We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Cca Requests Updates Please

Comments

-

No problem. It would actually help both of us to share any significant info on these people. There is one thing they do that is quite funny. I'll PM you as I don't wish to tip them off!Hi Blueforyou,

Thanks for the heads up, he was the most hideous man I've ever come across, talk about trying to bludgeon someone into submission. I definitely think I'm in for something of a rough ride!0 -

Another letter from 1st Cretins today.

---

Thank you for your lettr of 23 Feb 2009 of which contents are noted. (this was my 12+2 letter)

I can confirm that we received your request for the original copy of agreement to which I enclose a further copy with terms and conditions, originaly sent to you on 4th March 2009. You are correct; we are required to provide a copy of the agreement requested under the Consumer Credit Act within 12 working dats. It is also correct that if the default of the credit agreement contniues for one month, that an offence may be comitted. (they are upto date then!) However, if an offence is committed, that does not affect the rights and duties between us. The Act provides defences to any offence which we believe would apply, in this case where we have to obtain documents and information to answer your request from the original creditor

In your letter of 23 Feb 09 you have not specified upon which ground you rely for your notice under s10 of the Data Protection Act and therefore we do not consider this valid; furthermore this is not a valid request as it falls under the exemption in Schedule 2 section 2(a) of the Act.

I am somewhat suprised that 'you do not acknowledge any debt to out company' when you have paid 70% of the balance, I bring to your attention that there is an outstanding balance of £237.31 which is now due.

We further note that you have ommitted to sign your letter, please ensure all future correspondence is signed.

---

Attached is a very poor copy of application form and some very clear T&C's (it must be noted on the T&C's that under charges it states "we will charge you £x for..." yes it says £x.

So what to make of that then? I know 10past6 will say ignore it.

0 -

Hi All,

I’ve been reading through the last 20 or so pages and trying to get this right in my head, so I’ve written a simplistic summary of how I think it works. I’m trying to get the process right in my mind and I'd like someone to fill in the gaps.- Send initial CCA request letter(s).

- If I get a response, then put a thread on here and invite comments as to its validity.

- If no response, send a 12+2 letter. This is me informing the creditor that the account is now in dispute. As such no further payments need to be made; no further charges or interest can be added to the account and I should not receive a default notice or CCJ for any alleged missed payment.

- Ignore any other contact from them that is not a copy of my original agreement – either written or verbal – until 6 years after the 12+2 letter. At this time send them a ‘statute barred’ letter stating that the matter is now closed.

Thanks

แล้วไงต่อ0 -

Ok, as promised, my questions if someone would be so kind as to help.

What exactly should they send me in response to a CCA request if they are doing things correctly?

I've had a response from Barclaycard that is a covering letter saying, "This completes our obligation to you under section 78 of the Consumer Credit Act 1974." and a 2 pager stamped "1993 Barclaycard T/C" and headed "Barclaycard Conditions of Use. A copy for your records, it includes a notice about your cancellation rights." It doesn't contain a signature.

What happens after I send a 12+2 letter, do I do anything else?

When does the 6 year clock start ticking? Is it re-set every time I am in contact with them, even if this is a phone call, or general correspondence?

If they haven't satisfactorily answered after 12+2, can I stop them affecting my credit rating?

I've read about the 12+2+30 letter that people suggest doesn't need sending now. Which elements of it should I include in the 12+2 letter.

Thanks again.แล้วไงต่อ0 -

Coffeetime wrote: »

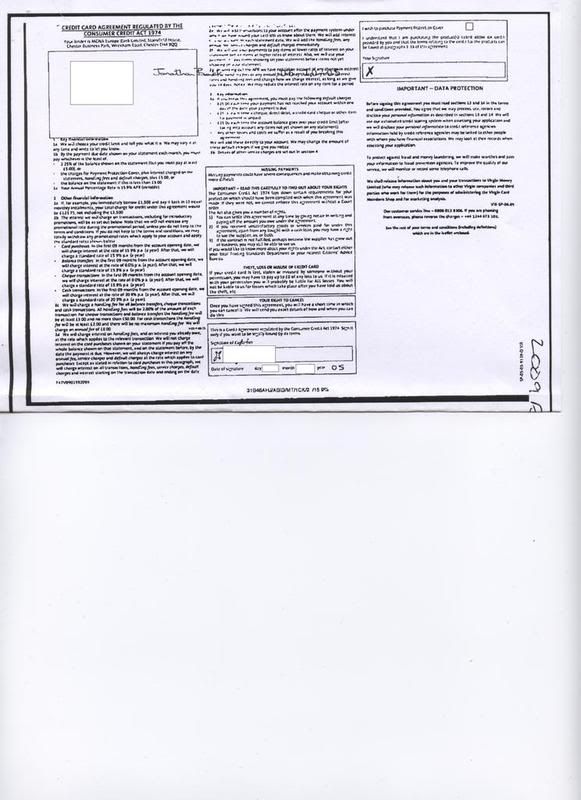

I have just recieved an identical copy of this one that Coffeetime has, mine is just as hard to read aswell! So would appreciate your opinions on wether this is a valid CCA or not.

This is also accompanied by 4 more pages of legible terms and conditions - these however are definatley not the T&C's valid at the time of applying for the card as it shows the new fees of £12.00 and other bits are different to the smaller printed copy.

The other thing that is confusing me is I sent the CCA request to Marlin, who we were paying - but Arrow Global (who passed the debt to Marlin) are replying.

They also enclose a monthly statement from MBNA - but no breakdown of any payments or charges to the DCA0 -

HiSent CCA to DCA on 20th, no reply and 12+2 is up. Current standing order is still to original creditor, so we're safe to cancel that?

Who is the debt with now?

What type of debt is it? O/D / CC / loan?Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

GemzCL Finance, CC

Your CCA request needs to go to whoever is managing your debt now, if that's CL, then that's who it needs to go to.

If they're refusing to let you set up a SO, go through there complaints procedure before reporting them.Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0 -

Sorry to be a complete techophobe, but I want to post a copy of the CCA response I've received from Barclaycard and don't know how.

I've scanned it into my computer as a .jpeg, but can't get it into a post.แล้วไงต่อ0 -

You need to upload it via this site first.MS_Dolphin wrote: »I've scanned it into my computer as a .jpeg, but can't get it into a post.Click here for Martins (MSE) advice on who to contact with Debt Issues - YOU HAVE NO REASON TO USE A FEE PAYING DEBT MANAGEMENT COMPANY- THEY CANNOT DO ANYMORE FOR YOU THAN THOSE LISTED IN MY LINK ABOVE.

All information given by myself is offered informally and without prejudice - if in doubt seek help from a qualified and insured professional0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards