We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Santander dividends and Self assessment

Imnoexpert_2

Posts: 350 Forumite

in Cutting tax

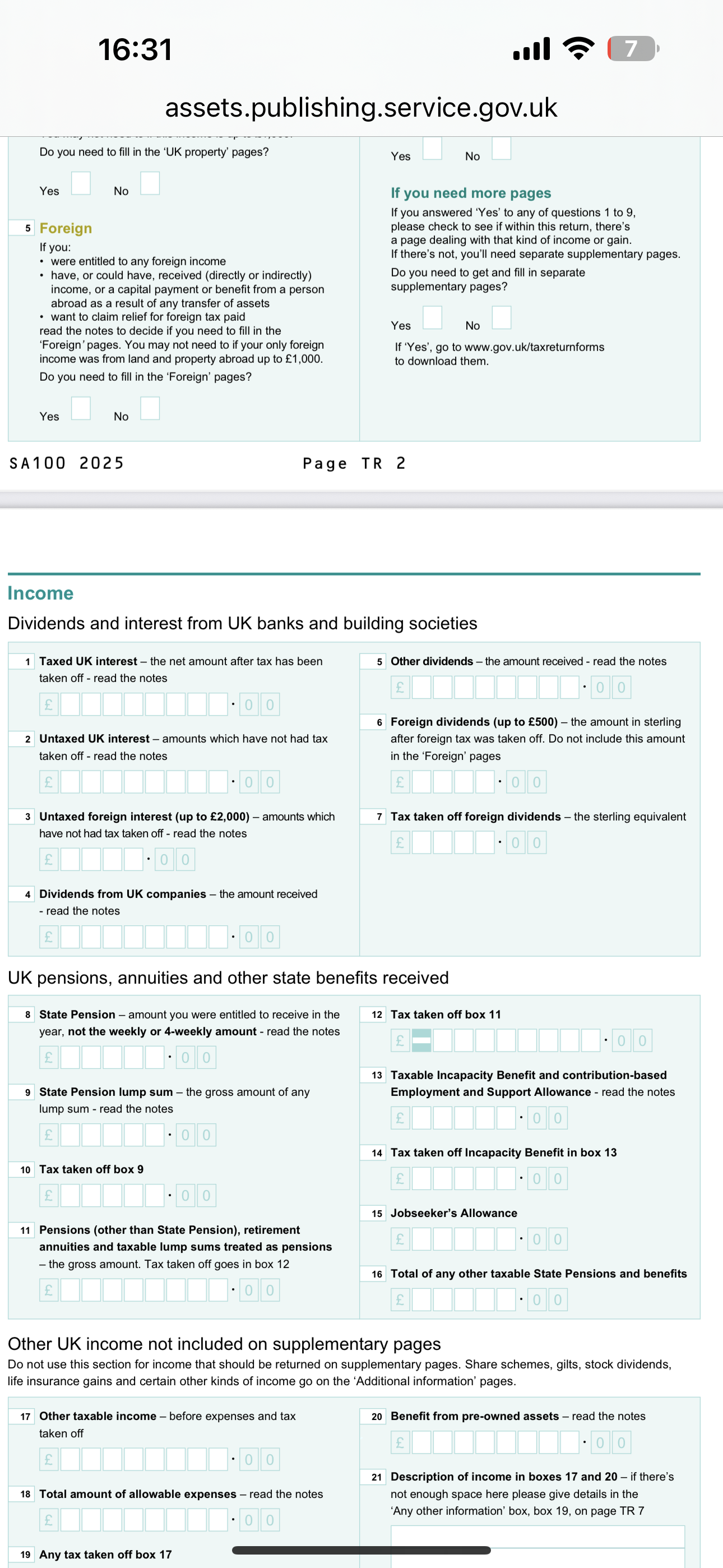

Can anyone help with advice about where (and how) on my self assessment form I enter the dividends I receive from Santander?

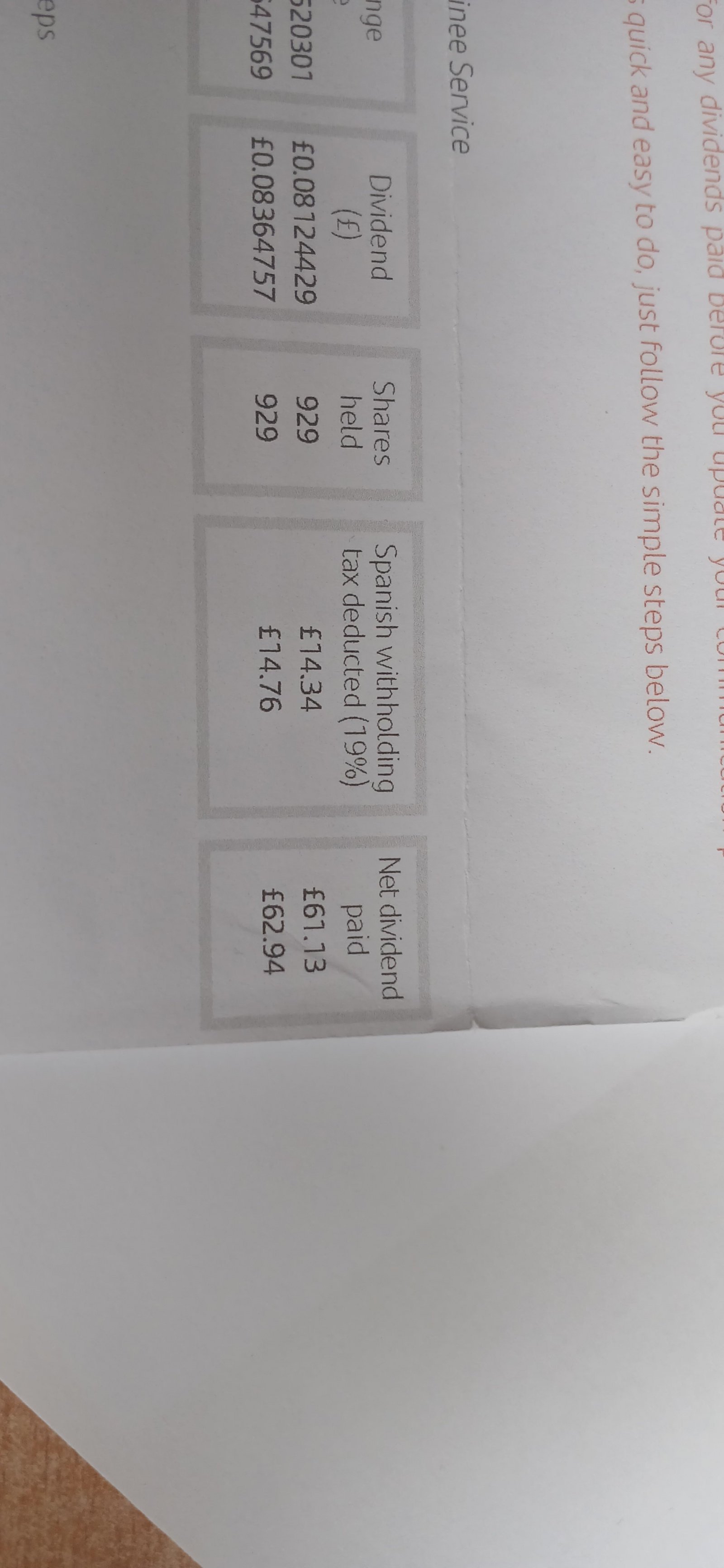

I got £62.94 dividend and paid £14.76 tax. It used to be called 'withholding tax' but doesn't seem to be now.

Other dividends push me over the £500 limit so I pay diidnd tax at the basic rate 8.75%.

The SA form and the guidance from HMRC and from Santander has gone over my head.

It's a small amount - and hardly worth the bother, but I like to get these things right!

Thanks

0

Comments

-

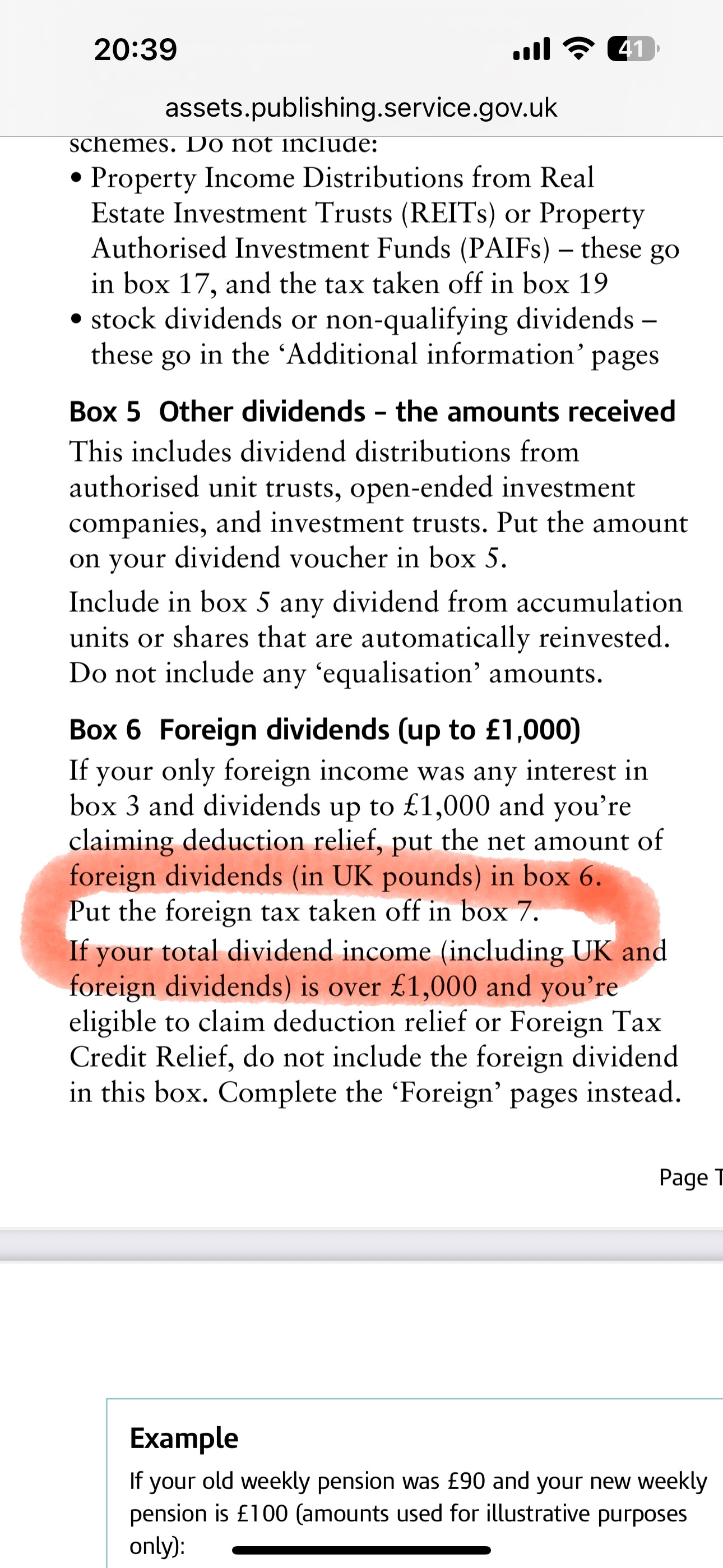

Foreign dividends (up to £500)?Imnoexpert_2 said:Can anyone help with advice about where (and how) on my self assessment form I enter the dividends I receive from Santander?I got £62.94 dividend and paid £14.76 tax. It used to be called 'withholding tax' but doesn't seem to be now.Other dividends push me over the £500 limit so I pay diidnd tax at the basic rate 8.75%.The SA form and the guidance from HMRC and from Santander has gone over my head.It's a small amount - and hardly worth the bother, but I like to get these things right!Thanks 0

0 -

Are these shares the ones listed on the UK stock exchange (LON: BNC)? If so, I believe you just put the dividend income in 'dividends - other' as they're not for a UK company. [NB if this is the case, why not hold them in an ISA and pay no dividend tax or capital gains tax?]Imnoexpert_2 said:Can anyone help with advice about where (and how) on my self assessment form I enter the dividends I receive from Santander?I got £62.94 dividend and paid £14.76 tax. It used to be called 'withholding tax' but doesn't seem to be now.Other dividends push me over the £500 limit so I pay diidnd tax at the basic rate 8.75%.The SA form and the guidance from HMRC and from Santander has gone over my head.It's a small amount - and hardly worth the bother, but I like to get these things right!Thanks

If you receive dividends in foreign currency this would go under 'foreign dividends'.

0 -

No, it's still a dividend from a foreign company. It's only in the foreign pages section that the OP will be able to claim relief against the Spanish withholding tax that's been deducted (if they want to claim it, if not and total foreign dividends are less than £500 then they can include alongside UK dividends as shown in the post above).Strummer22 said:

Are these shares the ones listed on the UK stock exchange (LON: BNC)? If so, I believe you just put the dividend income in 'dividends - other' as they're not for a UK company. [NB if this is the case, why not hold them in an ISA and pay no dividend tax or capital gains tax?]Imnoexpert_2 said:Can anyone help with advice about where (and how) on my self assessment form I enter the dividends I receive from Santander?I got £62.94 dividend and paid £14.76 tax. It used to be called 'withholding tax' but doesn't seem to be now.Other dividends push me over the £500 limit so I pay diidnd tax at the basic rate 8.75%.The SA form and the guidance from HMRC and from Santander has gone over my head.It's a small amount - and hardly worth the bother, but I like to get these things right!Thanks

If you receive dividends in foreign currency this would go under 'foreign dividends'.There are quite a few companies listed in London which are domiciled in Jersey and Guernsey that are classified as foreign but their functional currency is sterling and their dividends are paid in sterling.0 -

Not sure wht the current rates are but Spanish witholding was about 20% and you could only claim a 10% deduction on your UK return.0

-

19% and 10%. In theory you can reclaim the balance from the Spanish tax authority but good luck with that.TheGreenFrog said:Not sure wht the current rates are but Spanish witholding was about 20% and you could only claim a 10% deduction on your UK return.0 -

You have to be careful with that. You can only claim up to the UK tax due ON THAT SOURCE OF INCOME’.TheGreenFrog said:Not sure wht the current rates are but Spanish witholding was about 20% and you could only claim a 10% deduction on your UK return.If there is no tax due, perhaps covered by the dividend allowance, no foreign tax credit is available for set off.Many believe that, because are liable to tax elsewhere, that they can claim TCR.1 -

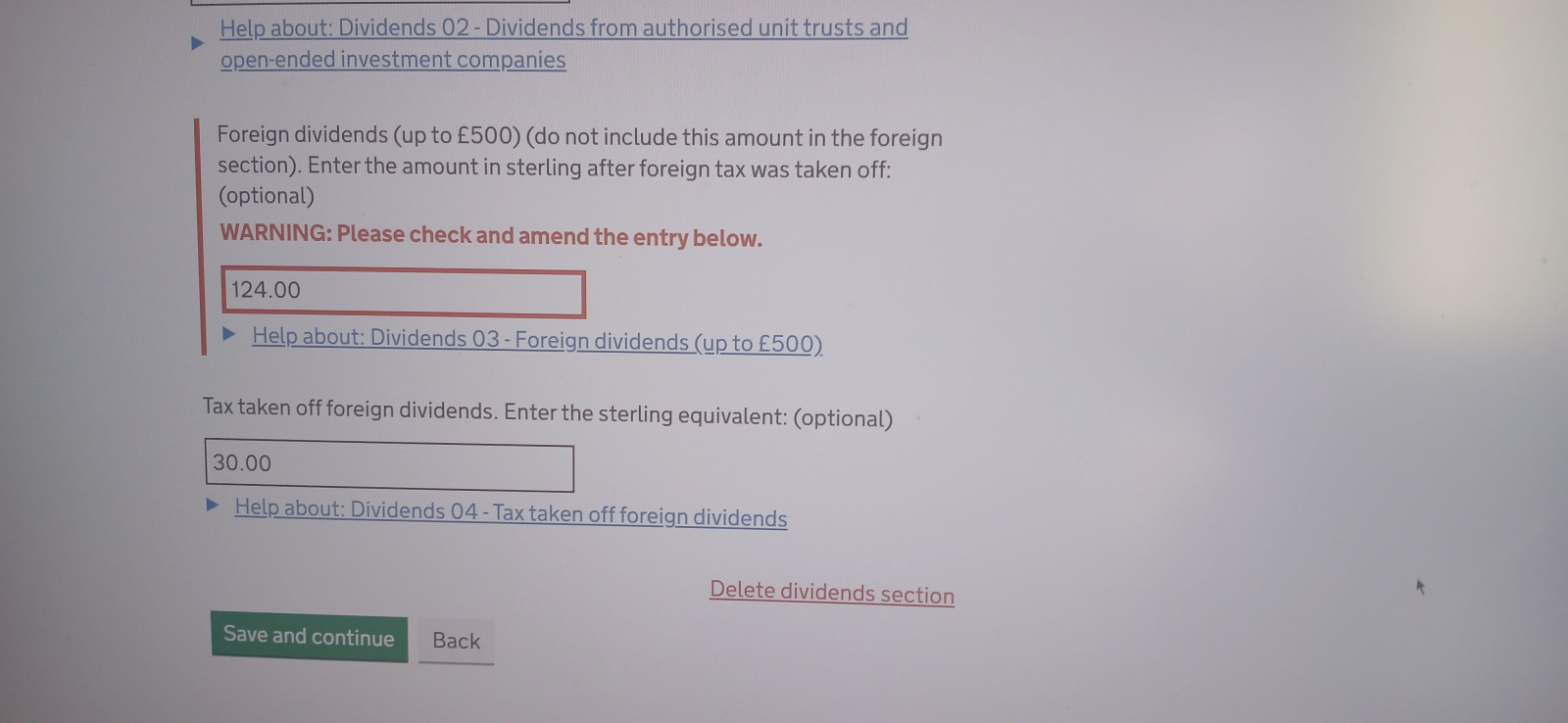

Thanks for your replies.I now don't feel so bad about being confused. I got these shares iirc from the Abbey National sale. So millions must have had them and lots like me must have them still.I am using the online not paper form and when I entered the figures correctly it told me there was an error. I now realise that if I don't enter the "Tax taken off foreign dividends. "Enter the sterling equivalent: (optional)" box figure the warning goes away. That was the bit that made me think I was doing it wrong.The result of this though is that I end up paying 'Spanish Taxof 19% AND UK tax at 8.75% (I'm basic rate). It hadn't sunk in that I would be double taxed, and it doesn't seem fair. Have I got that right?Incidentally my ISA is full so I can't put them in that - don't know how easy that woud be to do anyway, and then there is capital gains unless bed and ISA.....As you can see I'm still confused. I bet most people just don't declare it. How would HMRC find out?

0 -

You clearly doing something wrong with the entries - you must enter the foreign tax paid (sterling equivalent)

0

0 -

I am still (very) confused. See the text below from...

https://community-origin.hmrc.gov.uk/customerforums/sa/ca8be789-4703-f011-a4dd-0022481bdc0bIf, however, the company reinvests the dividends by using them to purchase additional shares on a shareholders’ behalf through a dividend reinvestment plan (DRIP) (the company reinvests the shares automatically, without the shareholder having to do a thing or ever receiving the dividends physically themselves), that shareholder does not pay income tax on the reinvested dividends until they eventually sell the shares. At the point of selling the shares, capital gains tax would apply on any increase in share value since the reinvestment occurred.I’m a Forum Ambassador and I support the Forum Team on the Credit Cards, Savings & investments, and Budgeting & Bank Accounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.0 -

Thanks for the help. 1.7 million people got Abbey National/Santander shares and I'm the only one confused and keen to pay the correct tax on them (or so it seems).Two questions before I give up?Should I be paying Spanish Tax and UK tax?How have I filled the form in wrong?this is my online self assessment, with the Tax statement from santander below

0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards