We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Nationwide - Fixed cash ISA due to mature in few weeks

boco803

Posts: 71 Forumite

Just want to double check that I've not missed anything regarding impending ISA maturity.

It would appear that you can only administer what you'd like to do with matured funds in branch, via postal form or over the phone. I'm pretty sure it was possible to provide instrustions via a dedicated webpage to move funds into a new ISA account or something in the the past?

So as it is now, if I just want to deal with it online, my only option is to let it mature into their maturity ISA, then initiate a transfer out to another providers' account?

0

Comments

-

I also think it was possible in the past to do it on line but apparently not now, which seems a bit regressive.boco803 said:Just want to double check that I've not missed anything regarding impending ISA maturity.It would appear that you can only administer what you'd like to do with matured funds in branch, via postal form or over the phone. I'm pretty sure it was possible to provide instrustions via a dedicated webpage to move funds into a new ISA account or something in the the past?So as it is now, if I just want to deal with it online, my only option is to let it mature into their maturity ISA, then initiate a transfer out to another providers' account?

Maybe they are trying the old bank trick where you had to pick your new card up from a branch so they could tya and sell you something else.

By coincidence I also have a maturing fixed rate cash ISA with N/wide and have opened a new cash ISA with Shawbrook about 20 mins ago and arranged a transfer.

They give you the option not to transfer before the maturity date . I have done it before and it works ok.2 -

Thanks for your reply.Looks like I'll have to see what's on offer, as Nationwide's Fixed Maturity ISA will only be paying something like 1.15%.Pretty sure Nationwide offered maturing ISA customers better rates too!0

-

Their one year fix is 4%, which is okboco803 said:Thanks for your reply.Looks like I'll have to see what's on offer, as Nationwide's Fixed Maturity ISA will only be paying something like 1.15%.Pretty sure Nationwide offered maturing ISA customers better rates too!

The longer fixes are 3.8% .0 -

Wonder if I'll be able to, if I decided to do so, apply for a new ISA shortly after my existing one matures, then either instruct funds to be moved over during the application process, or perform a transfer-in after the new one successfully opens?Anyone done this recently?0

-

That would usually be a common way to proceed, however, if you're talking about transferring internally with Nationwide then they actually have two different quirks with their fixed rate ISA accounts that are likely to mean that a branch visit is still needed.boco803 said:Wonder if I'll be able to, if I decided to do so, apply for a new ISA shortly after my existing one matures, then either instruct funds to be moved over during the application process, or perform a transfer-in after the new one successfully opens?Anyone done this recently?

The first from their fixed rate ISA T&Cs is that "you can only pay money into your account on the day you open it" and also that "you won’t be able to see your account on the Internet Bank or our Banking app until the final amount being transferred has been received and paid into your account"

This means that if the option to do an internal transfer isn't offered as part of the application process, then there will be no account visible in online banking and therefore you won't able to see whether there's an (online) option to request an internal transfer into it... and this is not likely to be an option anyway according to their ISA transfer help page, as you've already found out...Transfers to Nationwide

If you are transferring to us and are looking to open a new cash ISA, we will tell you what to do when you apply for an ISA with us. If you already have a Nationwide ISA and want to transfer to this account, we can help you in branch.

This does seem to be a hindrance to many - if you don't have a convenient branch then I would use it as an excuse to transfer to a different ISA provider and get a better rate.

1 -

As already said yesterday I opened a new Shawbrook fixed rate ISA ( I am already a customer) and requested a transfer of the N/wide ISA when it matures . It took 5 mins.boco803 said:Wonder if I'll be able to, if I decided to do so, apply for a new ISA shortly after my existing one matures, then either instruct funds to be moved over during the application process, or perform a transfer-in after the new one successfully opens?Anyone done this recently?

Immediately I could see the see account had been set up ( with zero funds) and about 12 hours later got an e mail that the request had been sent to N/wide.

Sometimes it does not work quite so fast.1 -

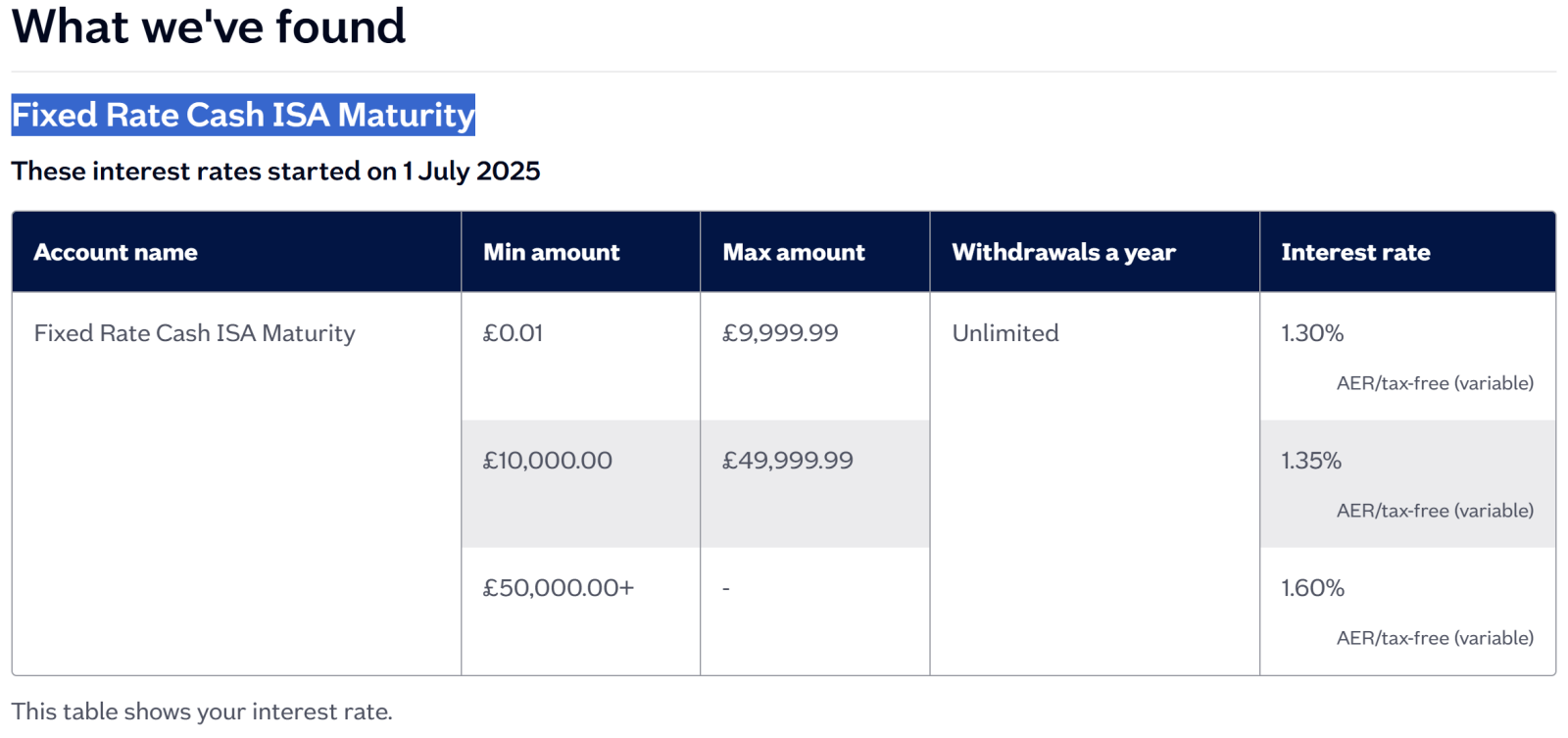

If your Nationwide ISA matures it will convert to an easy access ISA. This is what the Fixed Rate Cash ISA Maturity is or as you referred to Fixed Maturity ISA. This is not a new fix it's a Maturity account for a Fixed Rate ISA. That's why it has unlimited withdrawals (as seen below). You do have access to all Nationwide's ISA on maturity.boco803 said:Wonder if I'll be able to, if I decided to do so, apply for a new ISA shortly after my existing one matures, then either instruct funds to be moved over during the application process, or perform a transfer-in after the new one successfully opens?Anyone done this recently?

I had an FR ISA mature with them recently and you can move to a new fixed rate isa on maturity but as per their letter you must inform them of these instructions before your maturity date. This can be a postal form or branch visit as suggested below.

Alternatively, if you let your account mature you can then open a new fixed rate ISA and transfer the matured ISA funds into it on the date of opening, as you suggested above. I have seen the "transfer in funds to an ISA" when I opened my fixed rate ISA so it should still be available.

I don't think this is correct as my Nationwide maturity letter suggests that money can 1) be moved to a different ISA product and that 2) you can decide later by letting the account mature in the Fixed Maturity ISA.refluxer said:The first from their fixed rate ISA T&Cs is that "you can only pay money into your account on the day you open it" and also that "you won’t be able to see your account on the Internet Bank or our Banking app until the final amount being transferred has been received and paid into your account"

This means that if the option to do an internal transfer isn't offered as part of the application process, then there will be no account visible in online banking and therefore you won't able to see whether there's an (online) option to request an internal transfer into it... and this is not likely to be an option anyway according to their ISA transfer help page, as you've already found out...

Hope this helps.1 -

Yes, you're right - money can be transferred to a different Nationwide ISA at any point after it matures, but does the maturity letter specify this can be carried out online ?Ch1ll1Phlakes said:

I don't think this is correct as my Nationwide maturity letter suggests that money can 1) be moved to a different ISA product and that 2) you can decide later by letting the account mature in the Fixed Maturity ISA.refluxer said:The first from their fixed rate ISA T&Cs is that "you can only pay money into your account on the day you open it" and also that "you won’t be able to see your account on the Internet Bank or our Banking app until the final amount being transferred has been received and paid into your account"

This means that if the option to do an internal transfer isn't offered as part of the application process, then there will be no account visible in online banking and therefore you won't able to see whether there's an (online) option to request an internal transfer into it... and this is not likely to be an option anyway according to their ISA transfer help page, as you've already found out...

The quotes from the T&Cs (and general FAQs) suggest that transferring internally will require a branch visit (I guess this may possibly extend to post or phone) and that this can't be done online, which is what the OP would like to do.

1 -

It does not say specifically how these are done just gives the options. When I set up my fixed rate ISA, at the funding stage it highlighted all my other Nationwide accounts that I could add money from. These included my ISAs as far as I can remember so hoping I'm correct I think the transfer of matured ISA into a new Fixed rate ISA should be possible.refluxer said:

Yes, you're right - money can be transferred to a different Nationwide ISA at any point after it matures, but does the maturity letter specify this can be carried out online ?Ch1ll1Phlakes said:

I don't think this is correct as my Nationwide maturity letter suggests that money can 1) be moved to a different ISA product and that 2) you can decide later by letting the account mature in the Fixed Maturity ISA.refluxer said:The first from their fixed rate ISA T&Cs is that "you can only pay money into your account on the day you open it" and also that "you won’t be able to see your account on the Internet Bank or our Banking app until the final amount being transferred has been received and paid into your account"

This means that if the option to do an internal transfer isn't offered as part of the application process, then there will be no account visible in online banking and therefore you won't able to see whether there's an (online) option to request an internal transfer into it... and this is not likely to be an option anyway according to their ISA transfer help page, as you've already found out...

The quotes from the T&Cs (and general FAQs) suggest that transferring internally will require a branch visit (I guess this may possibly extend to post or phone) and that this can't be done online, which is what the OP would like to do.

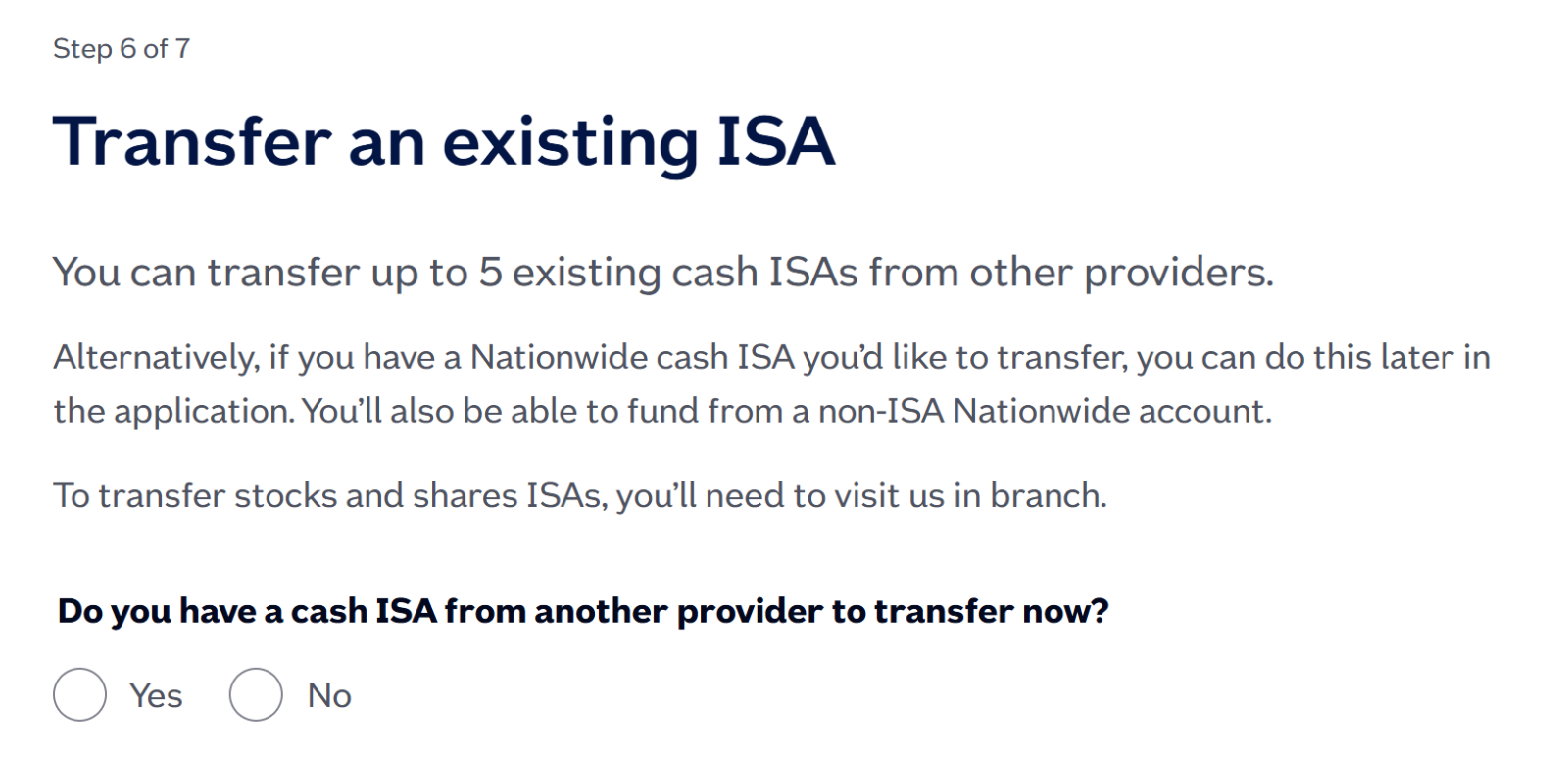

Ok out of curiosity's sake I started a fixed rate ISA application I have got to this stage which should clear this up for the OP.

Key Point: You can transfer a Nationwide ISA at a later stage of the application process. I didn't complete the process ad I don't want the hassle of having to cancel within 14 days.1 -

Although it’s not mentioned in the maturity letter, according to this page you can give instructions to reinvest online:

https://www.nationwide.co.uk/savings/help/fixed-rate-isa-maturity-options/I can’t see any problem with this as it looks quite straightforward so no branch visit or form by post required.

Am I missing something?

Andrew.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.6K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards