We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Unenforceability & Template Letters II

Comments

-

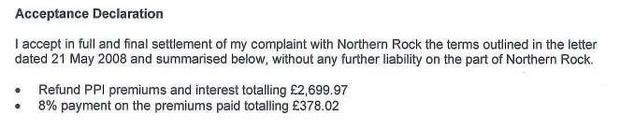

nonnynonny wrote: »PPI re-claim made, and refunded, via the documents above in 2008, a new account number generated, and a new monthly payment and duration advised via the documents above.

But because i have signed nothing else in terms of a new agreement post PPI refund, apart from the documents linked above, i am wondering what they would produce as a CCA, and if the above linked documents are all they have, then where does that leave me?

Hiya

See my last reply to you, bear in mind you confirmed above that the new loan was taken out in 2008 therefore s.127 is not applicable and you cannot make this debt unenforceable - period. No matter what mistakes are there, it will need to be repaid unless you take civil action (extremely costly) - not my suggested way forward. 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

NID,

Many thanks indeed! great letter, this should really stir them up!

Will keep you posted!

Munchins0 -

never-in-doubt wrote: »Hiya

Is this the only account you're looking at Unenforceability with? Usually you do this if you're happy to get defaulted etc (well not happy, but you know what I mean).... So if you're up-to-date with payments etc then why would you cease repayments, it will ruin your credit file :o

:o

No figure mate - have you thought this through?

no theres two accounts, each with about 4k debt on each. what i mean is ive always paid minimum repayments each month like 100 pound. so i stil have about 4k debt accumulated from 1996.0 -

Quick question, Although littlewoods were unable to provide me with a CCA they have still cashed the cheque, they haven't credited this to my account. The letter I sent clearly said that if they were unable to provide me with an original copy they were to return the payment.

I know it is only £1 but it has made me wonder if they have suddenly found my CCA

Has anyone else had this happen?

Thanks in advance0 -

Quick question, Although littlewoods were unable to provide me with a CCA they have still cashed the cheque, they haven't credited this to my account. The letter I sent clearly said that if they were unable to provide me with an original copy they were to return the payment.

I know it is only £1 but it has made me wonder if they have suddenly found my CCA

Has anyone else had this happen?

Thanks in advance

Dont worry - its a £1 lol (are you scottish hehe)

They always cash it even if they respond to say they do not have the CCA - you got the news you wanted, just let them keep the squiddy-pooh! ;):p

;):p  2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

never-in-doubt wrote: »Dont worry - its a £1 lol (are you scottish hehe)

They always cash it even if they respond to say they do not have the CCA - you got the news you wanted, just let them keep the squiddy-pooh! ;):p

;):p

lol no I Just had a thought that it meant they has found it!

Anyway posted the dispute letter as you suggested on the 2nd and waiting for it to show up on royal mail as being delivered. Do i give them 30 day from when i posted it or when they signed for it?

Thanks Again0 -

never-in-doubt wrote: »Hiya

Thanks for the additional info.

Ok from what I can tell, you had a loan and they added PPi to the loan. You then put a claim in for the mis-sold PPi and they refunded this refund back to your loan account (correct way of doing this) and then re-issued a loan, with the reduced balance?

If so, there is no problem because unless i'm missing the obvious, you signed this didn't you?

Also, they made it clear to you what would happen here:

So, in a nutshell - other than the fact unenforceability only applies to accounts BEFORE April 2007, i'd say you need to look to repay the loan. The bank hasn't broken any rules and they have, by all accounts, been quite good by knocking off almost £3k....

Not what you want to hear I know, but legally nothing you can do really....

They actually refunded the amount by bacs transfer into my account, not to the loan account, they then re-arranged the loan as per the above.LBM - Jan'10

DMP Start - 01st March 2010 - Debt £31,614

Debts at Highest - £36k Mid Jan 2010

Debt Free Date 22nd December 2015!

DMP - Just do it, don't hesitate.0 -

never-in-doubt wrote: »Hiya

What you attach seems perfectly fine to me, they are the terms in place at the time you took the card so it is fine. Problem with HSBC is they are really good at issuing correct agreements as they print their own version on headed paper, its the actual lost ones that allow you to win! As they evidently have your signature etc on them i'd be looking to start a repayment plan.....

Good Luck

Hello again N-i-d, thank you so much for taking the time to read my CCA, i will contact HSBC to start a payment plan, do you know if there is anyway i can get them to stop charging interest to the account as the payments i have been making are just covering the interest and the balance just does'nt go down, its only been the past 7 months ive had problems paying as i lost my job.:( Many Thanks Natalie0 -

lol no I Just had a thought that it meant they has found it!

Anyway posted the dispute letter as you suggested on the 2nd and waiting for it to show up on royal mail as being delivered. Do i give them 30 day from when i posted it or when they signed for it?

Thanks Again

No need to post anything else - you leave it alone now as it is unenforceable. :T 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Hello again N-i-d, thank you so much for taking the time to read my CCA, i will contact HSBC to start a payment plan, do you know if there is anyway i can get them to stop charging interest to the account as the payments i have been making are just covering the interest and the balance just does'nt go down, its only been the past 7 months ive had problems paying as i lost my job.:( Many Thanks Natalie

Hiya

The only way to avoid interest is to default the account, i.e. don't pay for a few weeks and when they default you and sell it on - interest usually stops. To be honest if you're not too fussed about your credit report then just get in touch and wait for them to sell it and pass to dca then offer the dca a F&F offer which they may take..... albeit you'll end up defaulted (only affects you for 6 years).... 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards