We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Which Index funds to invest in?

Comments

-

GeoffTF said:

I took the context here to be equity investment. Introducing other asset classes muddies the issue. There are people here who believe that under-weighting the US reduces their risk, but they have not offered any rational basis for that. They believe that the US market is overvalued and want to under-weight it as a result. That is an attempt to beat the market. There does not appear to be anyone here who wants to over-weight the US, but they nonetheless believe that there is an irrational excess demand for US stocks. There are some who think that they know better than the market, and others who know that they do not.masonic said:GeoffTF said:

The only reason for over-weighting or under-weighting the US is to beat the market. It is pointless otherwise. Nobody knows whether the US will out-perform or under-perform going forwards, but if you fancy a punt...Linton said:

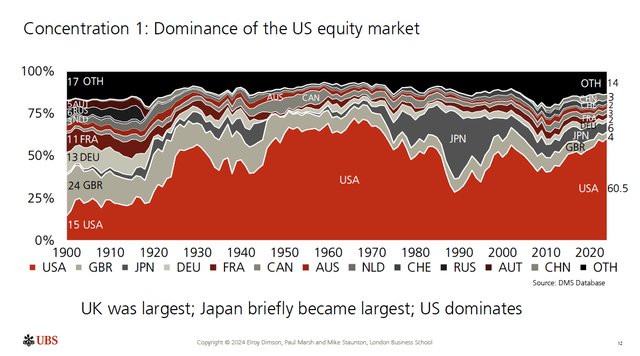

Depends on your objective. Is it maximising long term growth or generating sufficient growth at acceptable short/medium term risk? “Beating the market” is in my view far too risky an objective to attempt if you are managing a sizeable pot of money.leosayer said:US dominance isn't a recent phenomenon.

From here: https://www.ubs.com/global/en/investment-bank/insights-and-data/2024/global-investment-returns-yearbook.html

It does feel uncomfortable having such large concentration in one country and threads like this continue to concern me.

However, in the past I attempted and failed to "beat the market" by choosing certain countries over others. For the past 6-7 years my asset allocation is entirely down to market cap only and I'm very happy I did that.Is it pointless to hold anything less than 100% equities? Because you probably won't beat the market doing that.If your objective is something other than beating the market, then you can rationally select investments in a different proportion to a global index. Just like you could select investments from alternative asset classes.I think that's a little unfair. Some selected views from upthread:"I agree with you that there are many ways to sensibly set up a portfolio to meet one's needs...However where I would disagree is that a sensible reason for doing so is to beat the market...what one can do is to influence the volatility which may not matter much when in the accumulation phase but could be important if your investments are funding your day to day expenses""Unlike a professional money manager I don't need to be concerned about my "results" in the short term as long as I achieve my objective which is to protect the assets we have built up against inflation and allow us to spend it down in our retirement.""I'm not necessarily interested in better returns, I'm more interested in lower risk investments that offer some amount of control and produce a reasonable return. When markets sink and a tracker goes down, you have two choices, sell or take the ride to the bottom and hope it recovers within acceptable timescales. I would much rather have a less volatile fund that achieves say 50% of the upside but only looses a smaller amount on the way down. Trackers may be fine for the younger set but for the over 70's, they are less good."My own view aligns with much of this. I mentioned a few posts ago I have had a small tilt away from the US for a long time, and I've always acknowledged it would likely be a drag on my returns. The primary reason for me is the sector concentration at a high valuation, which increases loss potential. It's precisely because I don't believe I know what will happen that I don't want too many eggs in one basket.Another reasonable justification for underweighting the US (which hasn't been mentioned here but have elsewhere) is a desire to live off natural yield, since dividends are disfavoured in the US for tax reasons, and are subject to WHT for us foreigners.There will be some using this as a strategy to try to deliver market-beating returns for sure, but I don't think it is everyone's motivation.4 -

Unless I'm very misguided Geoff, I think that rationale includes that the US market is overvalued, expensive and unusually subject to political risk at present. I think there are other markets that aren't those things, ergo are lower risk.GeoffTF said:

I took the context here to be equity investment. Introducing other asset classes muddies the issue. There are people here who believe that under-weighting the US reduces their risk, but they have not offered any rational basis for that. They believe that the US market is overvalued and want to under-weight it as a result. That is an attempt to beat the market. There does not appear to be anyone here who wants to over-weight the US, but they nonetheless believe that there is an irrational excess demand for US stocks. There are some who think that they know better than the market, and others who know that they do not.0 -

masonic said:"I agree with you that there are many ways to sensibly set up a portfolio to meet one's needs...However where I would disagree is that a sensible reason for doing so is to beat the market...what one can do is to influence the volatility which may not matter much when in the accumulation phase but could be important if your investments are funding your day to day expenses""Unlike a professional money manager I don't need to be concerned about my "results" in the short term as long as I achieve my objective which is to protect the assets we have built up against inflation and allow us to spend it down in our retirement.""I'm not necessarily interested in better returns, I'm more interested in lower risk investments that offer some amount of control and produce a reasonable return. When markets sink and a tracker goes down, you have two choices, sell or take the ride to the bottom and hope it recovers within acceptable timescales. I would much rather have a less volatile fund that achieves say 50% of the upside but only looses a smaller amount on the way down. Trackers may be fine for the younger set but for the over 70's, they are less good."These are all quotes from people who believe that under-weighting the US reduces volatility. Where is the evidence for that? Volatility could be reduced by holding more cash or bonds, if that is what they want.

You seem to be saying that you do not like stocks on high valuations, because you believe that they have a higher loss making potential than the market. Where is the evidence for that? In theory, a market weighted portfolio is the most diversified portfolio. The US market has many more companies and higher earnings than any other market. It also has just about every type of business represented. Many of the big tech companies are near monopolies. Would you be happier if the Magnificent 7 were spread around the world?masonic said:My own view aligns with much of this. I mentioned a few posts ago I have had a small tilt away from the US for a long time, and I've always acknowledged it would likely be a drag on my returns. The primary reason for me is the sector concentration at a high valuation, which increases loss potential. It's precisely because I don't believe I know what will happen that I don't want too many eggs in one basket.

Restricting your self to high yielding stocks, entails missing out entire sectors and markets, reduces diversification and lowers the risk adjusted return.masonic said:Another reasonable justification for underweighting the US (which hasn't been mentioned here but have elsewhere) is a desire to live off natural yield, since dividends are disfavoured in the US for tax reasons, and are subject to WHT for us foreigners.0 -

chiang_mai said:

Unless I'm very misguided Geoff, I think that rationale includes that the US market is overvalued, expensive and unusually subject to political risk at present. I think there are other markets that aren't those things, ergo are lower risk.GeoffTF said:

I took the context here to be equity investment. Introducing other asset classes muddies the issue. There are people here who believe that under-weighting the US reduces their risk, but they have not offered any rational basis for that. They believe that the US market is overvalued and want to under-weight it as a result. That is an attempt to beat the market. There does not appear to be anyone here who wants to over-weight the US, but they nonetheless believe that there is an irrational excess demand for US stocks. There are some who think that they know better than the market, and others who know that they do not.Clearly, half the active investors in the market disagree. They believe that the US market is undervalued. Other markets have political risk too. The US market (and economy for that matter) is the strongest in the world, despite the current administration. The US has a better history for respecting property rights and free markets than elsewhere.I am not saying that it is wrong to try to beat the market, just that it is wishful thinking to believe that under-weighting the US reduces risk. Doing that has done badly so far, but nobody knows what will happen in the future. Strangely, people who have been losing so far still seem to believe that they have superior investment skills. Nonetheless, even a broken clock is right twice a day.1 -

GeoffTF said:masonic said:"I agree with you that there are many ways to sensibly set up a portfolio to meet one's needs...However where I would disagree is that a sensible reason for doing so is to beat the market...what one can do is to influence the volatility which may not matter much when in the accumulation phase but could be important if your investments are funding your day to day expenses""Unlike a professional money manager I don't need to be concerned about my "results" in the short term as long as I achieve my objective which is to protect the assets we have built up against inflation and allow us to spend it down in our retirement.""I'm not necessarily interested in better returns, I'm more interested in lower risk investments that offer some amount of control and produce a reasonable return. When markets sink and a tracker goes down, you have two choices, sell or take the ride to the bottom and hope it recovers within acceptable timescales. I would much rather have a less volatile fund that achieves say 50% of the upside but only looses a smaller amount on the way down. Trackers may be fine for the younger set but for the over 70's, they are less good."These are all quotes from people who believe that under-weighting the US reduces volatility. Where is the evidence for that? Volatility could be reduced by holding more cash or bonds, if that is what they want.There are various online tools that an investor can use to compare historic volatility and drawdowns of different allocations, or compare characteristics of specific portfolios over the shorter term. Take, for example, PortfolioCharts, which uses GBP-priced data from 1970 to 2024. You can play around with different geographic sectors and see what effect adjustments make to backtested volatility and drawdowns. If you stick within equities, then passive/factor-based allocations admittedly don't move the needle as far as cash or bonds, but with those come inflation and shortfall risk that could be mitigated by reducing risk within equities rather than reducing equities. The results can be very interesting and do point towards a value tilt and reduced US vs ROW, but also no EM. Such tools are increasingly being put behind paywalls or being discontinued, which is frustrating. I'm not best placed to discuss active investing in retirement, but I know there are some low volatility investment trusts that are suited to this, though the open-ended options are more limited.

There is plenty of evidence that major stockmarket crashes are great levelers when it comes to valuation. While markets generally take an optimistic view at other times, when this drains away valuations can fall dramatically, which would deal a double blow to those trading on very high earnings multiples.GeoffTF said:

You seem to be saying that you do not like stocks on high valuations, because you believe that they have a higher loss making potential than the market. Where is the evidence for that? In theory, a market weighted portfolio is the most diversified portfolio. The US market has many more companies and higher earnings than any other market. It also has just about every type of business represented. Many of the big tech companies are near monopolies. Would you be happier if the Magnificent 7 were spread around the world?masonic said:My own view aligns with much of this. I mentioned a few posts ago I have had a small tilt away from the US for a long time, and I've always acknowledged it would likely be a drag on my returns. The primary reason for me is the sector concentration at a high valuation, which increases loss potential. It's precisely because I don't believe I know what will happen that I don't want too many eggs in one basket.With my reduced US equity allocation, my allocation to the Mag 7 make up 10% of my net worth, with the largest single company exposure around 2.5%. That's an upper limit I am comfortable with. I would not want it to go any higher than that. I also don't want to reduce my allocation to equities any more than I already have.I wouldn't want the Mag 7 spread around the world, because if they were it would be extremely difficult to limit my exposure to them. I suppose the ideal would be that they all relisted in an insignificant market like the UK, as they'd essentially be the market and I could dial them down without any side-effects.I acknowledge that the US market has a lot going for it and that's why my US listed investments make up nearly a third of my net worth. I'm unlikely to be convinced I need more exposure than that, although you're welcome to present me with any evidence you have that my approach is misguided.

You'll hear no disagreement from me on those points. A reduction in total return sees to the last point. But if your focus is not on maximising return but instead on producing a lasting regular income from your accumulated assets, then a rational argument can be made for this approach, just not one based on achieving the best financial outcome. It is not an approach I would take, but I can see the case for it in certain circumstances.GeoffTF said:

Restricting your self to high yielding stocks, entails missing out entire sectors and markets, reduces diversification and lowers the risk adjusted return.masonic said:Another reasonable justification for underweighting the US (which hasn't been mentioned here but have elsewhere) is a desire to live off natural yield, since dividends are disfavoured in the US for tax reasons, and are subject to WHT for us foreigners.0 -

GeoffTF said:masonic said:"I agree with you that there are many ways to sensibly set up a portfolio to meet one's needs...However where I would disagree is that a sensible reason for doing so is to beat the market...what one can do is to influence the volatility which may not matter much when in the accumulation phase but could be important if your investments are funding your day to day expenses""Unlike a professional money manager I don't need to be concerned about my "results" in the short term as long as I achieve my objective which is to protect the assets we have built up against inflation and allow us to spend it down in our retirement.""I'm not necessarily interested in better returns, I'm more interested in lower risk investments that offer some amount of control and produce a reasonable return. When markets sink and a tracker goes down, you have two choices, sell or take the ride to the bottom and hope it recovers within acceptable timescales. I would much rather have a less volatile fund that achieves say 50% of the upside but only looses a smaller amount on the way down. Trackers may be fine for the younger set but for the over 70's, they are less good."(1)These are all quotes from people who believe that under-weighting the US reduces volatility. Where is the evidence for that? Volatility could be reduced by holding more cash or bonds, if that is what they want.

You seem to be saying that you do not like stocks on high valuations, because you believe that they have a higher loss making potential than the market. Where is the evidence for that? In theory, a market weighted portfolio is the most diversified portfolio. The US market has many more companies and higher earnings than any other market. It also has just about every type of business represented. Many of the big tech companies are near monopolies. Would you be happier if the Magnificent 7 were spread around the world?masonic said:My own view aligns with much of this. I mentioned a few posts ago I have had a small tilt away from the US for a long time, and I've always acknowledged it would likely be a drag on my returns. The primary reason for me is the sector concentration at a high valuation, which increases loss potential. It's precisely because I don't believe I know what will happen that I don't want too many eggs in one basket.

(2) Restricting your self to high yielding stocks, entails missing out entire sectors and markets, reduces diversification and lowers the risk adjusted return.masonic said:Another reasonable justification for underweighting the US (which hasn't been mentioned here but have elsewhere) is a desire to live off natural yield, since dividends are disfavoured in the US for tax reasons, and are subject to WHT for us foreigners.

1) Risk to an academic seems to be linked to standard deviation typically measured over 3 or 5 years. Higher standard deviation implies higher risk. Personally I do not care about the normal levels of movement one can associate with Gaussian noise generated by the internal operation of the market. It is the one-off systemic events that worry me.

The .com crash is a perfect example. Another was the 2008 financial crash. The chances of events of such a magnitude particularly affecting individual market sectors, happening within a few years as a pure chance random noise event must be for all practical purposes zero. They are a different type of event than that covered by academic "risk" and Gaussian noise and must be managed in a different way.

The obvious way of handling them is to ensure that one's portfolio is not particularly concentrated in any factor that could be affected by a catastrophic event thus minimising the effect on the overall portfolio.

2) Reduced diversification is a risk with income investing. However if one is aware of this it is not too difficult to provide broad global diversification using both equity and Fixed Interest of various types. Why should "Lowering risk adjusted return" be a concern given income is much more stable than capital value and one's objective is not to maximise total return but rather to safely extract sufficient ongoing income from limited assets?4 -

There's a chart in the middle of the link below that I rather like, it shows seven indicators of the US markets and their current position, versus their 20 year average. US stocks were the second best performing asset over that 20 year period but their collective P/E is over 28. Personally, I would never excessively buy into any fund with a P/E that high so why should I buy into a market with the same rating. It may be as you say that statistically speaking, 50% of investors think the market is undervalued but there is no evidence that can pursude me to join that camp. Fundamentals are at odds with excessive exuberance and all the risk appears to be to the downside. It's for that reason that my holdings will not change, albeit I did go from 17% to 25%, but that's it. And if I miss out on some extra profit, se la vie, I was never planning to shoot the lights out any way, only to make a decent return and to be able to sleep at night. If I can do those things without the US, that works for me.GeoffTF said:.Clearly, half the active investors in the market disagree. They believe that the US market is undervalued. Other markets have political risk too. The US market (and economy for that matter) is the strongest in the world, despite the current administration. The US has a better history for respecting property rights and free markets than elsewhere.I am not saying that it is wrong to try to beat the market, just that it is wishful thinking to believe that under-weighting the US reduces risk. Doing that has done badly so far, but nobody knows what will happen in the future. Strangely, people who have been losing so far still seem to believe that they have superior investment skills. Nonetheless, even a broken clock is right twice a day.

https://www.morningstar.com/markets/what-7-key-indicators-are-saying-about-market?utm_source=eloqua&utm_medium=email&utm_campaign=improvingfinances&utm_content=none_67765&utm_id=351380 -

I came up with an asset allocation a few years ago that I felt comfortable with. I had decided that I didn't want my returns skewed to heavily in one region, so I under-weighted US in favour of other regions. I knew that if US did relatively well I'd be worse off, and if it did worse I'd be better off. I had no desire to try and beat the market. I'd already decided that I'd be content to deviate from the either-way returns of a strategy not aligned with global market-cap weightings, but that was intentional.

Over the past few years my portfolio returns have been inferior to what they would have been due to my under-weighting of US. But that was built into my expectation from the outset and does not cause me any concern. The decision I made was to stick with my strategic asset allocation for the long term, rather than be swayed by any inclination to time any markets, attempts to beat any markets and so on.

The index funds I have in my portfolio simply reflect the asset allocation I have stuck to, subject only to occasional rebalancing if things deviate too much from it. Using index funds aligns with my feeling that the market knows best, and my asset allocation aligns with my feeling of comfort from being underweight in the US in favour of other regions so as not to have a holding that dominates my portfolio. I don't know what the risk-adjusted returns are compared to a global market-cap based portfolio, but I pay only limited attention to metrics employing standard deviation techniques. Instead, I consider risk in terms of black swan events and, whilst acknowledging my portfolio is just as prone to shocks arising from these, take some comfort in having less eggs in any single basket.4 -

There has been a few comments on here about the "smart money" going in to the US. Personally I'm not convinced it is "smart money" making clever decisions and more about professional money managers and their FOMO as they could lose their nice, lucrative job if they deviate from the current conventional path.

Look at the comments made about Warren Buffett, Nick Train and Terry Smith because their returns have lagged peers who have been heavier into US / Mag7 stocks.

They are well known names so are mentioned more often, but how many others fall down the league tables and end up with their P45 that don't get much attention?

PNL and CGT are two well established, generally well run ITs that many people invest in. Their objective is not too beat "market returns" as such but to deliver balanced, sustainable growth (and income if required) over an extended period. They've had a bad run over the last few years compared to many alternative investment options, and have failed to attain their own benchmark level of performance at times but I wouldn't call them "dumb money".

Irrational Exuberance might be real why should I take the chance when I don't need to?3 -

A sensible strategy that I whole heartedly agree with. A major part of this is adopting a mindset whereby it's OK if you don't make as much profit as you might have done, had you followed the conventional wisdom. I'm pretty sure that if the US market was swallowed by the oceans tomorrow, I could still easily make the returns that I'm comfortable with, in the remaining markets.ivormonee said:I came up with an asset allocation a few years ago that I felt comfortable with. I had decided that I didn't want my returns skewed to heavily in one region, so I under-weighted US in favour of other regions. I knew that if US did relatively well I'd be worse off, and if it did worse I'd be better off. I had no desire to try and beat the market. I'd already decided that I'd be content to deviate from the either-way returns of a strategy not aligned with global market-cap weightings, but that was intentional.

Over the past few years my portfolio returns have been inferior to what they would have been due to my under-weighting of US. But that was built into my expectation from the outset and does not cause me any concern. The decision I made was to stick with my strategic asset allocation for the long term, rather than be swayed by any inclination to time any markets, attempts to beat any markets and so on.

The index funds I have in my portfolio simply reflect the asset allocation I have stuck to, subject only to occasional rebalancing if things deviate too much from it. Using index funds aligns with my feeling that the market knows best, and my asset allocation aligns with my feeling of comfort from being underweight in the US in favour of other regions so as not to have a holding that dominates my portfolio. I don't know what the risk-adjusted returns are compared to a global market-cap based portfolio, but I pay only limited attention to metrics employing standard deviation techniques. Instead, I consider risk in terms of black swan events and, whilst acknowledging my portfolio is just as prone to shocks arising from these, take some comfort in having less eggs in any single basket.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards