We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

To use regular savers or not

Comments

-

Not it didn't, this is just plain wrong. This is such a common misconception.RunsFromRobots said:My regular saver with Virgin matured recently which was 10% on £250 per month. This yielded just over 5% on £3,000 over 12 months.

If you have capital already I don't see them as a great return but are good for those looking to start saving from scratch.

How is 10% not a great return? If you're wondering why you didn't receive an annual return of 10% on £3,000, it's because you didn't have £3,000 in the account for a year!

Think of it like this - let's say you have £3,600 in an account earning 4% interest - so £144 in interest a year (3600 x 4%).topyam said:Confused and can't get my head around whether regular savers accounts are an option for me...

I have savings - over £30k

What i can't understand is whether i am better having this in an easy access account paying a decent rate, or moving some into regular savers accounts?

Surely a decent amount is better altogether earning interest?

Sorry - I have read up on regular savers accounts, but still think I'm missing something in my understanding as so many of you use them.

Now instead of thinking of it as one lump, let's think of it as 12x individual chunks of £300, so each chunk is earning £12 a year (300 x 4%). Let's now think of interest on a monthly basis and consider that you are earning £1 per month per chunk.

Let's say you decided to sign up for First Direct (who have a Regular Saver paying 7% on up to £300 p/m).

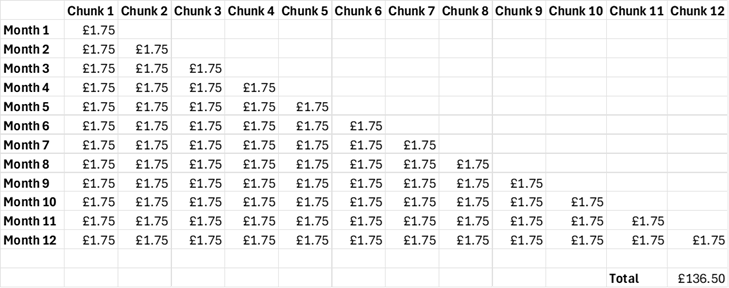

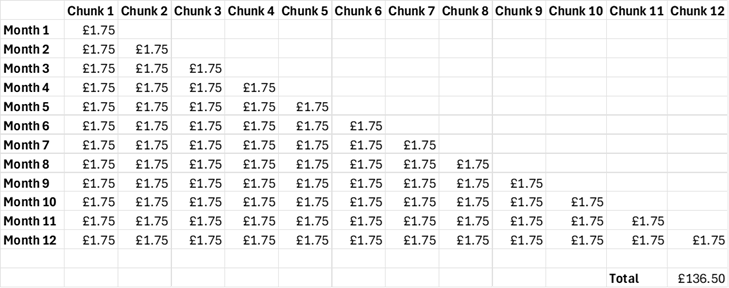

In the first month, you put in one of the chunks of £300. During the month, this chunk would earn £1.75 ((300 x 7%)/12) in interest.

In the second month, you put in another one of the chunks of £300. The first chunk again earns £1.75 and so does the second chunk.

Rinse and repeat.

You then end up with a situation like the below, earning you ~£136.50 in interest (and fortunately FD agree with my numbers: https://www.firstdirect.com/savings-and-investments/savings/regular-saver-account/ )

You were earning a rate of 7% on each chunk of money while it was First Direct. Don't get blinkered by only thinking of interest as an annual thing, it is actually calculated daily (but paid annually).

Now people like the above poster may say "But £136.50 is not 7% of £3600?" still missing the point that all the money wasn't with First Direct the whole year - perhaps concluding that 136.5/3600 is ~3.8%, so that is the 'real rate'. They might also forget that while the moneys not with First Direct, it would have been earning interest elsewhere.

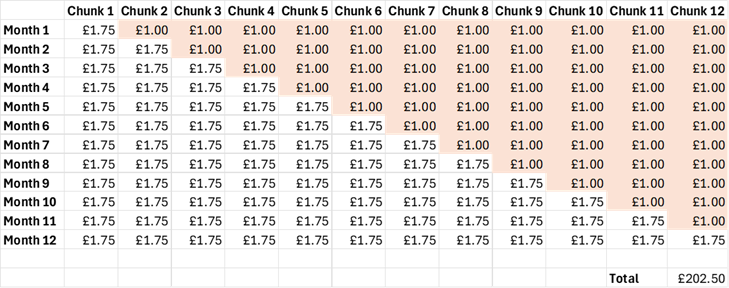

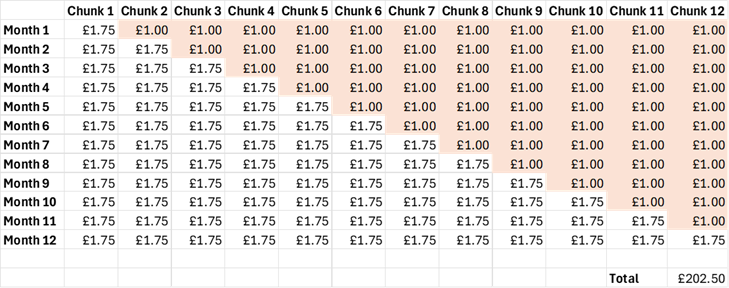

So to jump back to our 4% account, let's add in the interest that we would be earning on that while we were moving chunks into the regular saver.

You can now see that you would have earned £202.50 in interest on your £3,600 across a year.

Clearly that's better than the £144 of interest (3600 x 4%) you would have earned without regular savers - though this was probably obvious when you consider you're earning £1.75 per month on each chunk instead of £1.

Unfortunately there is a significant amount of people that do not understand how this works (and an unfortunate amount of them post on MSE also).

But it really is as simple as bigger number = better (unless one account is taxable and one is not and then it becomes a bit more nuanced).Know what you don't30 -

You're spot on, higher interest rate is better than lower interest rate, all other things being equal. Thanks for such a detailed explanation. It's no wonder people get confused when the likes of the post you quoted give misleading info which while maybe numerically correct is completely the wrong way of understanding it.Exodi said:

Unfortunately there is a significant amount of people that do not understand how this works (and an unfortunate amount of them post on MSE also).RunsFromRobots said:My regular saver with Virgin matured recently which was 10% on £250 per month. This yielded just over 5% on £3,000 over 12 months.

If you have capital already I don't see them as a great return but are good for those looking to start saving from scratch.

But it really is as simple as bigger number = better (unless one account is taxable and one is not and then it becomes a bit more nuanced).Remember the saying: if it looks too good to be true it almost certainly is.3 -

My simple way of viewing it is that the effective rate is about half way between the feeder account rate and the regular saver rate.I’m a Forum Ambassador and I support the Forum Team on the Credit Cards, Savings & investments, and Budgeting & Bank Accounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.0 -

I definitely think they are worth it, and for me it is like a hobby.

Beware, they can be addictive once you start Save £12k in 2022 #54 reporting for duty3

Save £12k in 2022 #54 reporting for duty3 -

Yes, and I also get a bit of a feeling of "beating the system"!dingling68 said:I definitely think they are worth it, and for me it is like a hobby.

Beware, they can be addictive once you start 5

5 -

Regular Savers, if they have a higher interest rate, will away earn you more than just leaving in a easy access account. Just for example consider the following looking at the first month of a regular saver cycle with £30ktopyam said:Confused and can't get my head around whether regular savers accounts are an option for me...

I have savings - over £30k

What i can't understand is whether i am better having this in an easy access account paying a decent rate, or moving some into regular savers accounts?

Surely a decent amount is better altogether earning interest?

Sorry - I have read up on regular savers accounts, but still think I'm missing something in my understanding as so many of you use them.

Option 1: Leave all in Easy Access account

Take an interest rate of around 4% which is reasonable at the moment

In one year £30k would earn £30000 x 0.04 = £1200 (Note this is over the PSA)

In one month then roughly £1200/12 = £100

Option 2: Drip feed money from easy access into regular saver

Say we have a regular saver paying 7% interest and can deposit £250 per month

In month one we have £29750 in the EA account and £250 in the regular saver

The interest for one year if we made no change would be as follows;

The easy access account would earn £29750 x 0.04 = £1190 per year ( or £99.17 per month)

The regular saver would earn £250 x 0.07 = £17.5 per year ( or £1.46 per month)

Putting these two values total your total interest for the year would be £1207.50 (or £100.63 per month)

While this increase might not seem like very much remember the amount in the regular saver could (and should) be increasing every month, so increasing more money is earning 7% instead of the 4% in the easy access account.

Full year usage

For reference, based on a £250 deposit per month in the regular saver for 12 months here's the interest (this is an approximation but is ok for comparison using the Formula = (month one value + month twelve value)/2 * interest )

Easy access (29750 + 27000)/2 x 0.04 = £1135

Regular Saver (250 + 250x12)/2 x 0.07 = £113.75

__________________________________________

Total = 1135 + 113.75 = £1248.75

So an extra £48.75 for 12 payments of £250 moved to the regular saver.

Note: many people of this forum have multiple regular savers on the go so can move more money each month to higher interest rates therefore earning more interest.

Sorry this is so long but hopefully this helps you understand why the regular savers are beneficial. If you want any further examples let me know, I have the time (yes it's a bit sad I know :'( ).3 -

@Exodi has beaten me to the punch and used the same interest rates so use whichever you find is clearer.Ch1ll1Phlakes said:

Regular Savers, if they have a higher interest rate, will away earn you more than just leaving in a easy access account. Just for example consider the following looking at the first month of a regular saver cycle with £30ktopyam said:Confused and can't get my head around whether regular savers accounts are an option for me...

I have savings - over £30k

What i can't understand is whether i am better having this in an easy access account paying a decent rate, or moving some into regular savers accounts?

Surely a decent amount is better altogether earning interest?

Sorry - I have read up on regular savers accounts, but still think I'm missing something in my understanding as so many of you use them.

........

Sorry this is so long but hopefully this helps you understand why the regular savers are beneficial. If you want any further examples let me know, I have the time (yes it's a bit sad I know :'( ).0 -

I know :'( Within a week I've gone from saying "I've got more than enough bank accounts" to faffing around endlessly with the Monmouthshire app.dingling68 said:I definitely think they are worth it, and for me it is like a hobby.

Beware, they can be addictive once you start

No need to scare the OP just yet... start it off nice and easy with something like Cooperative or Nationwide.

Bet they weren't expecting this many replies to their post! They don't know what they've let themselves in for...4 -

The "half the RS interest rate" approximation only makes sense if you have the full amount sitting in a 0% account and are transferring bits in gradually.

If you had the full amount then the more accurate calc is AVERAGE ( RS rate , Orig Account rate), which is the same as half if the original account rate is 0%. But if you started with the full money in a simple easy access account at say 4% that average gets a lot higher.

If you didn't have the full amount upfront then whether you drip it into a regular saver or an easy access makes no difference, you don't get interest on money you don't have!

2 -

I like your use of tablesExodi said:

Not it didn't, this is just plain wrong. This is such a common misconception.RunsFromRobots said:My regular saver with Virgin matured recently which was 10% on £250 per month. This yielded just over 5% on £3,000 over 12 months.

If you have capital already I don't see them as a great return but are good for those looking to start saving from scratch.

How is 10% not a great return? If you're wondering why you didn't receive an annual return of 10% on £3,000, it's because you didn't have £3,000 in the account for a year!

Think of it like this - let's say you have £3,600 in an account earning 4% interest - so £144 in interest a year (3600 x 4%).topyam said:Confused and can't get my head around whether regular savers accounts are an option for me...

I have savings - over £30k

What i can't understand is whether i am better having this in an easy access account paying a decent rate, or moving some into regular savers accounts?

Surely a decent amount is better altogether earning interest?

Sorry - I have read up on regular savers accounts, but still think I'm missing something in my understanding as so many of you use them.

Now instead of thinking of it as one lump, let's think of it as 12x individual chunks of £300, so each chunk is earning £12 a year (300 x 4%). Let's now think of interest on a monthly basis and consider that you are earning £1 per month per chunk.

Let's say you decided to sign up for First Direct (who have a Regular Saver paying 7% on up to £300 p/m).

In the first month, you put in one of the chunks of £300. During the month, this chunk would earn £1.75 ((300 x 7%)/12) in interest.

In the second month, you put in another one of the chunks of £300. The first chunk again earns £1.75 and so does the second chunk.

Rinse and repeat.

You then end up with a situation like the below, earning you ~£136.50 in interest (and fortunately FD agree with my numbers: https://www.firstdirect.com/savings-and-investments/savings/regular-saver-account/ )

You were earning a rate of 7% on each chunk of money while it was First Direct. Don't get blinkered by only thinking of interest as an annual thing, it is actually calculated daily (but paid annually).

Now people like the above poster may say "But £136.50 is not 7% of £3600?" still missing the point that all the money wasn't with First Direct the whole year - perhaps concluding that 136.5/3600 is ~3.8%, so that is the 'real rate'. They might also forget that while the moneys not with First Direct, it would have been earning interest elsewhere.

So to jump back to our 4% account, let's add in the interest that we would be earning on that while we were moving chunks into the regular saver.

You can now see that you would have earned £202.50 in interest on your £3,600 across a year.

Clearly that's better than the £144 of interest (3600 x 4%) you would have earned without regular savers - though this was probably obvious when you consider you're earning £1.75 per month on each chunk instead of £1.

Unfortunately there is a significant amount of people that do not understand how this works (and an unfortunate amount of them post on MSE also).

But it really is as simple as bigger number = better (unless one account is taxable and one is not and then it becomes a bit more nuanced). Compiler of the RS League Table.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards