We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Which Index funds to invest in?

Comments

-

A very interesting thread with so much information and views.

I have always been a bit weary of stock-markets, how they operate, how they react to stuff and mostly how so much money just gets pushed in automatically and manually in the good times and we just see rising markets during the majority of time zones, a very nice place to put money in if a person can handle emotions and ride out any big old long dips.

I feel stock-markets are just too disconnected from real life fundamentals and especially nowadays with so much data available, they just bounce along.

The USA markets are to behold on recent performances, the S&P 500 sticks out and the Mag-7 is amazing, think I read Nvida market cap is equal to the 220 smallest companies in the S&P 500. I do wonder if the Mag-7 are just too over valued and dragging up the S&P 500 and also dragging up other markets.

Trying to pick indexes, sectors, regions or whatever looks very complicated to me and I just favour that most common approach talked about of a global approach and if a investor feels personally too much exposure in areas they are nervous about, just use an offset or slider to taper down perceived over exposure.

I watched a video over the weekend that covers lots of my current feelings, I'll link it below as some may find it interesting.

*** https://youtu.be/bfgNtbr2KuE?si=yRVQ9gP2AQaVB6zI

https://youtu.be/bfgNtbr2KuE?si=yRVQ9gP2AQaVB6zI

1 -

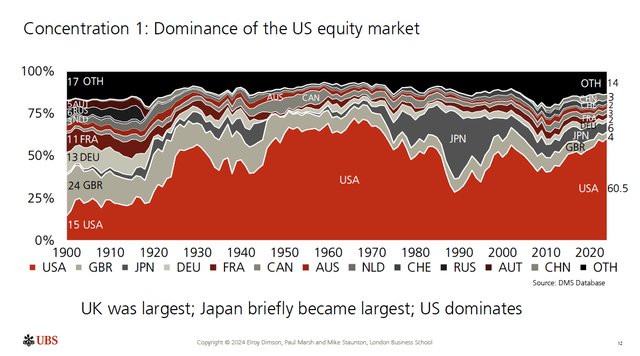

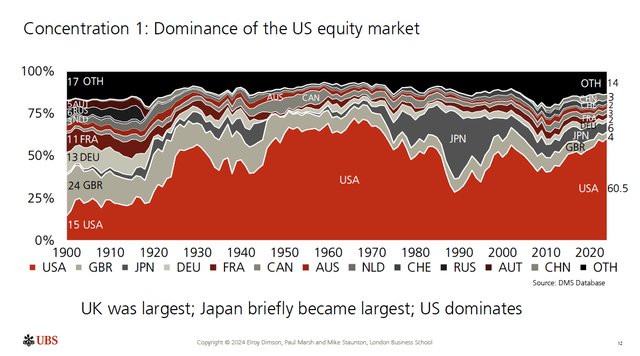

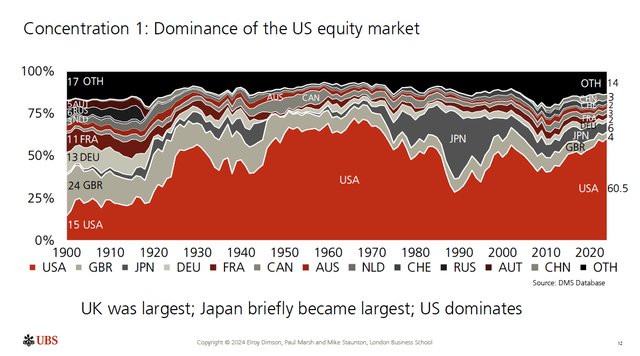

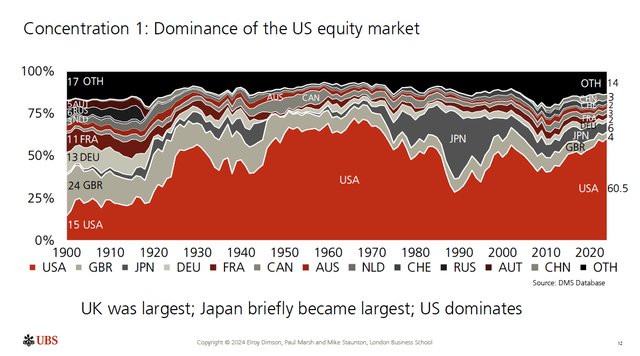

Depends on your objective. Is it maximising long term growth or generating sufficient growth at acceptable short/medium term risk? “Beating the market” is in my view far too risky an objective to attempt if you are managing a sizeable pot of money. If it is just play money, fine, but not if a failure jeopardises your life plans.leosayer said:US dominance isn't a recent phenomenon.

From here: https://www.ubs.com/global/en/investment-bank/insights-and-data/2024/global-investment-returns-yearbook.html

It does feel uncomfortable having such large concentration in one country and threads like this continue to concern me.

However, in the past I attempted and failed to "beat the market" by choosing certain countries over others. For the past 6-7 years my asset allocation is entirely down to market cap only and I'm very happy I did that.3 -

chiang_mai said:

It feels like the discussion has gone full circle and back to my desire to hold only 25% US, plus broadly equal wieght in the other regions I invest in. The argument that was put forward against that approach is that the smart money doesn't do that, which I don't believe is true!masonic said:Makes sense to me too. There's arguments on the basis of concentration and valuation, which is why I only hold 45% US.I've held various underweights to the US market for about a decade, although I've never gone as far as you as I don't have strong enough conviction. Just as well, as to date it has had a cost in terms of reduced returns. To that extent it doesn't feel very smart, but my priority in doing so wasn't to maximise returns. Year to date, things are looking quite different and the US is looking like the underperformer of my portfolio.I think it was InvesterJones that made the argument that there was plenty of smart money holding the Mag7 up at those lofty earnings multiples, and this is probably true. The trouble is that the smart money is fickle, and when it loses confidence that the billions being pumped into AI research turbocharging these companies' earnings, then we will likely see the effects.1 -

He said: "...because I believe more money will go into those assets..." which you apparently liked. I'm not sure that is much different to my statement "pouring money in" which you didn't seem to like.masonic said:Makes sense to me too. There's arguments on the basis of concentration and valuation, which is why I only hold 45% US.

In general, I think we're in trouble in the market economy we live in to question why demand of any asset pushes its price up. That includes a new poster of Trump playing beach volleyball.0 -

michael1234 said:

He said: "...because I believe more money will go into those assets..." which you apparently liked. I'm not sure that is much different to my statement "pouring money in" which you didn't seem to like.masonic said:Makes sense to me too. There's arguments on the basis of concentration and valuation, which is why I only hold 45% US.

In general, I think we're in trouble in the market economy we live in to question why demand of any asset pushes its price up. That includes a new poster of Trump playing beach volleyball.He said "I'm not investing more in EM because I believe more money will go into those assets..."Meaning that isn't what he believes.The sentence continues "...but because I believe having a broader base than 66% US exposure offers is a more sensible long term view at this point in time for us"Meaning that is what he believes. And I agree with that.Isn't it interesting how a group of words can be taken out of context to imply the exact opposite of what was actually being conveyed.2 -

It wasn't deliberate - I just wanted to focus on what I thought was relevant. But I apologise if you think I'd twisted things.masonic said:michael1234 said:

He said: "...because I believe more money will go into those assets..." which you apparently liked. I'm not sure that is much different to my statement "pouring money in" which you didn't seem to like.masonic said:Makes sense to me too. There's arguments on the basis of concentration and valuation, which is why I only hold 45% US.

In general, I think we're in trouble in the market economy we live in to question why demand of any asset pushes its price up. That includes a new poster of Trump playing beach volleyball.He said "I'm not investing more in EM because I believe more money will go into those assets..."Meaning that isn't what he believes.The sentence continues "...but because I believe having a broader base than 66% US exposure offers is a more sensible long term view at this point in time for us"Meaning that is what he believes. And I agree with that.Isn't it interesting how a group of words can be taken out of context to imply the exact opposite of what was actually being conveyed.0 -

I thought it was fairly unlikely it was deliberate so no worries there. I thought most likely you honed in on it without reading the rest of the post.michael1234 said:

It wasn't deliberate - I just wanted to focus on what I thought was relevant. But I apologise if you think I'd twisted things.masonic said:michael1234 said:

He said: "...because I believe more money will go into those assets..." which you apparently liked. I'm not sure that is much different to my statement "pouring money in" which you didn't seem to like.masonic said:Makes sense to me too. There's arguments on the basis of concentration and valuation, which is why I only hold 45% US.

In general, I think we're in trouble in the market economy we live in to question why demand of any asset pushes its price up. That includes a new poster of Trump playing beach volleyball.He said "I'm not investing more in EM because I believe more money will go into those assets..."Meaning that isn't what he believes.The sentence continues "...but because I believe having a broader base than 66% US exposure offers is a more sensible long term view at this point in time for us"Meaning that is what he believes. And I agree with that.Isn't it interesting how a group of words can be taken out of context to imply the exact opposite of what was actually being conveyed.2 -

The only reason for over-weighting or under-weighting the US is to beat the market. It is pointless otherwise. Nobody knows whether the US will out-perform or under-perform going forwards, but if you fancy a punt...Linton said:

Depends on your objective. Is it maximising long term growth or generating sufficient growth at acceptable short/medium term risk? “Beating the market” is in my view far too risky an objective to attempt if you are managing a sizeable pot of money.leosayer said:US dominance isn't a recent phenomenon.

From here: https://www.ubs.com/global/en/investment-bank/insights-and-data/2024/global-investment-returns-yearbook.html

It does feel uncomfortable having such large concentration in one country and threads like this continue to concern me.

However, in the past I attempted and failed to "beat the market" by choosing certain countries over others. For the past 6-7 years my asset allocation is entirely down to market cap only and I'm very happy I did that.0 -

GeoffTF said:

The only reason for over-weighting or under-weighting the US is to beat the market. It is pointless otherwise. Nobody knows whether the US will out-perform or under-perform going forwards, but if you fancy a punt...Linton said:

Depends on your objective. Is it maximising long term growth or generating sufficient growth at acceptable short/medium term risk? “Beating the market” is in my view far too risky an objective to attempt if you are managing a sizeable pot of money.leosayer said:US dominance isn't a recent phenomenon.

From here: https://www.ubs.com/global/en/investment-bank/insights-and-data/2024/global-investment-returns-yearbook.html

It does feel uncomfortable having such large concentration in one country and threads like this continue to concern me.

However, in the past I attempted and failed to "beat the market" by choosing certain countries over others. For the past 6-7 years my asset allocation is entirely down to market cap only and I'm very happy I did that.Is it pointless to hold anything less than 100% equities? Because you probably won't beat the market doing that.If your objective is something other than beating the market, then you can rationally select investments in a different proportion to a global index. Just like you could select investments from alternative asset classes.4 -

I took the context here to be equity investment. Introducing other asset classes muddies the issue. There are people here who believe that under-weighting the US reduces their risk, but they have not offered any rational basis for that. They believe that the US market is overvalued and want to under-weight it as a result. That is an attempt to beat the market. There does not appear to be anyone here who wants to over-weight the US, but they nonetheless believe that there is an irrational excess demand for US stocks. There are some who think that they know better than the market, and others who know that they do not.masonic said:GeoffTF said:

The only reason for over-weighting or under-weighting the US is to beat the market. It is pointless otherwise. Nobody knows whether the US will out-perform or under-perform going forwards, but if you fancy a punt...Linton said:

Depends on your objective. Is it maximising long term growth or generating sufficient growth at acceptable short/medium term risk? “Beating the market” is in my view far too risky an objective to attempt if you are managing a sizeable pot of money.leosayer said:US dominance isn't a recent phenomenon.

From here: https://www.ubs.com/global/en/investment-bank/insights-and-data/2024/global-investment-returns-yearbook.html

It does feel uncomfortable having such large concentration in one country and threads like this continue to concern me.

However, in the past I attempted and failed to "beat the market" by choosing certain countries over others. For the past 6-7 years my asset allocation is entirely down to market cap only and I'm very happy I did that.Is it pointless to hold anything less than 100% equities? Because you probably won't beat the market doing that.If your objective is something other than beating the market, then you can rationally select investments in a different proportion to a global index. Just like you could select investments from alternative asset classes.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards