We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Moneda Capital Warning

Comments

-

Good spot, but I hope not for those affected in reality. Probably some other forum members and I have the pleasure of this combo hosting the administration of Collateral P2P lending. We're now 7.5 years into this process......masonic said:

If the FCA call in the administrators, hopefully they'll appoint this one: https://www.bdo.co.uk/en-gb/our-people/shane-crooksjifmoose said:The SFO, working closely with the FCA, are also taking a very close interest in London Capital & Finance’s conduct, with five individuals already arrested and released under investigation including Paul Careless: the founder of ‘Surge Financial’Some spectacular nominative determinism there

Though hopefully this won't take as long as it doesn't involve property ( I hope..).2 -

I guess the question will be whether it involves any assets at allFrequentlyhere said:

Good spot, but I hope not for those affected in reality. Probably some other forum members and I have the pleasure of this combo hosting the administration of Collateral P2P lending. We're now 7.5 years into this process......masonic said:

If the FCA call in the administrators, hopefully they'll appoint this one: https://www.bdo.co.uk/en-gb/our-people/shane-crooksjifmoose said:The SFO, working closely with the FCA, are also taking a very close interest in London Capital & Finance’s conduct, with five individuals already arrested and released under investigation including Paul Careless: the founder of ‘Surge Financial’Some spectacular nominative determinism there

Though hopefully this won't take as long as it doesn't involve property ( I hope..). Remember the saying: if it looks too good to be true it almost certainly is.2

Remember the saying: if it looks too good to be true it almost certainly is.2 -

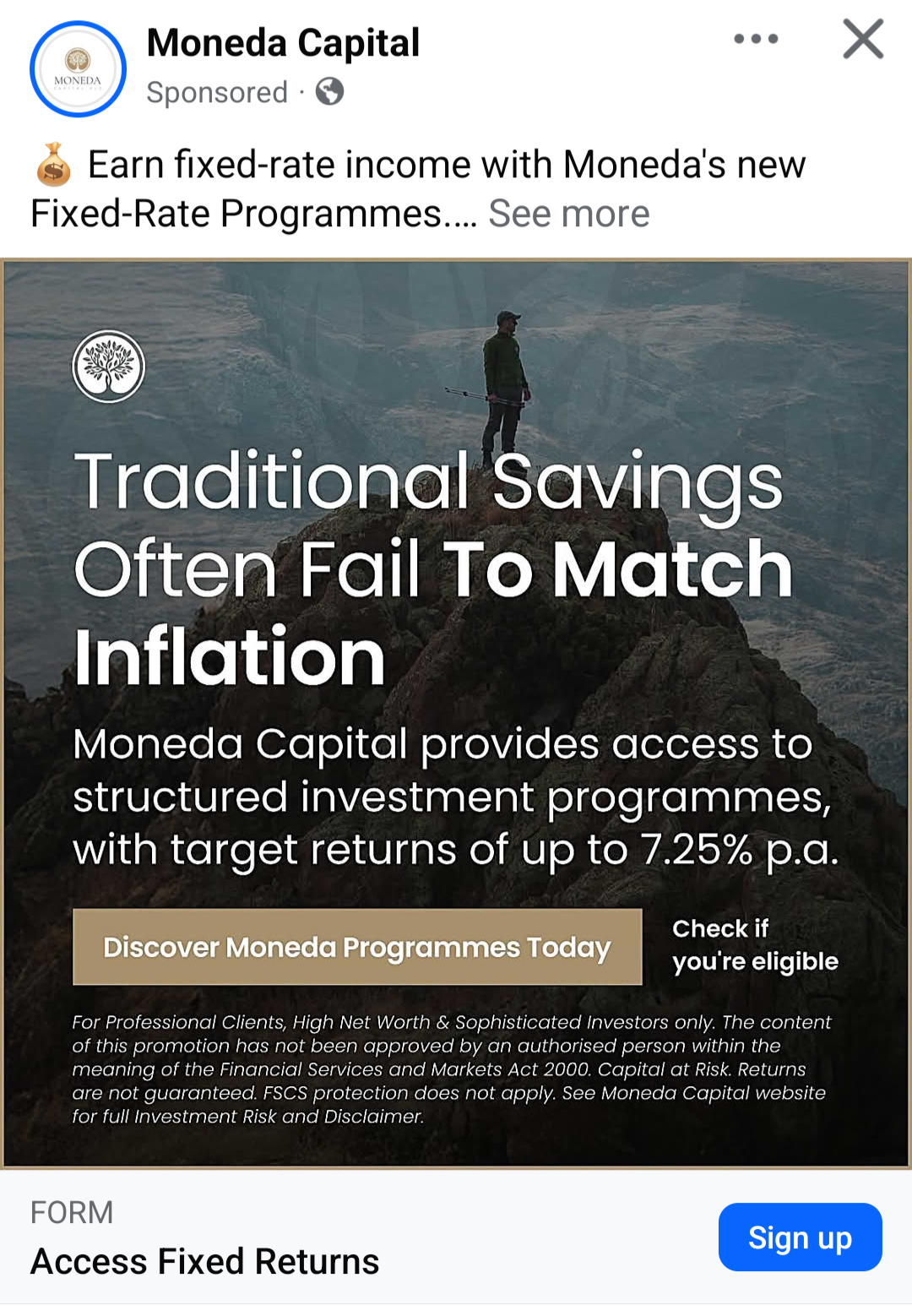

I invested my life savings into a Moneda savings account at the end of April 2025 that was offering 4.75% after I'd done a Google search for fixed rate savings accounts, where a website came up with a list of companies to invest with and they were one of them. I'd previously registered with Raisin UK to get a savings account with them (I wish I had stuck with them now) but as they'd been dragging their heals about getting back to me after registering with them and a week having gone by with no contact from them about them having opened an account for me (Thanks Raisin. You idiots), I decided to register with Moneda who were much quicker to respond. So I did the bank transfers with a 'Senior Portfolio Manager' called Harry Gill who advised me that my funds would be protected by FCA and the FSCS. And again, I only decided to go with them because of the Google reviews, Trustpilot reviews and Glassdoor reviews which were all 4.5 to 4.8 out of 5...and the one that gave me the most piece of mind was the 250 reviews on Trustpilot. Now at this point, I'm thinking that the majority of these reviews are fake but you just wouldn't think someone would spend all that time and effort to leave 250 reviews! Crazy. so now this week on Tuesday, I tried to log into my account via their website at monedacapitalgroup.com and that notice about them being investigated by the FSA was on there and was preventing me from logging in. I then looked up the investigation of Moneda on Google and it told me that they're under investigation because they are NOT covered by the FCA and the FSCS...and I had a terrible sinking feeling me stomach as I realised I'd been scammed. And now I'm extremely worriedjimjames said:There have been a few threads in the past about Moneda Capital that seem to have disappeared . The bank they claimed to be working with has confirmed that they have no contractual relationship with them but interestingly Moneda Capital has now amended their advertising.

Although they are still targeting social media (Instagram/Facebook) their ads now include the line that it is only for High Net Worth or sophisticated investors. Rather odd if these are deposit accounts protected by FSCS as they claimed previously but now says no FSCS. I wonder if FCA have been in touch to get changes made?

After they were claiming to be offering bank deposits previously Moneda are now saying the capital is at risk and returns aren't guaranteed. Anyone considering them should make sure they know exactly where there money is going and contact the relevant bank to be sure.

1

1 -

It is likely that many of the reviews were genuine. Because they created an excellent customer journey. Most people leave a review soon after handing over their money. Very few leave a review only after taking it all out, and among those are probably some fake ones. It's much easier to build a good reputation on social media than build a business. And this frees up more time to make your "customers" feel looked after.AshleeG said:I only decided to go with them because of the Google reviews, Trustpilot reviews and Glassdoor reviews which were all 4.5 to 4.8 out of 5...and the one that gave me the most piece of mind was the 250 reviews on Trustpilot. Now at this point, I'm thinking that the majority of these reviews are fake but you just wouldn't think someone would spend all that time and effort to leave 250 reviews! Crazy5 -

masonic said:

It is likely that many of the reviews were genuine. Because they created an excellent customer journey. Most people leave a review soon after handing over their money. Very few leave a review only after taking it all out, and among those are probably some fake ones. It's much easier to build a good reputation on social media than build a business. And this frees up more time to make your "customers" feel looked after.AshleeG said:I only decided to go with them because of the Google reviews, Trustpilot reviews and Glassdoor reviews which were all 4.5 to 4.8 out of 5...and the one that gave me the most piece of mind was the 250 reviews on Trustpilot. Now at this point, I'm thinking that the majority of these reviews are fake but you just wouldn't think someone would spend all that time and effort to leave 250 reviews! CrazyIndeed. I remember reading a plethora of five star Trustpoilot reviews for the infamous London Capital and Finance. The large majority were from people who had found handing their money over to Mr Ponzi to be a smooth and effortless process. Often they were also very impressed by the fact that they were able to see their (entirely fictional) balance online, as if that was a thing of wonder and not the bare minimum that you would expect from a savings or investment website. Virtually none were from people who had successfully extracted their money from Mr Ponzi.A bit like leaving a five star review for a used car dealer that says "The car he sold me is fantastic - it has four wheels. One day I'm going to try taking it for a drive."3 -

I have contacted the FCA. Very helpful but could not say much as its an ongoing case. Contacted the FSCS for info on compensation and the answer was the same. We need to be patient. Although they told me that its not a rare case . Indeed the fact the FCA is on it is a good sign but in terms of compensation it seems that its going to be very difficult...masonic said:Dingdangdu said:Has anybody else received an email from Moneda, purporting that they are under investigation by the FCA, and that anybody seeking further information should contact the FCA directly - they even provided the phone number and case reference number?The FCA does instruct firms to release approved communications to all known investors in such circumstances, so it is probably genuine and not the sort of thing they'd do without it being true. However, I'd be hesitant to use any contact details in the email just in case.There is little point contacting the FCA. If they need anything from you then they are capable of getting your details and contacting you directly, as they did me during their investigation into a fraudulent P2P platform I'd invested in some years ago. At some point they may gather evidence about what investors were told about what they were supposed to be investing in.0 -

Did not take long for an ambulance chasing law firm to spot a litigation opportunity

https://nationalfraudhelpline.co.uk/types-of-fraud/moneda-capital-investigation/#:~:text=Please contact us on 0333 0033218 or fill out our Claim Form.

Interestingly their approach is to invite affected savers to help build a class action against Moneda's bankers, presumably on the assumption that investor/savers monies have long since disappeared and the only entities now standing with deep enough pockets are the company's bankers.1 -

Abovetheradar said:

I have contacted the FCA. Very helpful but could not say much as its an ongoing case. Contacted the FSCS for info on compensation and the answer was the same. We need to be patient. Although they told me that its not a rare case . Indeed the fact the FCA is on it is a good sign but in terms of compensation it seems that its going to be very difficult...masonic said:Dingdangdu said:Has anybody else received an email from Moneda, purporting that they are under investigation by the FCA, and that anybody seeking further information should contact the FCA directly - they even provided the phone number and case reference number?The FCA does instruct firms to release approved communications to all known investors in such circumstances, so it is probably genuine and not the sort of thing they'd do without it being true. However, I'd be hesitant to use any contact details in the email just in case.There is little point contacting the FCA. If they need anything from you then they are capable of getting your details and contacting you directly, as they did me during their investigation into a fraudulent P2P platform I'd invested in some years ago. At some point they may gather evidence about what investors were told about what they were supposed to be investing in.The FCA are only "on it" after prodding from several forum members (and no doubt others). Red flags were first raised about 6 months before the FCA opened their investigation, which admittedly is an improvement on usual timescales. One has to wonder how much money was handed over in that time.You are correct that the issue of compensation will be difficult, since Moneda was unregulated and it appears no FSCS protected firm was involved in accepting deposits (those approached have denied any connection to Moneda).

Good grief, that branding!poseidon1 said:Did not take long for an ambulance chasing law firm to spot a litigation opportunity

https://nationalfraudhelpline.co.uk/types-of-fraud/moneda-capital-investigation/#:~:text=Please contact us on 0333 0033218 or fill out our Claim Form.

Interestingly their approach is to invite affected savers to help build a class action against Moneda's bankers, presumably on the assumption that investor/savers monies have long since disappeared and the only entities now standing with deep enough pockets are the company's bankers.2 -

Out of interest and based on the screenshot you quoted, what validation did Moneda do that you were a high net worth or sophisticated investor? Did they do any checks at all?AshleeG said:

I invested my life savings into a Moneda savings account at the end of April 2025 that was offering 4.75% after I'd done a Google search for fixed rate savings accounts, where a website came up with a list of companies to invest with and they were one of them.jimjames said:There have been a few threads in the past about Moneda Capital that seem to have disappeared . The bank they claimed to be working with has confirmed that they have no contractual relationship with them but interestingly Moneda Capital has now amended their advertising.

Although they are still targeting social media (Instagram/Facebook) their ads now include the line that it is only for High Net Worth or sophisticated investors. Rather odd if these are deposit accounts protected by FSCS as they claimed previously but now says no FSCS. I wonder if FCA have been in touch to get changes made?

After they were claiming to be offering bank deposits previously Moneda are now saying the capital is at risk and returns aren't guaranteed. Anyone considering them should make sure they know exactly where there money is going and contact the relevant bank to be sure.

Very frustrating that the lawyers from Moneda were so active getting threads shut down from here but also understandable from their side when it seems to have been such a lucrative business for them.Abovetheradar said:I have contacted the FCA. Very helpful but could not say much as its an ongoing case. Contacted the FSCS for info on compensation and the answer was the same. We need to be patient. Although they told me that its not a rare case . Indeed the fact the FCA is on it is a good sign but in terms of compensation it seems that its going to be very difficult...Remember the saying: if it looks too good to be true it almost certainly is.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards