We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Seeking Advice on Motor Finance Compensation Claims

I’d appreciate some advice regarding multiple motor finance compensation claims I signed up for through different solicitors under No-Win-No-Fee agreements.

After reviewing the terms, I’ve realised that solicitor fees could take up to 40% + VAT of any compensation I receive. I’m now considering handling the process myself to avoid these deductions.

Has anyone here successfully managed their own claim without a solicitor? If so, what’s the best approach, and are there any pitfalls I should watch out for?

Any guidance or shared experiences would be really helpful.

Thanks in advance!

Comments

-

I think your biggest problem is getting the agreements with (presumeably multiple) solicitors voided.1

-

Having signed contracts. Simply walking away may not be an option. Not just a question of doing what you want when you want. Probably best to see how matters unfold. As there's not going to be any movement for a while yet in any event.1

-

I’d appreciate some advice regarding multiple motor finance compensation claims I signed up for through different solicitors under No-Win-No-Fee agreements.oh dear. That was a mistake.Has anyone here successfully managed their own claim without a solicitor? If so, what’s the best approach, and are there any pitfalls I should watch out for?Nobody has (apart from the very early court cases that triggered this). However, no claims company has either.

Lets take a step back.- You can raise a complaint yourself without cost using the regulated complaints process. Its very easy to do and usually takes a couple of minutes.

- Or you can use a claims company to put the complaint in on your behalf but that too uses the same regulated complaints process that you would use (which is free of charge but you have agreed to pay a CMC x% for doing so).

- Or you wait until the FCA has completed its review and published its report and follow the instructions from there (and current indications are that the FCA will tell finance companies to be proactive and not require complaints).

You went with the CMC option and did it multiple times. its a bit like asking five window cleaners to clean your windows. You pay five times.

You need to look at the cancellation terms of each of the contracts you have signed. There is possibly going to be cancellation charges.

If you are lucky, and with the FCA looking likely to be going for a section 404 consumer redress scheme, the FCA may well void any FCA-regulated claims companies from taking any cut of the redress as they would have done no work in exchange for the redress (not that they do anything much anyway). It would be hard for an FCA regulated claims company to comply with the FCA's Consumer Duty if a section 404 scheme is set up. However, for law society-regulated claims companies, the FCA has no remit over them.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

Remember to stop now you have to pay them for the work they have already done.GBadi said:I’d appreciate some advice regarding multiple motor finance compensation claims I signed up for through different solicitors under No-Win-No-Fee agreements.

After reviewing the terms, I’ve realised that solicitor fees could take up to 40% + VAT of any compensation I receive. I’m now considering handling the process myself to avoid these deductions.

Has anyone here successfully managed their own claim without a solicitor? If so, what’s the best approach, and are there any pitfalls I should watch out for?

Any guidance or shared experiences would be really helpful.

Thanks in advance!

The current belief, assuming parliament dont intervene, is the FCA will require a redress programme from every lender meaning the lender will contact you and automatically pay any redress due, you won't need to chase them.1 -

Yes, i already did, thanksTadleyBaggie said:I think your biggest problem is getting the agreements with (presumeably multiple) solicitors voided.0 -

I canceled the contracts as I had 14 days option to cancel.Hoenir said:Having signed contracts. Simply walking away may not be an option. Not just a question of doing what you want when you want. Probably best to see how matters unfold. As there's not going to be any movement for a while yet in any event.0 -

Thank you for your time and comments. I know it was a mistake to sign with two solicitors but glad I managed to I cancel them as I had 14 days option to cancel. Thanksdunstonh said:I’d appreciate some advice regarding multiple motor finance compensation claims I signed up for through different solicitors under No-Win-No-Fee agreements.oh dear. That was a mistake.Has anyone here successfully managed their own claim without a solicitor? If so, what’s the best approach, and are there any pitfalls I should watch out for?Nobody has (apart from the very early court cases that triggered this). However, no claims company has either.

Lets take a step back.- You can raise a complaint yourself without cost using the regulated complaints process. Its very easy to do and usually takes a couple of minutes.

- Or you can use a claims company to put the complaint in on your behalf but that too uses the same regulated complaints process that you would use (which is free of charge but you have agreed to pay a CMC x% for doing so).

- Or you wait until the FCA has completed its review and published its report and follow the instructions from there (and current indications are that the FCA will tell finance companies to be proactive and not require complaints).

You went with the CMC option and did it multiple times. its a bit like asking five window cleaners to clean your windows. You pay five times.

You need to look at the cancellation terms of each of the contracts you have signed. There is possibly going to be cancellation charges.

If you are lucky, and with the FCA looking likely to be going for a section 404 consumer redress scheme, the FCA may well void any FCA-regulated claims companies from taking any cut of the redress as they would have done no work in exchange for the redress (not that they do anything much anyway). It would be hard for an FCA regulated claims company to comply with the FCA's Consumer Duty if a section 404 scheme is set up. However, for law society-regulated claims companies, the FCA has no remit over them.0 -

Thanks, yes already canceledDullGreyGuy said:

Remember to stop now you have to pay them for the work they have already done.GBadi said:I’d appreciate some advice regarding multiple motor finance compensation claims I signed up for through different solicitors under No-Win-No-Fee agreements.

After reviewing the terms, I’ve realised that solicitor fees could take up to 40% + VAT of any compensation I receive. I’m now considering handling the process myself to avoid these deductions.

Has anyone here successfully managed their own claim without a solicitor? If so, what’s the best approach, and are there any pitfalls I should watch out for?

Any guidance or shared experiences would be really helpful.

Thanks in advance!

The current belief, assuming parliament dont intervene, is the FCA will require a redress programme from every lender meaning the lender will contact you and automatically pay any redress due, you won't need to chase them.0 -

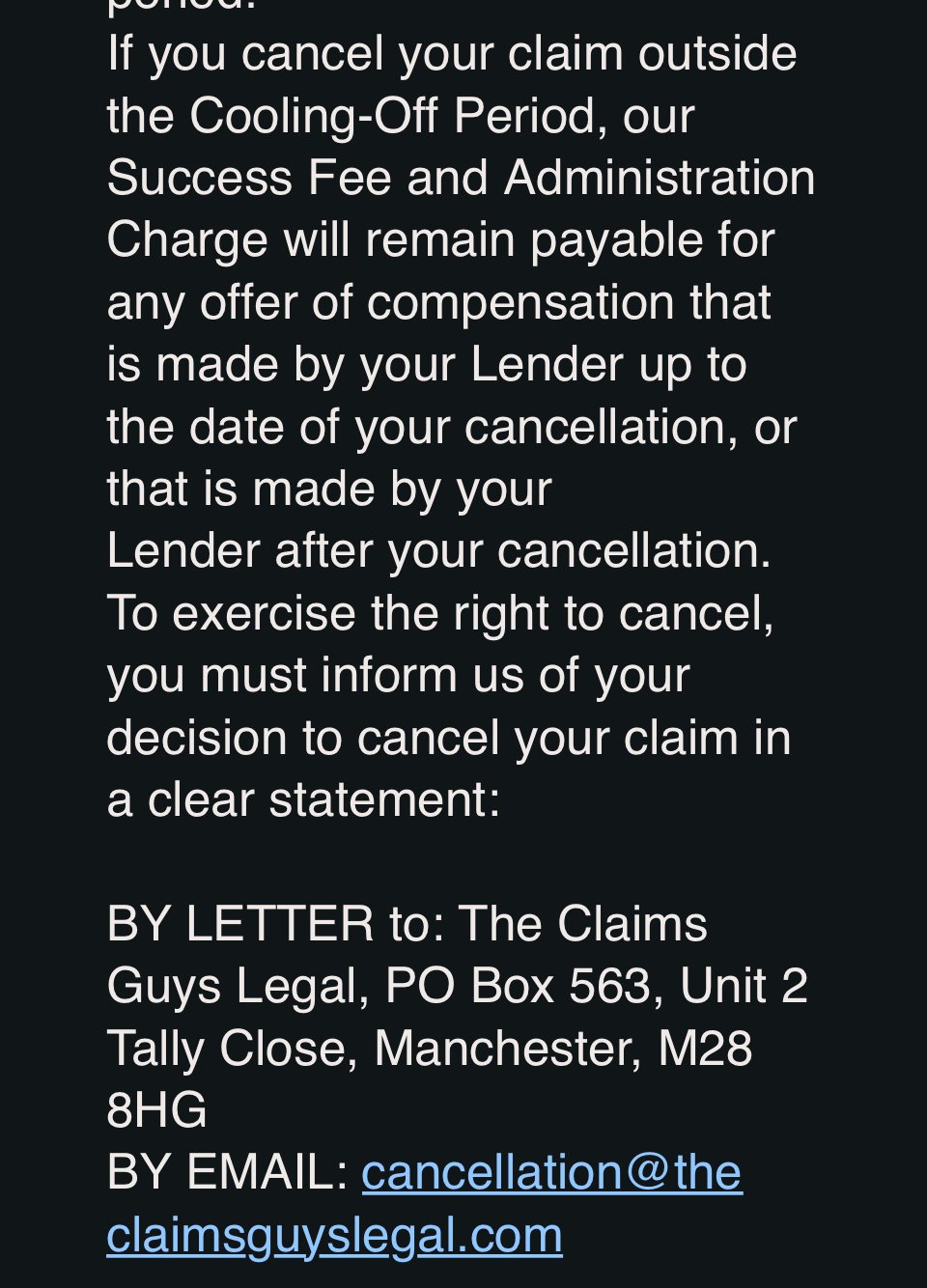

I am having an issue cancelling my claim with “the claims guys” please correct me if I’m wrong but according to their policy if I cancel now before any offer is made they can still charge me on a successful future claim?Hoenir said:Having signed contracts. Simply walking away may not be an option. Not just a question of doing what you want when you want. Probably best to see how matters unfold. As there's not going to be any movement for a while yet in any event. 0

0 -

I am having an issue cancelling my claim with “the claims guys” please correct me if I’m wrong but according to their policy if I cancel now before any offer is made they can still charge me on a successful future claim?Correct. However, you may get lucky. The FCA is planning to consult on a redress scheme, which should allow all existing complaints to be closed and the redress scheme used instead. That may cut the ambulance chasers out of it.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards