We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

New HL fee structure from 01/03/26

Comments

-

I transferred the remnants of my Woodford fund from interactive investor to BestInvest in 2023. I called to check they would accept it before submitting the request. Their position may since have changed but you could try them.

I recall trying a couple of other brokers and being refused at the time.

1 -

I've compared the charges of 6 providers, based on shares I hold in and outside an ISA, plus funds held within an ISA - factoring in 120 regular DD payments per year and 8 one-off buy/sells. Ignoring fees taken buy fund mangers, the annual charged by each provider is:

HL(from March): £525

AJ Bell: £425

II (from Feb): £202 (assuming AJ Bell charges for monthly Direct Debit fund investments)

Fidelity: £309

Scottish Widows: £40

Is it really correct that Scottish Widows has £nil ongoing charges for any funds or UK shares held in or outside an ISA?

How does regular investing work with Scottish Widows? There's very little information on their website. I can't see what the minimum regular monthly Direct Debit investment is PER FUND. I think the minimum DD payment is £50 - but does that mean the minimum investment per £50 per fund, or can £25 be regularly investment in each fund (like it can with HL)?

0 -

As per my earlier post, they have added a sentence to their online transfer form stating that it is possible if you contact them within 24 hours. This was not present the last time I transferred in an ISA.

0 -

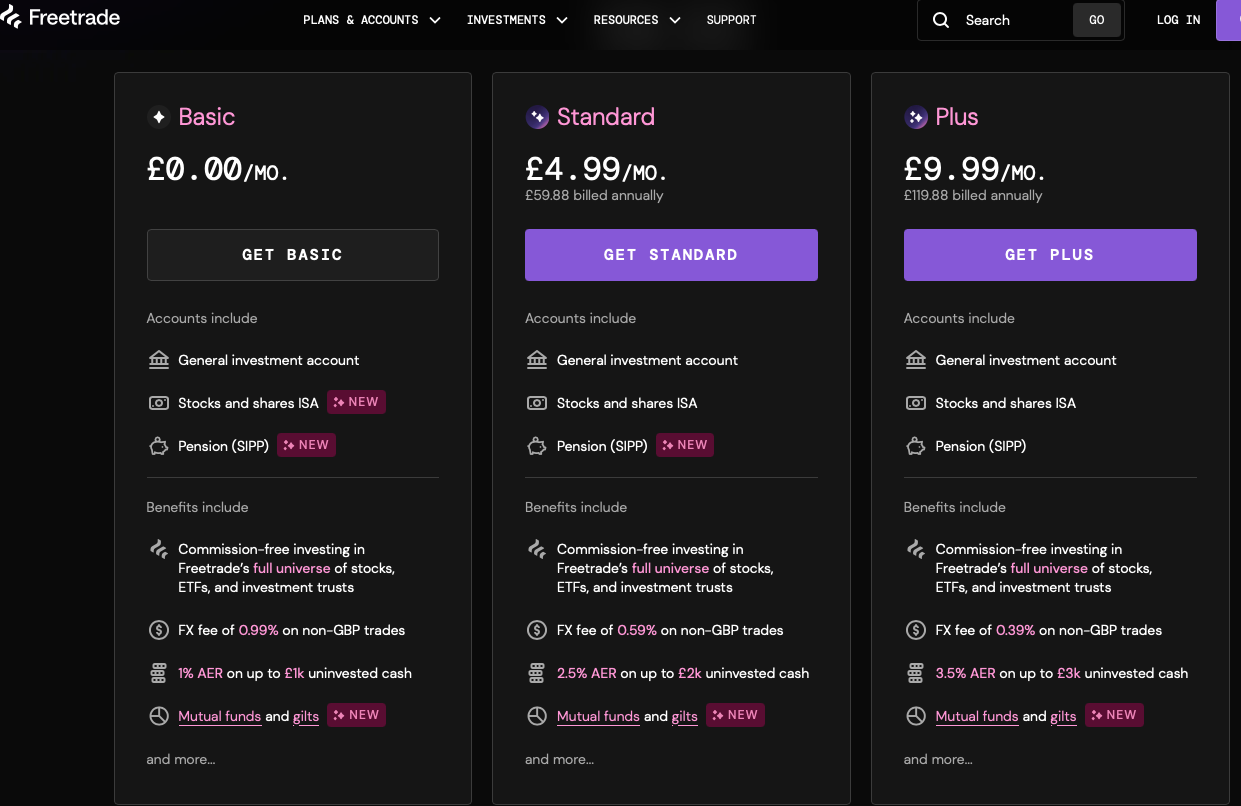

Is there any specific reason why Freetrade aren't being mentioned as an alternative? Don't think i've seen them mentioned at all in this thread.

0 -

It's probably not front of people's minds. I use it quite a bit and like it. It also has a web browser option now (Plus tier only?).

Freetrade now has a limited range of OEICs and gilts, it recently shook up its pricing which included making its free tier far more comprehensive so imo it's a good option. It was recently bought by IG so it's now backed by a longstanding, profitable company.

It's also running a 1% cashback offer on £10k+ Isa and Sipp transfers.

https://freetrade.io/offers/2026-tax-year-end-offer

IG Invest and CMC Invest are also options if you don't own OEICs.

1 -

thanks @wmb194

As someone who is about to transfer from ii to Freetrade for the 1% cashback, I just wondered if I was missing anything glaringly obvious.

0 -

It is correct that SW has no ongoing charges for dealing accounts or ISAs. It is not alone in that respect, and makes a profit nonetheless.

0 -

I thought I might have mentioned them, but I just inferred. I have named them on other threads though as I am currently switching to Freetrade too (though not from HL).

If you did, and had £500k sitting in funds in an HL SIPP, it would turn £1,750 per year of fees (£1,500 per year after their benevolent reduction) into £0 per year of fees PLUS a £5,000 cashback payment! 😯

• The rich buy assets.

• The poor only have expenses.

• The middle class buy liabilities they think are assets.1 -

I just thought of something. We are doing all these comparisons and we transfer to the cheaper platform. Boom, a few months on, the cheaper platforms up their fees as they can see HL has done, and they now have lots of ex-HL clients, so they can afford to do this, but still keep below HL to stay competitive.

Damn, we are back to where we were??? 😒

0 -

It's an eternal cycle, new free companies will then crop up to try and eat their lunch too, just as they did to the companies before them.

Much like bank accounts and car insurance it is up to the customers to keep on top of the market as all these industries love nothing more than inaction and complacency.

It is so commonplace now that the word used to describe it was "word of the year" for 2024 and Digital Word of the Year in 2023…I just don't know if I can post it on here, …so here is the link instead….. 😁

• The rich buy assets.

• The poor only have expenses.

• The middle class buy liabilities they think are assets.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards