We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Branch only or via QR code displayed in branch….(link challenge for @Bridlington1 ? 😂)surreysaver said:That's the Newcastle Monument Regular Saver successfully opened!

Shame the new Greggs pub is closed for a private event today :'(0 -

Yorkshire BS Christmas 2025 eRS

This one is due to mature on 31st October. Balance only £1500 (10 x £150, account was only available from Jan 25). Interest rate has dropped to 4.80%.

I've closed mine today a couple of weeks early. (Currently getting 4.55% on EA). Reason for early closure (apart from the unexciting rate) is to free up some money for RS deposits due on 3rd November Also, there is so much going on in my accounts at the turn of the month that an RS maturing on 31st October is just extra hassle.

Interest credited today is £30.82.5 -

csw5780 said:

Branch only or via QR code displayed in branch….(link challenge for @Bridlington1 ? 😂)surreysaver said:That's the Newcastle Monument Regular Saver successfully opened!

Shame the new Greggs pub is closed for a private event today :'(

I consider myself to be a male feminist. Is that allowed?0

I consider myself to be a male feminist. Is that allowed?0 -

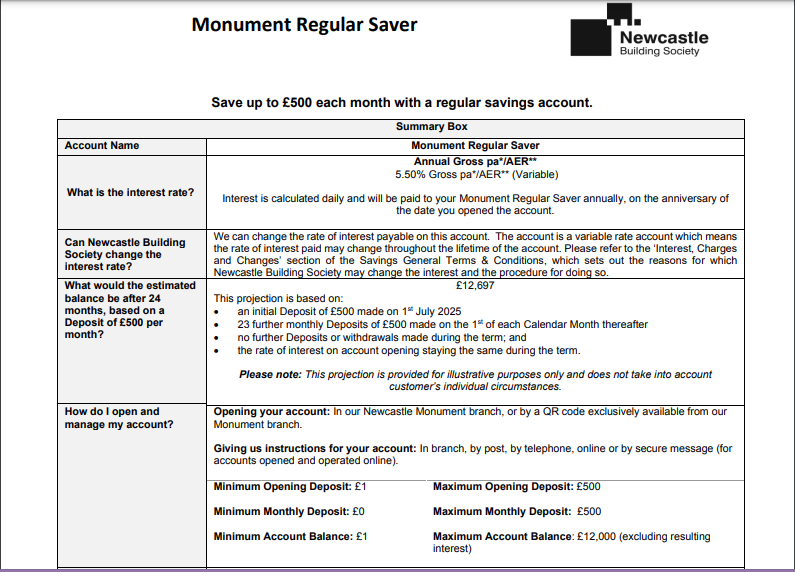

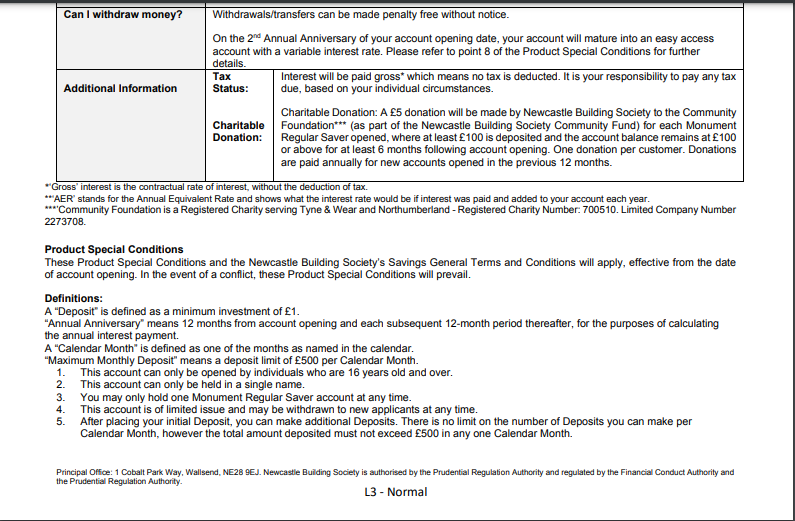

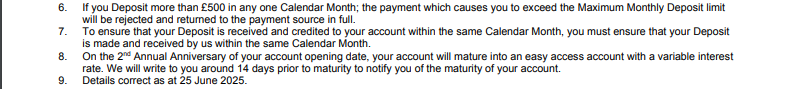

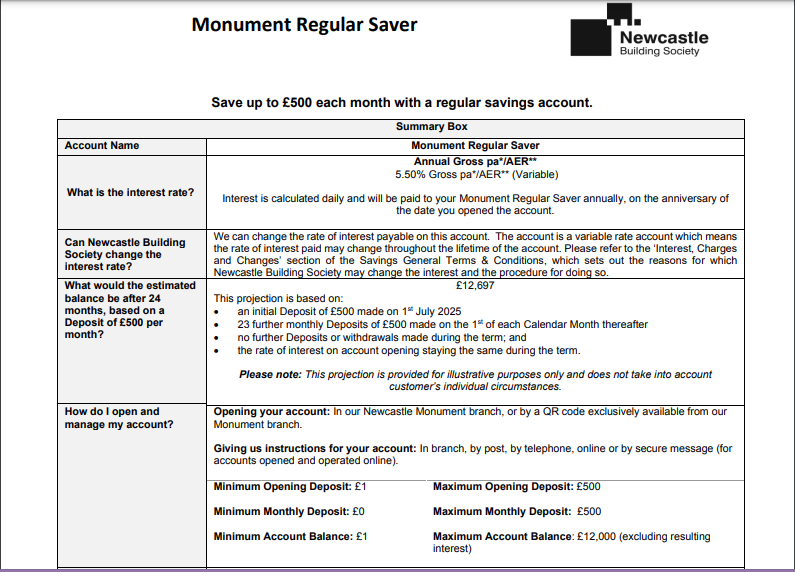

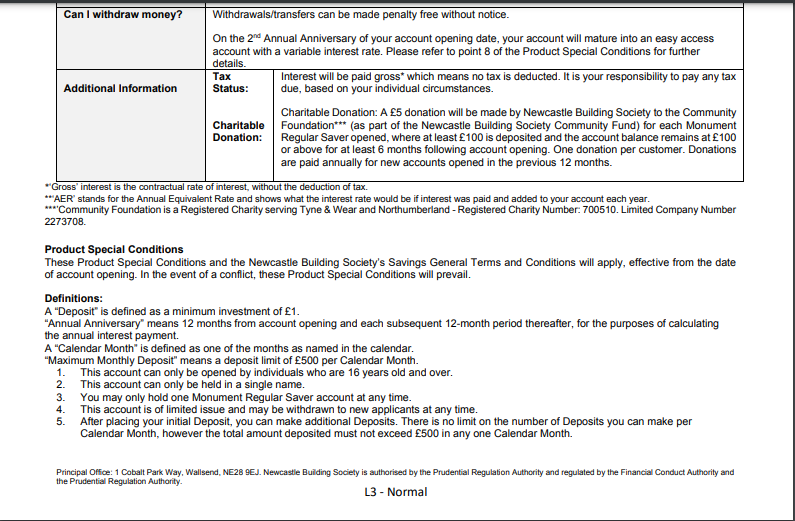

Rather than being Cryptic, here's the details

2 -

Unless anyone's willing to make a trip to Newcastle (or lives locally), no cripticalness about it.exel1966 said:Rather than being Cryptic, here's the details

It's quicker to hop on a train than send something in the post and wait for the response.I consider myself to be a male feminist. Is that allowed?0 -

If someone ( @surreysaver ?) has access to the branch, they could share the QR code here..csw5780 said:

Branch only or via QR code displayed in branch….(link challenge for @Bridlington1 ? 😂)surreysaver said:That's the Newcastle Monument Regular Saver successfully opened!

Shame the new Greggs pub is closed for a private event today :'(1 -

I don't want to be the irresponsible one ..gt94sss2 said:

If someone ( @surreysaver ?) has access to the branch, they could share the QR code here..csw5780 said:

Branch only or via QR code displayed in branch….(link challenge for @Bridlington1 ? 😂)surreysaver said:That's the Newcastle Monument Regular Saver successfully opened!

Shame the new Greggs pub is closed for a private event today :'(

But Gregg's beer sold in Fenwick is expensiveI consider myself to be a male feminist. Is that allowed?0 -

If you closed yours today when do they say you’ll get your money?Hattie627 said:Yorkshire BS Christmas 2025 eRS

This one is due to mature on 31st October. Balance only £1500 (10 x £150, account was only available from Jan 25). Interest rate has dropped to 4.80%.

I've closed mine today a couple of weeks early. (Currently getting 4.55% on EA). Reason for early closure (apart from the unexciting rate) is to free up some money for RS deposits due on 3rd November Also, there is so much going on in my accounts at the turn of the month that an RS maturing on 31st October is just extra hassle.

Interest credited today is £30.82.0 -

They could... but should they? It's rather pushing the boundaries to attempt to open a branch-opening only account without setting foot in the branch. And if one person has spent their own time, as well as possibly train/bus fare, to get to the branch, then it's a bit unfair for others to take advantage of that.gt94sss2 said:

If someone ( @surreysaver ?) has access to the branch, they could share the QR code here..csw5780 said:

Branch only or via QR code displayed in branch….(link challenge for @Bridlington1 ? 😂)surreysaver said:That's the Newcastle Monument Regular Saver successfully opened!

Shame the new Greggs pub is closed for a private event today :'(1 -

It depends where you draw the line.clairec666 said:

They could... but should they? It's rather pushing the boundaries to attempt to open a branch-opening only account without setting foot in the branch. And if one person has spent their own time, as well as possibly train/bus fare, to get to the branch, then it's a bit unfair for others to take advantage of that.gt94sss2 said:

If someone ( @surreysaver ?) has access to the branch, they could share the QR code here..csw5780 said:

Branch only or via QR code displayed in branch….(link challenge for @Bridlington1 ? 😂)surreysaver said:That's the Newcastle Monument Regular Saver successfully opened!

Shame the new Greggs pub is closed for a private event today :'(

After all, we are supposed to be a supportive forum helping others with our experiences/knowledge.

Personally, I think it is more dubious for some to try a 13th payment in cases where it is explicitly disallowed by T&C, or incorrectly using a freepost address to avoid the cost of a stamp..

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards