We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Sub Prime Credit Thread - Part V

Comments

-

ahh didnt see that

thanks0 -

- paying before can cause weird glitches

What kind of glitches? My Halifax On line banking told me the next payment date for my card was 31st of August. Only had it a few weeks and even though I haven't had a statement I paid it just in case. I cant think its right though as I havent had the card long enough to have to pay so soon I just didnt dare take any chances with it.

I guess better paying too soon than too late!3 defaults removed,, 1 judgment set aside

No debt - 1 mainstream card

Getting back on the financial radar0 -

Thanks

So when I pay money in I can just say to a normal cashier like "by the way I was thinking of getting a credit card again, how likely does it say I am to be accepted?" and then if they say "good chance" i'm at 70%+?

So when I pay money in I can just say to a normal cashier like "by the way I was thinking of getting a credit card again, how likely does it say I am to be accepted?" and then if they say "good chance" i'm at 70%+? Thanks

Thanks  So I could just ask for my risk band outright? I see you work there, wouldn't you get suspicious if somebody wanted to know that?

So I could just ask for my risk band outright? I see you work there, wouldn't you get suspicious if somebody wanted to know that?

Just ask whilst your on the phone to telephone banking charm the advisor and they may tell you. If some one was to ask me id just tell them personally they wont think your suspicious or anything Im an ex employee RBS GroupHowever Any Opinion Given On MSE Is Strictly My Own0

Im an ex employee RBS GroupHowever Any Opinion Given On MSE Is Strictly My Own0 -

after being accepted on-line with Capital One i got a rejection letter few days later, applied for a Vanquis Card and just got phone call being accepted, the APR was shocking but i will be buying then instantly logging on bank and repaying. Thanks for people pointing people like me in right direction to rebuild credit profile after these hard few last years!

I applied for Vanquis about 3 years ago, got rejected, then applied randomly this time last year (just to see if credit situation had improved) and I was accepted, applied for Capital one at same time, was accepted online (got all the green ticks) and got a rejection letter, tried six months later, got the green ticks but was rejected via post again, then tried again six months later (last week) and was accepted (green ticks) I expected the worse, and got a letter on Tuesday saying I was accepted and to sign the credit agreement (even though I had done this online). Anyway posted back credit agreement today, so we shall see what happens 0

0 -

If you have a direct debit taking the minimum or whatever it can take it anyway. Don't know about other glitches but I've heard of some before (them thinking you haven't paid because you've paid early etc), don't know what happens with the credit report if they think that...inkslinger wrote: »What kind of glitches? My Halifax On line banking told me the next payment date for my card was 31st of August. Only had it a few weeks and even though I haven't had a statement I paid it just in case. I cant think its right though as I havent had the card long enough to have to pay so soon I just didnt dare take any chances with it.

I guess better paying too soon than too late!

Halifax online banking? Vanquis shows in there? Don't understand that but be careful incase they take payment anyway... Natwest used to take money even when I paid early

Don't understand that but be careful incase they take payment anyway... Natwest used to take money even when I paid early

Haha thanks, will give it a go!Just ask whilst your on the phone to telephone banking charm the advisor and they may tell you. If some one was to ask me id just tell them personally they wont think your suspicious or anything

0

0 -

No I was my Halifax one card, sorry if i confused you there. I'll keep an eye on my account then, its akin to alchemy and black magic all of this really credit business. lol3 defaults removed,, 1 judgment set aside

No debt - 1 mainstream card

Getting back on the financial radar0 -

Just received an email from Very saying I've got £751786058 available to spend!

Wonder if they do houses?In need of a new signature! :rotfl:0 -

I'm getting a little confused at the moment and wondered if anyone could help?

Got my vanquis statement and paid it immediately in full through HSBC internet banking, and now I've just got a text saying I need to pay at least £5 by the 31/08 - does this mean I need to pay £5 before this months statement?

It's got me rather confused and I don't want to get hit with late payment charge!

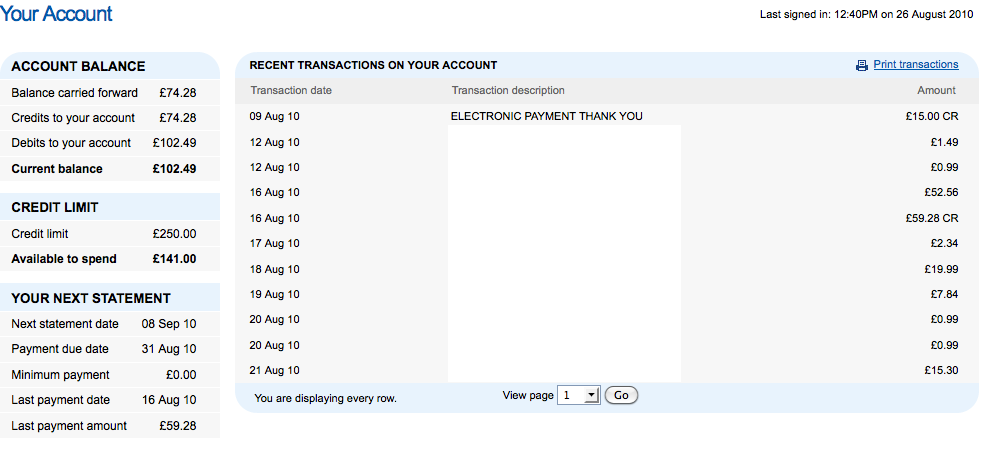

This is what my eVanquis looks like: 0

0 -

Just received an email from Very saying I've got £751786058 available to spend!

Wonder if they do houses?

Can you do us a print screen?

That's :rotfl: :rotfl: :rotfl: :rotfl: :rotfl: :rotfl: :rotfl:

You could max it and return it all when it arrives

That'll demonstrate ability to spend and repay in a way I've never known of before!Cashback Earned ¦ Nectar Points £68 ¦ Natoinwide Select £62 ¦ Aqua Reward £100 ¦ Amex Platinum £48

0 -

Anyone on who has had a CapOne card for a while? My credit limit was raised last month (4/5 months in) - is the 4-5 month raise/possibility of a raise something that is repeated, or is it typically a one-off?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards