We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Advice please re ticket for no vehicle license at a railway station

Comments

-

If the manufacture and sale of licence plates were strictly regulated (currently you can buy them from the internet) then it wouldn't be a problem. And stolen licence plates can be accompanied by a stolen tax disc.

If we're going to have a tax disc, lets combine it with an insurance disc or similar. To be honest I'd rather do away with tax discs altogether. The concept of paying several hundreds of pounds for the right to drive on the roads is just an obvious money-grabbing exercise.0 -

as per the title I have a query re a ticket I received at a railway station. I received a fixed penalty notice for not have a valid tax disc.

I did have a valid tax disc, it was stupidly left in the glove locker due to being rushed for work. The old tax disc was still on the windscreen.

Ist question - can someone tell me the wording of byelaw 14 section 129 that gives the railway company the right to fine me for no licence. I can see mention of obstructions only.

2nd question - my ticket only states that I do not have a valid tax disc. I can prove that I do. The ticket does not state a valid tax disc on display. Even though mine was (although not on the left side of the widscreen.

Your thoughts please

Usually a station forecourt is private property and the need to display a tax disc only applies to the public highway doesn't it?. 0

0 -

I'll scan the ticket tonite and upload it for people to see.

It was merseyrail who have issued the ticket not BTP.0 -

Looked at your original post. Do you mean Section 14 of Railway Bye-law 219? That's the one that relates to parking. Merseyrail were reported as using that to prosecute people who weren't parking within the marked bays in Chester.

Here's a link to the Byelaw. You want page 12...

http://www.arrivatrainswales.co.uk/WorkArea/showcontent.aspx?id=616

Absolutely nothing in there at all about tax discs or anything to do with complying with the RTA. It'll be interesting to see the ticket.

[edit] Bye-law 219 ended up as 129 in an amendment in 1993 but the wording of Section 14 is exactly the same.0 -

Please note that the 5 working day exemption only applies if applying to renew online or by phone and then only when the application to renew is made on or before the last day of the month of expiry.

It does not cover people who are tardy in renewing.0 -

testertrev wrote: »Usually a station forecourt is private property and the need to display a tax disc only applies to the public highway doesn't it?.

True, but the car park owners can set their own conditions for use of the land. There's a car park near Haworth that clamps anyone that's parked touching the lines for "Not parking in a marked bay".

Sounds like that parking without tax invalidates the conditions of use- although some people seem to think that the terms of use of all railway car parks are standardised through railway by-laws- can anyone clarify?

Not saying its fair, just that it's legal.Please note that the 5 working day exemption only applies if applying to renew online or by phone and then only when the application to renew is made on or before the last day of the month of expiry.

It does not cover people who are tardy in renewing.

It sounds though that this was a parking ticket, not a spot fine for a criminal offense. Any exemption from the offense of not displaying a tax disk on a public highway isn't relevant as that isn't how and why the ticket was issued.0 -

straight off the Direct.gov.uk website so looks like merseyrail owe me a appology. In case anyone finds this thread from googling a similar situation here is the link http://www.direct.gov.uk/en/Motoring/OwningAVehicle/HowToTaxYourVehicle/DG_10034732

Not really tbh, that rule only applies if you bought the tax disc online.0 -

i had bought it online on the fri and it arrived in the monday mornings post thats why i hadn't put it on before.Neil_Peters wrote: »Not really tbh, that rule only applies if you bought the tax disc online.

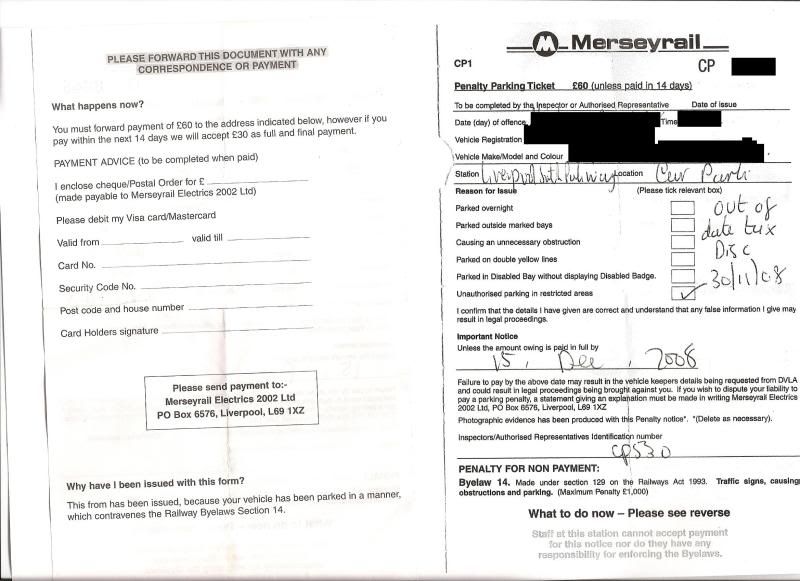

here is the ticket i had been issued

should i appeal or just leave it and see if they can take me to court?0 -

I received a fixed penalty notice for not have a valid tax disc.

2nd question - my ticket only states that I do not have a valid tax disc.

Resolved now then! It never said that.

It was for "Unauthorised parking in restricted areas".

Inspector noted OOD tax disc as an aside. All talk about VEL was pointless.

Looks legit to me - just my opinion. They quote the correct legislation. Ultimate defence would be in Mags Court I believe. I wouldn't recommend it.

-0 -

I was parked in the train car park in a normal space one of the 200 they have. It was parked in the lines not blocking in any other cars/vans. All i had was no tax on display. So to me it is VEL they are trying to charge me for.

I am not prepaired to pay a fine for something i have not done. Will they have photo evidence? as i would like to see how they can charge me under section 14 of the railway bylaws0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards