We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

with all the coverage of impending market crashes, what are you doing?

Comments

-

The market is certainly due a correction, it never rises in a straight line. We've had a number of crashes over the years, as well as smaller technical corrections. At the time of the hurricane in 1987. The Major/Lamont one in 1992. The tech bubble 2001. 2008 was really bad. Then COVID. There was a sharp blip when Trump went all "tariffs" earlier this year. The AI bubble has continued to inflate and bitcoin is pulling money out of the markets. I was mightily relieved that the markets rebounded so strongly after Trump's tariffs and I have been happy to lock in a lot of those profits over the last few weeks. I'm about 50% cash right now. My wife and I have been spending hours over recent days rigourously examining our holdings and looking to see where and when we'll start drip feeding money back in to shares and investment trusts. (As well as planning a couple of holidays) I'm in my late 70s, so my horizon will be different to younger people.3

-

Nothing at allSB1980 said:Sorry if this has been covered in other posts.As the title says really... all i see these days are reports that the AI bubble will crash, a market correction is coming etc etc i know that no one really knows, but is anyone doing anything in advance?

I am half tempted to sell some funds i'm pretty much 100% global equities in ISA LISA and Pension, 45yo M. My thoughts are that thing every is advised to avoid, timing the markets, sell now (high) hold in cash until the upcoming (therein lies the risk, i know) fall and then buy back in low.

I am not sure i am brave enough to actually do it, but is/has/will anyone attempt this?

0 -

I'm guessing your going to 50% cash is more about your need to take risk than timing the market ? Would love to hear more about how you invested during the 2000 - 2010 period. Presumably you were in accumulation phase.Deec said:The market is certainly due a correction, it never rises in a straight line. We've had a number of crashes over the years, as well as smaller technical corrections. At the time of the hurricane in 1987. The Major/Lamont one in 1992. The tech bubble 2001. 2008 was really bad. Then COVID. There was a sharp blip when Trump went all "tariffs" earlier this year. The AI bubble has continued to inflate and bitcoin is pulling money out of the markets. I was mightily relieved that the markets rebounded so strongly after Trump's tariffs and I have been happy to lock in a lot of those profits over the last few weeks. I'm about 50% cash right now. My wife and I have been spending hours over recent days rigourously examining our holdings and looking to see where and when we'll start drip feeding money back in to shares and investment trusts. (As well as planning a couple of holidays) I'm in my late 70s, so my horizon will be different to younger people.0 -

If 40% of your portfolio was in csh2 or similar (maybe you just inherited it), would you dump the lot on Monday into the rest of your portfolio ? Or might you pause for a few months to a year recognizing that now seems to be a wilder time politically and economically than usual?dunstonh said:with all the coverage of impending market crashes, what are you doing?Nothing.

There is a crash coming 365 days a year every year. There is never a time when a crash is not coming.

Statistically, you are better off closing your eyes and punching through the volailtiy and coming out the other side rather than trying to time the markets.0 -

I've obviously not stopped contributing to my pension, but I have stopped dropping in large lump sums. Which I've been doing regularly over the last few year's. You don't need to be any sort of expert to look at the P/E ratio of the companies pushing the S&P 500 ever higher and balk.michael1234 said:

If 40% of your portfolio was in csh2 or similar (maybe you just inherited it), would you dump the lot on Monday into the rest of your portfolio ? Or might you pause for a few months to a year recognizing that now seems to be a wilder time politically and economically than usual?dunstonh said:with all the coverage of impending market crashes, what are you doing?Nothing.

There is a crash coming 365 days a year every year. There is never a time when a crash is not coming.

Statistically, you are better off closing your eyes and punching through the volailtiy and coming out the other side rather than trying to time the markets.0 -

I wrote about this at the time (in April).OldScientist said:

Market timing requires making two decisionsSB1980 said:Sorry if this has been covered in other posts.As the title says really... all i see these days are reports that the AI bubble will crash, a market correction is coming etc etc i know that no one really knows, but is anyone doing anything in advance?

I am half tempted to sell some funds i'm pretty much 100% global equities in ISA LISA and Pension, 45yo M. My thoughts are that thing every is advised to avoid, timing the markets, sell now (high) hold in cash until the upcoming (therein lies the risk, i know) fall and then buy back in low.

I am not sure i am brave enough to actually do it, but is/has/will anyone attempt this?

1) When to get out

2) When to get in

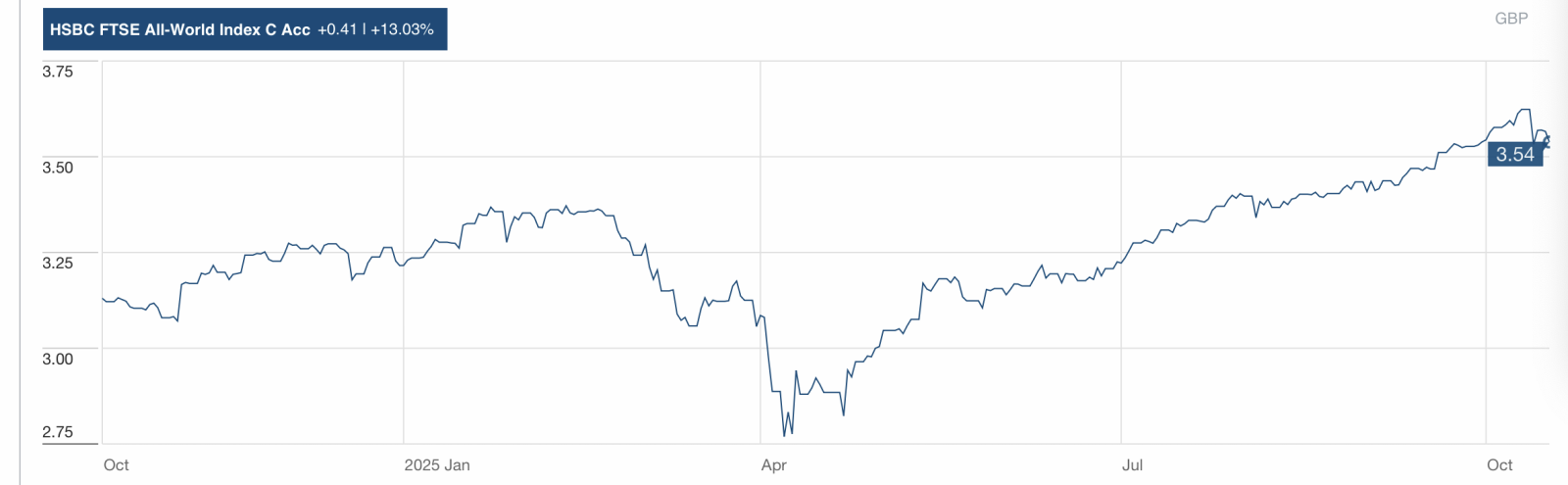

These times are very easy to spot after the event, e.g., the small 'dip' at the beginning of this year looked like this (using a global index fund), but harder at the time.

In 2025, getting out at the peak of the market (mid-Feb 2025) and getting back in at the bottom (early April) would have been great (although having bought back in at bottom, the second, short lived, dip might have caused some trepidation). But, at the time, nothing would have particularly identified either of those times since the same 'news' has been around (tariffs, Ukraine, AI, 'bubbles', etc.) for a while. Certainly, in the middle of the dip, there was no reason to believe that markets would not fall further or that they would recover so strongly as they eventually have (so far).

After every dip there are people online saying how well they did because they timed it right, but not many people own up to getting it wrong (since every trade has a buyer and a seller, they must exist). I also note that anyone contributing to their pension on a monthly basis would have 'bought the dip' without even having to think about it.

Assuming all your investments are for retirement and you are this nervous, then, as others have said, gradually dropping from 100% equities might be a good plan.

If your investments also include money that you might spend soon, do you have a cash buffer (perhaps 6 months expenditure) to see you through a) market fluctuations, and b) other unforeseen circumstances (e.g., unemployment)?

In my view, people confuse timing the market with perfect timing. If you are broadly out of the market, you are free to buy after a fall will plenty of reserves. Back in April, I did exactly that. I am mostly back out again (for a couple of months).

Nobody knows how low it was going to go in April. I was actually hoping for a much more significant fall, as the gains of the preceding 12 months had not even been scrubbed off. So I had only jumped back in with a reasonably modest portion of my holdings.

It's inarguable that buying in April was a lot cheaper than buying now.

Personally, I feel it's about discipline, primarily. If you can be disciplined enough not to worry about FOMO, and have the patience to wait for the next significant fall to get involved, and not be worried about maximising total gain, you will be able to beat £ cost averaging. This can only be tested if/when we get a long drawn out deep crash/correction, which in my view we have not seen since the GFC. So a very long time indeed, I'd say a generation. Most adults under 40 have not experienced this as an adult. At the moment, I feel like so many people still think and act as if it's a one way bet, especially those fixated on the 500, daq, and the sexy US names.

I've only really been 'actively' doing this significantly since 2019. So the covid/lockdown fall was great. I learned quite a lot then though, especially how difficult it is purchasing funds, as the swings mean the actual price can be vastly different to the price you commit to purchasing at. I knew the price would change of course, but I wasn't prepared for the value of the daily swings seen then. In my workplace pension I had to wait three days for a purchase price to be determined after instruction! Therefore in April I'd adapted to using ETFs and single shares (mainly IT), where I knew the price I was purchasing at. No doubt I will learn more in the next significant downturn.

Just for completeness, away from MMFs I am involved now in some way, but only high yield, so I can swallow falls there as capital gain is not my priority for those holdings, and I don't intend to sell, so the prevailing value is pretty irrelevant.1 -

Have you considered if your pension offers other attractive things to invest in? Corporate bonds, index linked gilts, money market funds, etc? Just because stock market valuations are high is no reason to stop getting the most tax benefits of making pension contributions. At the moment there are plenty of good investment choices that should keep up with or exceed inflation which favours running a diversified portfolio.jimexbox said:I've obviously not stopped contributing to my pension, but I have stopped dropping in large lump sums. Which I've been doing regularly over the last few year's. You don't need to be any sort of expert to look at the P/E ratio of the companies pushing the S&P 500 ever higher and balk.0 -

I’m 41. When I started investing I toyed with so many options when I started out with ETFs.

I flirted with defence ETFs, AI concentrated stocks, small caps, mid caps, gold, silver and so on.I like the idea of multiple ETFs and the idea of spreading risk but I know my downfall would be tweaking, constant rebalancing and questioning my decisions.

rightly or wrongly I decided to invest solely into an all world ETF, Invesco’s FWRG.I put three lump sums in and I invest what I can at the end of each month, usually between 500 and 700 pounds per month.I told myself when I started that I would ride the rollercoaster and keep adding regardless, many good YouTubers who repeat the mantras of you can’t time the market and time in the market beats trying to time the market.I know you need to be careful with people online giving opinions and advice but I stick to people who I believe to be genuine and remain open minded and objective, I’m not interested in get rich quick or jumping on bandwagons.

in 10/15/20 years I hope my plan works out.

with all the noise about a crash it can be unsettling but my plan remains the same.1 -

I don't necessarily disagree with that strategy, if it suits you.

My argument is that we need to experience another time when the markets crater, but this time, don't bounce back in the short term. That's when conviction will be tested.

It's very easy to put forward the advice to ignore all the chatter about crashes when the US is continually bouncing into all time highs. But I do recommend opening the bonnet and looking at what's underneath, and the cost of what you are adding into it. What are you buying when you purchase more FWRG? It's future earnings isn't it. Well, they are currently typically trading at one of the most expensive prices in the history of global markets. At the moment, market makers are carrying on, regardless.

4 -

I agree with both the op and also with many posters who say that a crash is always "comming" and not to over react. On balance, I think the risk currently is more to the downside than I am comfortable with, for that reason I have taken some profit and reduced some allocations. My allocations to Tech were always under control but my exposure to Financial Services was higher than it ought to be, so I have now taken some profit from key funds. Also, I invest globally so I've seen EM and Europe funds under pressure hence I've reduced allocations there, to a more comfortable level. In total, the adjustements amount to about 8% of my holdings, which always were at a fairly low level anyway. These actions take me to 48% equities, but given my advanced years, lower risk is my priority these days. My major concerns currently is the potential contagion from "cockroach" loans and secondly of course, the AI bubble.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards