We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Help!! HMRC randomly dipped in and took 1/4 of my wages

Comments

-

No, forget your "original" tax code.brutal_deluxe said:Thanks guys, appreciate this.

So listen, all I'm concerned about right now is what's happening from this point on.

The first thing that's stated in black and white is it's 'estimated' have "underpaid 549 tax this year". Fine, so once that 'debt' is clear, it's over right? Back to my original tax code? How can it be read any other way?

You will get a new tax code for the 2025-26 tax year which will not have the deduction relating to the £549 (which is an estimate of what you might owe for 2024-25, the final position will be reviewed later this summer/autumn).

But your 2025-26 tax code is likely to have the same deduction for untaxed interest (which is an estimate based on the latest information HMRC hold).

And if you owe tax for 2023-24 then that might be included in your 2025-26 tax code as well.

So whatever your original code was is unlikely to what you will have for 2025-26.1 -

In your original post you said the new tax code was K283X. The X isn't really part of the code, it signifies that the code should be used on a non cumulative basis, i.e. just on each pay day from now on without taking into account what you earned earlier in this tax year.brutal_deluxe said:

I'm assuming this includes my other savings accounts. Ok fine. I think all I needed to know was how much I can expect to have taken from my monthly pay for the immediate future. If I have underpaid (as they say) 549, and I have paid most of that this month, then the remainder is small and they won't take any more than they should?Bobziz said:Worth checking your other 'ISA' accounts too just in case they are not actually what you think they are.

I just don't want to have to chase a rebate or anything . It's definitely not going to be more than the 549 they day I've underpaid?

Once this has been established, I can consider moving from these non ISA accounts that I appear to have misunderstood

So if you earn exactly the same next month as you did when K283X was first used you can expect to pay the exact same amount of tax. That will only change on 6 April, when a new tax code should be in place (details of what that new tax code is might not be available just yet).1 -

If I pay the same amount next month then I would have paid 8 or 900 in total since this new code came into effect. That's in excess of what I apparently owe this year, surely I've got that wrong?Dazed_and_C0nfused said:

In your original post you said the new tax code was K283X. The X isn't really part of the code, it signifies that the code should be used on a non cumulative basis, i.e. just on each pay day from now on without taking into account what you earned earlier in this tax year.brutal_deluxe said:

I'm assuming this includes my other savings accounts. Ok fine. I think all I needed to know was how much I can expect to have taken from my monthly pay for the immediate future. If I have underpaid (as they say) 549, and I have paid most of that this month, then the remainder is small and they won't take any more than they should?Bobziz said:Worth checking your other 'ISA' accounts too just in case they are not actually what you think they are.

I just don't want to have to chase a rebate or anything . It's definitely not going to be more than the 549 they day I've underpaid?

Once this has been established, I can consider moving from these non ISA accounts that I appear to have misunderstood

So if you earn exactly the same next month as you did when K283X was first used you can expect to pay the exact same amount of tax. That will only change on 6 April, when a new tax code should be in place (details of what that new tax code is might not be available just yet).0 -

You have misunderstood the tax code. I suspect if you have the details of the previous tax code there is more than the £549 that has changed, you are paying extra towards the tax due on the untaxed interest HMRC expect you to receive in 2024-25.brutal_deluxe said:

If I pay the same amount next month then I would have paid 8 or 900 in total since this new code came into effect. That's in excess of what I apparently owe this year, surely I've got that wrong?Dazed_and_C0nfused said:

In your original post you said the new tax code was K283X. The X isn't really part of the code, it signifies that the code should be used on a non cumulative basis, i.e. just on each pay day from now on without taking into account what you earned earlier in this tax year.brutal_deluxe said:

I'm assuming this includes my other savings accounts. Ok fine. I think all I needed to know was how much I can expect to have taken from my monthly pay for the immediate future. If I have underpaid (as they say) 549, and I have paid most of that this month, then the remainder is small and they won't take any more than they should?Bobziz said:Worth checking your other 'ISA' accounts too just in case they are not actually what you think they are.

I just don't want to have to chase a rebate or anything . It's definitely not going to be more than the 549 they day I've underpaid?

Once this has been established, I can consider moving from these non ISA accounts that I appear to have misunderstood

So if you earn exactly the same next month as you did when K283X was first used you can expect to pay the exact same amount of tax. That will only change on 6 April, when a new tax code should be in place (details of what that new tax code is might not be available just yet).

NB. PAYE is always a provisional attempt to collect the correct tax, it is reviewed once the tax year ends and, if you paid too much or not enough, HMRC will let you know.2 -

OP has a salary of £45k and is earning about £6k pa in interest from unsheltered instant access savings accounts. This seems likely to put them very close to the higher rate tax threshold?OP are you making pension contributions etc. that will keep you in the basic rate band?N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.1 -

Perhaps this goes some way to explaining the £10,658 figure, if HMRC has assumed some or all of the interest falls into the higher rate band this year.QrizB said:OP has a salary of £45k and is earning about £6k pa in interest from unsheltered instant access savings accounts. This seems likely to put them very close to the higher rate tax threshold?OP are you making pension contributions etc. that will keep you in the basic rate band?

1 -

The £10,658 is based on a combination of the underlying amount owed that is trying to be collected, the tax rate that the PAYE income will be taxed at and the period left in the tax year that the tax owed will be collected over.masonic said:

Perhaps this goes some way to explaining the £10,658 figure, if HMRC has assumed some or all of the interest falls into the higher rate band this year.QrizB said:OP has a salary of £45k and is earning about £6k pa in interest from unsheltered instant access savings accounts. This seems likely to put them very close to the higher rate tax threshold?OP are you making pension contributions etc. that will keep you in the basic rate band?

So the nearer the end of the year the larger the deduction needs to be to collect relatively small sums.

£10,658 when an employer is only deducting basic rate tax would collect £2,131.60 over a full tax year.

But if the code with £10,658 deduction in was only being used for 3 months then it would only be intended to collect an extra £532.90 in that 3 month period.

2 -

Do you mean that tax isn't deducted via PAYE for such income?Dazed_and_C0nfused said:

Tax is never charged on that entry.Ayr_Rage said:

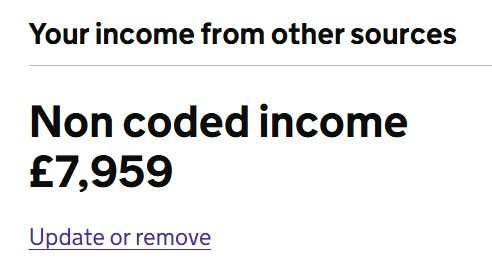

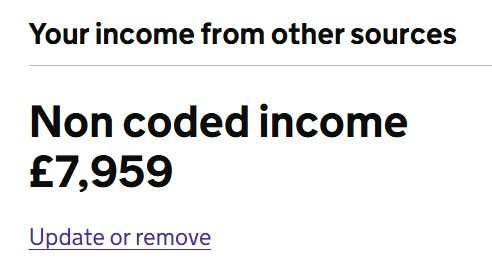

Going forward you need to check your online account for the amount of non coded income as HMRC will adjust your next tax code to recover the tax on that.brutal_deluxe said:Thanks guys, appreciate this.

So listen, all I'm concerned about right now is what's happening from this point on.

The first thing that's stated in black and white is it's 'estimated' have "underpaid 549 tax this year". Fine, so once that 'debt' is clear, it's over right? Back to my original tax code? How can it be read any other way?

You can update that figure yourself online once you've worked out your estimate. 0

0 -

Hmm, unless I'm reading the notice of coding incorrectly, the £10,658 is being added to the £553 prior untaxed interest and the £4,207 from 2023/24 to give a total of £15,248 leaving a negative personal allowance for this year. Which is consistent with the K coding. If the £10,658 has the effect of taking £178 in additional tax per month, the £4,760 of known untaxed interest requires £952 in basic rate tax to be paid this tax year in addition to the £532.90 being collected speculatively, for a total of £1,485. But OP claims his latest payslip was £600 lighter in the first month, and we believe that will be the same for the following 2 months if earnings are level. So something is not adding up.Dazed_and_C0nfused said:

The £10,658 is based on a combination of the underlying amount owed that is trying to be collected, the tax rate that the PAYE income will be taxed at and the period left in the tax year that the tax owed will be collected over.masonic said:

Perhaps this goes some way to explaining the £10,658 figure, if HMRC has assumed some or all of the interest falls into the higher rate band this year.QrizB said:OP has a salary of £45k and is earning about £6k pa in interest from unsheltered instant access savings accounts. This seems likely to put them very close to the higher rate tax threshold?OP are you making pension contributions etc. that will keep you in the basic rate band?

So the nearer the end of the year the larger the deduction needs to be to collect relatively small sums.

£10,658 when an employer is only deducting basic rate tax would collect £2,131.60 over a full tax year.

But if the code with £10,658 deduction in was only being used for 3 months then it would only be intended to collect an extra £532.90 in that 3 month period.

2 -

It isn't deducted via PAYE and it isn't included in a PAYE tax calculation. And there is no box on a Self Assessment return to declare "non coded income" as a thing in its own right (you might declare specific income types that were not in your tax code, rental income for example).eskbanker said:

Do you mean that tax isn't deducted via PAYE for such income?Dazed_and_C0nfused said:

Tax is never charged on that entry.Ayr_Rage said:

Going forward you need to check your online account for the amount of non coded income as HMRC will adjust your next tax code to recover the tax on that.brutal_deluxe said:Thanks guys, appreciate this.

So listen, all I'm concerned about right now is what's happening from this point on.

The first thing that's stated in black and white is it's 'estimated' have "underpaid 549 tax this year". Fine, so once that 'debt' is clear, it's over right? Back to my original tax code? How can it be read any other way?

You can update that figure yourself online once you've worked out your estimate.

https://www.gov.uk/hmrc-internal-manuals/paye-manual/paye130035

Note: The non coded income amount entered will be included with the PAYE income and Benefits in Kind (BIK) amount for the Total Income figure on which coding calculations are based. It will not be used in the End of Year reconciliation.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards