We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

bonds / gilts

Comments

-

Thanks @kempiejon, that post explains a lot to me.

So TN28.. I buy £10k of it now, earn peanuts interests every 6 months subject to tax 40%, then at maturity it goes up from 89p to £1 at that price I sell it - and gain about £1200 tax free (close to 4% for 3 years).

Just as a side question, comparing to Short Term Money funds - which pay 5-6% (and yes, fully taxable unless ISA/SIPP) - is the benefit of gilts that it's guaranteed return and that is almost 100% safe as it's backed by UK - which for some could justify lower return?1 -

@Newbie_John The dates attatched to the gilts are when the governement takes the gilt back, they redeem and you get the £1. Selling gilts is a different version as you may get £1 or a different amount, markets drive the price and hence yield; of course there are fees for buying and selling gilts but no fee if held to maturity. You can sell at at anytime in the market but holding to redemption guarantees that £1 price fee free. I don't know about money markets funds but 5-6% taxed doesn't look as good to me as 4% untaxed for 40% earners outside ISA/SIPP. Gilts here are being used as a similar vehicle to cash but low coupon trading below par (£1) is removing the interest tax liability and seeing gains as capital and capital gains on gilts are exempted that tax. Using gilts to minimise tax on savings interest is a bit niche for generalist investing. The man says don't let the tax tail wag the investment dog. Money in a global etf in a SIPP is to my mind likely more profitable longer term. I use gilts to fix known capital amounts for future expenditure over the next 5 years or so. The tax treatment compared to cash is a handy extra.1

-

@kempiejon so if you had an excess of cash and had maxed out ISA and have a SIPP (funded through a company) would you invest in gilts? sounds like you are saying its too silimlar to cash if I understand correctly?0

-

What might the problem be with similar to cash? Cash is dead useful. Cash and Gilts have different tax treatments.dannybbb said:@kempiejon so if you had an excess of cash and had maxed out ISA and have a SIPP (funded through a company) would you invest in gilts? sounds like you are saying its too silimlar to cash if I understand correctly?

I have invested in gilts in unsheltered accounts and in ISA/SIPP. If it sounds like I've said it's too close to cash I'll need to work on my explainering. It's different. One could think of a gilt as an agreement to return a fixed capital value - the principal on a fixed date - redemption while offering a know income - the coupon. The coupon is treated as income for tax purposes if the gilt is bought in the 2ndary market there could be a capital gain, that is exempt from taxation.

So, not really like cash, you can't really spend gilts, you buy them with a broker or other platform and are charged to do so, you can then sell with costs or hold to maturity and get the principal back without a dealing fee.

If I had an ISA and SIPP I could buy gilts within either of those shelters. If I had maxed both shelters and wanted to hold gilts for a fixed return over a known duration they might be a good asset choice. If I was holding cash above the interest allowance to avoid a tax bill I might pick a gilt, a short dated low couplon gilt trading below par.1 -

@kempiejon thanks for taking the time to clarify. in my case i have 270k in cash ISA's and around 500k in cash savings that are a mix of interest rates around 4.6-5% with cash rates seemingly declining im just considering what to do for the best with the money outside ISAS to best protect it from inflation - i'd like to keep 100k readily available but have been looking at better ways to keep the 400k. Im 50 and concerned about the stock market because of my age and potential of a big crash hance looking at gilts & bonds0

-

To protect from inflation there are index linked gilts but that's another story, a long one that confuses me.dannybbb said:@kempiejon thanks for taking the time to clarify. in my case i have 270k in cash ISA's and around 500k in cash savings that are a mix of interest rates around 4.6-5% with cash rates seemingly declining im just considering what to do for the best with the money outside ISAS to best protect it from inflation - i'd like to keep 100k readily available but have been looking at better ways to keep the 400k. Im 50 and concerned about the stock market because of my age and potential of a big crash hance looking at gilts & bonds

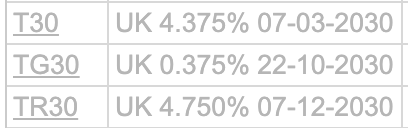

For now 4.5% on £500k cash is a taxable event? Gilts would remove much of that, again for that purpose it's low coupon gilts, below 1% as a starter, lower is generally better, they need to be priced below par so I gave an example from https://www.yieldgimp.com/gilt-yields of TN28 0.125% 89.63p to buy. On 01/07/2027 you get £1 for each gilt you bought at 89p having had income tax on 0.125% coupon for a couple of years. You'd have to work out your own tax on specific gilts compared to specific savings rates.

As an aside do you have other investments targeted for growth, for now there's an advantage over inflation with current interest rates but inflation is a risk to cash/fixed interest.

Personality drives investment styes and Gilts held to maturity do offer certainty that stock investing just doesn't. I prefer the potential in equities; gilts/cash are a minority of my portfolio to act as ballast.1 -

If you are not willing to invest in equities, then perhaps it is worth considering one or two of the capital preservation trusts, such as Personal Assets Trust or Capital Gearing Trust for diversification and a small amount of equities selected for defensive qualities.dannybbb said:Im 50 and concerned about the stock market because of my age and potential of a big crash hance looking at gilts & bonds1 -

@masonic its not that im not willing , i just hear a lot of talk about the stock market being overvalued, even if its not the percentage difference of stocks vs cash ( my sipp has seen around 6.5% growth in a year vs around 5 in cash doesnt seem to we worth the risk vs reward especially given the backdrop of all the talk of a crash, especially at my age. I realise its just talk but also think what the harm in waiting things out for a while. worst case i lose a few % best case ipreserve my savings and invest when things are nt as overvalued.

i will looj at those trusts though, thank you0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards