We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Unenforceability & Template Letters II

Comments

-

martinjohn wrote: »so to confirm even if you are right, the agreement is enforceable, you can still potentially look froward to 5years of bouncing from dca to dca and having phonecalls and threats etc. (doorstep visits and bailiffs maybe?) until the debt becomes statue barred

Sorry, they have cut & pasted the application form to make it look enforceable by including some of the prescribed terms above my signature but the job is so amateurish it's comical. I can't believe BC would go to such lengths!0 -

never-in-doubt wrote: »Hiya

Basically, you need to ignore all of them now - they are all unenforceable until such time they respond, with lawful agreements (yea rite lol) :rotfl: :rotfl:

Yea rite indeed !!!:rotfl:

Thanks for that will keep you all posted. You are the Carlsberg of MSE - probably the best.

:beer:A Bank is a place where they lend you an umberella in fair weather and asks for it back when it begins to rain - I hate them all0 -

never-in-doubt wrote: »Hiya

Look at page1 - Prescribed Terms. Basically, is it a signed agreement with the interest rate and repayment amounts showing? Failing that, load it to imageshack (free) and post link here - just leave spaces in the www like this w w w

Hi Never-in-doubt i know you are highly in demand on here, im sorry to bother you again, i'm still unsure if its enforceable, could you please take a look at my CCA for me, i will be greatful for any advise you could offer.:) Natalie

h t t p://img262.imageshack.us/i/img003o.jpg/

h t t p://img189.imageshack.us/i/img004ex.jpg/

h t t p://img59.imageshack.us/i/img005ep.jpg/

h t t p://img704.imageshack.us/i/img006at.jpg/

h t t p://img525.imageshack.us/i/img007e.jpg/0 -

Can anybody tell me if paypal are subject to the same rules as catalogues, banks etc.

Ive sent their DCA (EOS Solutions) the CCA request letter, to which they didnt reply. I sent them the reminder letter and they've replied with the paypal user agreement.

Can anyone help not sure what my next move is?

Thank you!!0 -

martinjohn wrote: »so to confirm even if you are right, the agreement is enforceable, you can still potentially look froward to 5years of bouncing from dca to dca and having phonecalls and threats etc. (doorstep visits and bailiffs maybe?) until the debt becomes statue barred

No, if the debt is enforceable (or unenforceable for that matter) you cannot expect numerous calls or threats from bailiffs - if you do, then simply go here: Dealing with Bailiffs Harassment and send the relevant letter which will stop them!

Obviously you're assuming that the debtor ignores the lender, which can work but sometimes it's best to aim for a F&F settlement if found to be enforceable..... or call their bluff and see if they go as far as court, if they do then you agree to a repayment schedule.

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Hi NID,

Would really appreciate acomment from you if you have time, I new but have read as many threads as I can to get to grips with this.

CCA'd Barclaycard on MSDW card from 2004, basically in dire straits and missed last 4 months minimum payments. What I received was an an application form that seemed to be enforceable. On closer inspection it is a "cut & paste" job with sections missing, lines through etc to include as much as they could. Obviously in doing this they scrapped half the original application form. My 7 year old could have done better!

Mercers are on my case now, threats aplenty! Should I write back to BC asking for an agreement to include all the missing sections? or just send the "in dispute" letter.

Thanks

Hiya

Mercers are the usual Barclays 'sharks' and have a habit of appearing right after a CCA Request! Muppets - they'll never learn will they?!

Ok, consider sending the following off to them - remember to add the reasons for believing it is fake (i.e. cut and paste; bad quality; unsigned; etc etc:Dear Sirs,

Account No: XXXXXXXX

Having recently requested a copy of the alleged original Credit Agreement (CCA), in line with the Consumer Credit Act 1974 (s.77-s.79), I was dismayed to receive what can only be described as a fraudulent document.

My reasons for this claim are set out below:- This form was never signed by myself;

- Add reason here

- Add reason here

I quote, from this article:The OFT goes on to advise that lenders would be acting unfairly, and potentially in breach of their consumer credit licenses, if they misled borrowers by:You're likely to claim that you have satisfied your obligation under s.78 (CCA1974) but i'd like to just check, as i'm slightly confused, where within s.78 of the CCA(1974) does it mention that you can fabricate a totally fraudulent document and purport it to be a copy of an original? If you'd please be so kind as to point me in the right direction...• hiding or disguising the fact that there was never a proper signed agreement in the first place

• providing only a copy of the current terms and conditions, not the original ones

I think you can see where I am going with this? I therefore think it is best we start again and ignore your recent correspondence as the junk it is.

So, as you have failed to comply with my lawful request for a true, signed copy of the agreement and other relevant documents mentioned in it, failed to send a full statement of the account and failed to provide any of the documentation requested but instead sent a forgery, any legal action you pursue will be averred as both unlawful & vexatious. Furthermore I shall counterclaim that any such action constitutes unlawful harassment and pursue legal action for the attempted fraud.

You may also consider this letter as a statutory notice under s.10 of the Data Protection Act (1998) to cease processing any data in relation to this account with immediate effect. This means you must remove all information regarding this account from your own internal records and from my records with any credit reference agencies.

Any attempted argument regarding case law such as McGuffick v RBS will be dismissed as this particular case has no bearing on the legal reporting methods that a lender has with the CRA, namely adding derogatory data whilst an account is in dispute, this account clearly is disputed.

As a result of everything put together in this letter, I do feel it would be in your best interests to consider this matter closed and write off the balance as a business loss. The last thing you need right now is bad publicity and a legal loss, by presenting a forged document that we both know does not and will never satisfy clear guidelines set out in s.127(3) CCA(1974).

Should you refuse to comply, you must within 30 days provide me with a detailed breakdown of your reasoning behind continuing to process my data and your reasoning as to why you issued a forged document under the pretence it was a copy of the original. It is not sufficient to simply state that you have a ‘legal right’; You must outline your reasoning in this matter and state upon which legislation this reasoning depends. Should you not respond within 30 days I expect that this means you agree to remove all such data.

Need I remind you that a creditor is not permitted to take ANY action against an account whilst it remains in dispute? The lack of a credit agreement is a very clear dispute and as such the following applies.* You may not demand any payment on the account, nor am I obliged to offer any payment to you.I reserve the right to report your actions to any such regulatory authorities as I see fit. You have 30 days from receiving this letter to contact me with your intentions to resolve this matter which is now a formal complaint. I therefore request a copy of your official complaints procedure which you are obliged to supply.

* You may not add further interest or any charges to the account.

* You may not pass the account to a third party.

* You may not register any information in respect of the account with any credit reference agency.

* You may not issue a default notice related to the account.

In light of the above, I would appreciate your due diligence in this matter and look forward to hearing from you, in writing within 30 days.Yours faithfullySign digitally 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Sorry, they have cut & pasted the application form to make it look enforceable by including some of the prescribed terms above my signature but the job is so amateurish it's comical. I can't believe BC would go to such lengths!

Don't worry too much about his comments, he seems to have some other motive by arguing points that really has no effect on anything - just stick to the main basis of this thread and you'll be fine.

See letter above - this contains a link that shows the OFT does not think this practice should be acceptable which is good enough for me right now.....

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Can anybody tell me if paypal are subject to the same rules as catalogues, banks etc.

Ive sent their DCA (EOS Solutions) the CCA request letter, to which they didnt reply. I sent them the reminder letter and they've replied with the paypal user agreement.

Can anyone help not sure what my next move is?

Thank you!!

LOL

PayPal is not a credit providor, you simply have a PP account - all you do is tell them to go away they cannot take ANY action against you.... Have a read here for some help: http://www.paypalsucks.com/

But in essence, as you never signed any paperwork they cannot do anything, you never authorised them to contact CRA's either so they cannot add a default against you - but one thing is for sure, they do not have a CCA so forget that idea.

What you need to do is just send any letters back as unknown, it is easy to get suckered into PayPal debt, say a buyer does a reversal/complaint - then PayPal tend to stick with them and before you know it you could have been scammed, lost a fortune and then PP hassle you with threats to top-up your account.

They have very limited legal powers and i'd be ignoring them.....

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Hi Never-in-doubt i know you are highly in demand on here, im sorry to bother you again, i'm still unsure if its enforceable, could you please take a look at my CCA for me, i will be greatful for any advise you could offer.:) Natalie

h t t p://img262.imageshack.us/i/img003o.jpg/

h t t p://img189.imageshack.us/i/img004ex.jpg/

h t t p://img59.imageshack.us/i/img005ep.jpg/

h t t p://img704.imageshack.us/i/img006at.jpg/

h t t p://img525.imageshack.us/i/img007e.jpg/

Hiya

What you attach seems perfectly fine to me, they are the terms in place at the time you took the card so it is fine. Problem with HSBC is they are really good at issuing correct agreements as they print their own version on headed paper, its the actual lost ones that allow you to win! As they evidently have your signature etc on them i'd be looking to start a repayment plan.....

Good Luck

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

nonnynonny wrote: »http://i892.photobucket.com/albums/ac126/nonnynonny123/nrock1.jpg

http://i892.photobucket.com/albums/ac126/nonnynonny123/nrock2.jpg

http://i892.photobucket.com/albums/ac126/nonnynonny123/nrock3.jpg

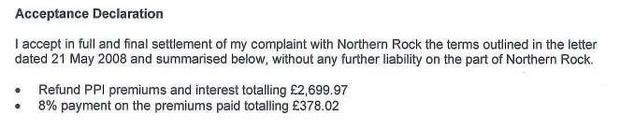

These are my so-called new 'agreements' with Northern Rock following a PPI refund.

If i CCA them, what do you think they would send?

I have just started a DMP and Northern Rock have probably just received my proposal, should i wait for their response on that before CCA'ing them, or just do it now?

Hiya

Thanks for the additional info.

Ok from what I can tell, you had a loan and they added PPi to the loan. You then put a claim in for the mis-sold PPi and they refunded this refund back to your loan account (correct way of doing this) and then re-issued a loan, with the reduced balance?

If so, there is no problem because unless i'm missing the obvious, you signed this didn't you?

Also, they made it clear to you what would happen here:

So, in a nutshell - other than the fact unenforceability only applies to accounts BEFORE April 2007, i'd say you need to look to repay the loan. The bank hasn't broken any rules and they have, by all accounts, been quite good by knocking off almost £3k....

Not what you want to hear I know, but legally nothing you can do really....

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards