We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Making a large gift and IHT implications?

Comments

-

Sea_Shell said:Who, ultimately, are your beneficiaries?

If you have sufficient £££ remaining in your estate to settle any potential IHT bill, is there a need to buy insurance?As previously mentioned, my niece is my beneficiary.I would consider buying insurance worth it to save my beneficiary having to find the money to pay the taxman.0 -

If you give your niece £200k, will you have enough to easily pay for any care needs from the rest of the estate?

Is at least some of your estate in easily accessible cash accounts? It's much easier to pay IHT direct from cash accounts rather than stocks and shares.If you've have not made a mistake, you've made nothing1 -

RAS said:If you give your niece £200k, will you have enough to easily pay for any care needs from the rest of the estate?

Is at least some of your estate in easily accessible cash accounts? It's much easier to pay IHT direct from cash accounts rather than stocks and shares.I would never gift a lot of money and be leave myself short. As for 'care needs', I've no intention of ending up paying the exorbitant fees charged by "nursing" homes.Most of my estate/assets are in an ISA in the form of shares and cash, which can moved to current account.Regards this Seven Year Rule on IHT for large gifts. I don't feel confident enough to take the chance on my health surviving intact for 7 years, especially if another plague like Covid breaks out.I think my best bet is to inquire about term insurance in a Trust, and see if the premiums are acceptable.0 -

OP, I'm not sure you quite understand how IHT works on your death. The nil-rate band of £325k absorbs the previous 7 years' gifts in chronological order. If the £200k gift to your niece is the first such gift (since gifts under the £3k annual exemption can be ignored), there will be no tax for her to pay and therefore no need for any insurance.

If you plan on making more than £325k of lifetime gifts, then the excess will be taxable (after your death) on the most recent donees and insurance may be relevant, but your niece still wouldn't suffer tax on her £200k gift.

1 -

But as the niece is also the beneficiary then if the amount has to be added back in to the estate because OP does not survive seven years (really hope you do OP!) the IHT will have to be paid and will reduce the net amount the niece receives at that point. Gifting now and surviving seven years, or insuring against not achieving that) will lessen the amount of IHT to be paid and therefore increase the net amount going to the niece as beneficiary if the Will,probate_slave said:OP, I'm not sure you quite understand how IHT works on your death. The nil-rate band of £325k absorbs the previous 7 years' gifts in chronological order. If the £200k gift to your niece is the first such gift (since gifts under the £3k annual exemption can be ignored), there will be no tax for her to pay and therefore no need for any insurance.

If you plan on making more than £325k of lifetime gifts, then the excess will be taxable (after your death) on the most recent donees and insurance may be relevant, but your niece still wouldn't suffer tax on her £200k gift.1 -

Yes, you're absolutely right, @poppystar. Insurance would certainly benefit the niece in that case.

I thought the OP meant that his niece was beneficiary of the £200k gift in question, rather than sole residuary beneficiary of his estate.

1 -

If your assets are £1million - and your niece is going to be the only beneficiary of your will - then taking out insurance to pay possible IHT on £200,000 from your estate could lead to your niece ultimately inheriting £810k instead of £710k.macadam said:Keep_pedalling said:What is your current net worth? What is your marital status?One option, if you are in good health, is to take out term insurance to cover IHT on large gifts in case of an early demise. So if your estate would get hit with an IHT liability on the entire gift then you would need a 7 year policy that would pay out £80k on your death.Net worth £700K in shares, and a house worth approximately £300K. Marital status... Single.I'll look into the term insurance to cover IHT, though I plan on lasting longer than 7 years.

Yes - that's £80k more, but either amount is going to be life changing. And the £200k gift might fall out consideration anyway (7 years). So is it really worth it?

If she's the sole beneficiary - she's not going to need to "find the money to pay the taxman". It would simply be deducted from the rest of your estate.

2 -

I don't think anyone really does plan to go to a nursing home, but life can force such outcomes.macadam said:I would never gift a lot of money and be leave myself short. As for 'care needs', I've no intention of ending up paying the exorbitant fees charged by "nursing" homes.

You are far better being able to fund your own care fees and have the choices that offers than unable to fund the costs and left to whatever the Local Authority think is best for you.4 -

Crack on and gift, sooner the better.Your life is too short to be unhappy 5 days a week in exchange for 2 days of freedom!1

-

poppystar said:

But as the niece is also the beneficiary then if the amount has to be added back in to the estate because OP does not survive seven years (really hope you do OP!) the IHT will have to be paid and will reduce the net amount the niece receives at that point. Gifting now and surviving seven years, or insuring against not achieving that) will lessen the amount of IHT to be paid and therefore increase the net amount going to the niece as beneficiary if the Will,probate_slave said:OP, I'm not sure you quite understand how IHT works on your death. The nil-rate band of £325k absorbs the previous 7 years' gifts in chronological order. If the £200k gift to your niece is the first such gift (since gifts under the £3k annual exemption can be ignored), there will be no tax for her to pay and therefore no need for any insurance.

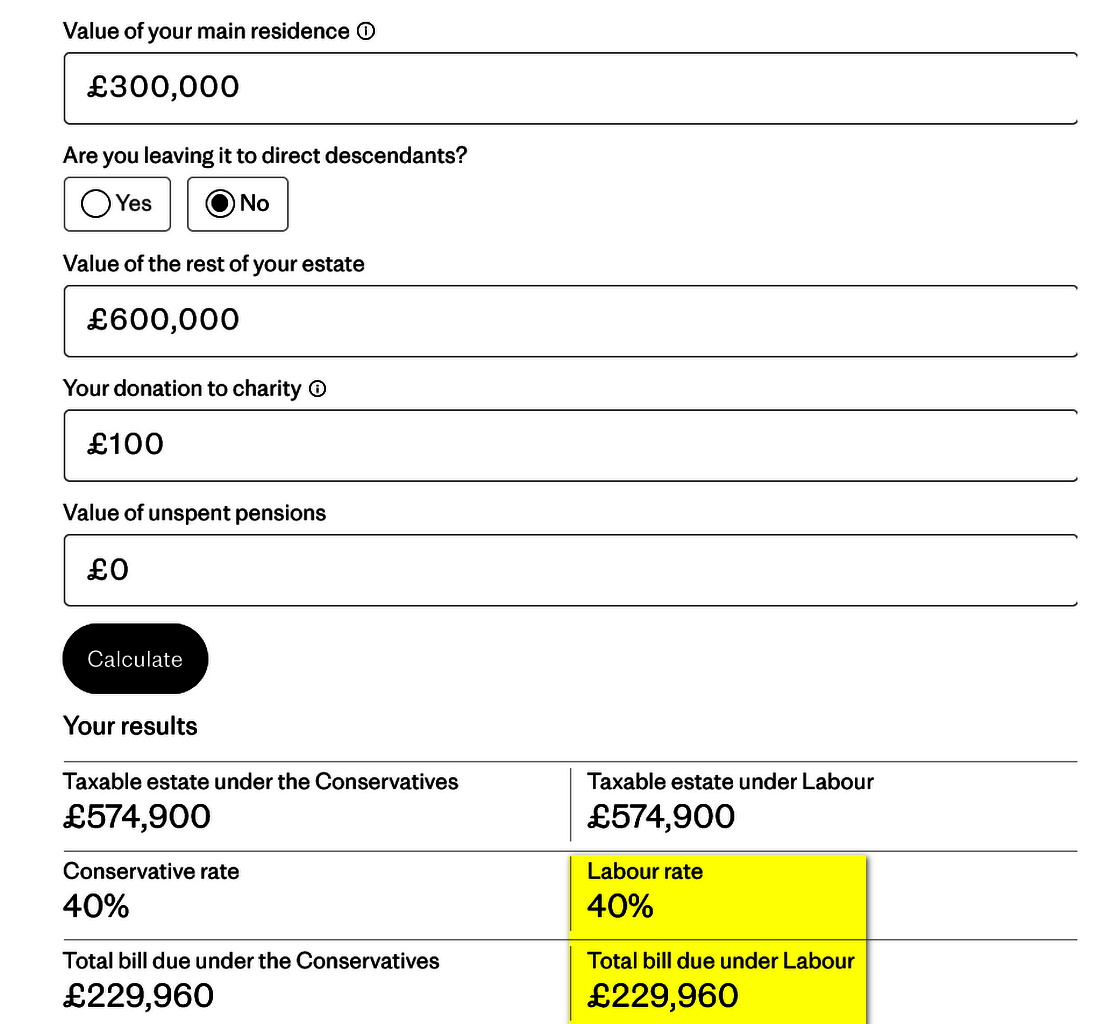

If you plan on making more than £325k of lifetime gifts, then the excess will be taxable (after your death) on the most recent donees and insurance may be relevant, but your niece still wouldn't suffer tax on her £200k gift.Thanks for your explanation. Yes. I, too, hope to survive 7 years.I completed one of these UK IHT Calculators, and was not happy with the projected tax bill.There's little I can do about the property tax, but I can attempt to reduce the remaining IHT on my estate. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards