We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Which Index funds to invest in?

Comments

-

I see what you mean. I had not considered that.leosayer said:

It's described by ESMA below. I can't find the delegated FCA rule.GeoffTF said:

What regulatory requirements? Many (but not all) IFAs use many funds when one or two would do to make it look as though they are doing more for their money. Vanguard is following this dubious practice in the belief that it sells. Using many funds costs Vanguard nothing.leosayer said:

The difference in the number of underlying funds between the UK and US version is likely down to different regulatory requirements.GeoffTF said:masonic said:Cus said:

It would also be interesting to see the percentage of UK based investors who invest in the S&P versus the FTSE against the same with US based investors, as well as the total number. Our home bias I suspect is not as biased as US investorsInvesterJones said:

I made a similar point about US home bias a few posts back - that's the obvious mix of population size and home investment. EM does contain two of the most populous nations so *if* there was a similar home bias and large number of investors then it doesn't really make the case for going to EM for extra value either - of course, they don't have anywhere near the same number of investors as the US does I'm sure, but I'd love to see what the actual investor population is country by country.Linton said:

It would seem to me that a large % of investors globally have a significant home bias and hence value opportunities in foreign countries lower than corresponding opportunities in their home market. If that was not the case the allocations adopted by investors in different countries would be the same.InvesterJones said:

But again that's not secret sauce. Reading that isn't suddenly going to make me spot an opportunity that the rest of the market doesn't know about. They do know about it, and still cause the odds to favour elsewhere.chiang_mai said:

An interesting read: https://www.investmentmagazine.com.au/2025/07/why-emerging-markets-are-back-in-focus/InvesterJones said:

If that was the case then the professional investor with more capital would take advantage and buy up EM/Asia to get increased returns for the price, bringing the cost up to the same risk adjusted return as other markets.

Hence global markets are skewed by the locations of investors.

The argument that buying opportunities self correct may well apply within a market, but it is less clear that it works between markets.It depends also how you define bias. Some would consider 60% S&P and 3% FTSE not biased. Then how biased is 100% S&P for a US person vs 20% FTSE for a UK person.I suspect home bias is much less of a thing in the UK than it was 20 or even 10 years ago, since it has been a drag on returns. Whereas in the US global diversification has been a losing strategy.The equity part of Vanguard UK LifeStrategy is 25% UK. For the US version it is 60% US. Vanguard has said more than once that the home bias is for marketing reasons, so those numbers should be a fair indication of what the market wants.The US version does not appear to have a home bias at all. Also note how much simpler the US portfolio is.

I'm sure Vanguard in the UK would prefer to hold 3 underlying funds rather than the 15+ they currently do.

"1. A UCITS may acquire the units of UCITS or other collective investment undertakings referred to in Article 50(1)(e), provided that no more than 10 % of its assets are invested in units of a single UCITS or other collective investment undertaking. Member States may raise that limit to a maximum of 20 %.2. Investments made in units of collective investment undertakings other than UCITS shall not exceed, in aggregate, 30 % of the assets of the UCITS."

https://www.esma.europa.eu/publications-and-data/interactive-single-rulebook/ucits/article-550 -

Yes I agree and at a technical level (almost pedantic level) there is only one way a stock can rise - a trade agreed between buyer and seller for a higher price than the last trade. But I was suggesting there are typically two ways that that can happen.GeoffTF said:

I expect that masonic is referring to 1. For every buyer there is a seller. Money can only be poured in at the same rate as it is poured out. Journalists do not seem to understand that. The price goes up if the buyers are keener than the sellers, not because they are more numerous.michael1234 said:

I think you are aiming this mostly at me or anyone else who thinks like me? I said in my original question that I thought there were two reasons a region's stocks may increase:masonic said:There seems to be a fundamental misunderstanding about what is required for a share price to go up. This can happen without money being poured into it. All it takes is news that materially changes the market's view of what the company is worth and participants will readily adjust their offer price. Only those with existing limit orders that are not paying attention are likely to have their shares taken off them at what they'll come to regard as a bargain price. Such news can be released while the market is closed, giving participants plenty of time to reappraise the situation.

1/ Money being "poured in" thus increasing demand

2/ The region itself doing better than expected. (i.e. the companies in the region doing better than expected possibly due to political and economic events). That implies the "news" is positive

I think you are referring 2 here.

Could you elaborate on why you believe this makes you think I have fundamentally misunderstood what is required for a stock to rise and fall?

I meant the phrase money "pouring in" to mean a situation in which there are more bids and/or those bids are at a higher rate than before. Maybe because someone has bought an index fund that requires the purchase of a given stock in that region.

Yes an equal amount of money will "pour out" to the seller, but the seller will relinquish fewer shares than he would have done had he sold them in the previous trade, and the market cap of the company will rise.

In some ways I'm surprised there is any discussion about this at all. If I tell my broker to buy some shares at any price and none are available, the exchange will ensure a seller is found likely at a higher price. The more money there is "going in" to a stock the more it will rise.0 -

michael1234 said:

I meant the phrase money "pouring in" to mean a situation in which there are more bids and/or those bids are at a higher rate than before. Maybe because someone has bought an index fund that requires the purchase of a given stock in that region.Index funds only buy or sell to match the net cash flow of investors into or out of the fund. If a buyer can be matched to a seller on the same day, then that wouldn't result in any market purchase, only any excess, which is likely to be small compared with the volume of shares traded by other market participants. Far more likely it will be conviction trades that would have a much more potent effect on prices.There is a separate issue of companies thriving and choosing to list in markets where there is a lot of money pouring in (access to capital), but that is not related to trade on the secondary market, and perhaps that is a key point of confusion with the terminology.

This still seems to be mistaking the trade execution for the reason for the price change. A shift in the supply and demand curves will be driven by changes to market sentiment and/or valuation. There will be some other catalyst behind the curves shifting to the point trading would cause a sustained price shift. Compare with the trading of antiques. An item's price goes up if collectors start believing it is worth more, or it becomes rarer. Money doesn't flow in and out of antiques.michael1234 said:

Yes an equal amount of money will "pour out" to the seller, but the seller will relinquish fewer shares than he would have done had he sold them in the previous trade, and the market cap of the company will rise.

You seem to be describing an 'at best' order here where immediate execution is prioritised over price. In such an order a price would not be specified and disregarded, you'd simply ask for a specific number of shares, or if your platform supports it, a specific value (where this is converted by your platform to an appropriate number of shares prior to advancing to the exchange). This number of shares would be matched with available limit orders on the order book, starting with the lowest price and working its way up until the order is filled. In most cases you will be given a quote which you can either execute or cancel as the order would be fulfilled immediately by a market maker.michael1234 said:

In some ways I'm surprised there is any discussion about this at all. If I tell my broker to buy some shares at any price and none are available, the exchange will ensure a seller is found likely at a higher price. The more money there is "going in" to a stock the more it will rise.If the order is large and the book is thin, then that does have the capacity to walk up the price. However, this is not the typical driving force for long term price movement. A healthy liquid stock will have a deep order book and even a relatively large order from an index fund would be absorbed with minimal and ephemeral effect. Index funds will normally use more sophisticated trading strategies like volume weighted average price orders to minimise the short-term price impact. Such factors can contribute to volatility (especially during downturns) but there is enough rational money in the market to arbitrage away any price movement that is not supported by collective conviction.This circles back to the previous point that index funds are price takers, not price setters.In contrast there can be money "pouring in" to open-ended investment funds, because that involves unit creation and the accumulation of assets from other market participants, but the underlying market itself does not have any money poured into it as a consequence. And the pouring of money into an index fund is neither necessary nor sufficient for an investor in that region to experience growth. But associating money pouring into regional investment funds with an improved regional valuation makes a lot of sense. This would be driven by investors making an active decision to grow their exposure to the region in question, so would be effect rather than cause. I do now wonder whether this was actually what you meant.1 -

user a says money is pouring in

user b explains how actually there is no extra money pouring in technically

user c jumps on said technical explanation and thinks that user a's description could be interpreted it in a different and realistic way and maybe user a kinda meant that

user a says of course

user b wonders if it was the case initially

user c writes elaborate post explaining nothing

See you on the next thread

3 -

Cus said:user a says money is pouring in

user b explains how actually there is no extra money pouring in technically

user c jumps on said technical explanation and thinks that user a's description could be interpreted it in a different and realistic way and maybe user a kinda meant that

user a says of course

user b wonders if it was the case initially

user c writes elaborate post explaining nothing

See you on the next threadI appreciate some may find that last post too long and it was only at the end I realised "user a" might have been referring to inflows into collective investment funds, rather than money flowing into the underlying index itself. Though they may or may not concur with my different and more realistic interpretation of their description. They might not agree it is more realistic.For those of the TL;DR persuasion, the core error is confusing cash flow (the action) with valuation (the reason). Putting money into index funds is one way to access long-term growth, but capital flowing into them isn't a source of long-term growth. Such a fund doesn't need to see any inflows of cash (into itself or other funds in the sector) for its existing investors to see growth.3 -

I think that I may have inadvertently started this discussion many pages ago when I outlined why I was pondering a reduction in my US exposure.

I haven't thought about my reasons to anywhere near the level of detail that has followed but am just working on the simplistic assumption that if the US (aka Mag 7) take a tumble then the more exposure I have the greater the hit to my "paper wealth".

As we intend to spend a fair chunk of that over the next 20 years or so then I don't need to take that risk and even if my alternative choices deliver a lower return I don't care as I am not aiming to build more wealth but trying to maintain the buying power of what I have.

I'm not investing more in EM because I believe more money will go into those assets but because I believe having a broader base than 66% US exposure offers is a more sensible long term view at this point in time for us. What makes sense to others may well be different.4 -

It makes a lot of sense to me. Though it did not need Trump to justify the re-allocation. Having 66% US has always carried the same risk and investing something worthwhile in EM the same benefit. Eggs and baskets.AlanP_2 said:I think that I may have inadvertently started this discussion many pages ago when I outlined why I was pondering a reduction in my US exposure.

I haven't thought about my reasons to anywhere near the level of detail that has followed but am just working on the simplistic assumption that if the US (aka Mag 7) take a tumble then the more exposure I have the greater the hit to my "paper wealth".

As we intend to spend a fair chunk of that over the next 20 years or so then I don't need to take that risk and even if my alternative choices deliver a lower return I don't care as I am not aiming to build more wealth but trying to maintain the buying power of what I have.

I'm not investing more in EM because I believe more money will go into those assets but because I believe having a broader base than 66% US exposure offers is a more sensible long term view at this point in time for us. What makes sense to others may well be different.0 -

Makes sense to me too. There's arguments on the basis of concentration and valuation, which is why I only hold 45% US.0

-

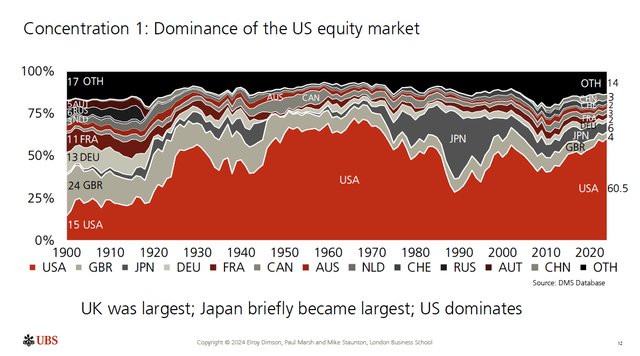

US dominance isn't a recent phenomenon.

From here: https://www.ubs.com/global/en/investment-bank/insights-and-data/2024/global-investment-returns-yearbook.html

It does feel uncomfortable having such large concentration in one country and threads like this continue to concern me.

However, in the past I attempted and failed to "beat the market" by choosing certain countries over others. For the past 6-7 years my asset allocation is entirely down to market cap only and I'm very happy I did that.

1 -

It feels like the discussion has gone full circle and back to my desire to hold only 25% US, plus broadly equal wieght in the other regions I invest in. The argument that was put forward against that approach is that the smart money doesn't do that, which I don't believe is true!masonic said:Makes sense to me too. There's arguments on the basis of concentration and valuation, which is why I only hold 45% US.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards