We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Help!! HMRC randomly dipped in and took 1/4 of my wages

Comments

-

Just pay the tax OP, like the rest of us do.1

-

In order to get to the bottom of all this, you're going to need to piece together the full story of where your money has been for the past few years and how much interest it's earned in each tax year, and in particular if/when any of the money has been in tax-free actual ISAs versus normal taxable savings accounts. If you've always misunderstood what an ISA really is and the interest has all been taxable all along (and at broadly similar rates) then yes, it's not obvious why the tax liability would change significantly, but as above, getting to the pertinent facts will help with understanding, rather than guessing....brutal_deluxe said:This just seems to get worse! So I checked my product which is entitled 'instant saver'. Is this different from an ISA? I thought ISA literally meant instant savings account?

Anyway why is all this only happening now?? I've been an Atom customer for about 4 years with no sign of HMRC. Bottom line is absolutely nothing has changed with my circumstances this tax year, no changes in savings, if anything I'm getting less interest, yet all of a sudden I'm paying hundreds extra tax??!1 -

I think it's fair to say the op has some work to do to check their records but one thing which could be a significant factor is simply the fairly sudden jump in interest rates during the 2022-23 and 2023-24 tax years.eskbanker said:

In order to get to the bottom of all this, you're going to need to piece together the full story of where your money has been for the past few years and how much interest it's earned in each tax year, and in particular if/when any of the money has been in tax-free actual ISAs versus normal taxable savings accounts. If you've always misunderstood what an ISA really is and the interest has all been taxable all along (and at broadly similar rates) then yes, it's not obvious why the tax liability would change significantly, but as above, getting to the pertinent facts will help with understanding, rather than guessing....brutal_deluxe said:This just seems to get worse! So I checked my product which is entitled 'instant saver'. Is this different from an ISA? I thought ISA literally meant instant savings account?

Anyway why is all this only happening now?? I've been an Atom customer for about 4 years with no sign of HMRC. Bottom line is absolutely nothing has changed with my circumstances this tax year, no changes in savings, if anything I'm getting less interest, yet all of a sudden I'm paying hundreds extra tax??!

The capital in non ISA might not have changed much but the interest rates will undoubtedly have changed.2 -

Thanks guys, appreciate this.

So listen, all I'm concerned about right now is what's happening from this point on.

The first thing that's stated in black and white is it's 'estimated' have "underpaid 549 tax this year". Fine, so once that 'debt' is clear, it's over right? Back to my original tax code? How can it be read any other way?

0 -

That’s a bit harsh. The OP hasn’t said they aren’t going to pay what is owed, they are just trying to understand the rationale behind the amount - and thanks to the helpful people on this thread the picture is starting to become clearer.wolvoman said:Just pay the tax OP, like the rest of us do.13 -

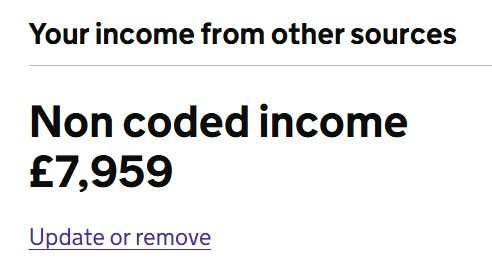

Going forward you need to check your online account for the amount of non coded income as HMRC will adjust your next tax code to recover the tax on that.brutal_deluxe said:Thanks guys, appreciate this.

So listen, all I'm concerned about right now is what's happening from this point on.

The first thing that's stated in black and white is it's 'estimated' have "underpaid 549 tax this year". Fine, so once that 'debt' is clear, it's over right? Back to my original tax code? How can it be read any other way?

You can update that figure yourself online once you've worked out your estimate.

0 -

Back to your original tax code would result in that tax being refunded. So the tax code needs to stay the same. Over 80% of the owed tax has now been collected from your last pay period, so in the next couple of months, the extra deductions will be small.brutal_deluxe said:Thanks guys, appreciate this.

So listen, all I'm concerned about right now is what's happening from this point on.

The first thing that's stated in black and white is it's 'estimated' have "underpaid 549 tax this year". Fine, so once that 'debt' is clear, it's over right? Back to my original tax code? How can it be read any other way?

2 -

Worth checking your other 'ISA' accounts too just in case they are not actually what you think they are.4

-

I'm assuming this includes my other savings accounts. Ok fine. I think all I needed to know was how much I can expect to have taken from my monthly pay for the immediate future. If I have underpaid (as they say) 549, and I have paid most of that this month, then the remainder is small and they won't take any more than they should?Bobziz said:Worth checking your other 'ISA' accounts too just in case they are not actually what you think they are.

I just don't want to have to chase a rebate or anything . It's definitely not going to be more than the 549 they day I've underpaid?

Once this has been established, I can consider moving from these non ISA accounts that I appear to have misunderstood0 -

Tax is never charged on that entry.Ayr_Rage said:

Going forward you need to check your online account for the amount of non coded income as HMRC will adjust your next tax code to recover the tax on that.brutal_deluxe said:Thanks guys, appreciate this.

So listen, all I'm concerned about right now is what's happening from this point on.

The first thing that's stated in black and white is it's 'estimated' have "underpaid 549 tax this year". Fine, so once that 'debt' is clear, it's over right? Back to my original tax code? How can it be read any other way?

You can update that figure yourself online once you've worked out your estimate. 1

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards