We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Hopefully debt free before Mortgage renewal in June 2026

Comments

-

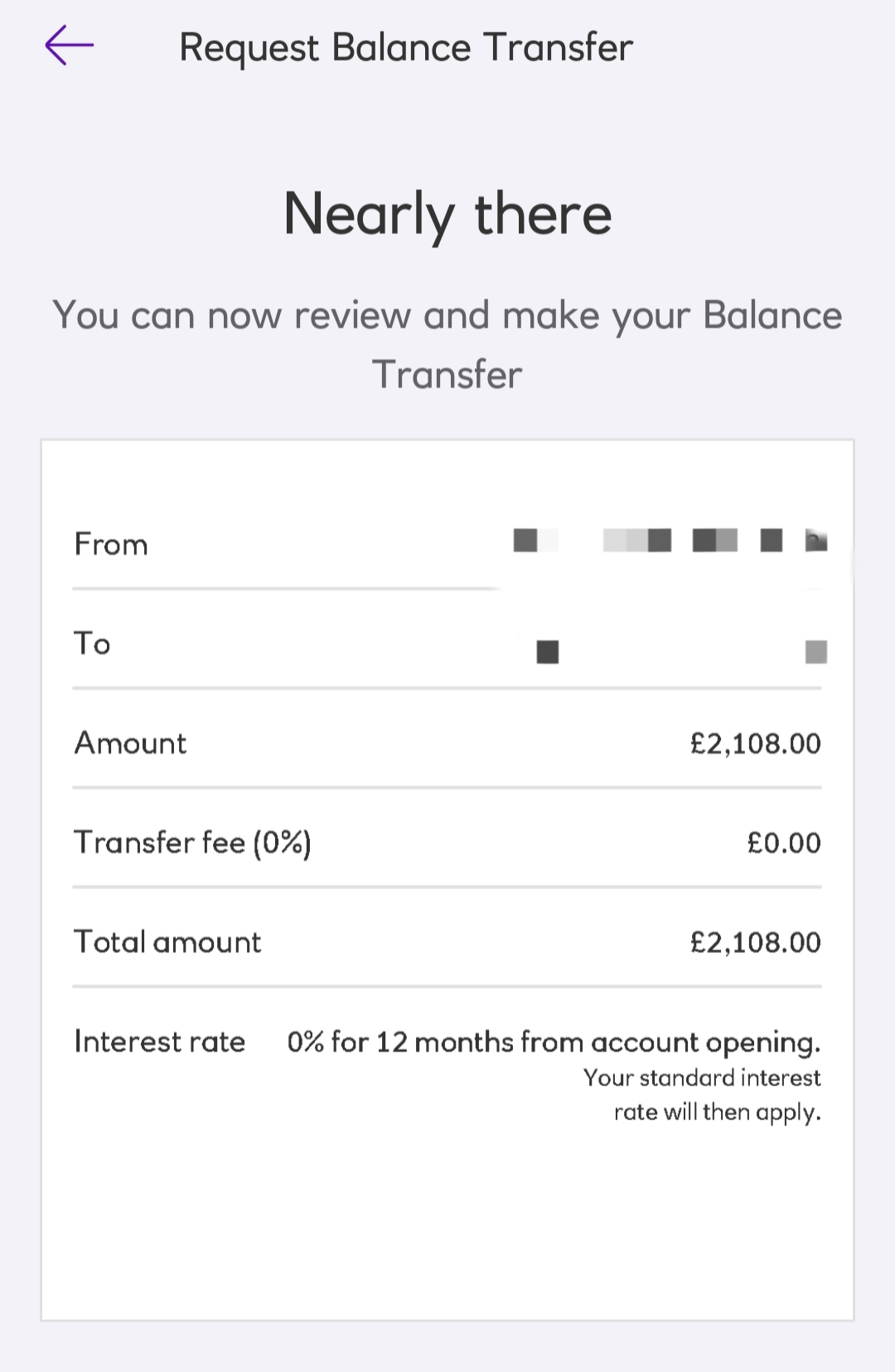

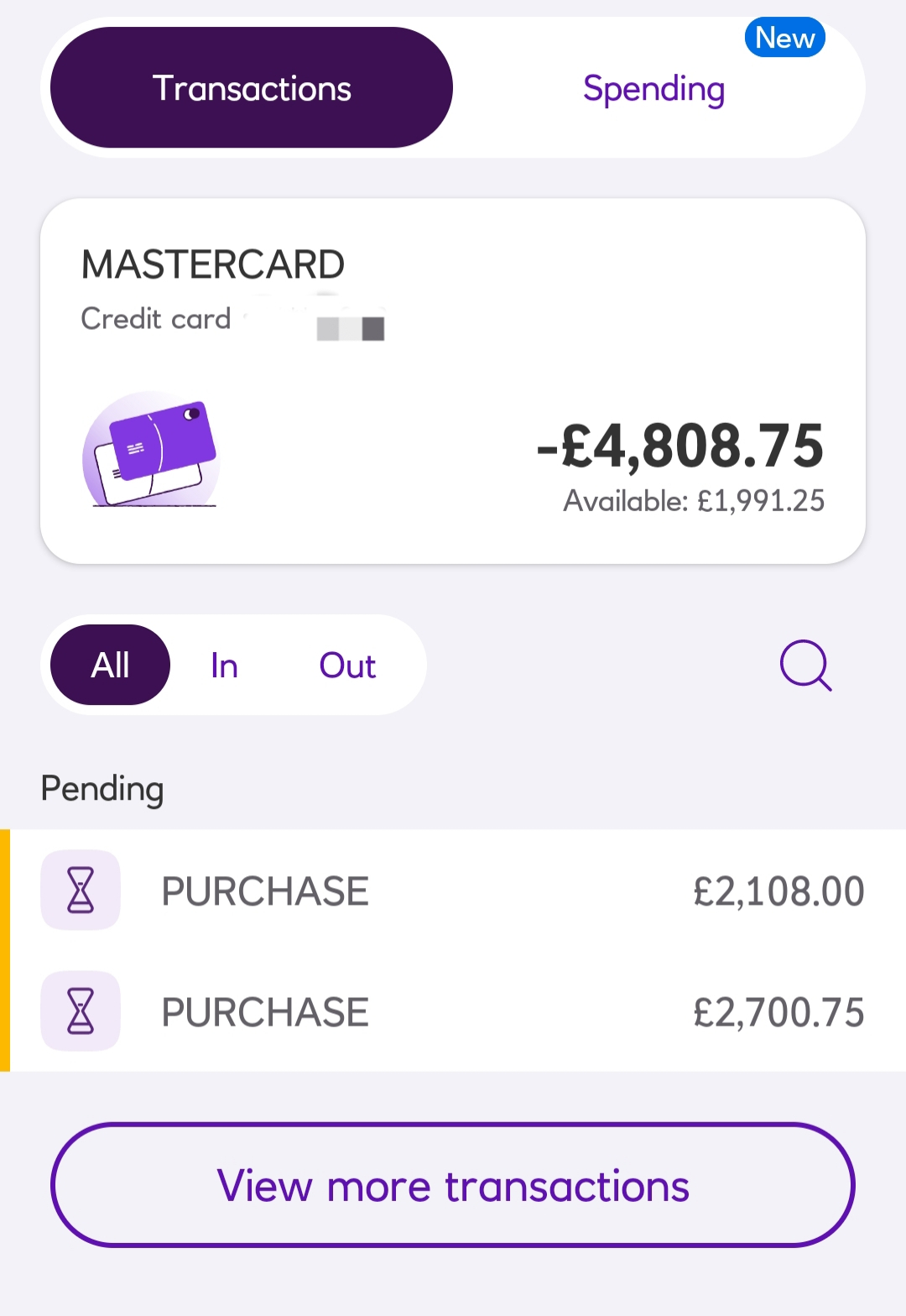

I have now just done another balance transfer of my full Tesco CC balance of £2108.00 to my Natwest CC, giving me a balance on my Natwest CC now of £4808.75

Debts on Jan 6th 2025

Tesco Credit card 0% = £2273

Virgin Credit Card 0% = £1230

Hastings Loan 12.70% = £2962.60

Total = £6465.60

Natwest CC £0 - 25/12/251 -

Well done on the 100 days of payments.Looking forward to seeing your balance reduce.1

-

So now i am at the stage where i have all my debts (£4808.75) on 1 credit card (Natwest), apart from the £1 on the Hastings loan account, and i have 12 months 0% to get it paid off, which i really hope to get it all paid by then, Hopefully by the end of the calendar year if possible.

I have now cancelled my direct debit of £55.00 that i pay to my Tesco CC around the 20th of the month. I will keep an eye on this in case the balance transfer doesnt go through before my payment is due as i dont want to miss a payment and incur any charges or fees.

I have tried to cancel my direct debit (£25 a month) on my Virgin CC account, but because its due to come out of my bank within the next 7 business days (13th of the month) it wont let me cancel it via the app and tells me to call the number on the card to resolve it. I know i can just cancel my direct debit via my bank, but i dont want Virgin to charge a fee or penalty for a missed payment if i did this. So i will call them tomorrow and see what they say.

Because i now have only 1 account to pay off my debts im unsure of how i will proceed with my payments, as you know before i was doing a payment a day, increasing by 1p a day, towards my hastings loan (currently due to pay £2.02 today), i was also doing weekly payments, increasing by £1 a week, towards my Virgin CC (currently due to pay £38.00 this Friday).

I also had monthly Direct debits of £25 for my Virgin CC & £55 for my Tesco CC.

Then at the end of the month i pay a lump sum with whatever i have left in my bank account to pay off the loan as quickly as i can.

I want to continue the daily payments as these help me so much with discipline, focus, encouragement and a sense of achievement, so i will keep them going. But going forward im not sure i can afford to keep up with the rising weekly payments as they increase over time along with the rising daily payments aswell. Before i was due to pay my Virgin CC off within a couple of months so the weekly payments would have stopped giving me extra money to pay the increasing daily payments on the Hastings loan, which then a few months later would also have stopped, then leaving me with just my Tesco CC to pay.

But now for example say in 6 months time if i continued with what i was doing but with only the Natwest CC, my weekly payments would be roughly £62 a week (6 months x 4 weeks a month = 24 so £24 a week more than my next payment of £38).

Plus i would also have daily payments of (6 months of 30 days = 180 (roughly) £1.80) on top of the the £2.02 i am at already so £3.82 ish

Which is around £114.60 a month for daily payments and £248.00 a month (4 weeks) roughly for the weekly payments, which i think could be too much of a push to sustain the longer it goes on.

So im going to pay my daily payments until the end of the week and try and think of a way to pay extra amounts along the way weekly or something like that so it gives me a boost every so often. I will of course also pay a lump sum of whatever i have spare at the end of the month the day before payday to give myself a big monthly boost to get it paid off as quickly as possible.

So Todays Natwest CC daily payment is £2.02 leaving a total debt balance of £4806.73

I hope you all get that, sorry to waffle on but i like to make things clear in my own head by writing it all down, so i can look back on it if i need to in the future, it makes sense to me even if it doesnt to anyone else

Debts on Jan 6th 2025

Tesco Credit card 0% = £2273

Virgin Credit Card 0% = £1230

Hastings Loan 12.70% = £2962.60

Total = £6465.60

Natwest CC £0 - 25/12/251 -

Thank youvampirotoothus said:Looking forward to reading your update tomorrow. You're making great headway, well done V x Debts on Jan 6th 2025

Debts on Jan 6th 2025

Tesco Credit card 0% = £2273

Virgin Credit Card 0% = £1230

Hastings Loan 12.70% = £2962.60

Total = £6465.60

Natwest CC £0 - 25/12/251 -

..........

Debts on Jan 6th 2025

Tesco Credit card 0% = £2273

Virgin Credit Card 0% = £1230

Hastings Loan 12.70% = £2962.60

Total = £6465.60

Natwest CC £0 - 25/12/252 -

What we did when we were paying off debt and managed to BT most of it to a 0% CC was to divide the outstanding amount on the new BT CC by the months till the 0% ran out. For us this gave £700 per month that we needed to pay to get it cleared. We then set up a DD for £100 (slightly above the min but not too much) per month to pay off the CC. We then put the remaining £600 per month into high interest savings accounts, fixed ones at the beginning to get more interest, flexible ones towards the end. We kept the interest as it paid out and paid everything off and became debt free over a month before 0% ran out.

Just throwing this in as an idea because you could play around with your daily/weekly amts in the same way just into a savings account.3 -

Well, i was going to call Virgin and try and get my direct debit to them stopped before it came out my account. but i checked my bank account before work, to see if any direct debits had come out and the Virgin CC payment had already come out of my account. So my Virgin CC now has a positive balance of +£25.00 which i will arrange to get back once the payment has clear in my Virgin CC account. I will now also cancel my direct debit to them.

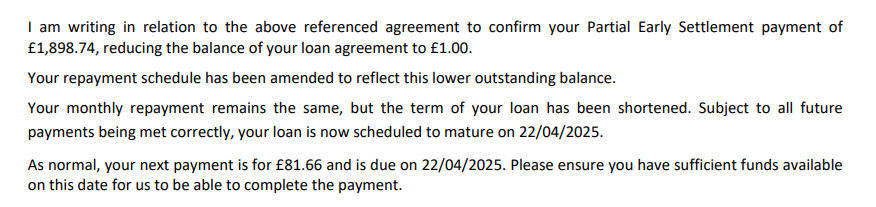

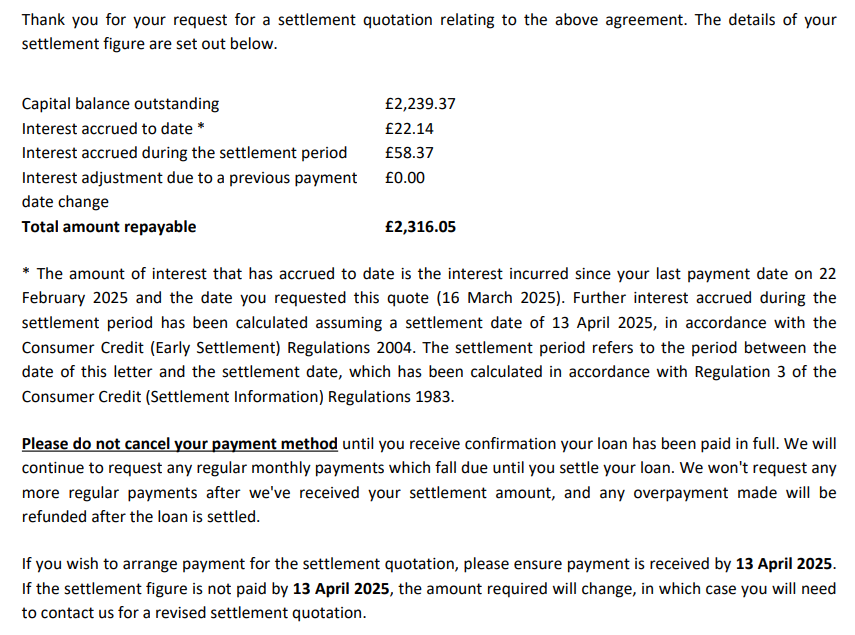

Regarding my Hastings loan. When i made the payment from my Virgin CC to clear all but £1.00 of the balance, it showed that the final payment would be £13.02 on my last payment date 22/4/2025 (as shown in the pic i posted when i made the payment). But i have today received an email saying my final payment will now be £81.66.

I take it they have added the interest on that they said they would if i make a full settlement anyway. Like they had quoted when i previously got a settlement figure a while ago (see below). The interest total then was £80.51, so roughly the same. This settlement quote runs out on the 13th April, so what im thinking is now my balance is £1.00 i will generate a new settlement figure after this date and see if it less than the £81.66 figure quoted in their email that they will be taking on 22/4/25. If it is less than im winning, if it's not then i will simply pay the £81.66 and that will be the end of the Hastings loan, and i will have still saved money by paying it off early and moving it to a 0% CC.

No money spent today

Direct debit

Virgin CC £25.00 which i will be getting back, as i didnt cancel my direct debit in time.

Debt payments

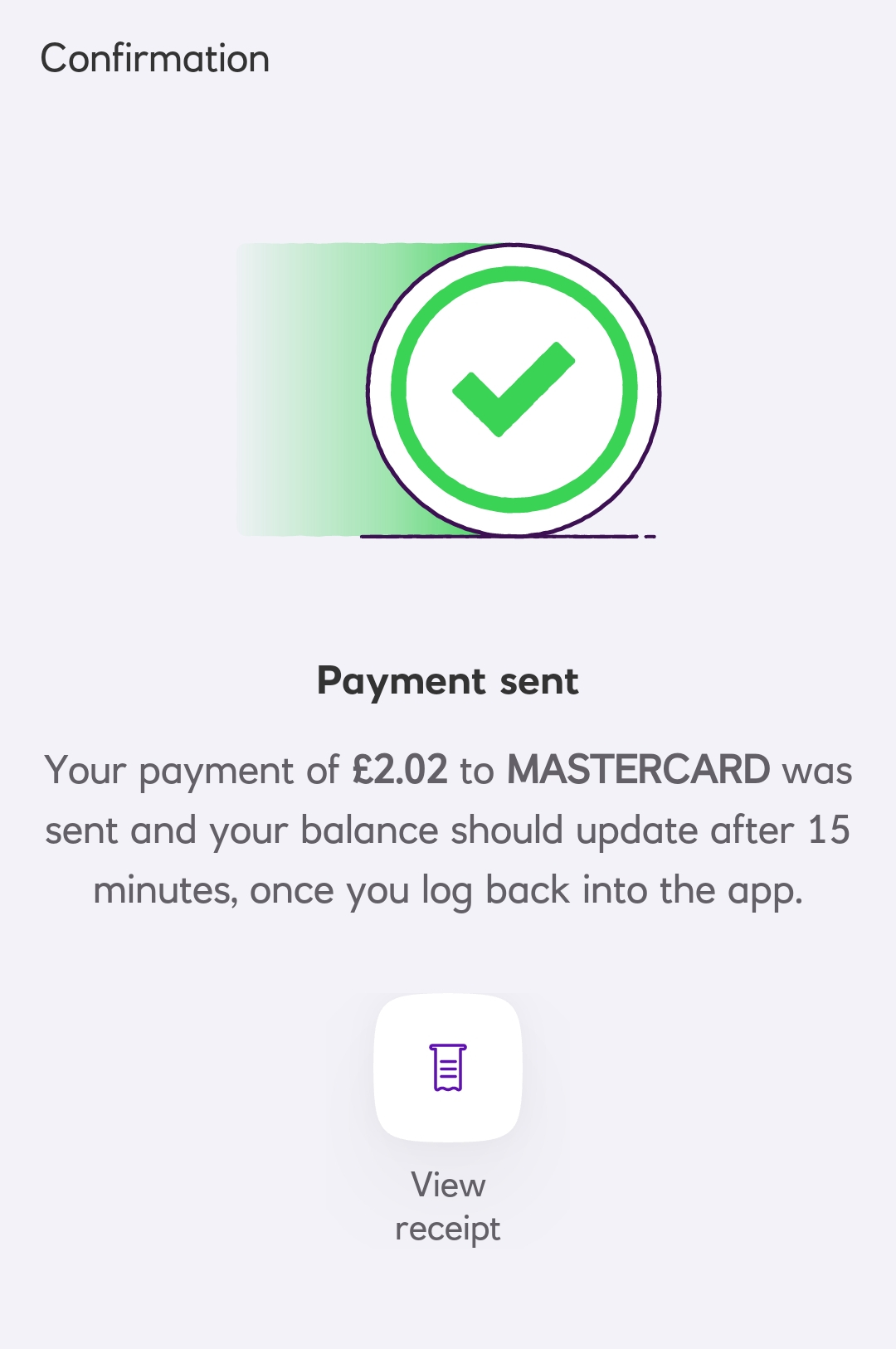

Natwest CC Daily payment £2.03. Total paid this month £4.05 (to this card & £18.73 to my old Hastings loan - Same debt). Total Debt outstanding now £4804.70

So 12 months (0%) to pay this off which gives me an average of £400.39 per month to pay to get it cleared in that time. Hopefully i can try and get around that figure or more in order to bring that average down and clear it sooner if at all possible.

Debts on Jan 6th 2025

Tesco Credit card 0% = £2273

Virgin Credit Card 0% = £1230

Hastings Loan 12.70% = £2962.60

Total = £6465.60

Natwest CC £0 - 25/12/252 -

................

Debts on Jan 6th 2025

Tesco Credit card 0% = £2273

Virgin Credit Card 0% = £1230

Hastings Loan 12.70% = £2962.60

Total = £6465.60

Natwest CC £0 - 25/12/253 -

Thanks for that. It is a really good idea to make a bit of money for yourself along the way as you pay your debts. I dont think that would work for me, as im not very good at keeping money in savings accounts and having money there is tempting for me to spend. I've alluded to this as my downfall in a previous post. It is going to be the hardest part of getting out of debt for me, the actual dealing with spare money/saving and building up money after i have paid my debts off in full. I have nearly always lived in debt and can always pay it off, i find that the easy part, its staying out of debt and trying to save that i find difficult.Spendless said:What we did when we were paying off debt and managed to BT most of it to a 0% CC was to divide the outstanding amount on the new BT CC by the months till the 0% ran out. For us this gave £700 per month that we needed to pay to get it cleared. We then set up a DD for £100 (slightly above the min but not too much) per month to pay off the CC. We then put the remaining £600 per month into high interest savings accounts, fixed ones at the beginning to get more interest, flexible ones towards the end. We kept the interest as it paid out and paid everything off and became debt free over a month before 0% ran out.

Just throwing this in as an idea because you could play around with your daily/weekly amts in the same way just into a savings account.

I would highly recommend people who can keep money in a savings account without touching it to follow your very good advice, but for me im afraid it won't work. I also like to see the debt coming down over time as a boost and encouragement to keep focused on paying it off.

Thanks for your helpful advice though Debts on Jan 6th 2025

Debts on Jan 6th 2025

Tesco Credit card 0% = £2273

Virgin Credit Card 0% = £1230

Hastings Loan 12.70% = £2962.60

Total = £6465.60

Natwest CC £0 - 25/12/253

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards