We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

bonds / gilts

Comments

-

I include NCYF in my portfolio. It's exposed to the stock market but underlying the trading are high yielding fixed interest securities. Not something to go all in on imo, but failing a black swan event, I expect distributions to remain consistent. So for me, a long term buy and hold.0

-

There are various stock markets. There are numerous stock indexes. Equities is a very broad generalisation. Covering a multitude of activities that company's undertake. Worth spending some time researching and learning. As there's a vast universe out there. That's far more complex than it might first appear.dannybbb said:i just hear a lot of talk about the stock market being overvalued,3 -

@Hoenir i have read a lot over the last year but still feel like i know nothing, well, I know more than i did a year ago

but still concerned about what I have in my sipp which is why Im thinking of selling what i have and being more sure im doing the right thing. my sipp is 50 in balanced hsbc global and 28k in dynamic - thinking of at least selling the dynamic element for now

but still concerned about what I have in my sipp which is why Im thinking of selling what i have and being more sure im doing the right thing. my sipp is 50 in balanced hsbc global and 28k in dynamic - thinking of at least selling the dynamic element for now

0 -

Seems like you'd be a good candidate for using an IFA, being of quite a nervous disposition. It is a lot of money and therefore a lot of responsibility, so could be money well spent.1

-

yeah, ive actually reached out to a couple of local ones with no reply , will try some others0

-

Just nosing around the internet/MSE forums and noticed the prices quoted on AJ Bell site for these two gilts.

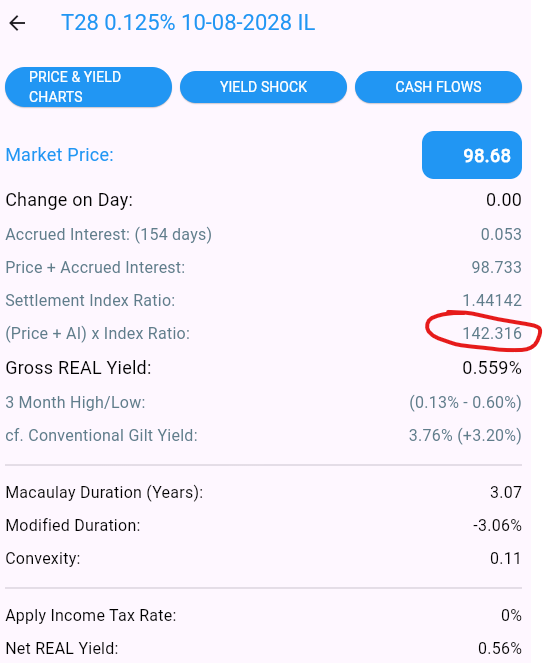

Issuer Coupon (%) Maturity date PriceTreasury Index-Linked 0.125% 22/03/2026 0.125 22-Mar-26 98.7 TR26 | GB00BYY5F144 | £ Treasury Index-Linked 0.125% 10/08/2028 0.125 10-Aug-28 98.69 T28 | GB00BZ1NTB69 | £ As the coupon is very low, I take it the return is in capital gain at redemption. If so, how on earth can they both have (virtually) the same current price, if the second one doesn't mature until 17 months after the first one?0 -

T28 is an index-linked gilt, so you would be getting the difference in RPI plus that capital gain and coupon. RPI in Aug 2028 is likely to be considerably higher than RPI in March 2026 (3 month lag noted).otherwayup said:Just nosing around the internet/MSE forums and noticed the prices quoted on AJ Bell site for these two gilts.Issuer Coupon (%) Maturity date PriceTreasury Index-Linked 0.125% 22/03/2026 0.125 22-Mar-26 98.7 TR26 | GB00BYY5F144 | £ Treasury Index-Linked 0.125% 10/08/2028 0.125 10-Aug-28 98.69 T28 | GB00BZ1NTB69 | £ As the coupon is very low, I take it the return is in capital gain at redemption. If so, how on earth can they both have (virtually) the same current price, if the second one doesn't mature until 17 months after the first one?0 -

Given the bonds are in essence identical. Why should their prices differ markedly when valued as at today.otherwayup said:Just nosing around the internet/MSE forums and noticed the prices quoted on AJ Bell site for these two gilts.Issuer Coupon (%) Maturity date PriceTreasury Index-Linked 0.125% 22/03/2026 0.125 22-Mar-26 98.7 TR26 | GB00BYY5F144 | £ Treasury Index-Linked 0.125% 10/08/2028 0.125 10-Aug-28 98.69 T28 | GB00BZ1NTB69 | £ As the coupon is very low, I take it the return is in capital gain at redemption. If so, how on earth can they both have (virtually) the same current price, if the second one doesn't mature until 17 months after the first one?

These are clean not dirty prices though. Which factor in accrued interest etc.0 -

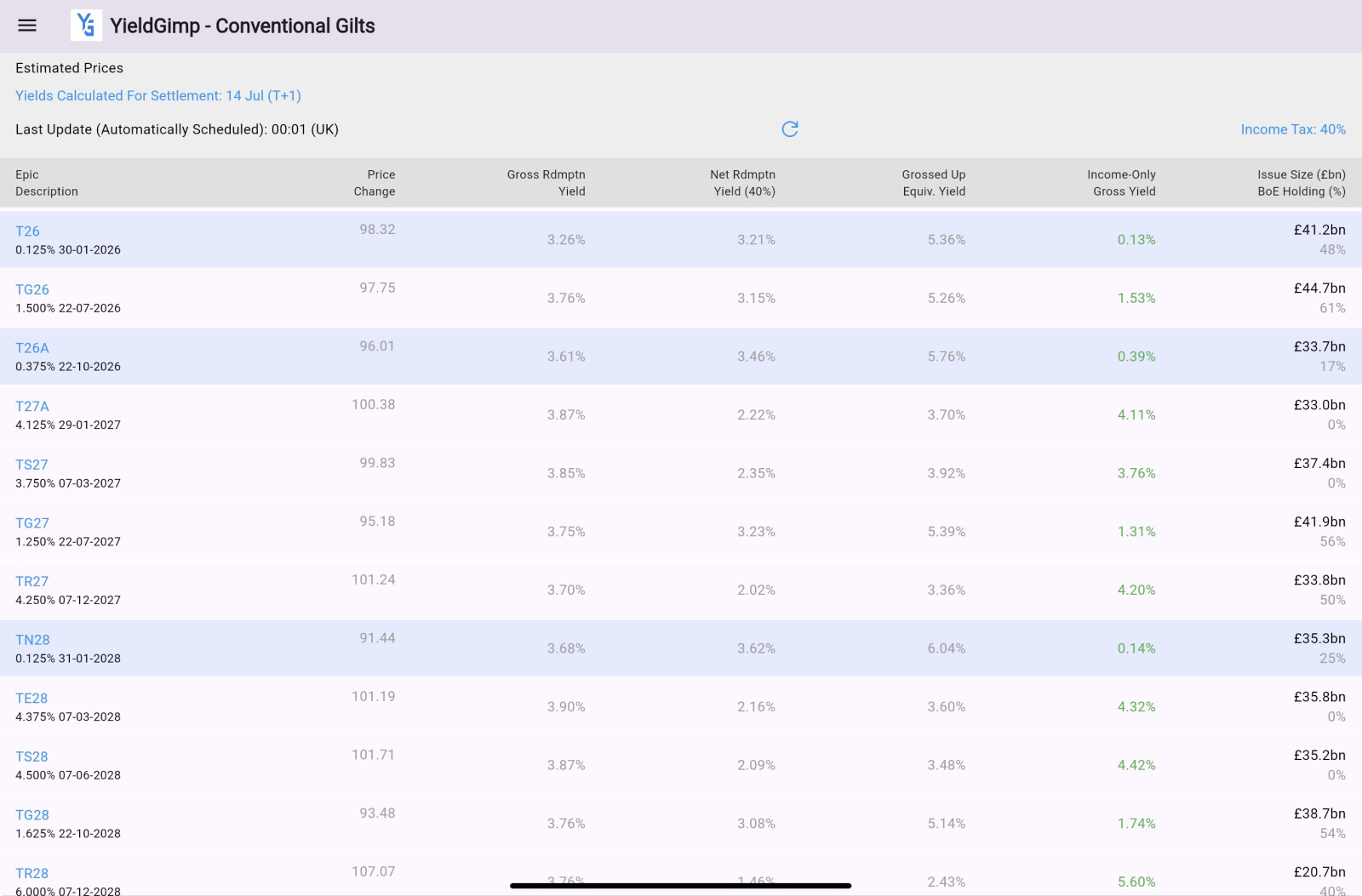

Because they're linkers. You can see the difference in yields between conventional, low coupon gilts of a similar tenor e.g., T26 3.21% vs TN28 3.62% and TG28 3.6%:otherwayup said:Just nosing around the internet/MSE forums and noticed the prices quoted on AJ Bell site for these two gilts.Issuer Coupon (%) Maturity date PriceTreasury Index-Linked 0.125% 22/03/2026 0.125 22-Mar-26 98.7 TR26 | GB00BYY5F144 | £ Treasury Index-Linked 0.125% 10/08/2028 0.125 10-Aug-28 98.69 T28 | GB00BZ1NTB69 | £ As the coupon is very low, I take it the return is in capital gain at redemption. If so, how on earth can they both have (virtually) the same current price, if the second one doesn't mature until 17 months after the first one?

0 -

Thought I had it for a second; I saw the index ratio below and though, ahh at redemption, based on the RPI since issuance so far this will return capital at 142, instead of 100, but it can't be that you pay 98.68 now and get 142 in 3yrs can it?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards