We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

TSB £160 switching offer starting 22/01/2025

steven141

Posts: 470 Forumite

What’s in the switcher offer?

Step 1

£100 switcher bonus

- Complete a full switch request when you open an account with us

- Log into the TSB Mobile Banking App

- Make at least 5 payments using the debit card on your new account

- If you do all of this before 14 March 2025, we’ll pay your £100 bonus between 28 March and 11 April 2025

Step 2

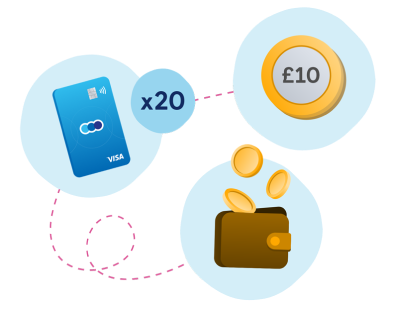

Up to £60 cashback

- If you complete Step 1, you can earn £10 cashback each month for the first 6 months - that’s double the cashback we normally offer!

- To qualify for cashback, make at least 20 debit card payments each calendar month

- Any cashback earned will be automatically paid into your account the next calendar month

Step 3

Choose a treat for staying

Complete Step 1 and make 20 debit card payments in August 2025 to choose your treat in September 2025:

- A night away for two at a wide range of hotels including Mercure, booked through Take Time

- 2 ODEON cinema tickets each month for 3 months

- NOW Entertainment Membershipfor 6 months

1

Comments

-

I'm fairly new to the switching game, although have completed 2 in the last 3 months (First Direct and Nationwide)

Would it be unwise to go for a 3rd in such a short space of time? Mortgage renewal is about 16 months away.

First impressions are that £160 is a bit lower than previous, and the 6 x £10 would require me to use the card pretty much like my usual current account (x20 payments per month). So whilst not ideal, I would just need to get used to using the TSB card instead.

The choice of an additional bonus in September from the 3 listed seems pretty decent though.0 -

If your application is in 16 months it shouldn’t affect it. They normally say don’t make any new applications 3-6 months before a big application. Also avoid applying for any unwanted overdraft and you should be as fine as if you never applied for the account.It’s worthwhile if you switch to using your debit card to them until you make 20 transactions. I’m not eligible for this as I noticed that it was early 2023 I got a bonus. I got a bit excited when I saw the new offer

0

0 -

!!!!!! my last switch was 26/10/2022!0

-

I don’t think I’ll go beyond the £100 but might do this for a very short stay. Thanks OP.I messed up my last switch with them so didn’t qualify for the payment. I’ve probably done well over 20 switches and that was the first one I got wrong.To be fair, I had another 2 on the go at the same time.1

-

Just to avoid making a mess of it again.Do you need to use the actual debit card or is Apple Pay ok?Edit: Just read offer and you can.0

-

Not eligible for the switch offer but would one still get the 6 x 10 monthly double cashback on a new account?0

-

I have applied, and initiated the switch. Probably about 20 mins work in total.

Now I just need to make 125 debit card payments over the next 6 months or so 0

0 -

I've avoided TSB switches, mainly due to the 20 transactions. I don't have many options left however.

I'm sure I don't make 20 debit card transactions in a month in total, and I've other accounts I need to use to maintain rewards on them - spending £500 on Halifax for instance.0 -

Nebulous2 said:I've avoided TSB switches, mainly due to the 20 transactions. I don't have many options left however.

I'm sure I don't make 20 debit card transactions in a month in total, and I've other accounts I need to use to maintain rewards on them - spending £500 on Halifax for instance.

You'll still get £100 for switching, needing only 5 DC payments.

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards