels.

The firewall that markets thought existed between Greece, Portugal and Ireland and the much bigger and systemic economies of Spain and Italy is in danger of being an illusion.

http://www.bondvigilantes.com/'In nature, there are neither rewards nor punishments - there are Consequences.'0 -

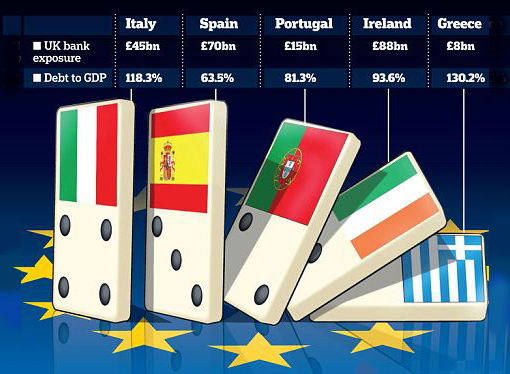

No, stupid, it's not this domino:

It's this potential domino:

OK then, one really possible scenario:

http://blogs.telegraph.co.uk/finance/andrewlilico/100010332/what-happens-when-greece-defaults/

However, let's be honest here. Who really knows what will ultimately happen, until it, happens (the default, that is!)? :think:There is a pleasure in the pathless woods, There is a rapture on the lonely shore, There is society, where none intrudes, By the deep sea, and music in its roar: I love not man the less, but Nature more...0 -

Certainly a bit of a domesday scenario and definitely sensationalist, but still, it makes you wonder how it's all going to pan out.worldtraveller wrote: »

Thank ***k we never joined the Euro.

Give me a pocketful of pretty green any day.

(Apologies to anyone not old enough to remember the Jam!) Nothing is foolproof, as fools are so ingenious!

Nothing is foolproof, as fools are so ingenious! 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards