We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Property probate trust nightmare

beadlebunny

Posts: 15 Forumite

Hi all, please help, getting so much conflicting advice.

Mum set up a property probate trust with a co called Thy Will Be Done and the house was put into mine and sister's names with HMRC in 2015, with mum able to live in the house for her lifetime and we cannot sell without making a declaration with a conveyancer, no sole sales without the other agreeing etc.

Mum passed away last month, it's agreed that no probate is due on the house given the type of trust it is, but now we are confused about IHT and CGT.

The house was probably worth slightly less than 325k in 2025 but no paperwork remains. Value now is about 550k.

How does my mum and dad's nil rate bands (and dad's allowance of 325k) that I understand pass to me and sister affect the increase in value in this trust, if at all? Can we still use those? Do we have to pay IHT or CGT on any of this? Solicitor wants 10k to even look at it.

Aware this 10 year anniversary o the trust inception is coming up and that may trigger IHT if that is due?

Any advice or pointers appreciated.

Mum set up a property probate trust with a co called Thy Will Be Done and the house was put into mine and sister's names with HMRC in 2015, with mum able to live in the house for her lifetime and we cannot sell without making a declaration with a conveyancer, no sole sales without the other agreeing etc.

Mum passed away last month, it's agreed that no probate is due on the house given the type of trust it is, but now we are confused about IHT and CGT.

The house was probably worth slightly less than 325k in 2025 but no paperwork remains. Value now is about 550k.

How does my mum and dad's nil rate bands (and dad's allowance of 325k) that I understand pass to me and sister affect the increase in value in this trust, if at all? Can we still use those? Do we have to pay IHT or CGT on any of this? Solicitor wants 10k to even look at it.

Aware this 10 year anniversary o the trust inception is coming up and that may trigger IHT if that is due?

Any advice or pointers appreciated.

0

Comments

-

Unfortunately your mother fell victim to dodgy sales people who are the only people to profit from setting up a pointless trust.

For IHT purposes the house still forms part of her estate, but, assuming she inherited everything from his estate, your father’s transferable NRB is till available. You should however take professional advice on winding up the trust.1 -

Where are you getting your advice - and in particular where does 'it's agreed that no probate is due on the house given the type of trust it is' come from?beadlebunny said:Hi all, please help, getting so much conflicting advice.

Mum set up a property probate trust with a co called Thy Will Be Done and the house was put into mine and sister's names with HMRC in 2015, with mum able to live in the house for her lifetime and we cannot sell without making a declaration with a conveyancer, no sole sales without the other agreeing etc.

Mum passed away last month, it's agreed that no probate is due on the house given the type of trust it is, but now we are confused about IHT and CGT.

The house was probably worth slightly less than 325k in 2025 but no paperwork remains. Value now is about 550k.

How does my mum and dad's nil rate bands (and dad's allowance of 325k) that I understand pass to me and sister affect the increase in value in this trust, if at all? Can we still use those? Do we have to pay IHT or CGT on any of this? Solicitor wants 10k to even look at it.

Aware this 10 year anniversary o the trust inception is coming up and that may trigger IHT if that is due?

Any advice or pointers appreciated.

Nobody here has seen any of the paperwork, and there is very limited information in your post, so relying on answers on this forum is unsafe. I know how unhelpful that sounds, but I'm afraid that's the reality.Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

You say no paperwork remains. Are you saying the original trust document has disappeared? If so who has told you the house can be sold without probate if the original trust document is no longer present? I accept that the property being in the name of you and your sister assists you both in being able to sell , but without the trust document how exactly do you plan to report your mother's occupation of the house ( a reservation of benefit) for the purposes of probate for her remaining estate?beadlebunny said:Hi all, please help, getting so much conflicting advice.

Mum set up a property probate trust with a co called Thy Will Be Done and the house was put into mine and sister's names with HMRC in 2015, with mum able to live in the house for her lifetime and we cannot sell without making a declaration with a conveyancer, no sole sales without the other agreeing etc.

Mum passed away last month, it's agreed that no probate is due on the house given the type of trust it is, but now we are confused about IHT and CGT.

The house was probably worth slightly less than 325k in 2025 but no paperwork remains. Value now is about 550k.

How does my mum and dad's nil rate bands (and dad's allowance of 325k) that I understand pass to me and sister affect the increase in value in this trust, if at all? Can we still use those? Do we have to pay IHT or CGT on any of this? Solicitor wants 10k to even look at it.

Aware this 10 year anniversary o the trust inception is coming up and that may trigger IHT if that is due?

Any advice or pointers appreciated.

In this regard please see below link to a thread related to another trust set up for similar purposes as your mother. The OP in that instance fortunately retained the trust document so on examining the trust terms, it was clear ( on analysis thereof) that they should be able to secure certain positive outcomes with regard to CGT and IHT, with the help of a suitably qualified professional. Have a careful read especially with regard to eventual professional help needed.

https://forums.moneysavingexpert.com/discussion/comment/81389592#Comment_81389592

Incidentally, this 'Thy will be done'' firm still appears to actively selling their trust 'solutions'. Does their outline ( link below) of how it was set up ring a bell?

https://thywill.es/property-trusts/#sole-owner

Since they are still trading it is possible they still retain a sign and dated copy of the original trust (if you don't have it) , bearing in mind they would have dealt with all the land registry formalities after it was executed.

If you can supply a redacted copy of the original trust document it may then be possible to offer more clarity on the likely tax implications going forward.

Important to note these trusts were never designed to mitigate IHT but if done properly, they should not worsen the IHT position, whilst any cgt exposure accruing during the trust beneficiary's lifetime should have been eliminated on death.

2 -

Hi all, thanks for replies. No I of course won't take advice here as gospel but I'm just looking for guidance that I can then investigate further or even just to take to another law firm.

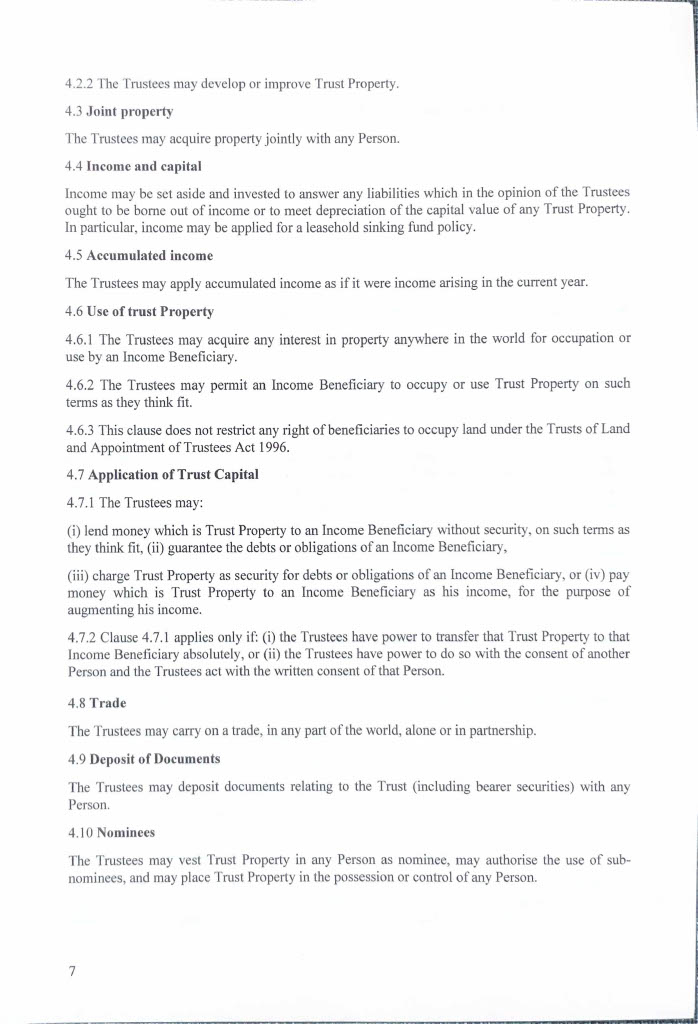

I have the trust document and the will. The trust doc says no probate. Happy to supply a redacted copy, bear with me.

Many, many thanks for the links I will check them out now.

All I am hopeful for is that we don't pay IHT where previously, without this trust, it would not have been due.

0 -

I have been told this is a settlor interested in-life trust with gift or reservation of benefit with the added complexity of the 10 year tax anniversary now due...

We are being quoted £3k plus vat to register/close the trust (but the forms look fairly simple?) and then another £5.5ishk to do the following (despite probate not being needed or asked for, outside of property held is trust the estate value is 5k):- Preparing all paperwork for HMRC for Inheritance Tax purposes (whether or not there is tax to pay).

- Obtaining the Grant of Probate.

- Simple income tax returns during the period of Estate Administration ~ known as informal reporting to HM Revenue & Customs.

- Assent of the title to me and my sister

0 -

It turns out the firm we are dealing with are just will writers, not trust experts or accredited probate practitioners, so am now getting quotes elsewhere from actual qualified legal experts. This may explain why my gut feeling has been so off about them and the advice we've been getting.0

-

Please supply the redacted trust deed. Particularly need to see whether or not the trust automatically terminates on death of your mother ( as was the case in the other thread I sent you).beadlebunny said:I have been told this is a settlor interested in-life trust with gift or reservation of benefit with the added complexity of the 10 year tax anniversary now due...

We are being quoted £3k plus vat to register/close the trust (but the forms look fairly simple?) and then another £5.5ishk to do the following (despite probate not being needed or asked for, outside of property held is trust the estate value is 5k):- Preparing all paperwork for HMRC for Inheritance Tax purposes (whether or not there is tax to pay).

- Obtaining the Grant of Probate.

- Simple income tax returns during the period of Estate Administration ~ known as informal reporting to HM Revenue & Customs.

- Assent of the title to me and my sister

If not then obviously the will writing firm are engaged in unashamedly attempt to gouge the family with unconscionable fees by preying on your ignorance regarding what the trust was supposed to do, compared to what it actually does based on their drafting of the trust terms.

Looking at the firm's current marketing of their trust ( at a very cheap intial fee) , it now becomes obvious it is a trap designed to hammer the surviving family with a complex and expensive exit from the arrangement.

Quite disgusting and a warning to others who may be reading this thread.

3 -

Just to clarify - the will company and trust company are different. The Will company quotes the above, the trust company say they can disband the trust for 2k or just under, but no mention of IHT or anything and sounds so dodgy. I will try to attach the file now.0

-

Part 1 - more pages to follow0 -

Part two - more to follow0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards