We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Unenforceability & Template Letters II

Comments

-

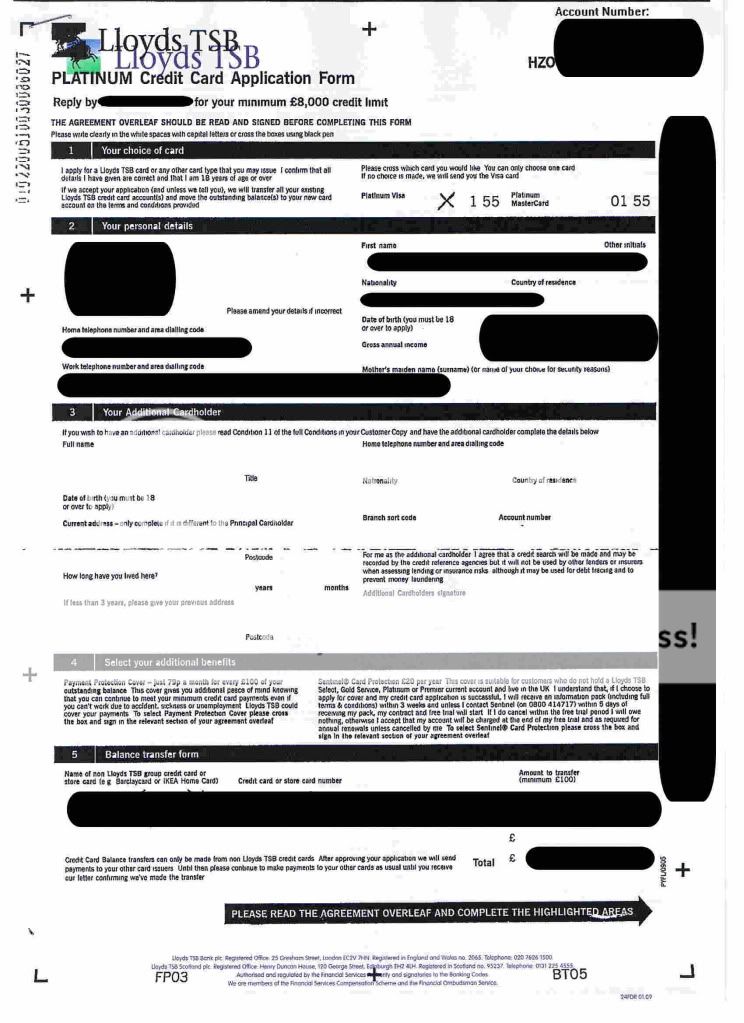

OK, here's the Lloyds TSB loan.... I'd LOVE to get 'rid' of this one.....never-in-doubt wrote: »eh? you've been doing what? :eek::eek::eek:

Good job I like you or i'd not help you already, lol, never ever pay when you're fighting unenforceability - ruins everything!

http://s991.photobucket.com/albums/af35/captainhaggis/Lloyds%20TSB%20Loan/

And the credit card is here :

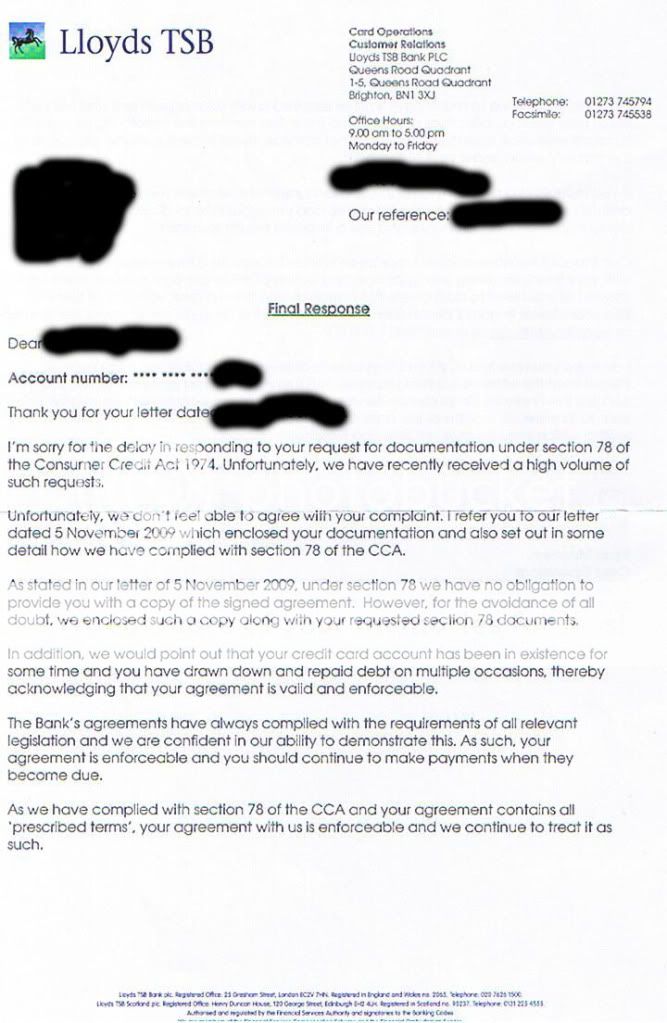

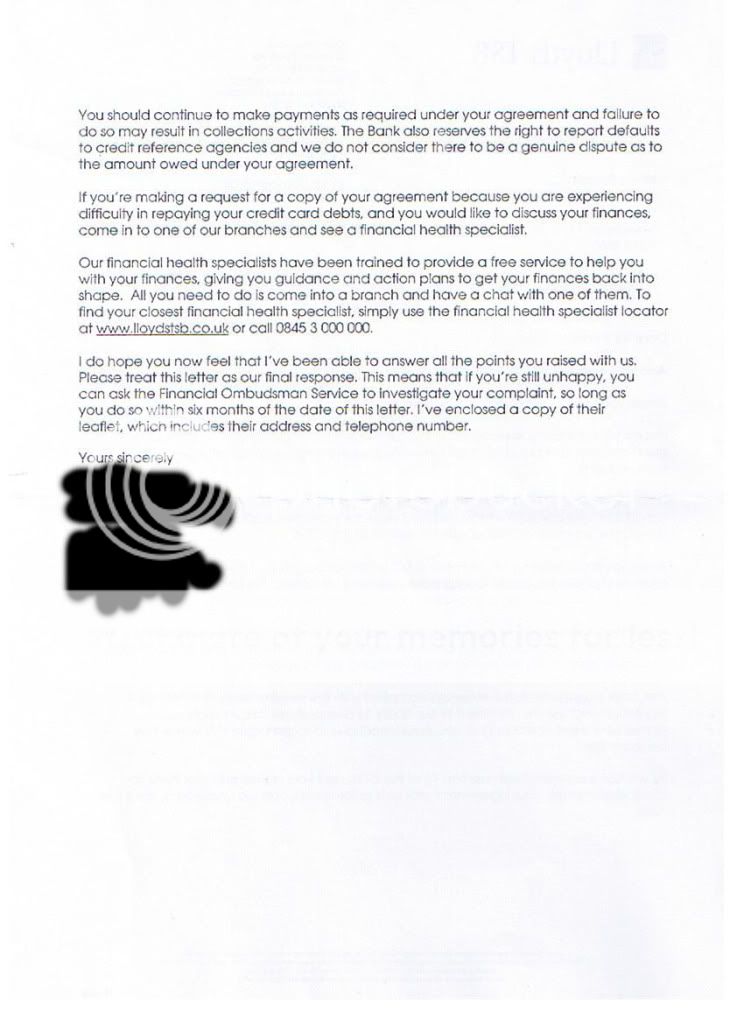

I responded to this with a Dispute Letter and they replied :

Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0

Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

My CCA arrived, but it's never been signed by me!

I knew about this debt, but didn't agree with there high interest rate and tried to get a better deal, so i never formaly agreed to there interest rate or there fees.

can anyone help me on this? what would be my next step? can i reclaim the interest on this account? or anything else?

0 -

knight_La_Mancha wrote: »Hi NID,

One more question about Barclays loan. It was taken after April 2007. I applied on line, did not tick on computer signature and opted to sign the loan agreement on paper and returned to them.

I CCA’d them and got an agreement without my signature. As per your previous advice, I knew that’s no way to argue the unenforceability. However, I went through the loan account statement they sent me in respond to my SAR. There was an entry registered in 2008 – “A/C CLOSED statement balance 0.00”

Then, the next page of the statement started with the outstanding balance I owed that time under a complete different account number.

Does that mean anything?

Thank you for your expertise and time again.

Hiya

That is when they closed the account and sold it, so whoever owns the debt now (probably the DCA writing to you) will add a default from whatever the default date was using the balance that was on the old record, in essence each account can only have 1 live CRA record. As Barclays have sold (assigned) the debt to a DCA they must close their entry and the DCA then adds their own using the same details, check the reference against the DCA letter ref and see if it matches

Either way, don't worry too much about this entry - the main point is; as it was after 04/07 you cannot utilise unenforceability - period :mad: 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

My CCA arrived, but it's never been signed by me!

I knew about this debt, but didn't agree with there high interest rate and tried to get a better deal, so i never formaly agreed to there interest rate or there fees.

can anyone help me on this? what would be my next step? can i reclaim the interest on this account? or anything else?

Fermi, as far as I know, moved your post and started a thread of your own.

Thread here: CCA received - now confused 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Hi guys,

I need a bit of advice please about a vodafone debt that has been sold to Fredricksons DCA. At the time we could not afford the repayments and vodafone kindly doubled the debt with extra charges & fees & then sold it to Fredricksons. I CCA'd them (not sure if I did the right thing) but they have written back saying the the account is not covered by the CCA. I just need a bit of advice please on my next step as I would ideally not want to repay the full amount if possible as it is mostly charges. Can I follow the F&F process even though the debt is not covered by the CCA? I would appreciate your thoughts on this. With many thanks in advance :hello:0 -

was asked to try this tread instead, i'am just not sure what to do with it

stuck with a cca with no signed agreement and the company say's this doesn't matter, is this correct?0 -

captainhaggis wrote: »OK, here's the Lloyds TSB loan.... I'd LOVE to get 'rid' of this one..... http://s991.photobucket.com/albums/af35/captainhaggis/Lloyds%20TSB%20Loan/ And the credit card is here :

Hmmm mate I hate to be the bearer of bad news, you know what's coming right?

They are both enforceable in my opinion, bummer but I doubt you can do much as they have provided signed copies and unless you dispute ever signing them, we cannot accuse them of copy/paste therefore have to assume they do have the originals - the Prescribed Terms are fully intact, on both.

Sorry matey, time to consider a F&F offer or agree a payment plan. The adverse will drop off your credit file after 6 years regardless whether you have completed paying the debt or not.

I'll text you the third alternative later, won't go down too well on here ;)

;)  2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

Hi guys,

I need a bit of advice please about a vodafone debt that has been sold to Fredricksons DCA. At the time we could not afford the repayments and vodafone kindly doubled the debt with extra charges & fees & then sold it to Fredricksons. I CCA'd them (not sure if I did the right thing) but they have written back saying the the account is not covered by the CCA. I just need a bit of advice please on my next step as I would ideally not want to repay the full amount if possible as it is mostly charges. Can I follow the F&F process even though the debt is not covered by the CCA? I would appreciate your thoughts on this. With many thanks in advance :hello:

Vodafone, as a utility company, do not conform to the CCA and so are correct in what they say. You ought to be sending a F&F offer letter - use the template from page 1 but remove any mention of CCA (if any exists) as they are not governed by the CCA either.

The main principles are the same though, i.e. if they remove data from the CRA's etc then you will pay....

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

was asked to try this tread instead, i'am just not sure what to do with it

stuck with a cca with no signed agreement and the company say's this doesn't matter, is this correct?

Sorry mate not read your thread yet, but if that's what it is i'll help here.

Ok, so who did you CCA, what did they send (be specific) and can you upload it and post the link or image up here? If not PM me the link and i'll post the image for you.

Basically a signed agreement is not required, they can send a reconstituted version if they want but usually when they decline to send the signed copy it suggests they do not actually have one! If they did, they'd send it - surely?

However, please confirm when you took the card out, who the lender is, the debt amount, when did you last pay, what is the CRA status (i.e. default or late payment marker).... basically give us a detailed update so we know what the score is then i'll sort you a response to send (if relevant) :beer: 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0 -

No worries mate. Thanks for looking. I'd sent a dispute to LTSB about the credit card but they said it was fully enforceable so I've kept paying.never-in-doubt wrote: »Hmmm mate I hate to be the bearer of bad news, you know what's coming right?

They are both enforceable in my opinion, bummer but I doubt you can do much as they have provided signed copies and unless you dispute ever signing them, we cannot accuse them of copy/paste therefore have to assume they do have the originals - the Prescribed Terms are fully intact, on both.

Sorry matey, time to consider a F&F offer or agree a payment plan. The adverse will drop off your credit file after 6 years regardless whether you have completed paying the debt or not.

I'll text you the third alternative later, won't go down too well on here ;)

;)

Cheers as alwaysHi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards