We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Council tax - single occupancy confusion

sky_rat

Posts: 268 Forumite

I have been claiming single occupancy discount for council tax as I live on my own.

My daughter moved in a few years ago when she was 16. She left school at 16 and studied full time for 2 years, so I was still able to claim single occupancy.

She has since finished studying but only works around 4 to 10 hours a week part time.

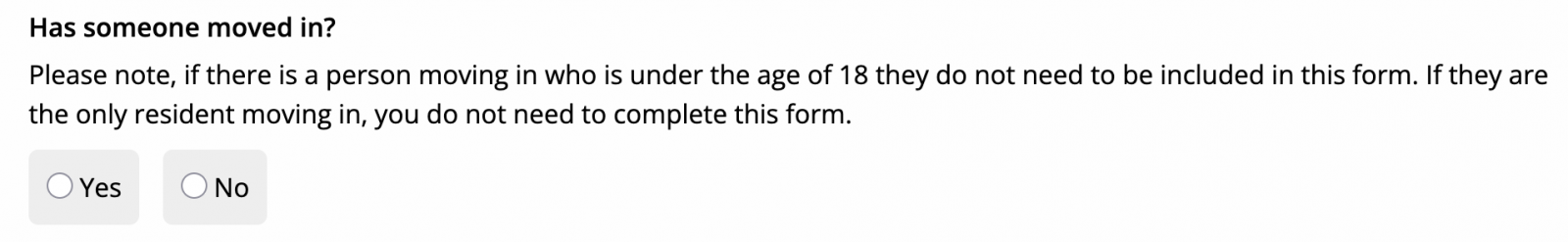

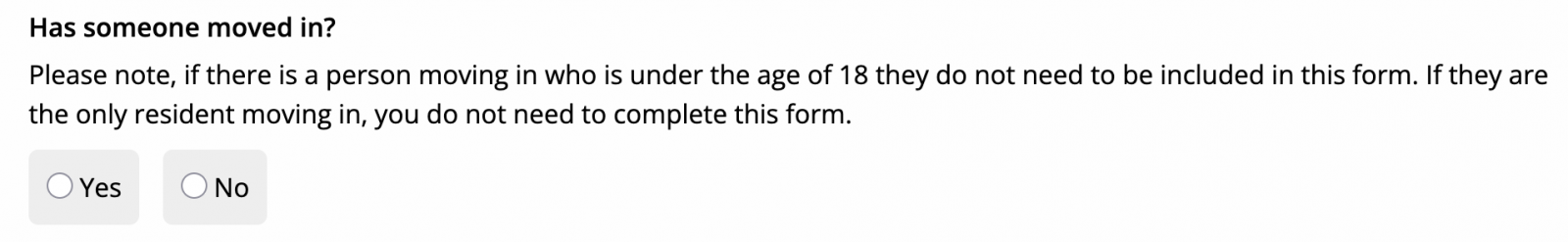

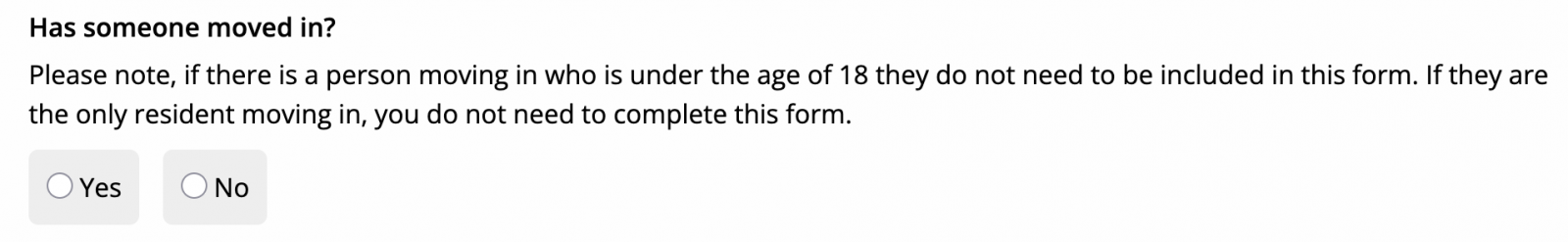

I went online to cancel the single occupancy discount, but I am confused by the statement shown in the screenshot below...

The part that confuses me is where it says "If they are the only resident moving in, you do not need to complete this form".

The part that confuses me is where it says "If they are the only resident moving in, you do not need to complete this form". This implies that I don't need to complete the form as she is the only resident moving in, or am I missing something ?

0

Comments

-

My daughter moved in a few years ago when she was 16.How many years is a few years and how old is she now?0

-

The statement says somebody under the age of 18 . She is 18 so it no longer applies.sky_rat said:

She moved in 2 years ago aged 16, so she’s 18 nowsheramber said:My daughter moved in a few years ago when she was 16.How many years is a few years and how old is she now?She moved in when 16 so not moving in now.1 -

sheramber said:

The statement says somebody under the age of 18 . She is 18 so it no longer applies.sky_rat said:

She moved in 2 years ago aged 16, so she’s 18 nowsheramber said:My daughter moved in a few years ago when she was 16.How many years is a few years and how old is she now?She moved in when 16 so not moving in now.I’m confused ?So it’s her age when she moves in that applies?

the fact she is no longer under 18 means I still get the discount ?She could live here until she’s 40 and I would still get discount ?

because she was 16 when she moved in ?0 -

No, it only applies until she is 18.sky_rat said:sheramber said:

The statement says somebody under the age of 18 . She is 18 so it no longer applies.sky_rat said:

She moved in 2 years ago aged 16, so she’s 18 nowsheramber said:My daughter moved in a few years ago when she was 16.How many years is a few years and how old is she now?She moved in when 16 so not moving in now.I’m confused ?So it’s her age when she moves in that applies?

the fact she is no longer under 18 means I still get the discount ?She could live here until she’s 40 and I would still get discount ?

because she was 16 when she moved in ?Once she is 18 she is no longer distegarded2 -

So why do they say "If they are the only resident moving in, you do not need to complete this form".sheramber said:

No, it only applies until she is 18.sky_rat said:sheramber said:

The statement says somebody under the age of 18 . She is 18 so it no longer applies.sky_rat said:

She moved in 2 years ago aged 16, so she’s 18 nowsheramber said:My daughter moved in a few years ago when she was 16.How many years is a few years and how old is she now?She moved in when 16 so not moving in now.I’m confused ?So it’s her age when she moves in that applies?

the fact she is no longer under 18 means I still get the discount ?She could live here until she’s 40 and I would still get discount ?

because she was 16 when she moved in ?Once she is 18 she is no longer distegardedShe is the only resident who has moved in !No one else has moved in.The statement reads that if she is the only person who has moved in, then there is no need to complete the form.Is the statement incorrect then?0 -

It's a poorly phrased form.

There are now 2 adults (aged 18 or over) living in the property so you should now pay the full rate of council tax.3 -

Is the person moving in under 18? If the only person moving in is the person under 18, you do not need to complete the form.sky_rat said:

Your have a person who is now 18 "moving in" by virtue of turning 18.

I think you know that the single person discount is no longer available, so just fill in the form in whatever way achieves the outcome of the discount being cancelled and the new CT bill being issued.

I assume the Council will know that your Daughter lives at the property because of the Electoral Role submission which should have included her as over 16.1 -

What happens if you press no? Because she's not moved in but she has turned 18 and is now a non-disregarded adult.

Or maybe the 'moving in' question is actually asking 'is another adult now living with you?' which in this case is yes, because she is now an adult.1 -

As Neil49 said, it’s poorly phrasedGrumpy_chap said:

Is the person moving in under 18? If the only person moving in is the person under 18, you do not need to complete the form.sky_rat said:

Your have a person who is now 18 "moving in" by virtue of turning 18.

I think you know that the single person discount is no longer available, so just fill in the form in whatever way achieves the outcome of the discount being cancelled and the new CT bill being issued.

I assume the Council will know that your Daughter lives at the property because of the Electoral Role submission which should have included her as over 16.

And this is what I don’t understand about council tax and tax. They already have the information, so why don’t they just automatically apply it ?

she is on the electoral, so why don’t they automatically cancel the discount ?They have all the information on me yet I have to put in the effort of checking, understanding and informing.Just seems absurd to me.Then to top it off they can’t even phrase basic English, which just adds to confusion !0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards